Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED HELP ASAP PLEASE AND THANKYOU!!! (I only have an hour left to figure this out) (If possible please show the calculations that explain

I NEED HELP ASAP PLEASE AND THANKYOU!!!

(I only have an hour left to figure this out) (If possible please show the calculations that explain how to get the numbers; I'm struggling severely with understanding this topic) (I'm also unsure as to why my calculations aren't working)

Thank You!!!

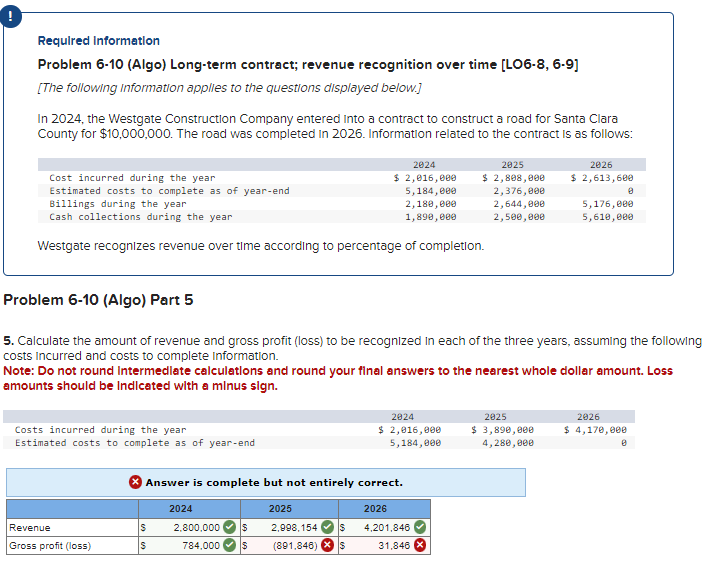

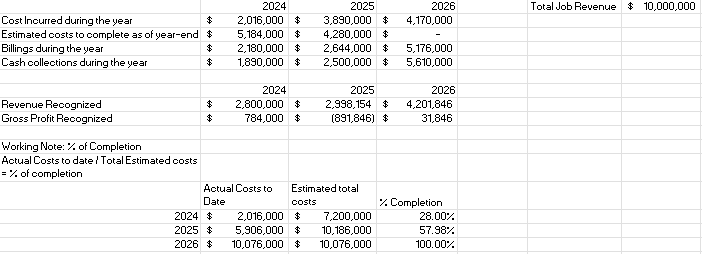

Required Information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applles to the questions displayed below.] In 2024, the Westgate Construction Company entered Into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Westgate recognizes revenue over time according to percentage of completion. Problem 6-10 (Algo) Part 5 Calculate the amount of revenue and gross profit (loss) to be recognized In each of the three years, assuming the followit osts Incurred and costs to complete information. Note: Do not round Intermedlate calculatlons and round your final answers to the nearest whole dollar amount. Loss imounts should be Indlcated with a minus sign. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|r|}{2024} & \multicolumn{2}{|r|}{2025} & 2026 & \multirow[t]{2}{*}{ Total Job Revenue } & \multirow[t]{2}{*}{$10,000,000} \\ \hline Cost lnourred during the year & $ & 2,016,000 & $ & 3,890,000 & 4,170,000 & & \\ \hline Estimated costs to complete as of year-end & $ & 5,184,000 & $ & 4,280,000 & $ & & \\ \hline Billings during the year & $ & 2,180,000 & $ & 2,644,000 & 5,176,000 & & \\ \hline Cash collections during the year & $ & 1,890,000 & $ & 2,500,000 & 5,610,000 & & \\ \hline & & 2024 & & 2025 & 2026 & & \\ \hline Revenue Recognized & $ & 2,800,000 & $ & 2,998,154 & 4,201,846 & & \\ \hline Gross Profit Recognized & $ & 784,000 & $ & (891,846) & 31,846 & & \\ \hline Working Note: \% of Completion & & & & & & & \\ \hline ActualCoststodatelTotalEstimatedcosts=%ofcompletion & & & & & & & \\ \hline & AoDa & al Costs to & Es: & iated total & % Completion & & \\ \hline 2024 & $ & 2,016,000 & $ & 7,200,000 & 28.00% & & \\ \hline 2025 & $ & 5,906,000 & $ & 10,186,000 & 57.98% & & \\ \hline 2026 & $ & 10,076,000 & $ & 10,076,000 & 100.00% & & \\ \hline \end{tabular}

Required Information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applles to the questions displayed below.] In 2024, the Westgate Construction Company entered Into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Westgate recognizes revenue over time according to percentage of completion. Problem 6-10 (Algo) Part 5 Calculate the amount of revenue and gross profit (loss) to be recognized In each of the three years, assuming the followit osts Incurred and costs to complete information. Note: Do not round Intermedlate calculatlons and round your final answers to the nearest whole dollar amount. Loss imounts should be Indlcated with a minus sign. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|r|}{2024} & \multicolumn{2}{|r|}{2025} & 2026 & \multirow[t]{2}{*}{ Total Job Revenue } & \multirow[t]{2}{*}{$10,000,000} \\ \hline Cost lnourred during the year & $ & 2,016,000 & $ & 3,890,000 & 4,170,000 & & \\ \hline Estimated costs to complete as of year-end & $ & 5,184,000 & $ & 4,280,000 & $ & & \\ \hline Billings during the year & $ & 2,180,000 & $ & 2,644,000 & 5,176,000 & & \\ \hline Cash collections during the year & $ & 1,890,000 & $ & 2,500,000 & 5,610,000 & & \\ \hline & & 2024 & & 2025 & 2026 & & \\ \hline Revenue Recognized & $ & 2,800,000 & $ & 2,998,154 & 4,201,846 & & \\ \hline Gross Profit Recognized & $ & 784,000 & $ & (891,846) & 31,846 & & \\ \hline Working Note: \% of Completion & & & & & & & \\ \hline ActualCoststodatelTotalEstimatedcosts=%ofcompletion & & & & & & & \\ \hline & AoDa & al Costs to & Es: & iated total & % Completion & & \\ \hline 2024 & $ & 2,016,000 & $ & 7,200,000 & 28.00% & & \\ \hline 2025 & $ & 5,906,000 & $ & 10,186,000 & 57.98% & & \\ \hline 2026 & $ & 10,076,000 & $ & 10,076,000 & 100.00% & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started