Question

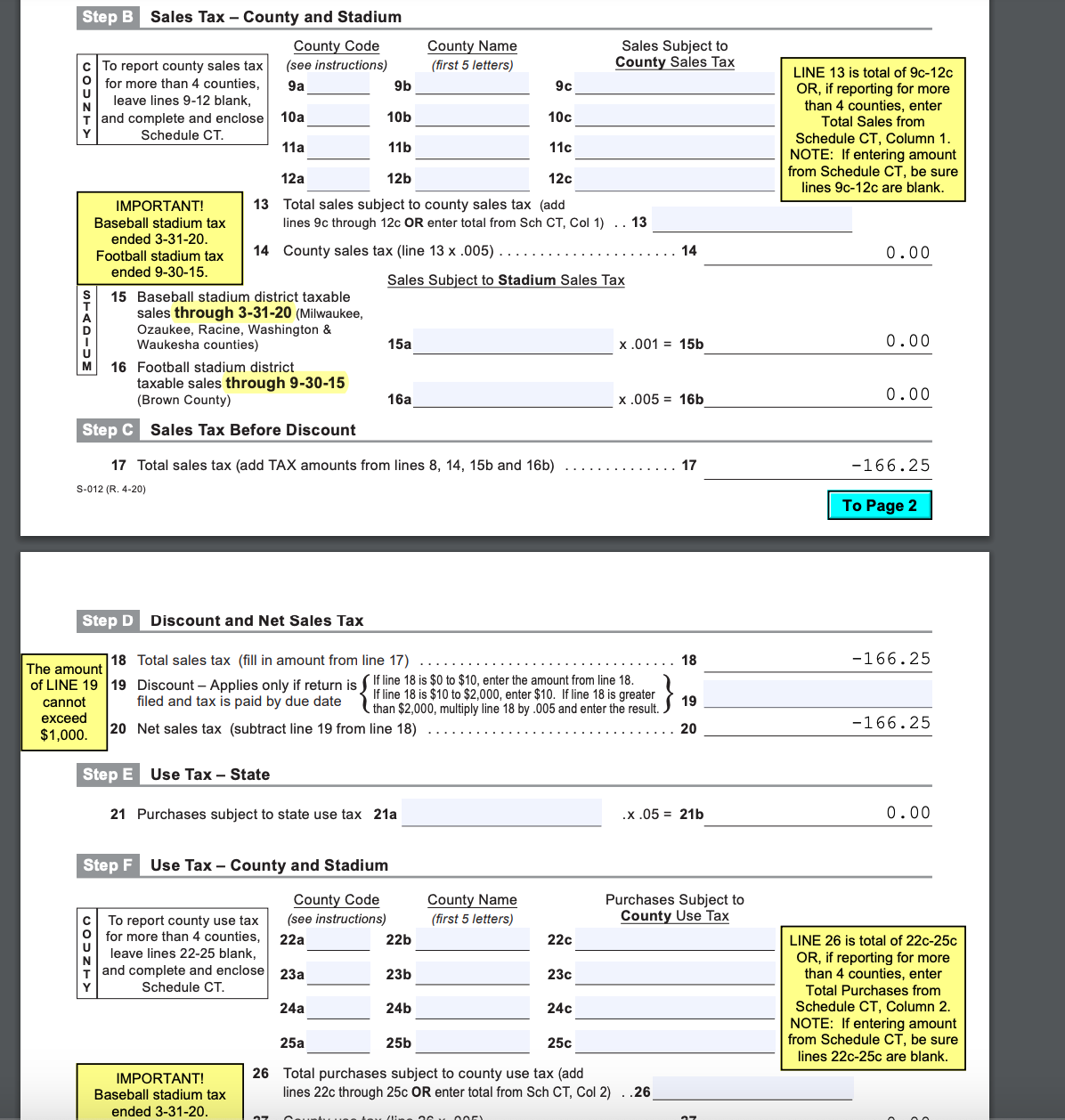

I need help filling out ST-12 form Taxable Sales Non-Taxable Sales Total Landscaping Services$6,032.25$774.00$8,032.25Landscaping Sales$8,600.00$2,450.00$9,824.00Total$14,632.25$3,224.0017,856.25 Craig went to a farmers market in Illinois mid July.

I need help filling out ST-12 form

Craig went to a farmers market in Illinois mid July. During that weekend, they had sales of $1,300. This amount is included in the non-taxable Landscaping Sales. The remaining were sales for which they had exemption certificates.

Customers returned $550.00 worth of merchandise for the 3rd quarter (July - September). These were trees and shrubs that the customers found unsatisfactory.

You suggested to Craig that he write off an Invoice to Tasty Cakery from June 3, 2026. This customer's phone is disconnected and statements have been returned no forwarding address. The amount of sales and services provided was $375. Craig agreed and this customers invoice was removed from the accounting software.

Craig plans on offering snow removal services starting this winter season. He purchased heavy duty shelving for his storage facility from a supplier in Minnesota to hold the bags of salt he will be purchasing. The shelving cost $1,250. No tax was paid on this purchase.

You will complete and file the return and pay the tax by the due date. The due date for a quarterly filer is the last day of the monthly following the quarter.

Craig Smith, President will be the contact person and the signer of the ST-12 on October 15th, 2026. You will enclose the return with full payment of tax due on that date.

18 Total sales tax (fill in amount from line 17 ) 166.25 19 Discount - Applies only if return is filed and tax is paid by due date Ifline18is$0to$10,entertheamountfromline18.Ifline18is$10to$2,000,enter$10.Ifline18isgreaterthan$2,000,multiplyline18by.005andentertheresult. 20 Net sales tax (subtract line 19 from line 18) 19 166.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started