Answered step by step

Verified Expert Solution

Question

1 Approved Answer

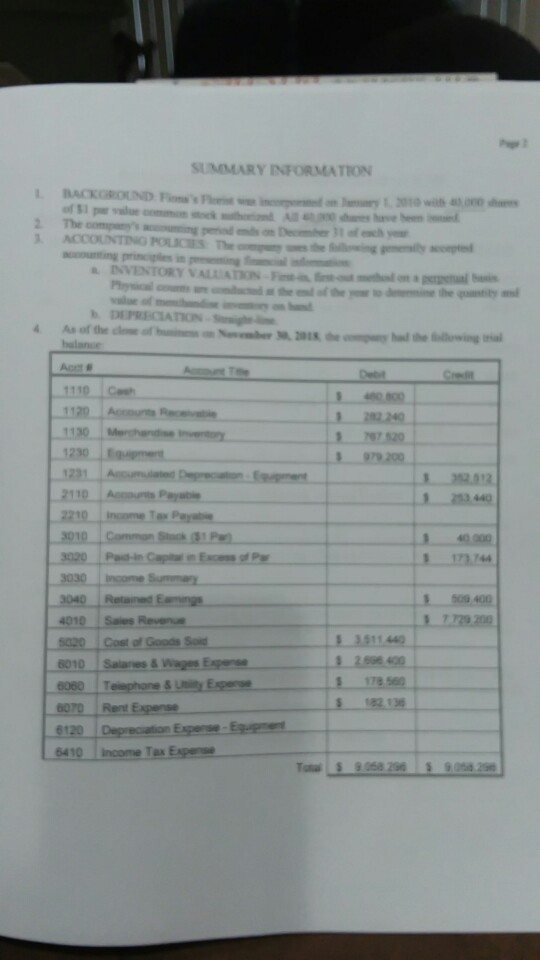

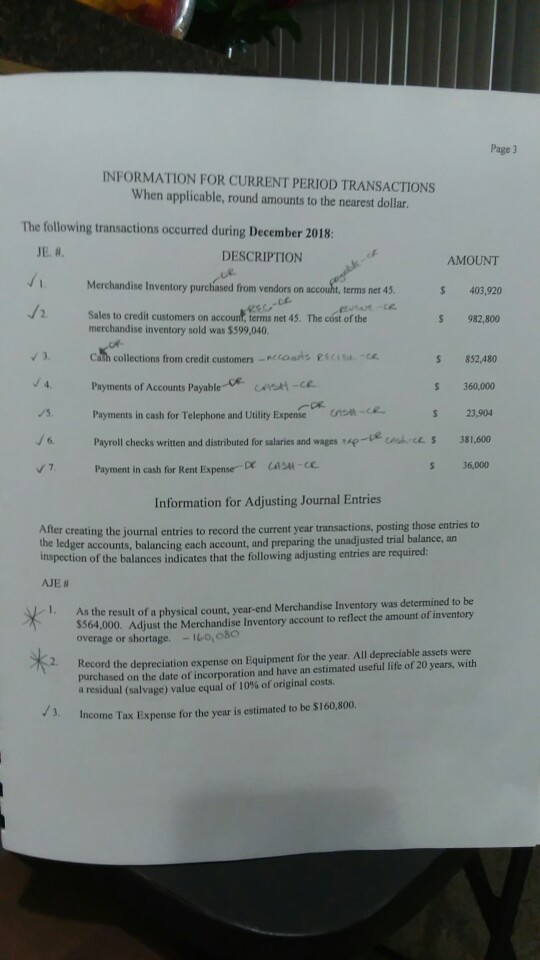

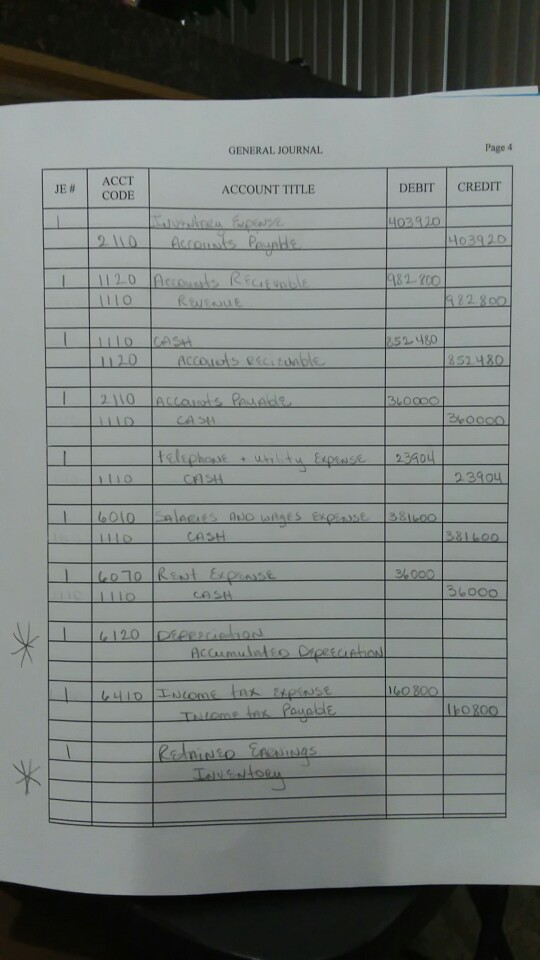

I need help completing general journal, General ledger, unadjusted trial balance, adjusted trial balance, income statement, statement of retained earnings, balance sheet, and post closing

I need help completing general journal, General ledger, unadjusted trial balance, adjusted trial balance, income statement, statement of retained earnings, balance sheet, and post closing trial balance. The post closing trial balance is not attached like the other pages.

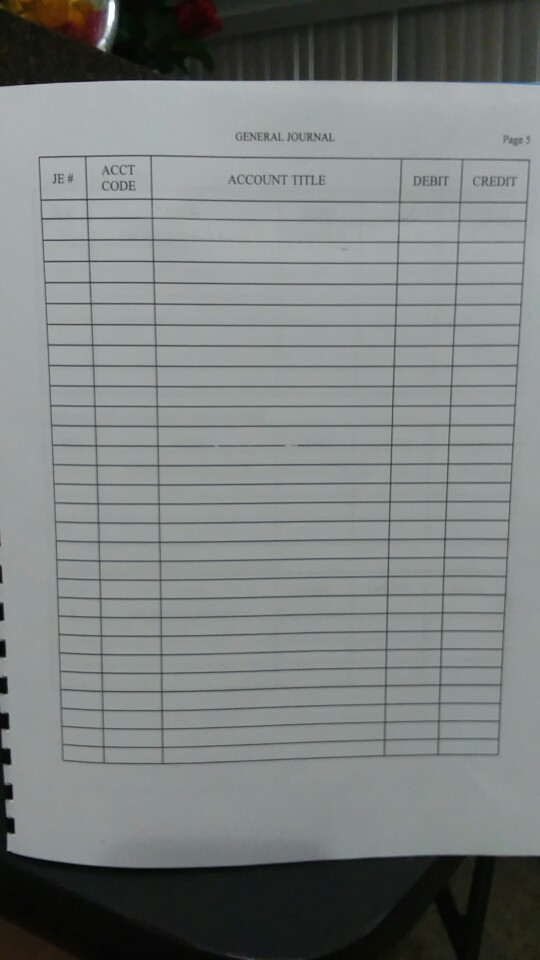

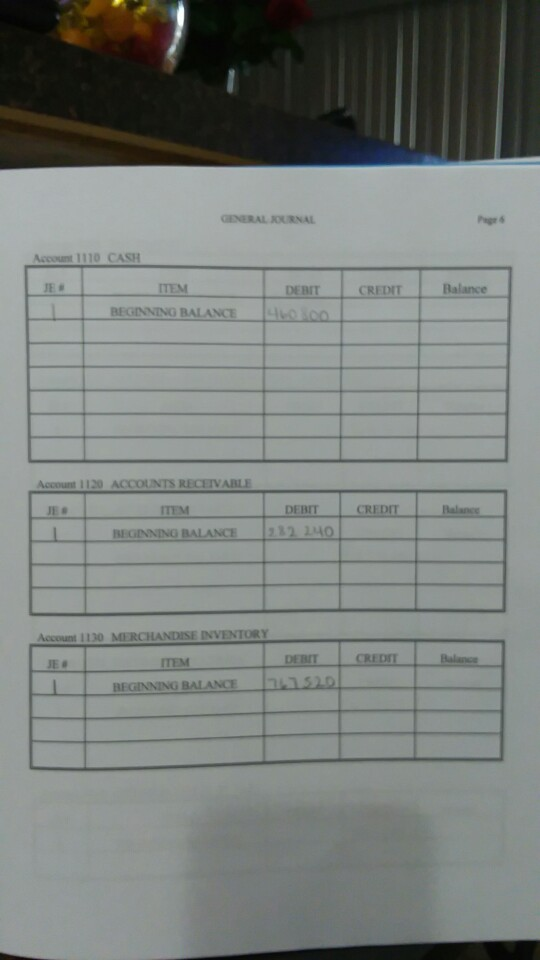

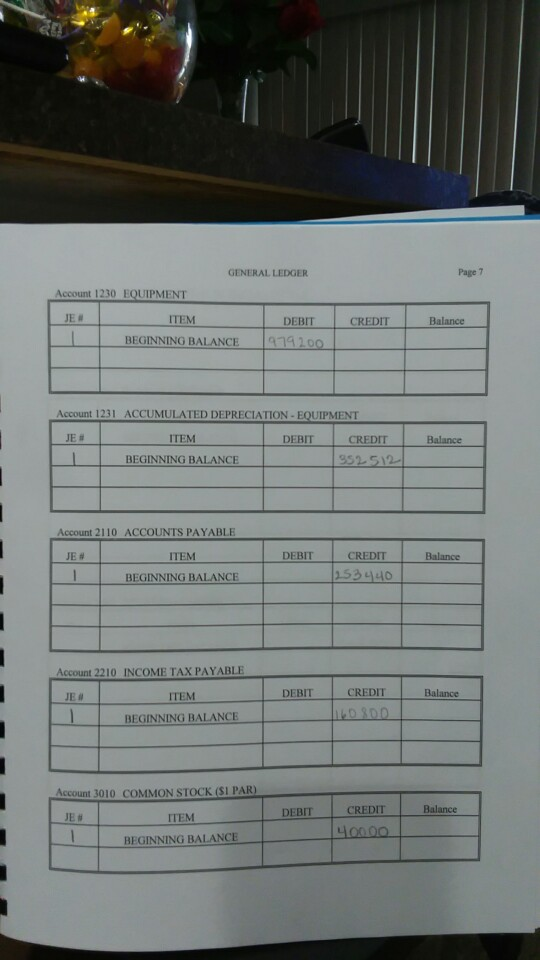

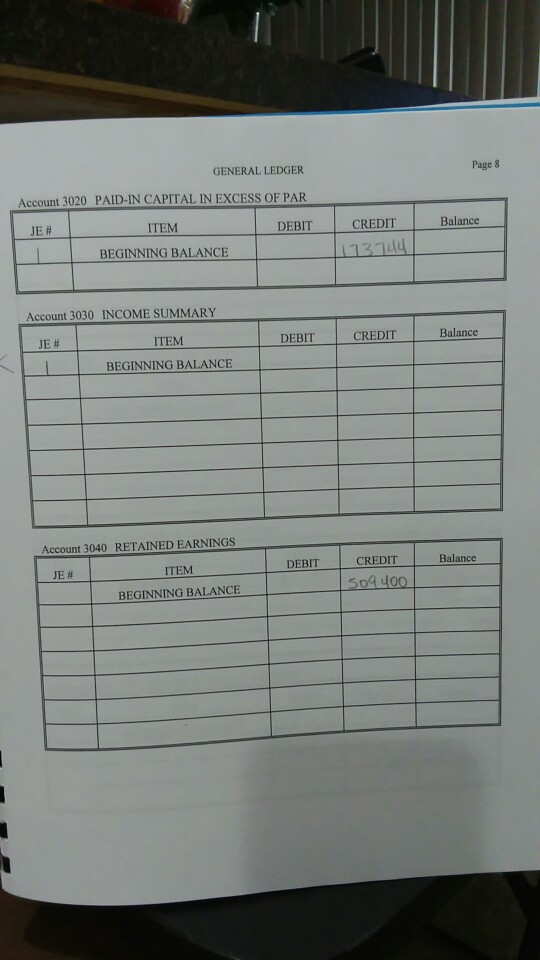

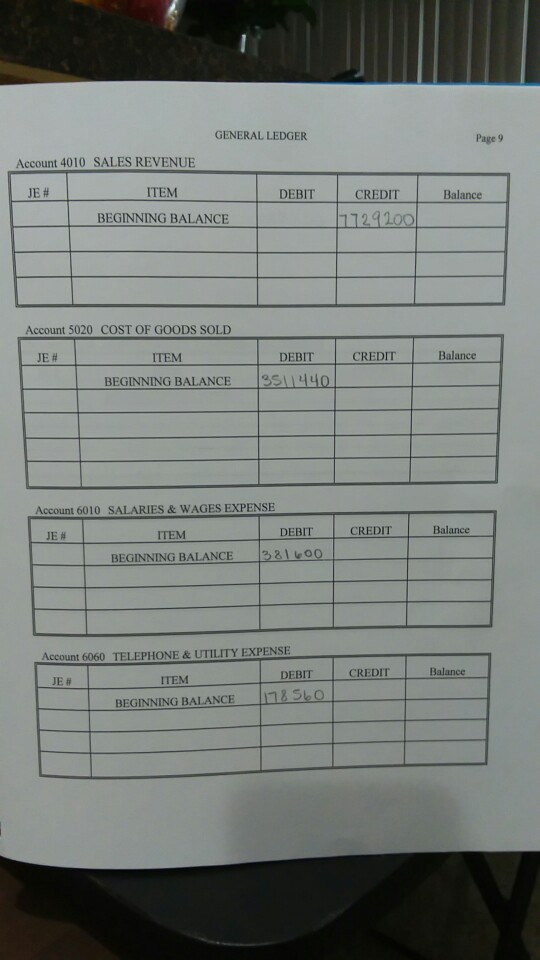

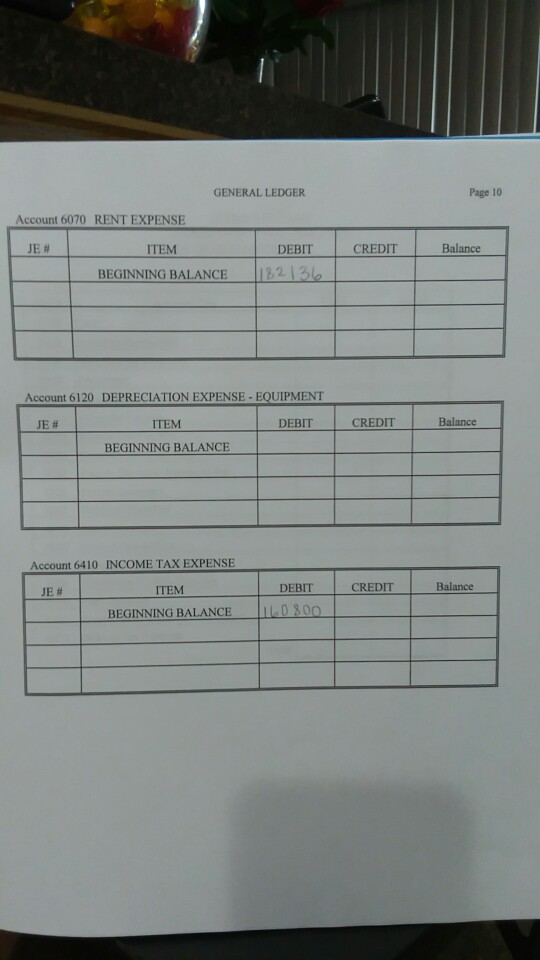

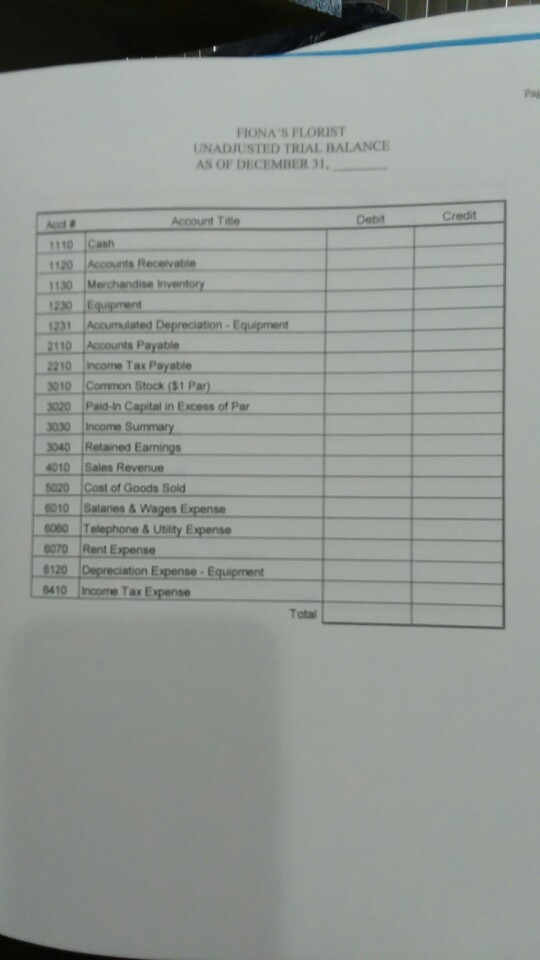

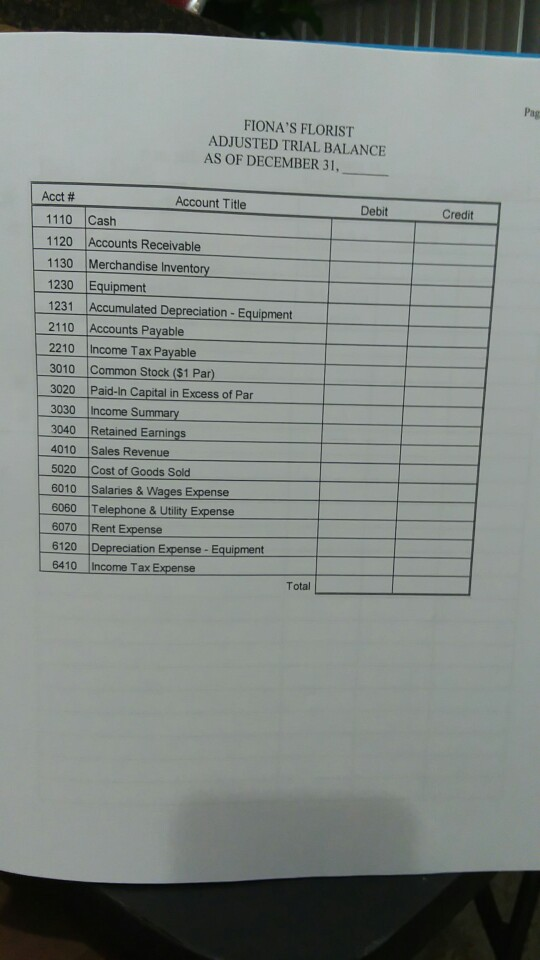

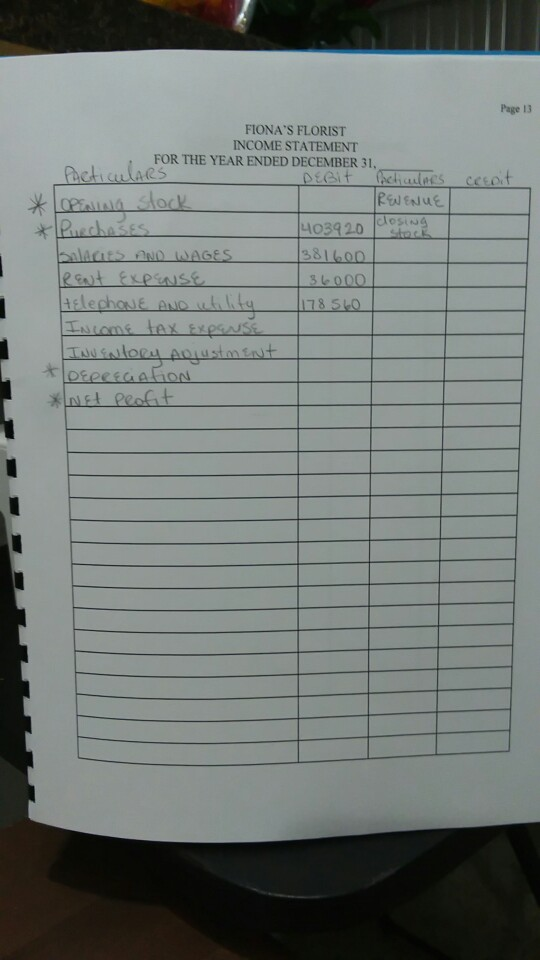

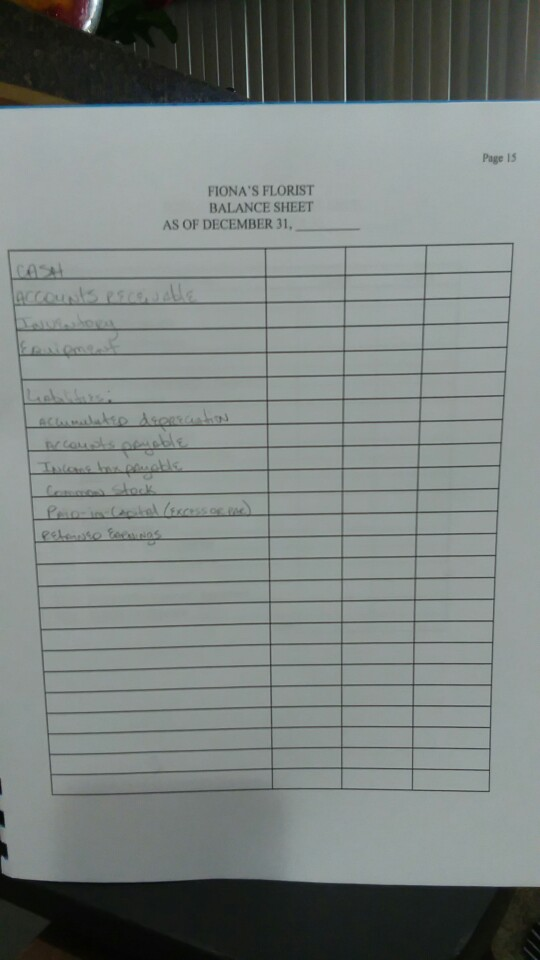

SUMMARY INFORMATIO of$11 value INVENTORY VALIATION-Fs- ou DEPRECIATION-Si Ace 110 Ce 2110 At Paya 123744 Retained E 509 400 4010 Saies Revee of Goods Sod 6010 Salaries & ages Esperse 60 Rent Expense 6410 linane Tax Page 3 NFORMATION FOR CURRENT PERIOD TRANSACTIONS When applicable, round amounts to the nearest dollar The following transactions occurred during December 2018: JE. W DESCRIPTION AMOUNT s 403,920 $ 982,800 852,480 360,000 S 23,904 6 Payroll checks written and distributed for salaries and wages ap-te ce c 381,600 Merchandise Inventory purchased from vendors on account, terms net 45. Sales to credit customers on accour terms net 45The cost of the merchandise inventory sold was $599,040 V 3. collections from credit customersncons ecie Payments of Accounts Payable -ce Payments in cash for Telephone and Uility ExpenseCA 36,000 Payment in cash for Rent Expense D CASH-CC Information for Adjusting Journal Entries After creating the journal entries to record the current year transactions, posting those entries to the ledger accounts, balancing each account, and inspect preparing the unadjusted trial balance, an ion of the balances indicates that the following adjusting entries are required AJE # As the result of a physical count, year-end Merchandise Inventory was deternined to be 5564,000. Adjust the Merchandise Inventory account to reflect the amount of inventory overage or shortage. -140,080 1. Record the depreciation expense on Equipment for the year. All depreciable assets were purchased on the date of incorporation and have an estimated useful life of 20 years, with a residual (salvage) value equal of 10% oforiginal costs. ncome Tax Expense for the year is estimated to be $160,800. Page 4 GENERAL JOURNAL ACCT JE# | CODE ACCOUNT TITLE DEBIT CREDIT 82-200 cA GENERAL JOURNAL Page 5 ACCT JE # 1 CODE ACCOUNT TITLE DEBIT CREDIT CENERAL JOURNAL ccont 1110 CASH JE# ITEM DEIT CREDIT Balance BEGINNING BALANCE Account 1120 ACCOUNTS RECEVABLE JE 8 ITEM BEGINNING BALANCE Account ii30 MERCHANDISE DEBIT CREDIT ITEM GENERAL LEDGER Page 7 Account 1230 EQUIPMENT ITEM DEBIT Balance BEGINNING BALANCE | 9n9 20 Account 1231 ACCUMULATED DEPRECIATION-EQUIPMENT JE# ITEM DEBIT CREDIT Balance BEGINNING BALANCE Account 2110 ACCOUNTS PAYABLE JE# ITEM DEBIT CREDIT Balance Account 2210 INCOME TAX PAYABLE ITEM DEBIT CREDIT Balance BEGINNING BALANCE Account 3010 COMMON STOCK (SI PAR CREDIT Balance ITEM BEGINNING BALANCE GENERAL LEDGER Account 3020 PAID-IN CAPITAL IN EXCESS OF PAR DEBIT Page 8 JE# ITEM CREDIT Balance Account 3030 INCOME SUMMARY JE# DEBIT CREDIT Balance BEGINNING BALANCE Account 3040 RETAINED EARNINGS ITEM DEBIT CREDIT Balance BEGINNING BALANCE GENERAL LEDGER Page 9 Account 4010 SALES REVENUE JE# ITEM DEBIT CREDIT Balance BEGINNING BALANCE Account 5020 COST OF GOODS SOLD JE# ITEM DEBIT CREDIT Balance Account 6010 SALARIES & WAGES EXPENSE JE # ITEM DEBIT Balance BEGINNING BALANCE 38100 060 TELEPHONE & UTLITY EXPENSE DEBIT CREDIT Balance JE# ITEM -1510 BEGINNING BALANCE GENERAL LEDGER Page 10 Account 6070 RENT EXPENSE JE# ITEM DEBIT CREDIT Balance BEGINNING BALANCE 1122 Account 6120 DEPRECIATION EXPENSE-EQUIPMENT JE# ITEM DEBIT CREDIT Balance BEGINNING BALANCE Account 6410 INCOME TAX EXPENSE ITEM DEBIT CREDIT Balance BEGINNING BALANCEILO 800 Pag FIONA'S FLORIST UNADJUSTED TRIAL BALANCE AS OF DECEMBER 31 Credit Account Title Debit 1110 Cash 120-AccountsRecevable M30-Merchandise Inventor. 230Eqipment 131. AccumulatedDefreciation-Equipment 10-AcourtsPayable 2210 Income Tax Peyable 3010 Common Stock ($1 Par) 3020 Paid-in Capital in Excess of Par 3030 Income Summary 3040 Retained Earnings 4010 Sales Revenue 5020 Cost of Goods Sold 9010 Salaries& Wages Expense 600 Telephone &Utility Expense 00 Rent Expense 8120 6410 Income Tax Expense Expense-Equipment Total Pag FIONA'S FLORIST ADJUSTED TRIAL BALANCE AS OF DECEMBER 31, . Acct # 1110 Cash 1120 Accounts Receivable Account Title Debit Credit 2110 Accounts Payable 2210 Income Tax Payable 3010 Common Stock ($1 Par) 3020 Paid-In Capital in Excess of Par 3030 Income Summary 3040 Retained Earnings 4010 Sales Revenue 5020 Cost of Goods Sold 6010 Salaries &Wages Expense 6060 Telephone &Utility Expense 6070 Rent Expense 6120 Depreciation Expense- Equipmert 6410 Income Tax Expense Total Page 13 FIONA'S FLORIST INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31 O. 381600 Page 14 FIONA'S FLORIST STATEMENT OF RETAINED EARNINGS FOR THE YEAR ENDED DECEMBER 31 Page IS FIONA'S FLORIST BALANCE SHEET AS OF DECEMBER 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started