Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help asap.please post original answer not from someone else . Explain. 7-21 LO 2,3 The auditor for a fictional company, Johnston Wholesal- ing,

I need help asap.please post original answer not from someone else .

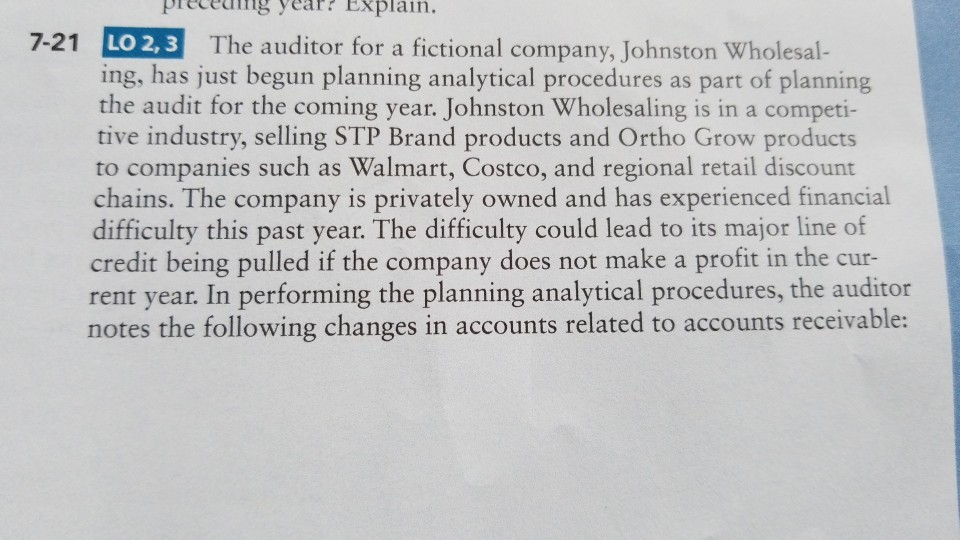

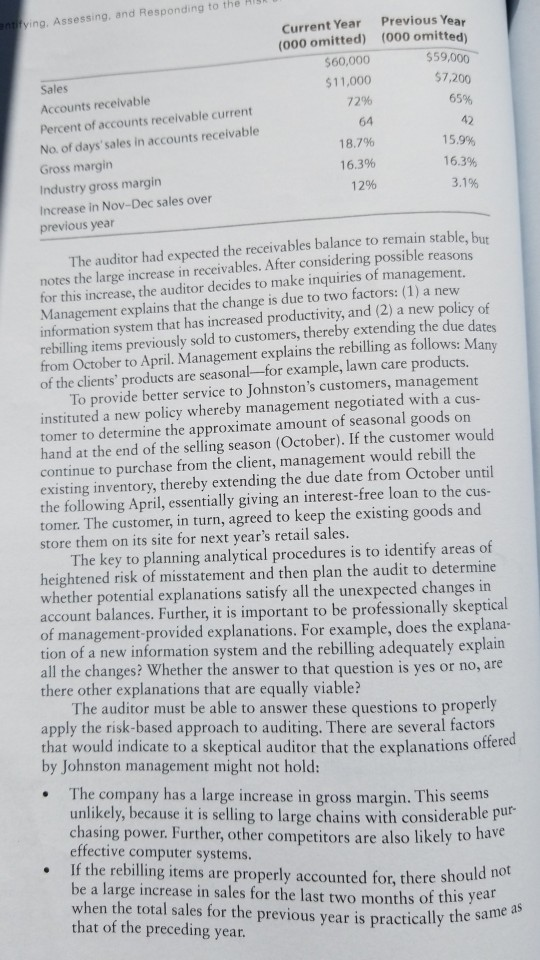

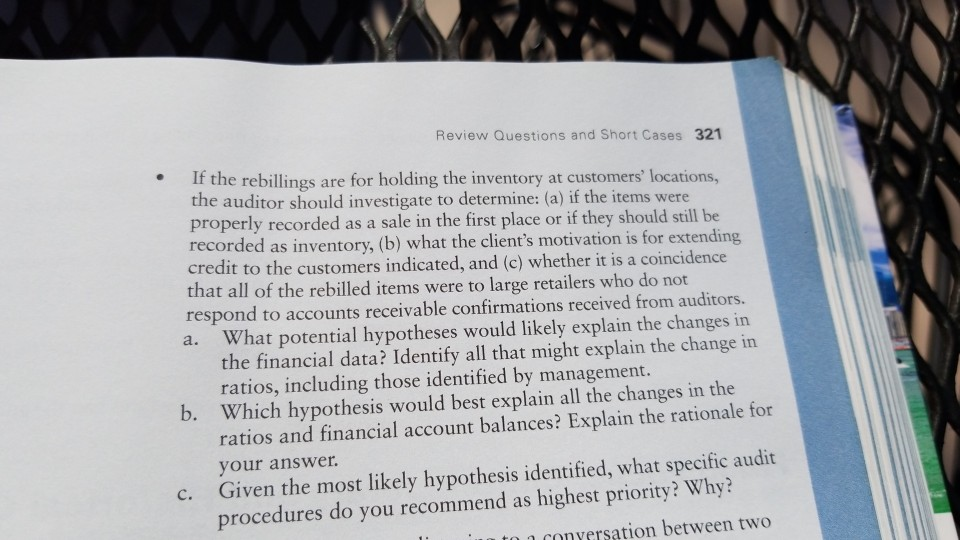

Explain. 7-21 LO 2,3 The auditor for a fictional company, Johnston Wholesal- ing, has just begun planning analytical procedures as part of planning the audit for the coming year. Johnston Wholesaling is in a competi- tive industry, selling STP Brand products and Ortho Grow products to companies such as Walmart, Costco, and regional retail discount chains. The company is privately owned and has experienced financial difficulty this past year. The difficulty could lead to its major line of credit being pulled if the company does not make a profit in the cur- rent year. In performing the planning analytical procedures, the auditor notes the following changes in accounts related to accounts receivable: 64 18.7% antering Assessing and Responding to the Current Year Previous Year (000 omitted) (000 omitted) $60,000 Sales $11,000 Accounts receivable 7296 Percent of accounts receivable current No. of days' sales in accounts receivable Gross margin 16.396 Industry gross margin 1296 Increase in Nov-Dec sales over previous year The auditor had expected the receivables balance to remain stable, but notes the large increase in receivables. After considering possible reasons for this increase, the auditor decides to make inquiries of management. Management explains that the change is due to two factors: (1) a new information system that has increased productivity, and (2) a new policy of rebilling items previously sold to customers, thereby extending the due dates from October to April. Management explains the rebilling as follows: Many of the clients' products are seasonal-for example, lawn care products. To provide better service to Johnston's customers, management instituted a new policy whereby management negotiated with a cus- tomer to determine the approximate amount of seasonal goods on hand at the end of the selling season (October). If the customer would continue to purchase from the client, management would rebill the existing inventory, thereby extending the due date from October until the following April, essentially giving an interest-free loan to the cus- tomer. The customer, in turn, agreed to keep the existing goods and store them on its site for next year's retail sales. The key to planning analytical procedures is to identify areas of heightened risk of misstatement and then plan the audit to determine whether potential explanations satisfy all the unexpected changes in account balances. Further, it is important to be professionally skeptical of management provided explanations. For example, does the explana- tion of a new information system and the rebilling adequately explain all the changes? Whether the answer to that question is yes or no, are there other explanations that are equally viable? The auditor must be able to answer these questions to properly apply the risk-based approach to auditing. There are several factors that would indicate to a skeptical auditor that the explanations offered by Johnston management might not hold: when the total sales for the previous year is practically the same as $59,000 $7,200 65% 42 15.9% 16.3% 3.1% The company has a large increase in gross margin. This seems unlikely, because it is selling to large chains with considerable pur- chasing power. Further, other competitors are also likely to have effective computer systems. If the rebilling items are properly accounted for, there should not be a large increase in sales for the last two months of this year . that of the preceding year. Review Questions and Short Cases 321 . a. If the rebillings are for holding the inventory at customers' locations, the auditor should investigate to determine: (a) if the items were properly recorded as a sale in the first place or if they should still be recorded as inventory, (b) what the client's motivation is for extending credit to the customers indicated, and (c) whether it is a coincidence that all of the rebilled items were to large retailers who do not respond to accounts receivable confirmations received from auditors. What potential hypotheses would likely explain the changes in the financial data? Identify all that might explain the change in ratios, including those identified by management. b. Which hypothesis would best explain all the changes in the ratios and financial account balances? Explain the rationale for your answer. Given the most likely hypothesis identified, what specific audit procedures do you recommend as highest priority? Why? conyersation between two CStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started