I NEED HELP ASAP

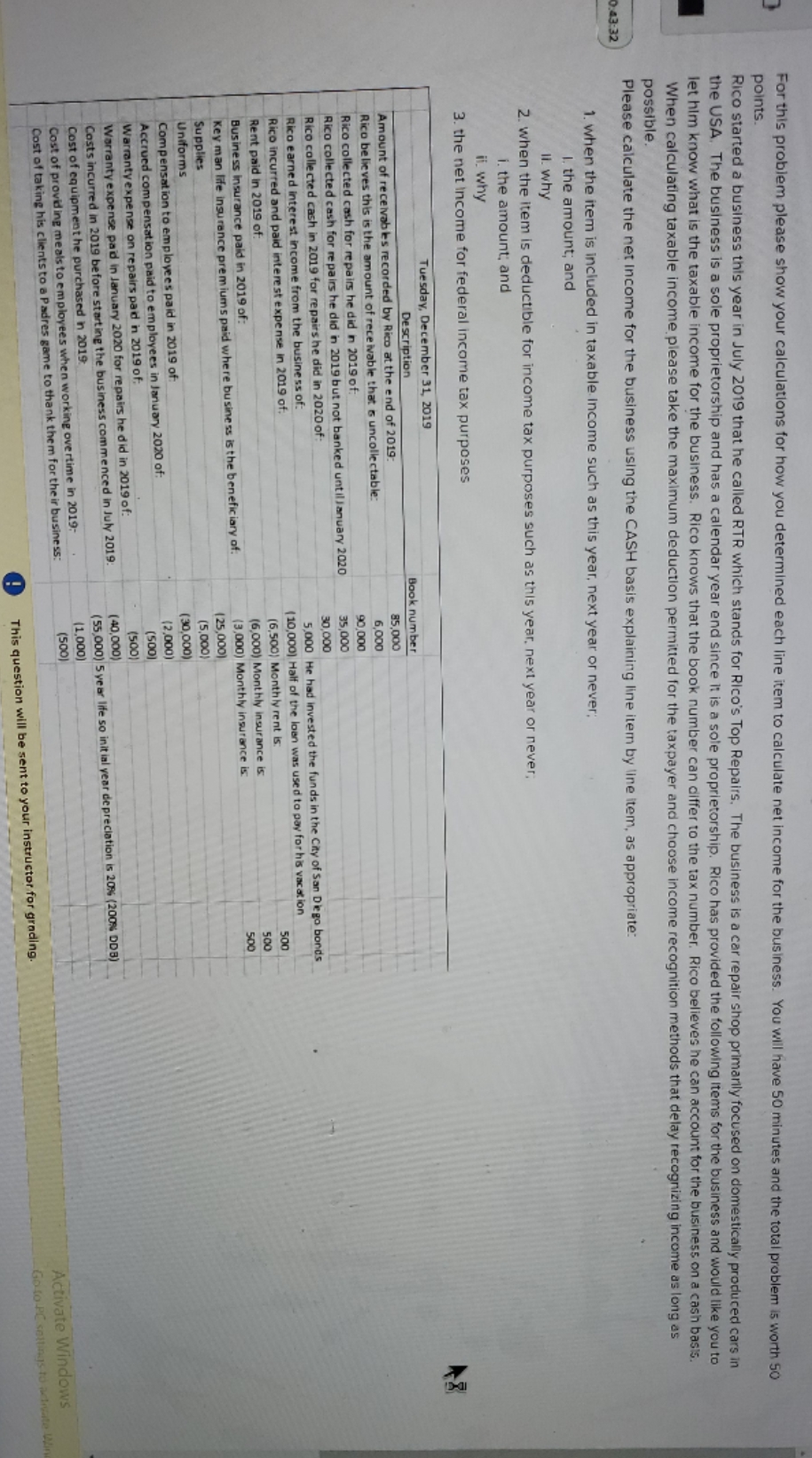

points. For this problem please show your calculations for how you determined each line item to calculate net income for the business. You will have 50 minutes and the total problem is worth 50 Rico started a business this year in July 2019 that he called RTR which stands for Rico's Top Repairs. The business is a car repair shop primarily focused on domestically produced cars in the USA. The business is a sole proprietorship and has a calendar year end since it is a sole proprietorship. Rico has provided the following items for the business and would like you to let him know what is the taxable income for the business. Rico knows that the book number can differ to the tax number. Rico believes he can account for the business on a cash basis. possible. When calculating taxable income, please take the maximum deduction permitted for the taxpayer and choose income recognition methods that delay recognizing income as long as ):43:32 Please calculate the net Income for the business using the CASH basis explaining line item by line item, as appropriate: 1. when the item is included in taxable Income such as this year, next year or never; I. the amount; and I1 . why 2. when the item is deductible for income tax purposes such as this year, next year or never, i. the amount; and it. why 3. the net Income for federal income tax purposes Tuesday, December 31, 2019 Description Book number Amount of receivables recorded by Rico at the end of 2019: 85,000 Rico believes this is the amount of receivable that & uncollectable: 6,000 Rico collected cash for repairs he did in 2019 of: 90,000 Rico collected cash for repairs he did in 2019 but not banked until January 2020 35,000 Rico collected cash in 2019 for repairs he did in 2020 of: 30,000 Rico earned interest income from the business of: 5,000 He had invested the funds in the City of San Diego bonds Rico incurred and paid interest expense in 2019 of. (10,000) Half of the loan was used to pay for his vacation Rent paid in 2019 of: (6,500) Monthly rent is: 500 Business insurance paid in 2019 of: (6,000) Monthly insurance is 500 Key man life insurance premiums paid where business is the beneficiary of. (3,000) Monthly insurance is 500 Supplies (25,000) Uniforms (5,000) Compensation to employees paid in 2019 of (30,000) Accrued compensation paid to employees in January 2020 of: (2,000) Warranty expense on repairs paid in 2019 of. (500] Warranty expense paid in January 2020 for repairs he did in 2019 of: 1500) Costs incurred in 2019 before starting the business commenced in July 2019. (40,000) Cost of equipment he purchased in 2019. 55,000) 5 year life so initial year depreciation is 20% (200% DDB) Cost of providing meals to employees when working overtime in 2019; (1,000) Cost of taking his clients to a Padres game to thank them for the ir business: (500) Activate Windows This question will be sent to your instructor for grading. Go to PC settings to activate Win