Answered step by step

Verified Expert Solution

Question

1 Approved Answer

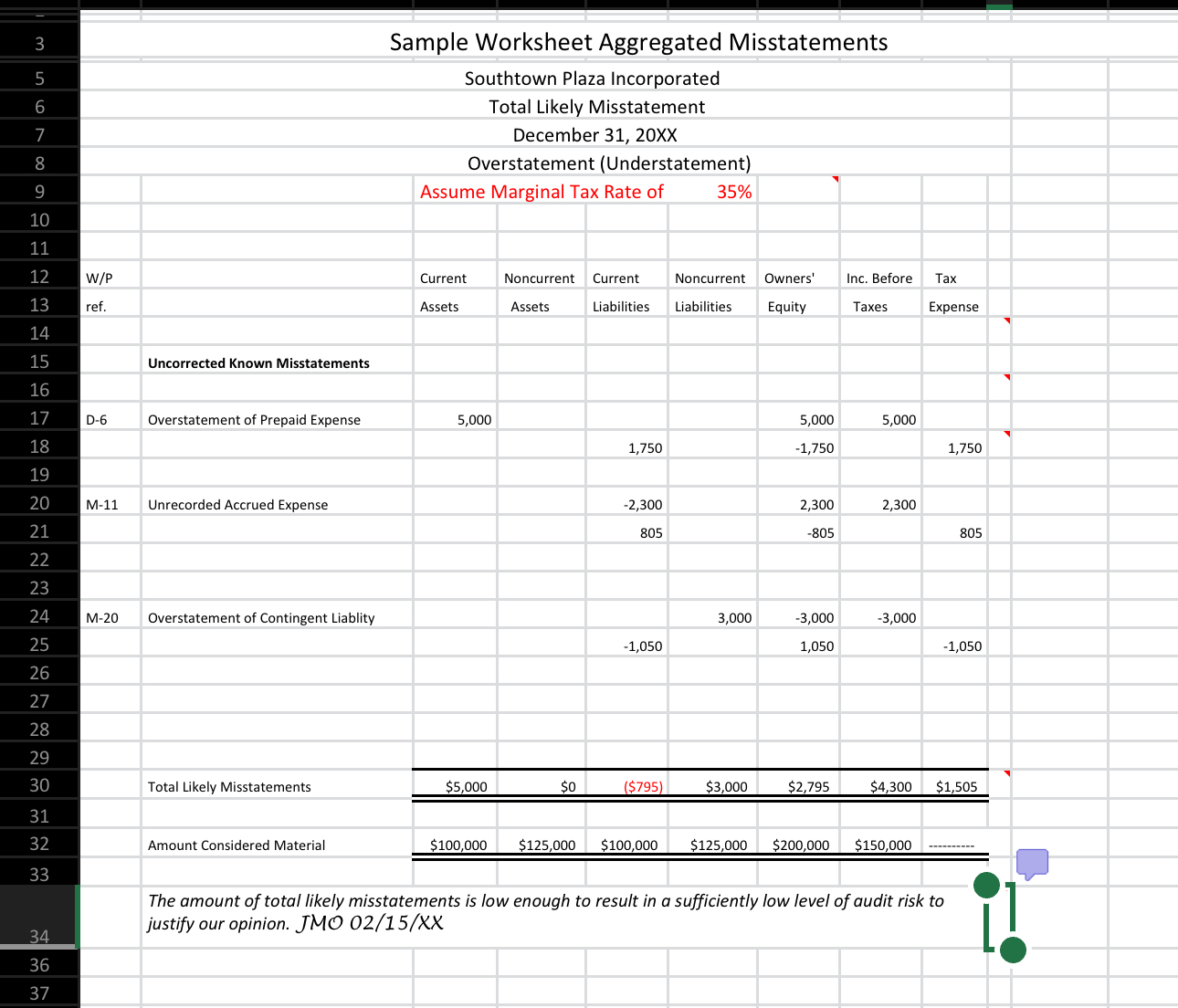

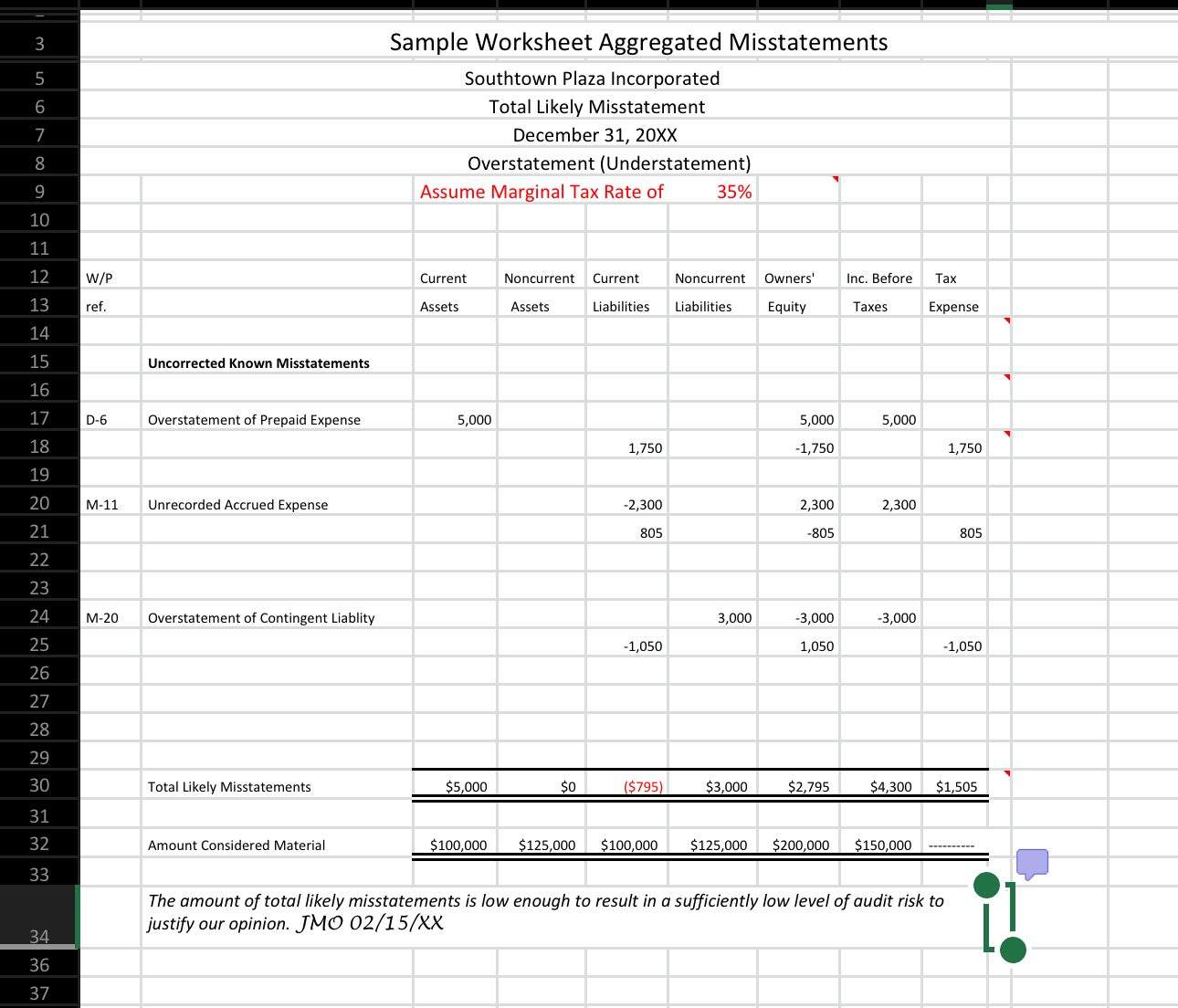

I need help filling in this excel sheet. Please use formulas when necessary and write out the formula that is used. Please refer to assessment

I need help filling in this excel sheet. Please use formulas when necessary and write out the formula that is used.

Please refer to assessment instructions and scoring guides before beginning this assessment. You are nearing the end of GPCs audit. As the auditor, you must evaluate the importance of all uncorrected misstatements to determine if the risk of a material misstatement is sufficiently low to support issuance of an unmodified opinion. Four uncorrected misstatements have been identified. Though no individual uncorrected misstatement is qualitatively material, the quantitative affect must be analyzed individually and in the aggregate. The uncorrected misstatements are as follows. Understated accrued liabilities bonus payable: $ Understated prepaid insurance: $ Overstated inventory due to spoilage: $ Understated allowance for uncollectible accounts: $Ignore errors discovered in earlier parts of the assessment. Assume they have been adjusted. Use the provided Excel workbook to complete a schedule of Aggregated Misstatements for Green Pastures Cheese, LLC Assume that the tax rate is Analyze the results, and enter a conclusion on the workpaper. Assume that the following amounts are considered material. Current Assets: $Noncurrent Assets: $Current Liabilities: $Noncurrent Liabilities: $Owners Equity: $Income before Taxes: $ The schedule should follow the sample format provided in the Excel template. Review the provided sample, the following notes, and evaluation of audit findings in chapter to help you understand the process. Each uncorrected misstatement will require rows of analysis. The first row is the impact of the uncorrected misstatement on the balance sheet and pretax net income. The second row is the tax effect of the uncorrected misstatement based upon the provided marginal tax rate. Each row will have entries. Use the accounting equation ALE to help analyze the effect of the uncorrected misstatement on equity and income before taxes. Errors that result in an overstatement of income will result in overstated Equity. Overstatements are entered as a positive number. Understatements are negative. Overstatements of pretax net income result in overstated tax expense and taxes payable current liability Understatements have the opposite impact. The materiality levels are included below the column totals to support the conclusion that the adjustments are, or are not, considered material. The work paper must include a conclusion, preparer initials, and a date. Later the reviewer will add their initials and date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started