I need help answering this question please.

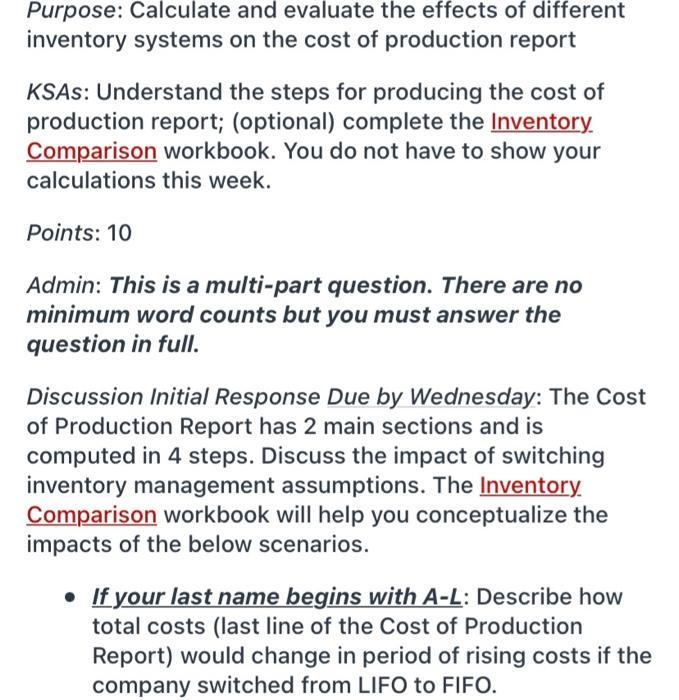

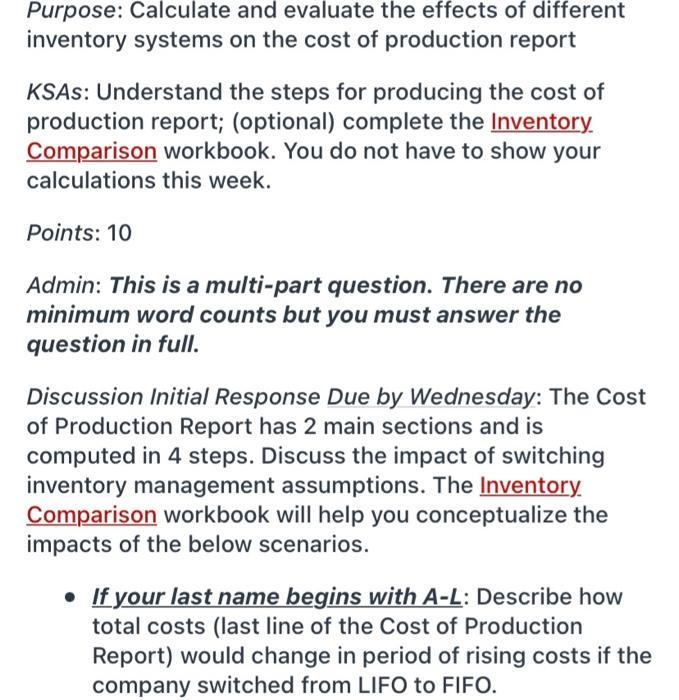

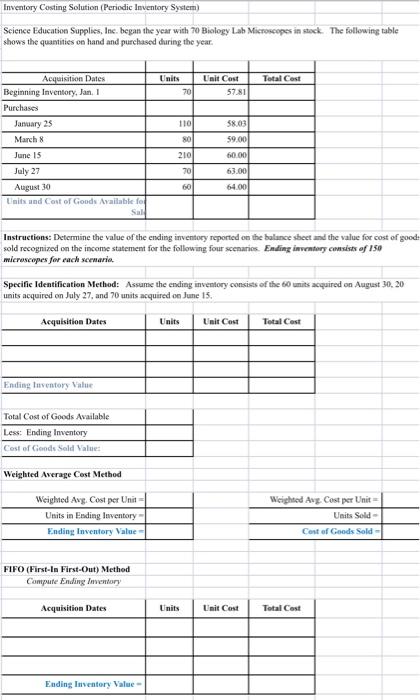

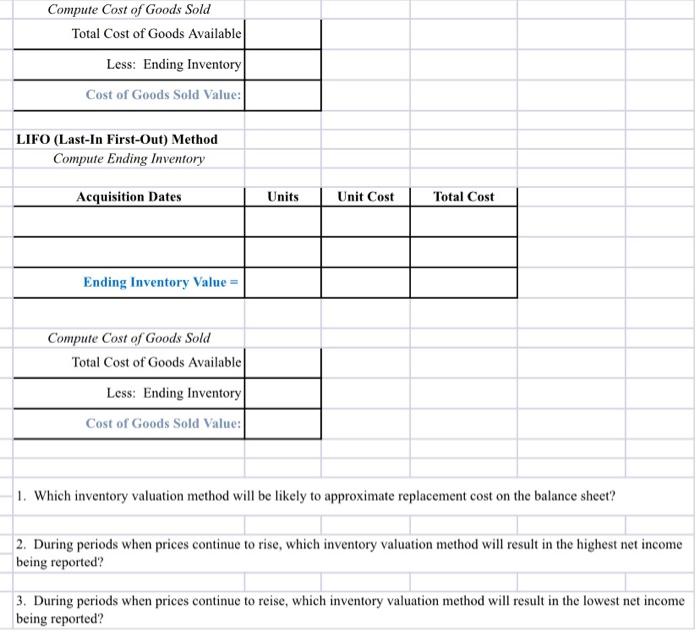

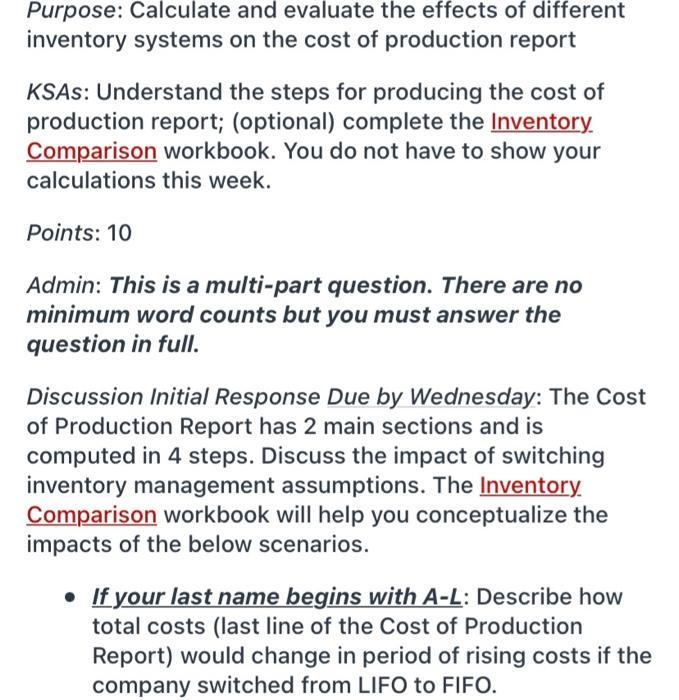

Purpose: Calculate and evaluate the effects of different inventory systems on the cost of production report KSAS: Understand the steps for producing the cost of production report; (optional) complete the Inventory Comparison workbook. You do not have to show your calculations this week. Points: 10 Admin: This is a multi-part question. There are no minimum word counts but you must answer the question in full. Discussion Initial Response Due by Wednesday: The Cost of Production Report has 2 main sections and is computed in 4 steps. Discuss the impact of switching inventory management assumptions. The Inventory Comparison workbook will help you conceptualize the impacts of the below scenarios. If your last name begins with A-L: Describe how total costs (last line of the Cost of Production Report) would change in period of rising costs if the company switched from LIFO to FIFO. Inventory Costing Solution (Periodic Inventory System) Science Education Supplies, Inc. began the year with 70 Biology Lab Microscopes in stock. The following table shows the quantities on hand and purchased during the year Units Total Cost Unit Cost 57.81 20 110 58.03 Acquisition Dates Beginning Inventory, Jan. 1 Purchases January 25 March June 15 July 27 August 30 Units and Cost of Goods Available for 80 59.00 210 60.00 70 63.00 60 64.00 Instructions: Determine the value of the ending inventory reported on the balance sheet and the value for cost of good sold recognized on the income statement for the following four scenarios Ending inventory consists of 150 microscopes for each semarie Specific Identification Method: Assume the ending inventory consists of the 60 units acquired on August 30, 20 units acquired on July 27, and 70 units acquired on June 15. Acquisition Dates Units Unit Cost Total Cost Ending liventory Value Total Cost of Goods Available Less: Ending Inventory Cost of Goods Sold Values Weighted Average Cost Method Weighted Avg. Cost per Unit Units in Ending laventory Ending Inventory Value Weighted Avg. Cost per Unit Units Sold - Cost of Goods Sold FIFO (First-In First-Out) Method Compute Ending Inventory Acquisition Dates Units Unit Cost Total Cost Ending lnventory Value Compute Cost of Goods Sold Total Cost of Goods Available Less: Ending Inventory Cost of Goods Sold Value: LIFO (Last-In First-Out) Method Compute Ending Inventory Acquisition Dates Units Unit Cost Total Cost Ending Inventory Value = Compute Cost of Goods Sold Total Cost of Goods Available Less: Ending Inventory Cost of Goods Sold Value: 1. Which inventory valuation method will be likely to approximate replacement cost on the balance sheet? 2. During periods when prices continue to rise, which inventory valuation method will result in the highest net income being reported? 3. During periods when prices continue to reise, which inventory valuation method will result in the lowest net income being reported