Answered step by step

Verified Expert Solution

Question

1 Approved Answer

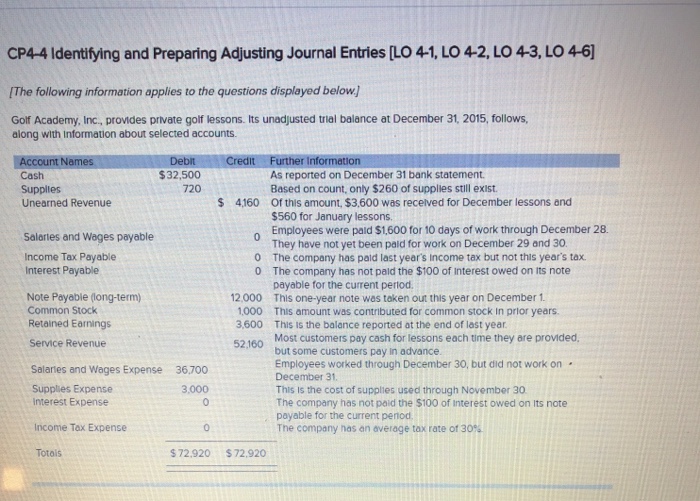

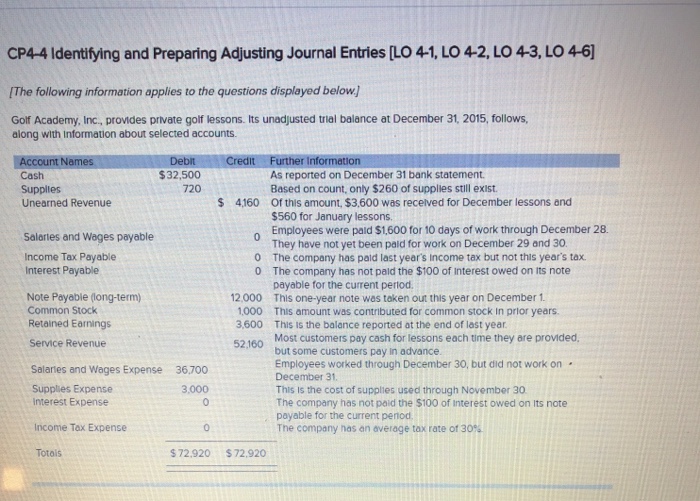

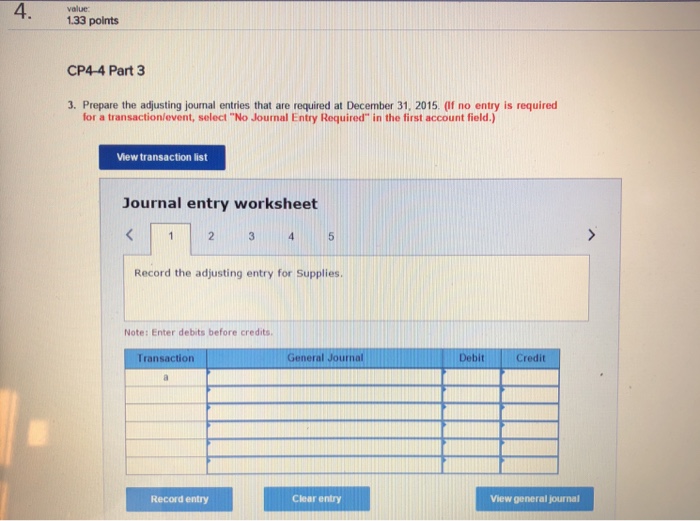

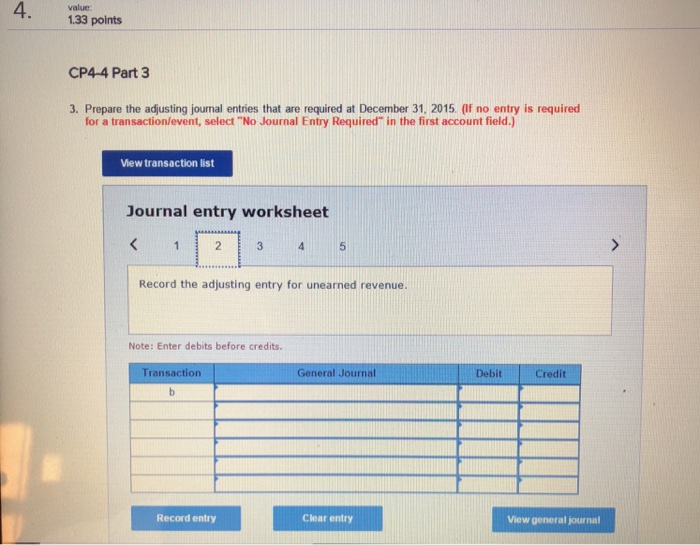

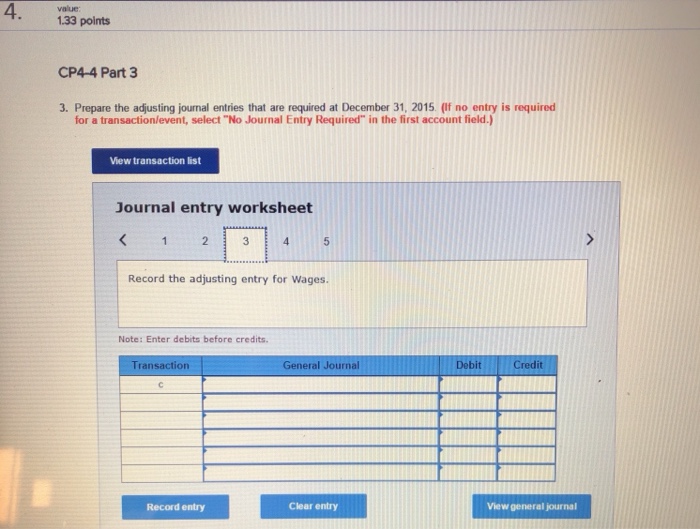

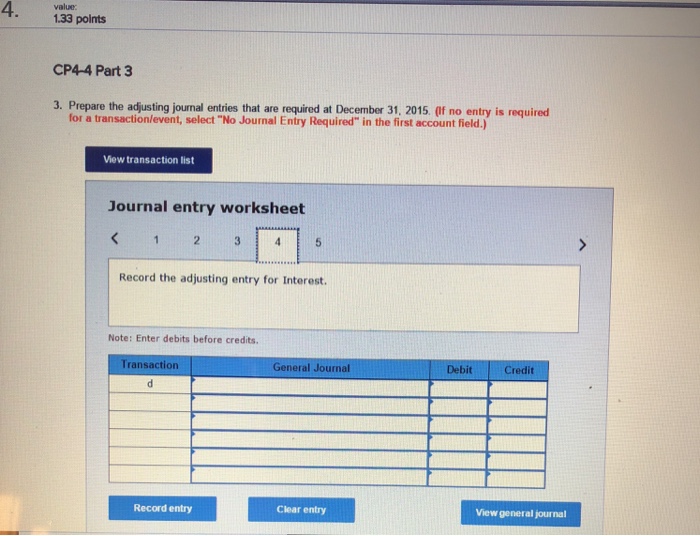

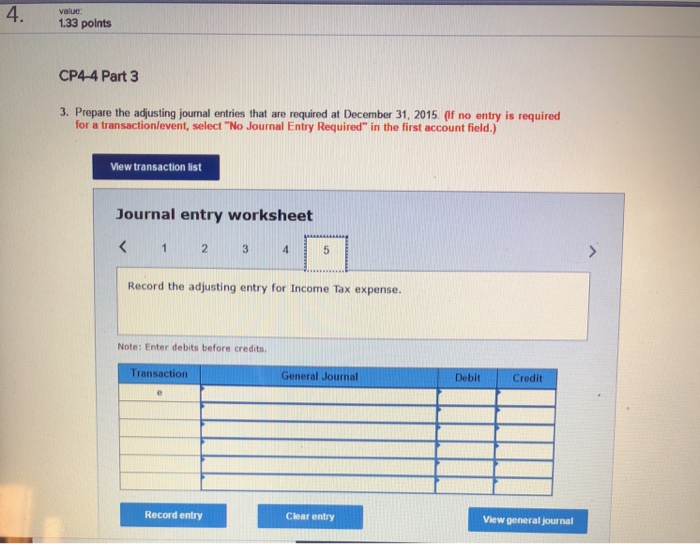

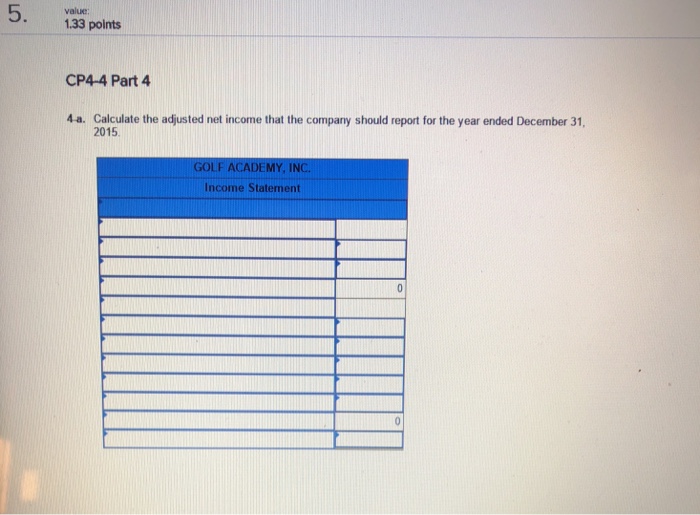

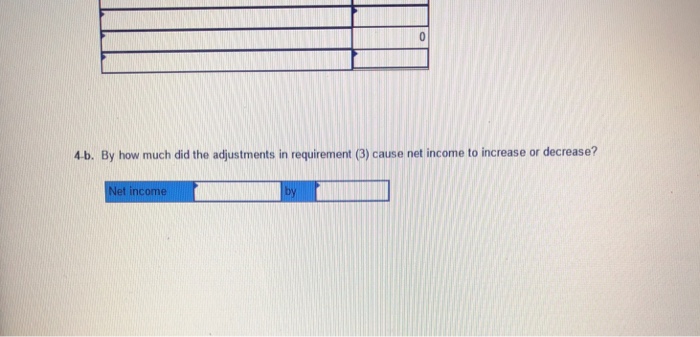

I need help answering this question, please! I tried, but I couldnt. Help me! Thanks CP4-4 Identifying and Preparing Adjusting Journal Entries [LO 4-1, L?42,

I need help answering this question, please! I tried, but I couldnt. Help me!

Thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started