i need help creating a formal report addressed to the CFO of the company containing your analysis and recommendations. Based off this information.

i need help creating a formal report addressed to the CFO of the company containing your analysis and recommendations. Based off this information.

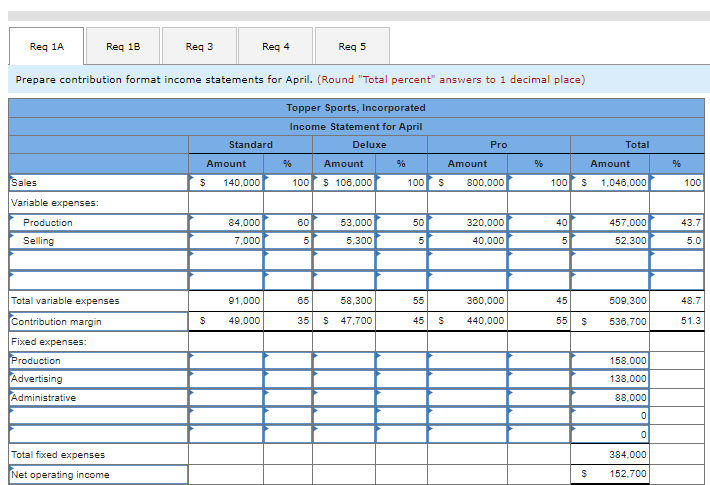

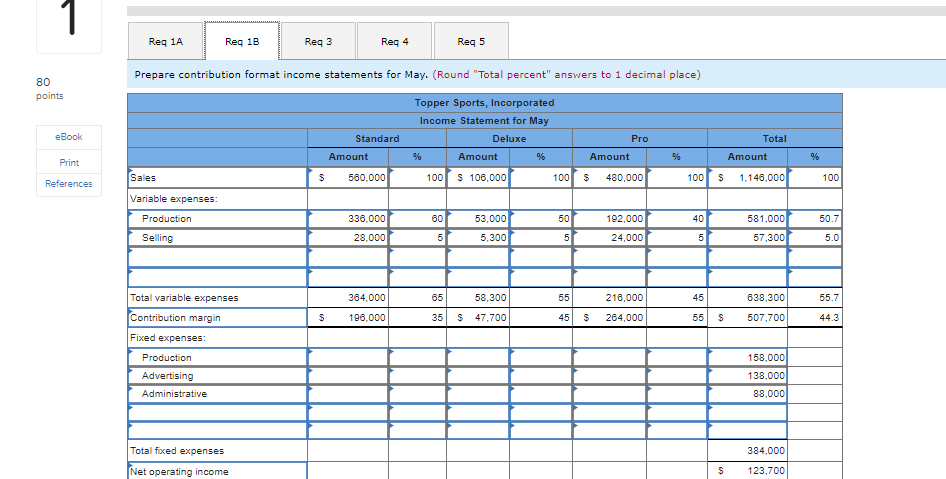

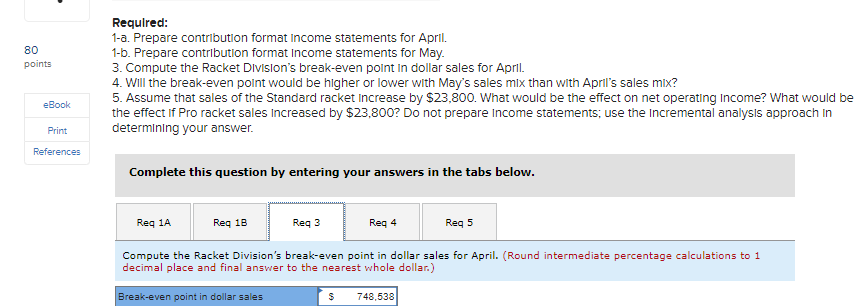

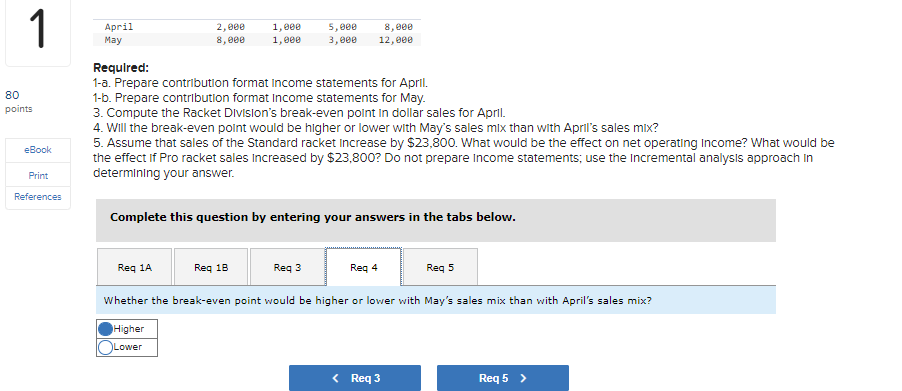

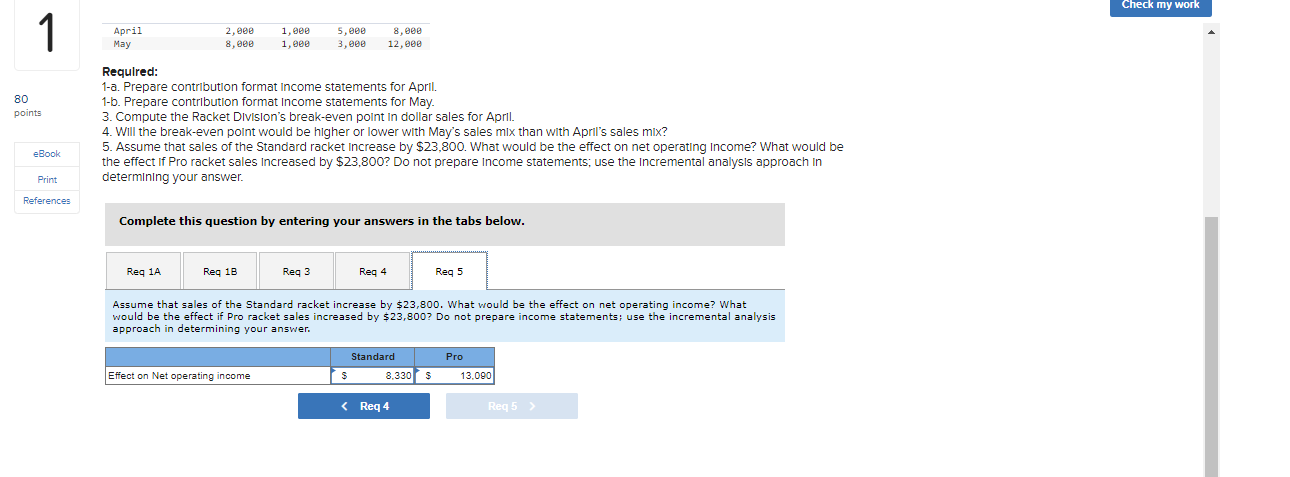

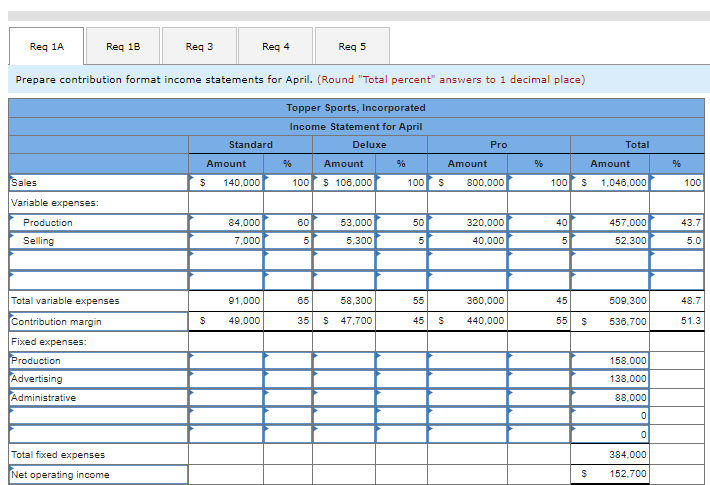

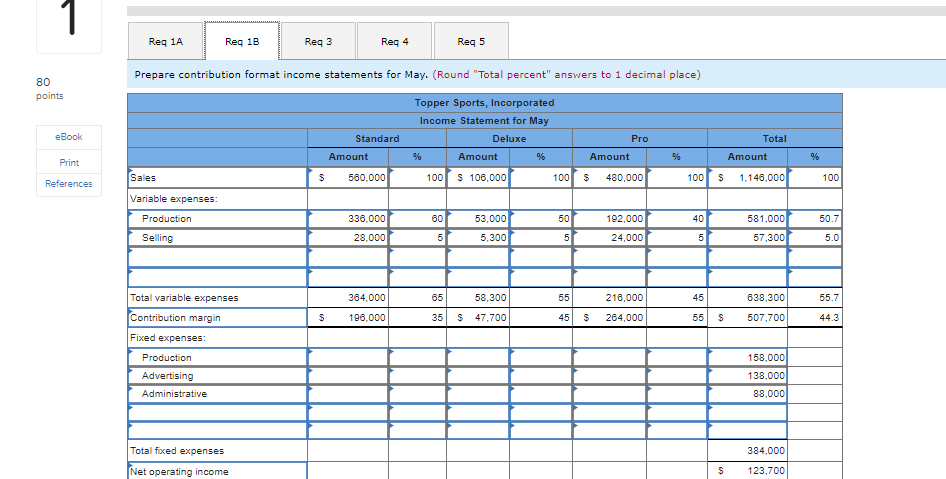

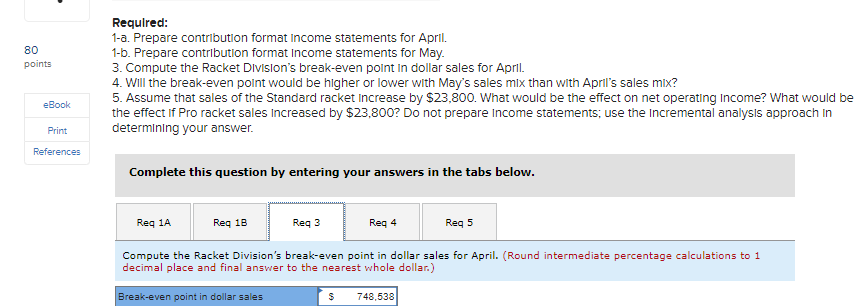

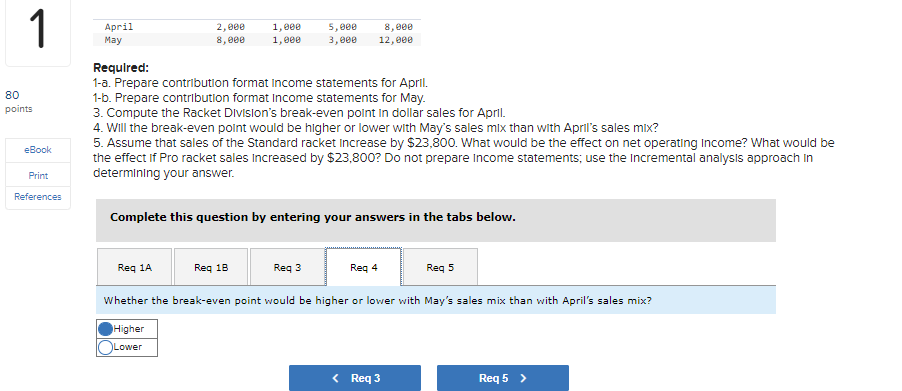

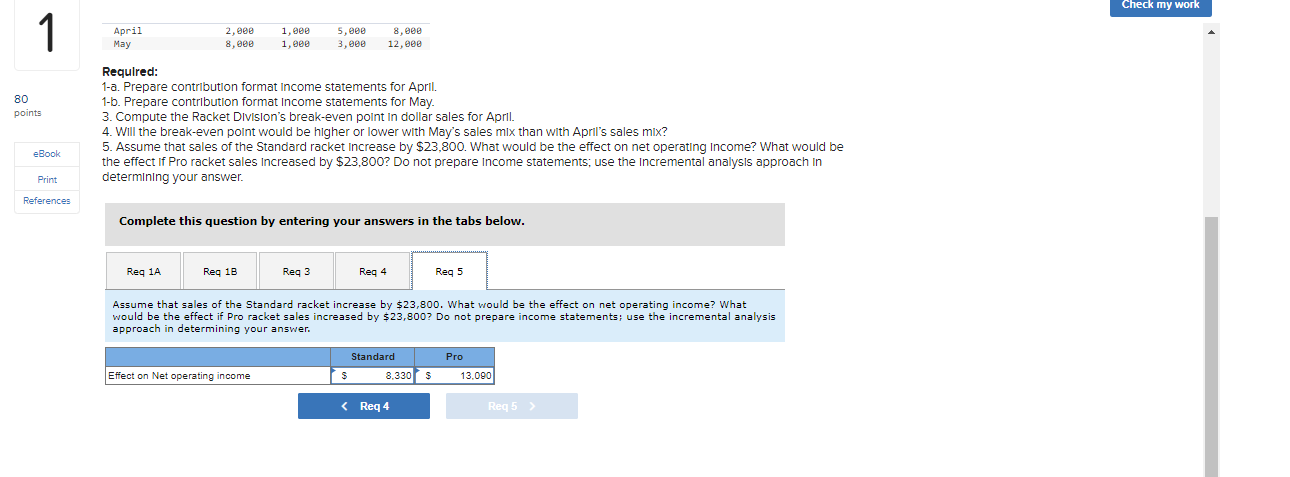

Reg 1A Reg 1B Reg 3 Reg 4 Reg 5 Prepare contribution format income statements for April. (Round "Total percent" answers to 1 decimal place) Topper Sports, Incorporated Income Statement for April Deluxe Standard Pro Amount % Amount % % Total Amount S 1,046,000 Amount s 800,000 % Sales s 140.000 100 $ 106,000 100 100 100 Variable expenses: Production 84,000 60 53,000 50 320,000 40 457.000 52.300 43.7 5.0 Selling 7,000 5 5,300 5 40.000 5 Total variable expenses 91,000 65 58,300 55 360,000 45 509.300 48.7 Contribution margin s 49,000 35 $ 47,700 45 S 440.000 55 S 536.700 51.3 Fixed expenses Production 158,000 138.000 Advertising Administrative 88.000 0 0 Total fixed expenses 384.000 Net operating income s 152.700 Reg 1A Reg 1B Reg 3 Reg 4 Reg 5 Prepare contribution format income statements for May. (Round "Total percent" answers to 1 decimal place) 80 points Topper Sports, Incorporated Income Statement for May Deluxe % Amount % eBook Total Standard Amount Pro Amount % Print Amount % Sales $ 560,000 100 100 $ 106,000 $ References 480,000 100 S 1.140,000 100 Variable expenses 336.000 60 53,000 50 192,000 40 581,000 50.7 Production Selling 28.000 5 5.300 5 24,000 5 57.300 5.0 384.000 65 58,300 55 45 638,300 55.7 216,000 264,000 s 196.000 35 $ 47.700 45 $ 55 S 507,700 44.3 Total variable expenses Contribution margin Fixed expenses: Production Advertising Administrative 158,000 138,000 88,000 Total fixed expenses 384,000 Net operating income $ 123.700 80 points Required: 1-a. Prepare contribution format Income statements for April. 1-b. Prepare contribution format Income statements for May 3. Compute the Racket Division's break-even point in dollar sales for April. 4. Will the break-even point would be higher or lower with May's sales mix than with April's sales mix? 5. Assume that sales of the Standard racket increase by $23,800. What would be the effect on net operating Income? What would be the effect if Pro racket sales increased by $23,800? Do not prepare Income statements; use the incremental analysis approach in determining your answer. eBook Print References Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 3 Reg 4 Reg 5 Compute the Racket Division's break-even point in dollar sales for April. (Round intermediate percentage calculations to 1 decimal place and final answer to the nearest whole dollar.) Break-even point in dollar sales $ 748,538 1 April May 2,000 8, eee 1, eee 1, eee 5, eee 3,000 8, eee 12,000 80 points Required: 1-a. Prepare contribution format Income statements for April. 1-b. Prepare contribution format Income statements for May. 3. Compute the Racket Division's break-even point in dollar sales for April. 4. Will the break-even point would be higher or lower with May's sales mix than with April's sales mix? 5. Assume that sales of the Standard racket increase by $23,800. What would be the effect on net operating Income? What would be the effect if Pro racket sales increased by $23,800? Do not prepare Income statements, use the incremental analysis approach in determining your answer. eBook Print References Complete this question by entering your answers in the tabs below. Req 1A Req 1B Reg 3 Req 4 Reg 5 Whether the break-even point would be higher or lower with May's sales mix than with April's sales mix? Higher Lower Check my work April May 2, eee 8, eee 1, eee 1. eee 5, eee 3. eee 8, eee 12,000 80 points Required: 1-a. Prepare contribution format Income statements for April. 1-b. Prepare contribution format Income statements for May. 3. Compute the Racket Division's break-even point in dollar sales for April. 4. Will the break-even point would be higher or lower with May's sales mix than with April's sales mix? 5. Assume that sales of the Standard racket Increase by $23.800. What would be the effect on net operating Income? What would be the effect if Pro racket sales increased by $23,800? Do not prepare Income statements, use the incremental analysis approach in determining your answer. eBook Print References Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 3 Reg 4 Reg 5 Assume that sales of the Standard racket increase by $23,800. What would be the effect on net operating income? What would be the effect if Pro racket sales increased by $23,800? Do not prepare income statements; use the incremental analysis approach in determining your answer. Standard 8.330 $ Pro 13.090 Effect on Net operating income Check my work April May 2, eee 8, eee 1, eee 1. eee 5, eee 3. eee 8, eee 12,000 80 points Required: 1-a. Prepare contribution format Income statements for April. 1-b. Prepare contribution format Income statements for May. 3. Compute the Racket Division's break-even point in dollar sales for April. 4. Will the break-even point would be higher or lower with May's sales mix than with April's sales mix? 5. Assume that sales of the Standard racket Increase by $23.800. What would be the effect on net operating Income? What would be the effect if Pro racket sales increased by $23,800? Do not prepare Income statements, use the incremental analysis approach in determining your answer. eBook Print References Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 3 Reg 4 Reg 5 Assume that sales of the Standard racket increase by $23,800. What would be the effect on net operating income? What would be the effect if Pro racket sales increased by $23,800? Do not prepare income statements; use the incremental analysis approach in determining your answer. Standard 8.330 $ Pro 13.090 Effect on Net operating income

i need help creating a formal report addressed to the CFO of the company containing your analysis and recommendations. Based off this information.

i need help creating a formal report addressed to the CFO of the company containing your analysis and recommendations. Based off this information.