i need help doing part c.

i posted before but it was solved with values from another question.

please use these values its a waste of my questions.

please solve part c 1

this is the full data!!

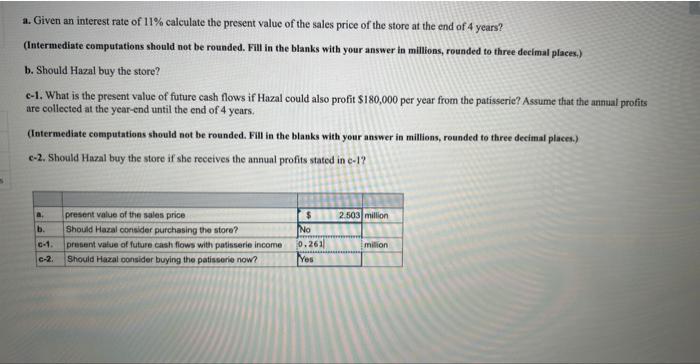

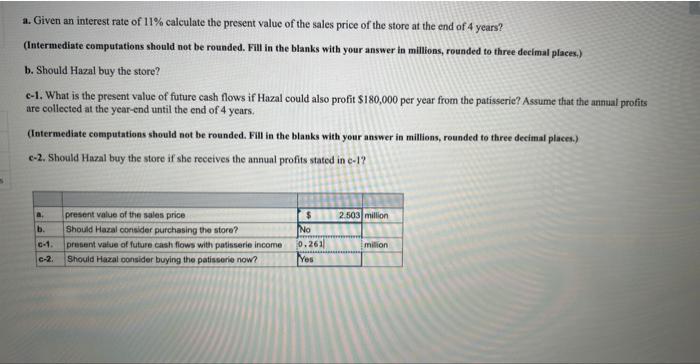

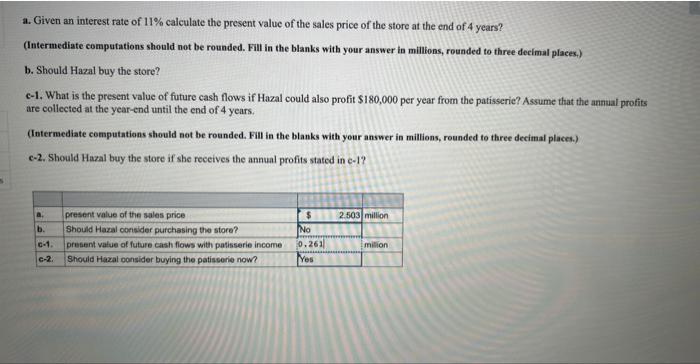

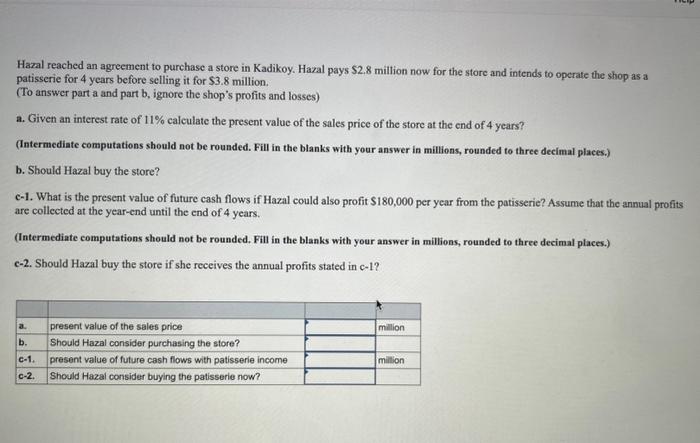

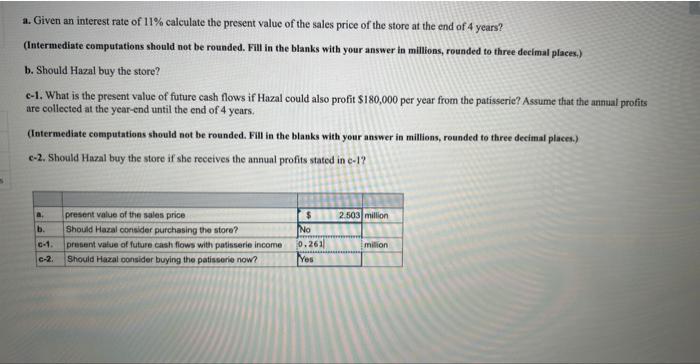

please dont solve for values of another question

a. Given an interest rate of 11% calculate the present value of the sales price of the store at the end of 4 years? (Intermediate computations should not be rounded. Fill in the blanks with your answer in millions, rounded to three deeimal places.) b. Should Hazal buy the store? c-1. What is the present value of future cash flows if Hazal could also profit $180,000 per year from the patisserie? Assume that the anmual profits are collected at the year-end until the end of 4 years. (Intermediate computations should not be rounded. Fill in the blanks with your answer in millions, rounded to three decimal place.) c-2. Should Hazal buy the store if she receives the annual profits stated in c-1? a. Given an interest rate of 11% calculate the present value of the sales price of the store at the end of 4 years? (Intermediate computations should not be rounded. Fill in the blanks with your answer in millions, rounded to three deeimal places.) b. Should Hazal buy the store? c-1. What is the present value of future cash flows if Hazal could also profit $180,000 per year from the patisserie? Assume that the anmual profits are collected at the year-end until the end of 4 years. (Intermediate computations should not be rounded. Fill in the blanks with your answer in millions, rounded to three decimal place.) c-2. Should Hazal buy the store if she receives the annual profits stated in c-1? Hazal reached an agreement to purchase a store in Kadikoy. Hazal pays $2.8 million now for the store and intends to operate the shop as a patisserie for 4 years before selling it for $3.8 million. (To answer part a and part b, ignore the shop's profits and losses) a. Given an interest rate of 11% calculate the present value of the sales price of the store at the end of 4 years? (Intermediate computations should not be rounded. Fill in the blanks with your answer in millions, rounded to three decimal places.) b. Should Hazal buy the store? c-1. What is the present value of future cash flows if Hazal could also profit $180,000 per year from the patisserie? Assume that the annual profits are collected at the year-end until the end of 4 years. (Intermediate computations should not be rounded. Fill in the blanks with your answer in millions, rounded to three decimal places.) c-2. Should Hazal buy the store if she receives the annual profits stated in c-1