I need help ASAP please. Need to turn in tonight.

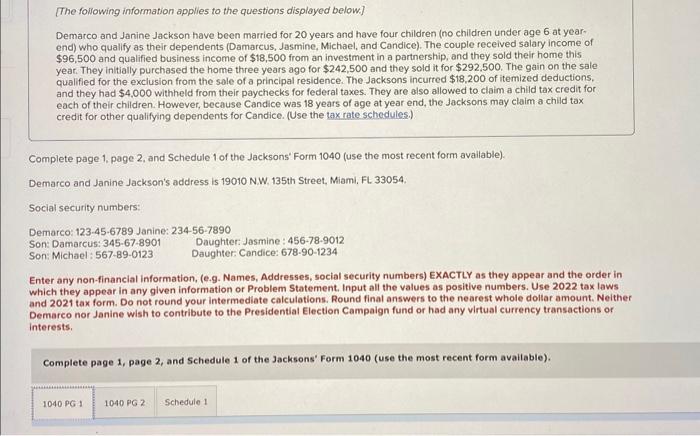

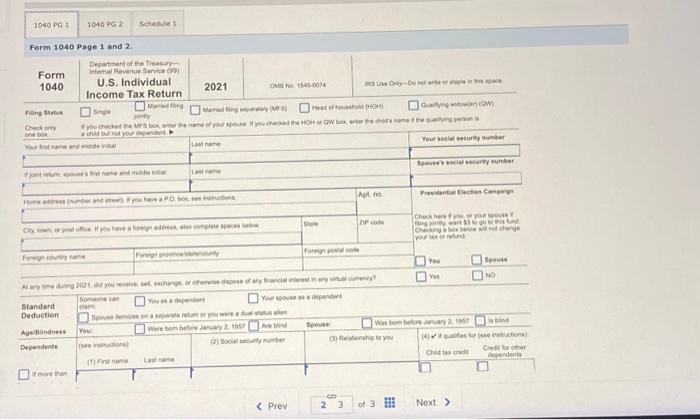

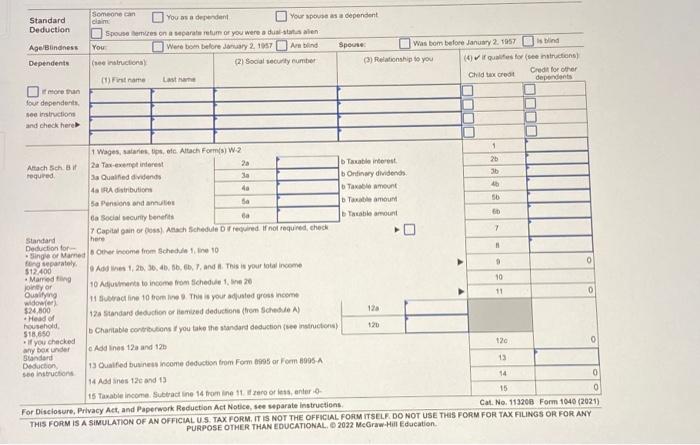

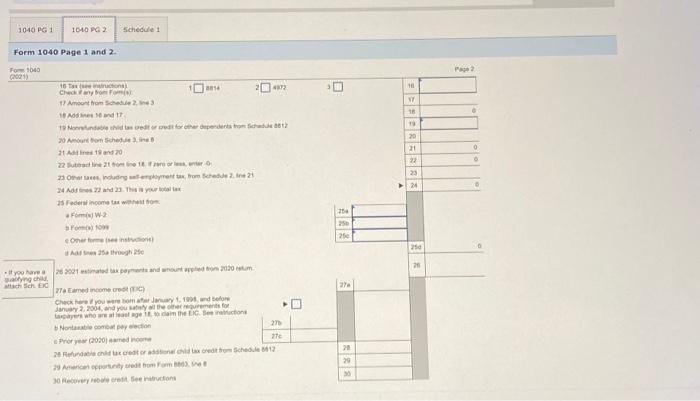

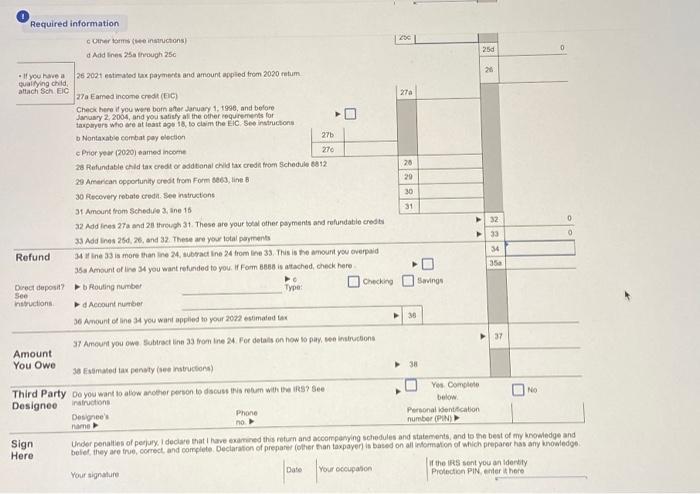

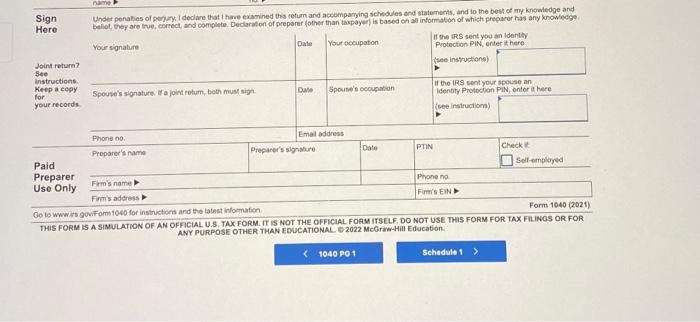

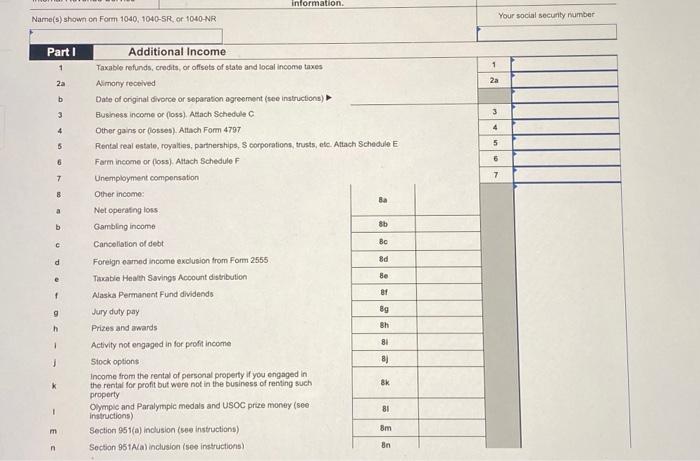

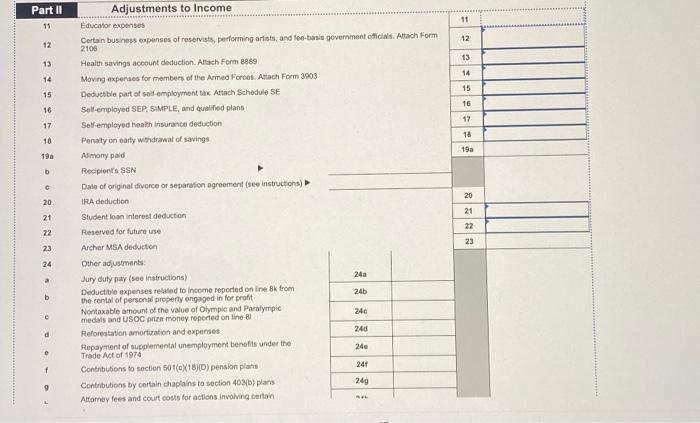

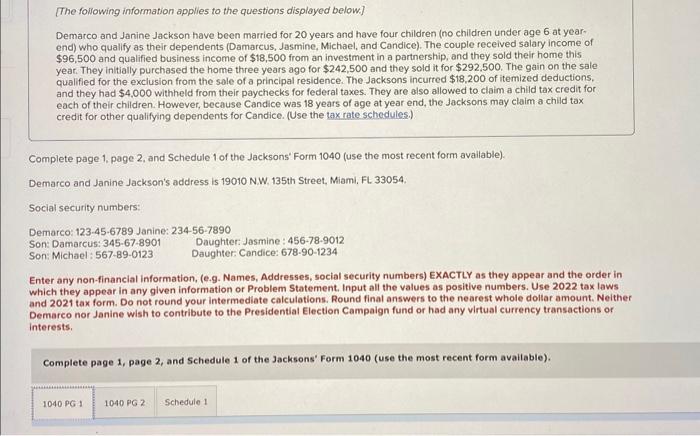

\[ 1040 \text { PG } 1 \longdiv { 1 0 4 0 \text { PG } 2 } \text { schedule } 1 \] Form 1040 Page 1 and 2. Fonesi) 9000 is Modiver se and 17 . so ancert bon sichediet 2 ines thedines to ans 20 25 federi income tax wethet boes: ofomivi w2 sfortan 100 is SOher forme isee instrustione) it Mar une 25 a troogh ase gavireg onid, ria Eamed income orede (roc); b Nontanable comovit par election 30 Hecorey rooks ersth see inibuctons Sig Her Your signature tomen ANY PURPOSE OTHER THAN EOUCATIONAL O2022 MeGraw-HIII Education. [The following information applies to the questions displayed below] Demarco and Janine Jackson have been married for 20 years and have four children (no children under age 6 at yearend) who qualify as their dependents (Damarcus, Jasmine, Michael, and Candice). The couple received salary income of $96,500 and qualified business income of $18,500 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $242,500 and they sold it for $292,500. The gain on the sale qualified for the exclusion from the sole of a principal residence. The Jacksons incurted $18,200 of itemized deductions. and they had $4,000 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice was 18 years of age at year end, the Jacksons may claim a child tax credit for other qualifying dependents for Candice. (Use the tax rate schedules.) Complete page 1, page 2, and Schedule 1 of the Jacksons' Form 1040 (use the most recent form available). Demarco and Janine Jackson's address is 19010 N.W. 135th Street, Miami, FL. 33054. Social security numbers: Demarco: 123-45-6789 Janine: 234567890 Son: Damarcus: 345678901 Daughter: Jasmine : 456-78-9012 Son: Michael : 567890123 Daughter: Candice: 678901234 Enter any non-financial information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear and the order in which they appear in any given information or Problem Statement. Input all the values as positive numbers. Use 2022 tax laws and 2021 tax form. Do not round your intermediate calculations. Round final answers to the nearest whole dollar amount. Neither Demarco nor Janine wish to contribute to the Presidential Election Campaign fund or had any virtual currency transactions or interests. Complete page 1, page 2, and Schedule 1 of the Jacksons' Form 1040 (use the most recent form available). Part II Adjustments to Income 15 Educator expensos 12 Cortan busness expanses of reservists, performing artists, and tee-basis government oflicis's. Altach Form 13 Health savings account deduction. Altach Form 8989 14 Moving expenaes for members of the Avmed Fordos: Attach Form 3903 15 Deductible part of sot-employment tax. Attach Schedule SE 16 Selt-emplayed SEP. SMMPLE, and qualined plans 17 Self-employed heaith insurance deduction 18 Penaty on early whadrawat of savings 19a Amony paid b Recipients SSN c. Dale of onginal divorce or separation agreement (see instructions) 20: IRA doduction 21 Student ioon interost deduction 22 Reserved for future use 23 Archer MSA deduction 24 Other adjustmants: Jury duty pay (see instructions) b Deductible expenses related to income reported on ine 8k from the rental of personal property angaged in for profit Nontaxable amount of the value of Olympie and Paralympic medals and USOC prize money repocted on line Bi Reforeatation amortization and expenses Repoyment of supplemental unemployment benofits under the Trade Act of 1974 Contributens to soction 501 (c) (18)(D) pension plans Contribubiens by cortain chaplains to section 403(b) plars Attorney fees and court costs for actions involving certain Name(s) showt on Form 1040,10405R or 1040NR Form 1040 page 1 and z