Answered step by step

Verified Expert Solution

Question

1 Approved Answer

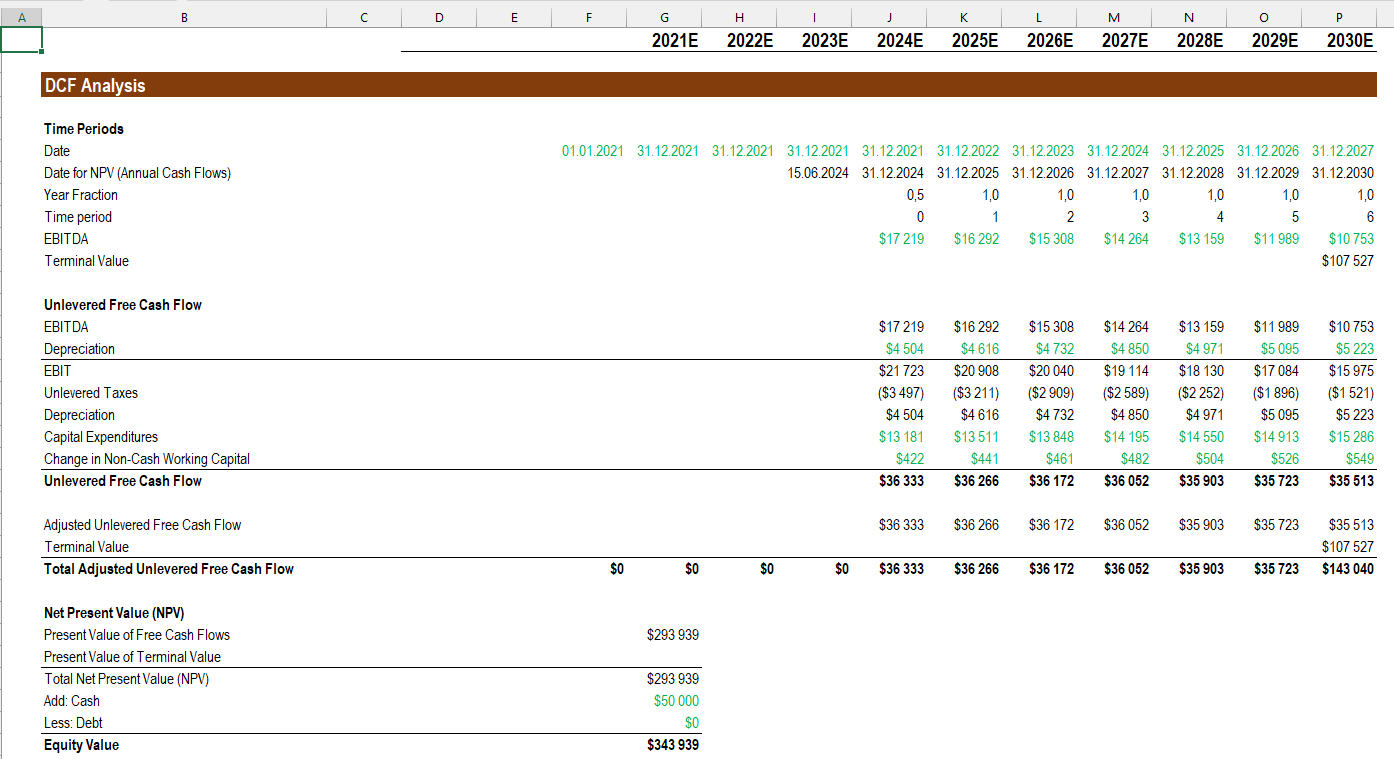

I need help and explaining to how, and with which formulas to use to find this: Based on the DCF analysis and using WACC as

I need help and explaining to how, and with which formulas to use to find this:

"Based on the DCF analysis and using WACC as the discount rate, what is the implied equity value of Company XYZ on January 1, 2021?"

A) 79,946

B) 77,210

C) 73,712

D) 79,292

WACC = 16.8 %

B C D E F G 1 N H 2022E K 2025E L 2026E M 2027E o 2029E 2021E 2023E 2024E 2028E 2030E DCF Analysis Time Periods Date Date for NPV (Annual Cash Flows) Year Fraction Time period EBITDA Terminal Value 01.01.2021 31.12.2021 31.12.2021 31.12.2021 31.12.2021 31.12.2022 31.12.2023 31.12.2024 31.12.2025 31.12.2026 31.12.2027 15.06.2024 31.12.2024 31.12.2025 31.12.2026 31.12.2027 31.12.2028 31.12.2029 31.12.2030 0,5 1,0 1,0 1,0 1,0 1,0 1,0 0 1 2 3 4 5 6 $17 219 $16 292 $15 308 $14 264 $13 159 $11989 $10 753 $107 527 Unlevered Free Cash Flow EBITDA Depreciation EBIT Unlevered Taxes Depreciation Capital Expenditures Change in Non-Cash Working Capital Unlevered Free Cash Flow $17219 $4504 $21 723 ($3 497) $4504 $13 181 $422 $36 333 $16 292 $4616 $20 908 ($3 211) $4616 $13511 $441 $36 266 $15 308 $4732 $20 040 ($2 909) $4732 $13 848 $461 $36 172 $14 264 $4 850 $19 114 ($2 589) $4 850 $14 195 $482 $36 052 $13 159 $4971 $18 130 ($2 252) $4971 $14550 $504 $35 903 $11 989 $5 095 $17 084 ($1 896) $5 095 $14913 $526 $35 723 $10 753 $5223 $15 975 ($1 521) $5 223 $15 286 $549 $35 513 $36 333 $36 266 $36 172 $36 052 $35 903 $35 723 Adjusted Unlevered Free Cash Flow Terminal Value Total Adjusted Unlevered Free Cash Flow $35513 $107 527 $143 040 $0 $0 $0 $0 $36 333 $36 266 $36 172 $36 052 $35 903 $35 723 $293 939 Net Present Value (NPV) Present Value of Free Cash Flows Present Value of Terminal Value Total Net Present Value (NPV) Add: Cash Less: Debt Equity Value $293 939 $50 000 $0 $343 939 B C D E F G 1 N H 2022E K 2025E L 2026E M 2027E o 2029E 2021E 2023E 2024E 2028E 2030E DCF Analysis Time Periods Date Date for NPV (Annual Cash Flows) Year Fraction Time period EBITDA Terminal Value 01.01.2021 31.12.2021 31.12.2021 31.12.2021 31.12.2021 31.12.2022 31.12.2023 31.12.2024 31.12.2025 31.12.2026 31.12.2027 15.06.2024 31.12.2024 31.12.2025 31.12.2026 31.12.2027 31.12.2028 31.12.2029 31.12.2030 0,5 1,0 1,0 1,0 1,0 1,0 1,0 0 1 2 3 4 5 6 $17 219 $16 292 $15 308 $14 264 $13 159 $11989 $10 753 $107 527 Unlevered Free Cash Flow EBITDA Depreciation EBIT Unlevered Taxes Depreciation Capital Expenditures Change in Non-Cash Working Capital Unlevered Free Cash Flow $17219 $4504 $21 723 ($3 497) $4504 $13 181 $422 $36 333 $16 292 $4616 $20 908 ($3 211) $4616 $13511 $441 $36 266 $15 308 $4732 $20 040 ($2 909) $4732 $13 848 $461 $36 172 $14 264 $4 850 $19 114 ($2 589) $4 850 $14 195 $482 $36 052 $13 159 $4971 $18 130 ($2 252) $4971 $14550 $504 $35 903 $11 989 $5 095 $17 084 ($1 896) $5 095 $14913 $526 $35 723 $10 753 $5223 $15 975 ($1 521) $5 223 $15 286 $549 $35 513 $36 333 $36 266 $36 172 $36 052 $35 903 $35 723 Adjusted Unlevered Free Cash Flow Terminal Value Total Adjusted Unlevered Free Cash Flow $35513 $107 527 $143 040 $0 $0 $0 $0 $36 333 $36 266 $36 172 $36 052 $35 903 $35 723 $293 939 Net Present Value (NPV) Present Value of Free Cash Flows Present Value of Terminal Value Total Net Present Value (NPV) Add: Cash Less: Debt Equity Value $293 939 $50 000 $0 $343 939

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started