i need help filling out the charts

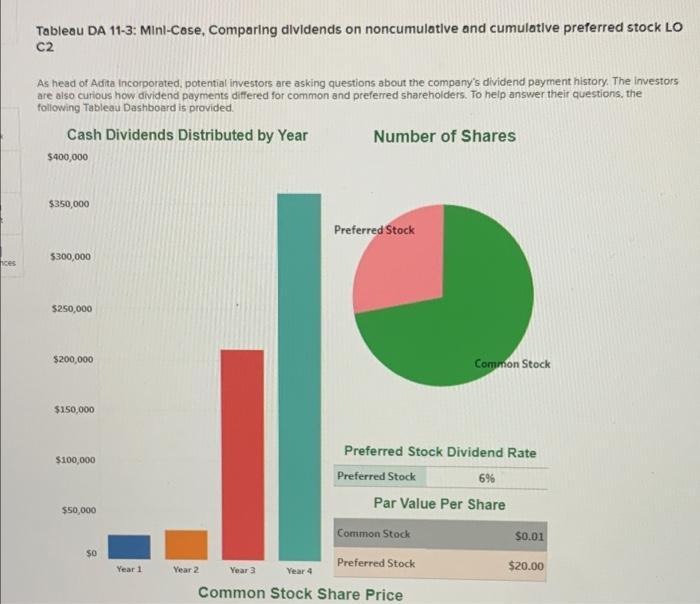

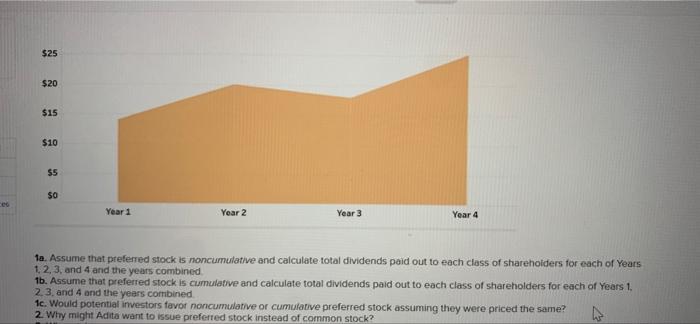

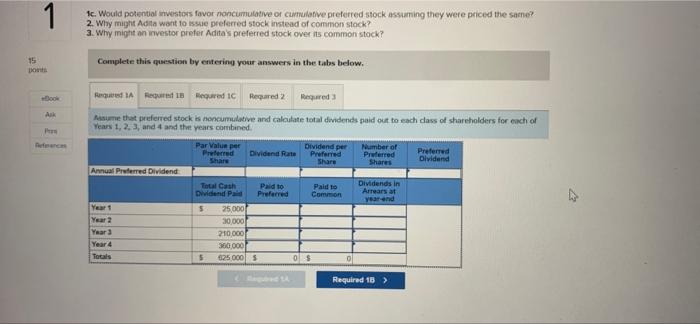

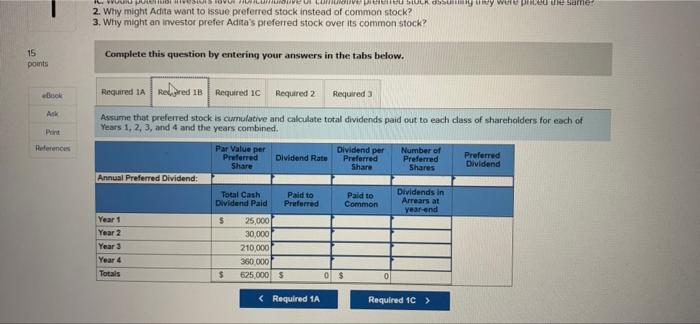

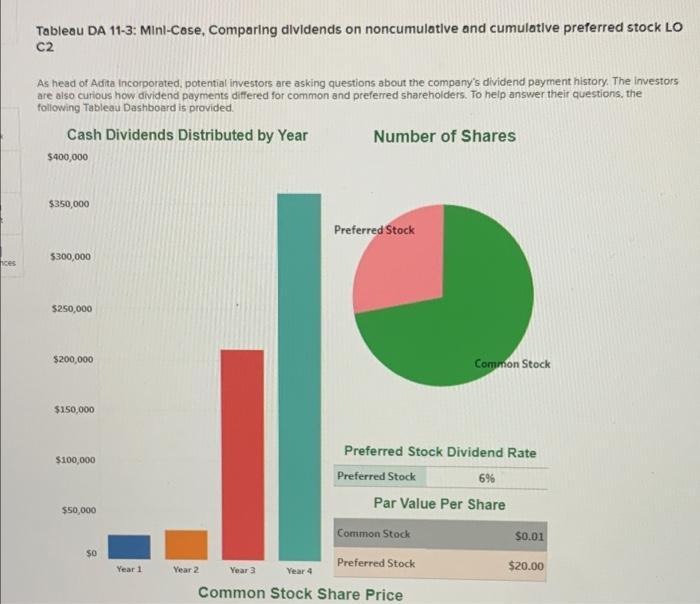

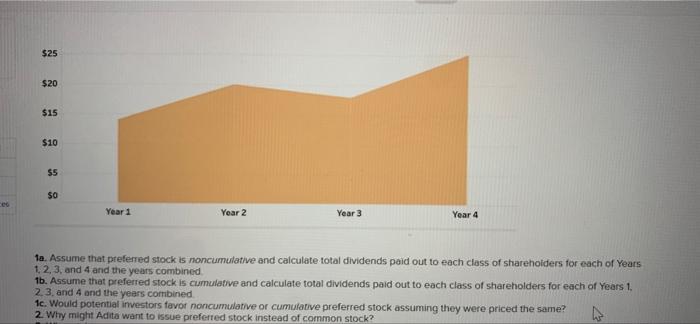

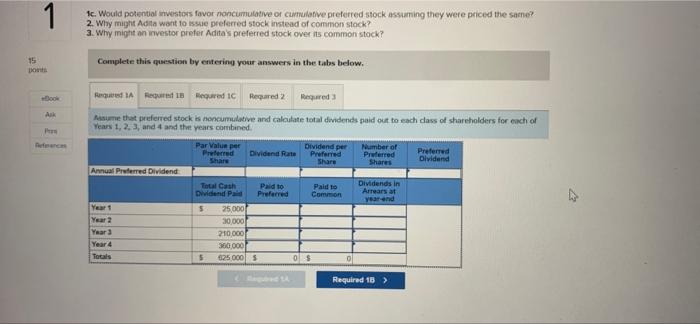

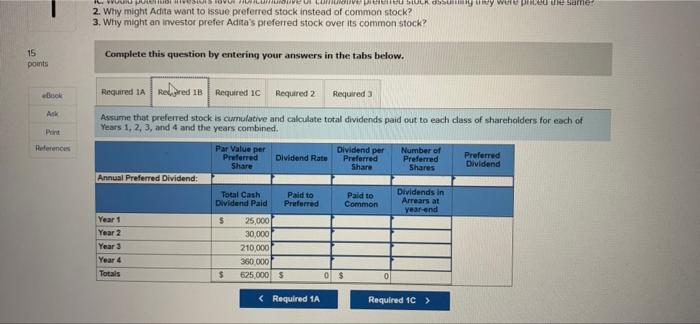

Tableau DA 11-3: Mini-Cose, Comparing dividends on noncumulative and cumulative preferred stock LO C2 As head of Adita incorporated, potential investors are asking questions about the company's dividend payment history. The investors are also curious how dividend payments differed for common and preferred shareholders. To help answer their questions, the following Tableau Dashboard is provided. Cash Dividends Distributed by Year Number of Shares $400,000 $350,000 Preferred Stock 5300,000 ces $250,000 $200,000 Common Stock $150,000 $100,000 Preferred Stock Dividend Rate Preferred Stock 6% Par Value Per Share Common Stock $0.01 $50.000 $0 Preferred Stock Year 1 Year 2 Year $20.00 Year 4 Common Stock Share Price $25 $20 $15 $10 55 $0 Year 1 Year 2 Year 3 Year 4 1a. Assume that preferred stock is noncumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined 1b. Assume that preferred stock is cumulative and calculate total dividends paid out to each class of shareholders for each of Years 1. 2.3, and 4 and the years combined 10. Would potential investors favor noncumulative or cumulative preferred stock assuming they were priced the same? 2. Why might Adita want to issue preferred stock instead of common stock? 1 ic. Would potential investors favor no cumulative or cumulative preferred stock assuming they were priced the same 2. Why might Adita want to issue preferred stock instead of common stock? 3. Why might an investor prefer Adita's preferred stock over its common stock? 15 Complete this question by entering your answers in the tabs below. Book AR Required It is Hewed 1 Reqared2 Regered Masume that preferred stock is no cumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. Par Value per Dividend per Number of Preferred Dividend Rate Preferred Preferred Powered Share Shares Dividend Annual Preferred Dividend Dividends in Total Cash Paid to Paid to Dwidend Pa Preferred Arrears at Common Year-end Yet 5 25.000 Year 2 30,000 Year 210.000 Year 4 360.000 Totals 525000 $ OS 0 Required 18 ) NU ve SLR sumy w pr.edule samer 2. Why might Adita want to issue preferred stock instead of common stock? 3. Why might an investor prefer Adita's preferred stock over its common stock? 15 points Complete this question by entering your answers in the tabs below. Required 1A Relored 11 Required ic Beck Required 2 Required 3 Ask Assume that preferred stock is cumulative and calculate total dividends paid out to each class of shareholders for each of Years 1, 2, 3, and 4 and the years combined. Print References Par Value per Preferred Share Dividend Rate Dividend per Preferred Share Number of Preferred Shares Preferred Dividend Annual Preferred Dividend: Paid to Common Dividends in Arrears at Year-end Year 1 Year 2 Year Year 4 Total Cash Paid to Dividend Paid Preferred $ 25,000 30,000 210,000 350 000 $ 525 000 5 Totals 0 $ 0