I need help figuring out (C) in the first part and help with filling out the form.

I need help figuring out (C) in the first part and help with filling out the form.

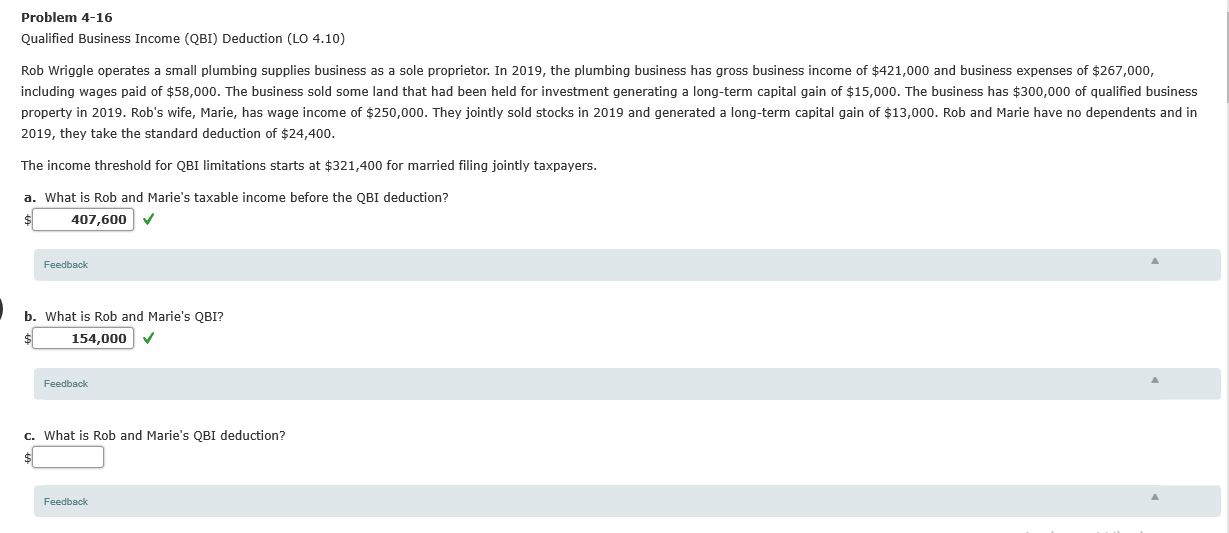

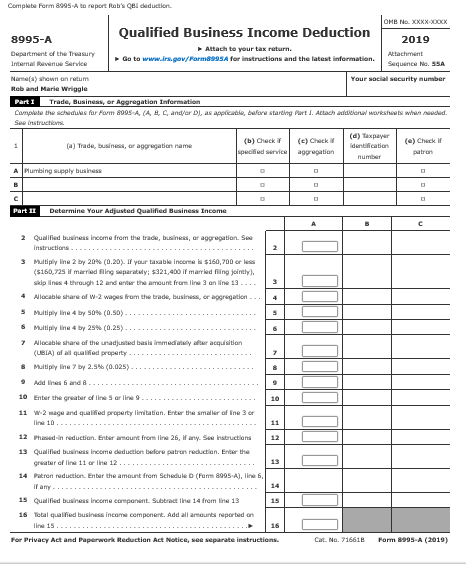

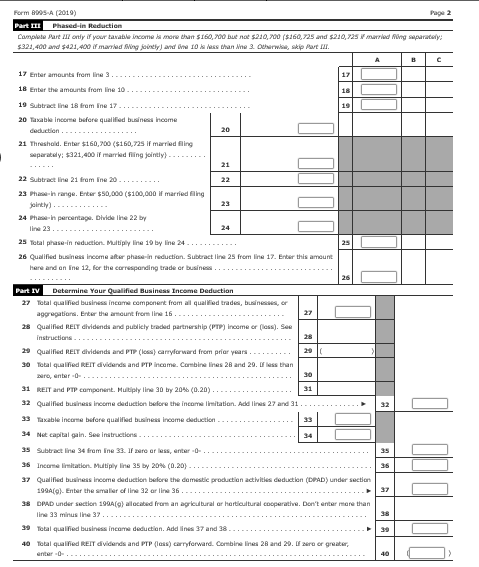

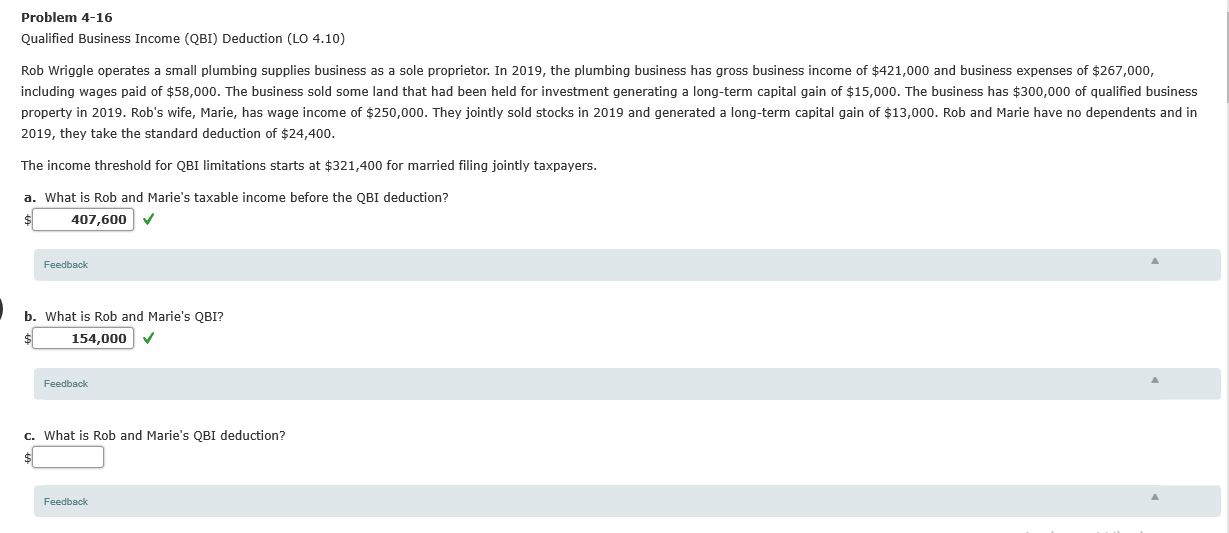

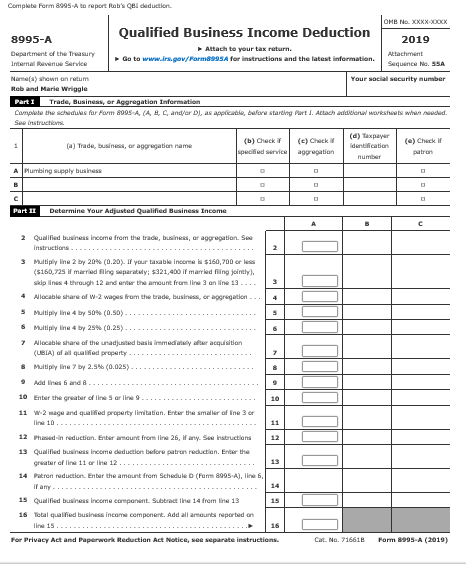

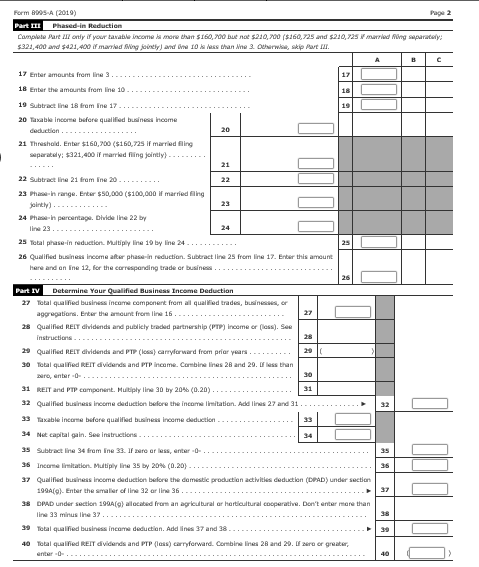

Problem 4-16 Qualified Business Income (QBI) Deduction (LO 4.10) Rob Wriggle operates a small plumbing supplies business as a sole proprietor. In 2019, the plumbing business has gross business income of $421,000 and business expenses of $267,000, including wages paid of $58,000. The business sold some land that had been held for investment generating a long-term capital gain of $15,000. The business has $300,000 of qualified business property in 2019. Rob's wife, Marie, has wage income of $250,000. They jointly sold stocks in 2019 and generated a long-term capital gain of $13,000. Rob and Marie have no dependents and in 2019, they take the standard deduction of $24,400. The income threshold for QBI limitations starts at $321,400 for married filing jointly taxpayers. a. What is Rob and Marie's taxable income before the QBI deduction? $ 407,600 V Feedback b. What is Rob and Marie's QBI? $ 154,000 Feedback c. What is Rob and Marie's QBI deduction? Feedback Como por el deduction Qualified Business Income Deduction 8995-A 2019 Go to www.irepov/Forms for instructions and the latest information r ty ube Your wo Rob and Marie Wriggle Parts Trade, Business, or Aggregation Information Cam the schedules for Form 1995 A (A . Candor DL, as applicable before starting Part I. Attach aditional work was de (e) Check (a) Trade, bus , or aggregation name (b) Check specified service (c) Check aggregation (d) Taxpayer Identification number A ubing ly business Part II Determine Your Adjusted Qualified Business Income 2 3 Qualified business income from the trade, business, or aggregation. See Instructions.. Multiply line 2 by 20 (0.20). If your taxable income $160,700 or less ($160,725 f married filing separately: $921,400 if married filing jointly skip lines 4 though 12 and are the amount from line 3 on line 13.. 4 Allocable share of W-2 wages from the trade, business, or aggregation... 5 6 Multiply line 4 by 50 (0.50)... Multiply line 4 by 2 (0.25)... Alacable share of the na t (RIA) of al t y 7 ivmedy er acquisition & Multiply line by 2.5 (0.025)......... 10 ter the greater of lines or line... 11 w 2 wage and qualified property limitation Enter the smaller af line 3 10. 12 P 13 r oduction, the amount from line 25 any. See Instructions Qualified business income deduction before patron reduction Enter the 14 Production Enter the amount from Schedule ( 2995 Alines 15 Quad 16 Wal income component. Subtract line 14 from line 13 d besincome component Add alla portadan For Privacy Act and Paperwork Reduction Act Notice, se separate instructions C 7 16618 Form 8905-A (2019) FormA 2010) Part 1 Phase Reduction Came ly of your income more than ISO200 to $210.00 $160,725 and 210,725 m 2. and 100 Ort g 17 metromine..... 20 Incore bore qualified business income Geduction 21 Threshold er 160.00 (5160725 married filing ry : 321,00 d ing jointly). married filing 22 Subtract line 21 from ine 20......... 23 P inranger s ($100,000 intly). 24 Phin percentage Divide line 22 by 25 Total phase in reduction Multiply line 10 by line 24....... 26 Qualified b oss income after phase in reduction Subtractine 25 from line 17. Enter this amount here and an ine 12, for the corresponding trade or business..... Part IV Determine Your Qualified Business Income Deduction 27 Total qualified business income component from all qualed trades, businesses, or aggregation in the amount from line 16 28 Qualified REET dividends and publicly traded partnership (PTP) income or (less). See instructions. 20 Quailed RELY dividends and PTP( ) carryforward from prior years........ 30 Total qualified REIT dividends and PTP income. Combineres 28 and 29. less than anter 31 REIT and PTP component. Multiply line 30 by 20% (0.20)..... 32 Qualified business income deduction before the income imitation Adelines 27 and 31 . 33 Sabie Income before qualified business income deduction 34 Nu capital gain. See Instructions..... .. 35 Subtract line 34 from ine 33. eressenter 35 Incarn a tion in 35 by 2014 (20) --- 37 Quad income deduction before the domestic production active deduction (DD ) under section G) the fine 32 3 38 CAD under section L o cated from an agricul t ural cooperate. Don't meet 40 a REIT dvigs and PTP ) forward Ga i nes 28 and 29. or greater Problem 4-16 Qualified Business Income (QBI) Deduction (LO 4.10) Rob Wriggle operates a small plumbing supplies business as a sole proprietor. In 2019, the plumbing business has gross business income of $421,000 and business expenses of $267,000, including wages paid of $58,000. The business sold some land that had been held for investment generating a long-term capital gain of $15,000. The business has $300,000 of qualified business property in 2019. Rob's wife, Marie, has wage income of $250,000. They jointly sold stocks in 2019 and generated a long-term capital gain of $13,000. Rob and Marie have no dependents and in 2019, they take the standard deduction of $24,400. The income threshold for QBI limitations starts at $321,400 for married filing jointly taxpayers. a. What is Rob and Marie's taxable income before the QBI deduction? $ 407,600 V Feedback b. What is Rob and Marie's QBI? $ 154,000 Feedback c. What is Rob and Marie's QBI deduction? Feedback Como por el deduction Qualified Business Income Deduction 8995-A 2019 Go to www.irepov/Forms for instructions and the latest information r ty ube Your wo Rob and Marie Wriggle Parts Trade, Business, or Aggregation Information Cam the schedules for Form 1995 A (A . Candor DL, as applicable before starting Part I. Attach aditional work was de (e) Check (a) Trade, bus , or aggregation name (b) Check specified service (c) Check aggregation (d) Taxpayer Identification number A ubing ly business Part II Determine Your Adjusted Qualified Business Income 2 3 Qualified business income from the trade, business, or aggregation. See Instructions.. Multiply line 2 by 20 (0.20). If your taxable income $160,700 or less ($160,725 f married filing separately: $921,400 if married filing jointly skip lines 4 though 12 and are the amount from line 3 on line 13.. 4 Allocable share of W-2 wages from the trade, business, or aggregation... 5 6 Multiply line 4 by 50 (0.50)... Multiply line 4 by 2 (0.25)... Alacable share of the na t (RIA) of al t y 7 ivmedy er acquisition & Multiply line by 2.5 (0.025)......... 10 ter the greater of lines or line... 11 w 2 wage and qualified property limitation Enter the smaller af line 3 10. 12 P 13 r oduction, the amount from line 25 any. See Instructions Qualified business income deduction before patron reduction Enter the 14 Production Enter the amount from Schedule ( 2995 Alines 15 Quad 16 Wal income component. Subtract line 14 from line 13 d besincome component Add alla portadan For Privacy Act and Paperwork Reduction Act Notice, se separate instructions C 7 16618 Form 8905-A (2019) FormA 2010) Part 1 Phase Reduction Came ly of your income more than ISO200 to $210.00 $160,725 and 210,725 m 2. and 100 Ort g 17 metromine..... 20 Incore bore qualified business income Geduction 21 Threshold er 160.00 (5160725 married filing ry : 321,00 d ing jointly). married filing 22 Subtract line 21 from ine 20......... 23 P inranger s ($100,000 intly). 24 Phin percentage Divide line 22 by 25 Total phase in reduction Multiply line 10 by line 24....... 26 Qualified b oss income after phase in reduction Subtractine 25 from line 17. Enter this amount here and an ine 12, for the corresponding trade or business..... Part IV Determine Your Qualified Business Income Deduction 27 Total qualified business income component from all qualed trades, businesses, or aggregation in the amount from line 16 28 Qualified REET dividends and publicly traded partnership (PTP) income or (less). See instructions. 20 Quailed RELY dividends and PTP( ) carryforward from prior years........ 30 Total qualified REIT dividends and PTP income. Combineres 28 and 29. less than anter 31 REIT and PTP component. Multiply line 30 by 20% (0.20)..... 32 Qualified business income deduction before the income imitation Adelines 27 and 31 . 33 Sabie Income before qualified business income deduction 34 Nu capital gain. See Instructions..... .. 35 Subtract line 34 from ine 33. eressenter 35 Incarn a tion in 35 by 2014 (20) --- 37 Quad income deduction before the domestic production active deduction (DD ) under section G) the fine 32 3 38 CAD under section L o cated from an agricul t ural cooperate. Don't meet 40 a REIT dvigs and PTP ) forward Ga i nes 28 and 29. or greater

I need help figuring out (C) in the first part and help with filling out the form.

I need help figuring out (C) in the first part and help with filling out the form.