Answered step by step

Verified Expert Solution

Question

1 Approved Answer

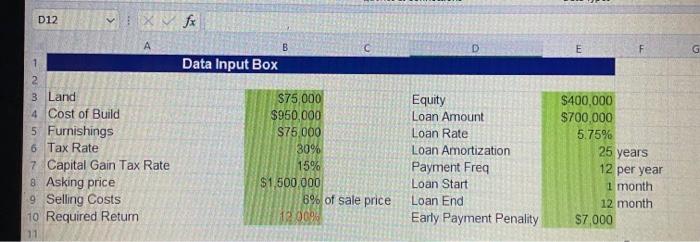

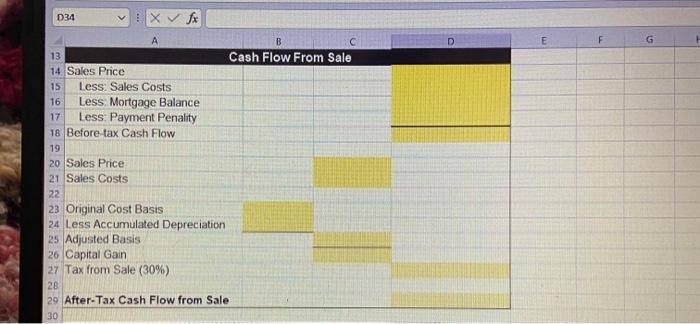

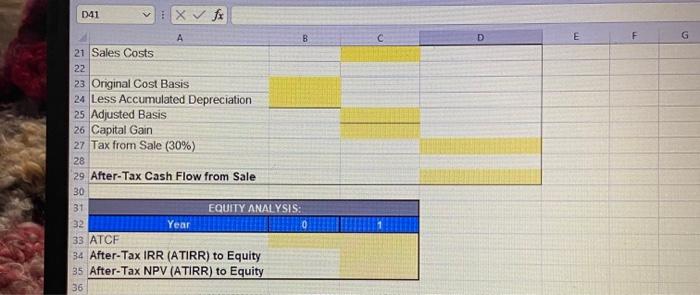

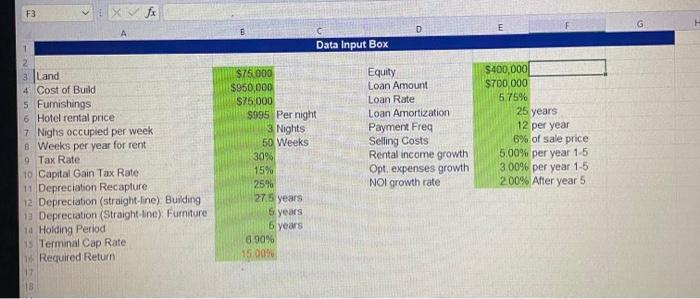

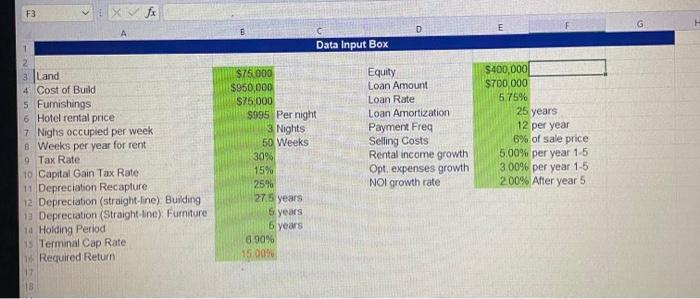

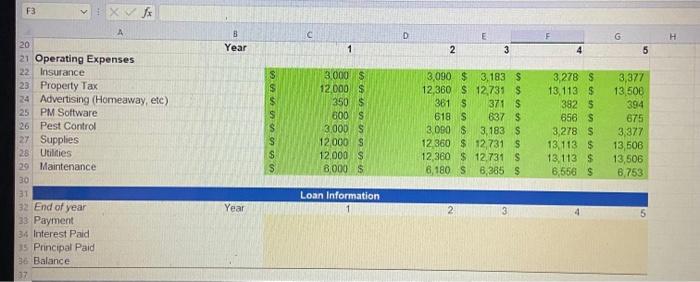

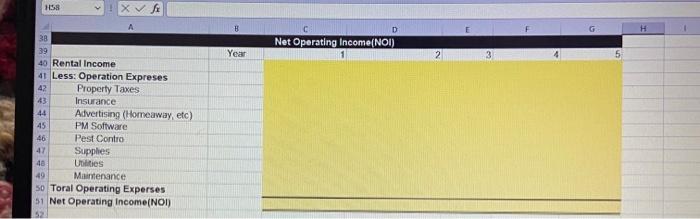

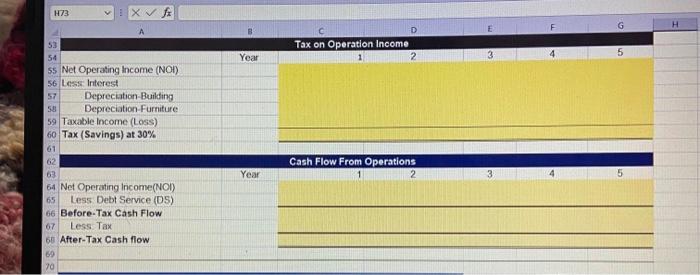

i need help filling out the rest of these tables. Please have both excel answers and formulas available to be seen. Thank you in advance!

i need help filling out the rest of these tables. Please have both excel answers and formulas available to be seen. Thank you in advance!

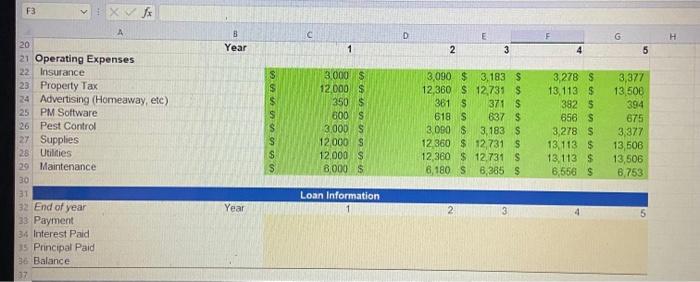

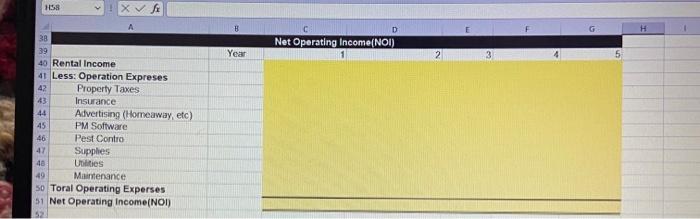

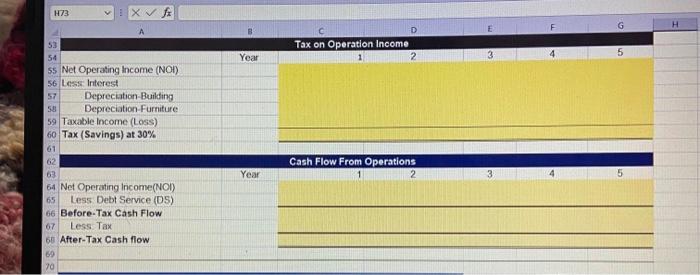

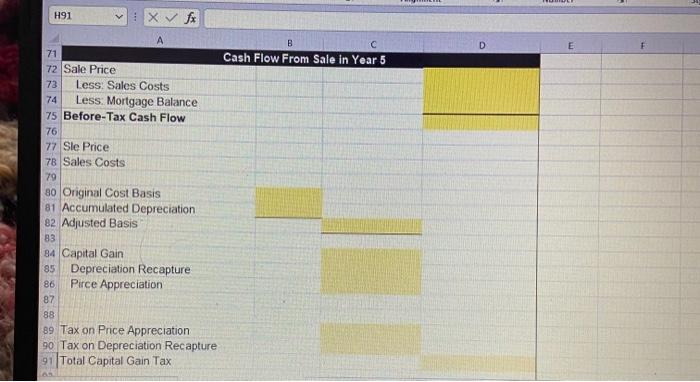

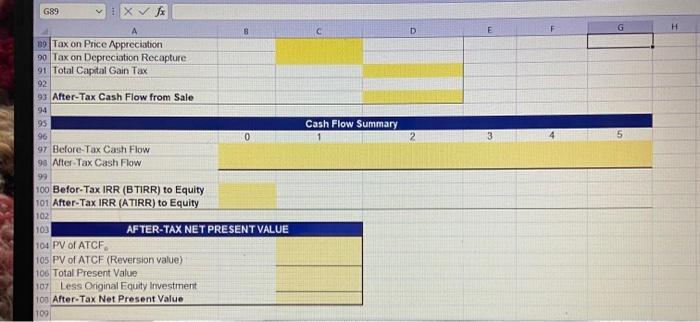

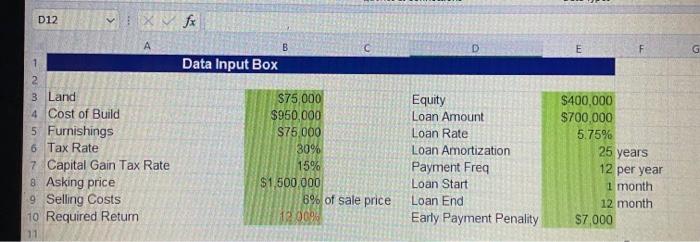

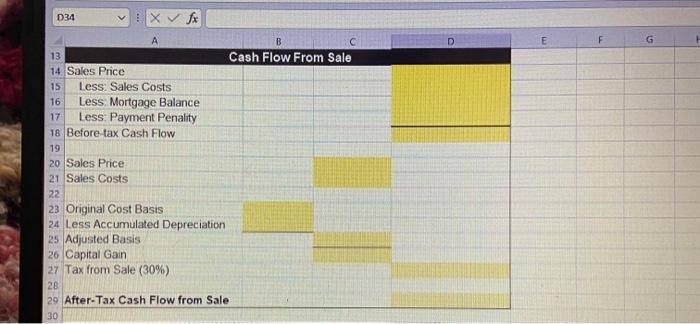

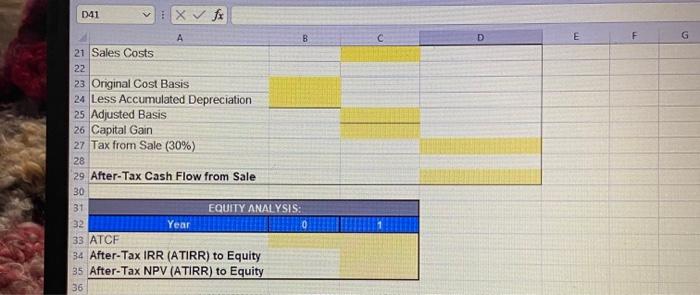

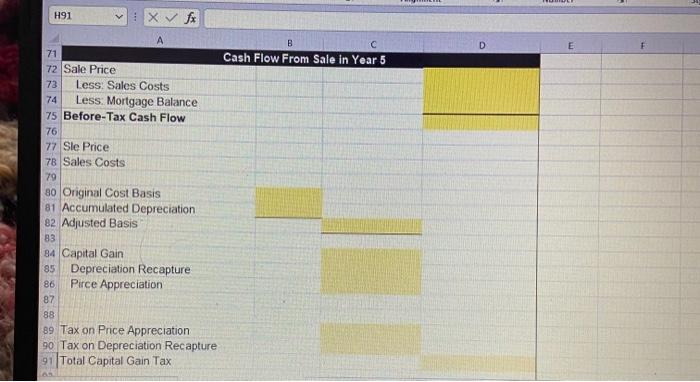

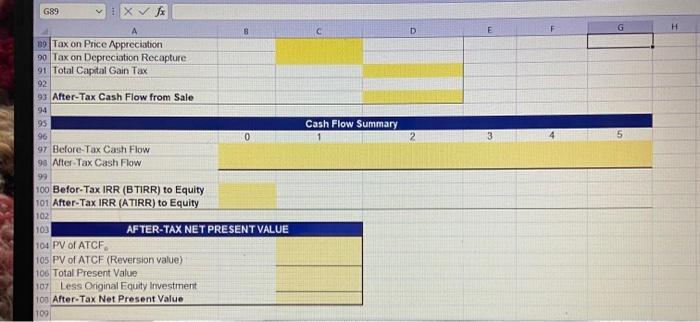

-N D12 A 2 3 Land 4 Cost of Build 5 Furnishings 6 Tax Rate 7 Capital Gain Tax Rate 8 Asking price 9 Selling Costs 10 Required Return 11 fx Data Input Box B $75,000 $950,000 $75,000 30% 15% $1,500,000 12.00% 6% of sale price Equity Loan Amount Loan Rate Loan Amortization Payment Freq Loan Start Loan End Early Payment Penality E $400,000 $700,000 5.75% F 25 years 12 per year 1 month 12 month $7,000 G X fx A 13 14 Sales Price 15 Less: Sales Costs 16 Less: Mortgage Balance 175 Less: Payment Penality 18 Before-tax Cash Flow 19 20 Sales Price 21 Sales Costs 22 23 Original Cost Basis 24 Less Accumulated Depreciation 25 Adjusted Basis 26 Capital Gain 27 Tax from Sale (30%) 28 29 After-Tax Cash Flow from Sale 30 D34 B Cash Flow From Sale D D41 X fx A 21 Sales Costs 22 23 Original Cost Basis 24 Less Accumulated Depreciation 25 Adjusted Basis 26 Capital Gain 27 Tax from Sale (30%) 28 29 After-Tax Cash Flow from Sale 30 31 32 Year 33 ATCF 34 After-Tax IRR (ATIRR) to Equity 35 After-Tax NPV (ATIRR) to Equity 36 EQUITY ANALYSIS: C D G F3 3 Land 4 Cost of Build 5 Furnishings 6 Hotel rental price 7 Nighs occupied per week 8 Weeks per year for rent 9 Tax Rate 10 Capital Gain Tax Rate: 11 Depreciation Recapture. 12 Depreciation (straight-line): Building 13 Depreciation (Straight-line) Furniture 14 Holding Period 15 Terminal Cap Rate: 16 Required Return 17 181 fx A $75.000 $950,000 $75.000 $995 Per night 3 Nights 50 Weeks 30% 15% 25% 27.5 years 5 years 6 years 6.90% 15.00% Data Input Box D Equity Loan Amount Loan Rate Loan Amortization Payment Freq Selling Costs Rental income growth Opt. expenses growth NOI growth rate E $400,000 $700,000 5.75% 25 years 12 per year 6% of sale price 5.00% per year 1-5 3.00% per year 1-5 2.00% After year 5 G F3 fx V 20 21 Operating Expenses 22 Insurance 23 Property Tax 24 Advertising (Homeaway, etc) 25 PM Software 26 Pest Control 27 Supplies 28 Utilities 29 Maintenance 30 31 32 End of year 33 Payment 34 Interest Paid 35 Principal Paid 36 Balance 37 B Year Year SSSSSSSS C 1 3,000 $ 12,000 $ 350 $ 600 S 3.000 S 12,000 S 12,000 $ 8,000 $ Loan Information D E 2 3 3,090 $ 3,183 $ 12,360 $ 12,731 S 361 S 371 S 618 S 637 $ 3,183 S 3,000 $ 12,360 $ 12,731 S 12,360 $12.731 S 6,180 S 6,365 $ 2 3 G 5 3,278 S 3,377 13,113 S 13,500 382 S 394 656 S 675 3,278 S 3,377 13,113 S 13,506 13,113 S 13,506 6,556 $ 6,753 5 H H58 38 39 40 Rental Income 41 Less: Operation Expreses 42 Property Taxes 43 Insurance 44 Advertising (Homeaway, etc) 45 PM Software 46 Pest Control 47 Supplies 48 Ubilities 49 Maintenance 50 Toral Operating Experses 51 Net Operating Income(NOI) B Year Net Operating Income(NOI) 2 3 H73 A 53 54 55 Net Operating Income (NOI) 56 Less Interest 57 Depreciation Building Depreciation-Furniture 58 59 Taxable Income (Loss) 60 Tax (Savings) at 30% 61 62 63 64 Net Operating Income(NOI) Less Debt Service (DS) 65 66 Before-Tax Cash Flow 67 Less Tax 68 After-Tax Cash flow. 5833335882 69 70 Year Year D Tax on Operation Income 2 Cash Flow From Operations 1 2 3 3 5 X fx A 71 72 Sale Price 73 Less: Sales Costs 74 Less: Mortgage Balance 75 Before-Tax Cash Flow 76 77 Sle Price 78 Sales Costs 79 80 Original Cost Basis 81 Accumulated Depreciation 82 Adjusted Basis 83 84 Capital Gain 85 Depreciation Recapture 86 Pirce Appreciation 87 88 89 Tax on Price Appreciation 90 Tax on Depreciation Recapture 91 Total Capital Gain Tax H91 B Cash Flow From Sale in Year 5 D G89 VEX fx 89 Tax on Price Appreciation 90 Tax on Depreciation Recapture 91 Total Capital Gain Tax 92 93 After-Tax Cash Flow from Sale 94 95 96 97 Before-Tax Cash Flow 98 After-Tax Cash Flow 99 100 Befor-Tax IRR (BTIRR) to Equity 101 After-Tax IRR (ATIRR) to Equity 102 103 104 PV of ATCF, 105 PV of ATCF (Reversion value) 106 Total Present Value 107 Less Original Equity Investment 100 After-Tax Net Present Value 109 0 AFTER-TAX NET PRESENT VALUE Cash Flow Summary D 2 3 G H -N D12 A 2 3 Land 4 Cost of Build 5 Furnishings 6 Tax Rate 7 Capital Gain Tax Rate 8 Asking price 9 Selling Costs 10 Required Return 11 fx Data Input Box B $75,000 $950,000 $75,000 30% 15% $1,500,000 12.00% 6% of sale price Equity Loan Amount Loan Rate Loan Amortization Payment Freq Loan Start Loan End Early Payment Penality E $400,000 $700,000 5.75% F 25 years 12 per year 1 month 12 month $7,000 G X fx A 13 14 Sales Price 15 Less: Sales Costs 16 Less: Mortgage Balance 175 Less: Payment Penality 18 Before-tax Cash Flow 19 20 Sales Price 21 Sales Costs 22 23 Original Cost Basis 24 Less Accumulated Depreciation 25 Adjusted Basis 26 Capital Gain 27 Tax from Sale (30%) 28 29 After-Tax Cash Flow from Sale 30 D34 B Cash Flow From Sale D D41 X fx A 21 Sales Costs 22 23 Original Cost Basis 24 Less Accumulated Depreciation 25 Adjusted Basis 26 Capital Gain 27 Tax from Sale (30%) 28 29 After-Tax Cash Flow from Sale 30 31 32 Year 33 ATCF 34 After-Tax IRR (ATIRR) to Equity 35 After-Tax NPV (ATIRR) to Equity 36 EQUITY ANALYSIS: C D G F3 3 Land 4 Cost of Build 5 Furnishings 6 Hotel rental price 7 Nighs occupied per week 8 Weeks per year for rent 9 Tax Rate 10 Capital Gain Tax Rate: 11 Depreciation Recapture. 12 Depreciation (straight-line): Building 13 Depreciation (Straight-line) Furniture 14 Holding Period 15 Terminal Cap Rate: 16 Required Return 17 181 fx A $75.000 $950,000 $75.000 $995 Per night 3 Nights 50 Weeks 30% 15% 25% 27.5 years 5 years 6 years 6.90% 15.00% Data Input Box D Equity Loan Amount Loan Rate Loan Amortization Payment Freq Selling Costs Rental income growth Opt. expenses growth NOI growth rate E $400,000 $700,000 5.75% 25 years 12 per year 6% of sale price 5.00% per year 1-5 3.00% per year 1-5 2.00% After year 5 G F3 fx V 20 21 Operating Expenses 22 Insurance 23 Property Tax 24 Advertising (Homeaway, etc) 25 PM Software 26 Pest Control 27 Supplies 28 Utilities 29 Maintenance 30 31 32 End of year 33 Payment 34 Interest Paid 35 Principal Paid 36 Balance 37 B Year Year SSSSSSSS C 1 3,000 $ 12,000 $ 350 $ 600 S 3.000 S 12,000 S 12,000 $ 8,000 $ Loan Information D E 2 3 3,090 $ 3,183 $ 12,360 $ 12,731 S 361 S 371 S 618 S 637 $ 3,183 S 3,000 $ 12,360 $ 12,731 S 12,360 $12.731 S 6,180 S 6,365 $ 2 3 G 5 3,278 S 3,377 13,113 S 13,500 382 S 394 656 S 675 3,278 S 3,377 13,113 S 13,506 13,113 S 13,506 6,556 $ 6,753 5 H H58 38 39 40 Rental Income 41 Less: Operation Expreses 42 Property Taxes 43 Insurance 44 Advertising (Homeaway, etc) 45 PM Software 46 Pest Control 47 Supplies 48 Ubilities 49 Maintenance 50 Toral Operating Experses 51 Net Operating Income(NOI) B Year Net Operating Income(NOI) 2 3 H73 A 53 54 55 Net Operating Income (NOI) 56 Less Interest 57 Depreciation Building Depreciation-Furniture 58 59 Taxable Income (Loss) 60 Tax (Savings) at 30% 61 62 63 64 Net Operating Income(NOI) Less Debt Service (DS) 65 66 Before-Tax Cash Flow 67 Less Tax 68 After-Tax Cash flow. 5833335882 69 70 Year Year D Tax on Operation Income 2 Cash Flow From Operations 1 2 3 3 5 X fx A 71 72 Sale Price 73 Less: Sales Costs 74 Less: Mortgage Balance 75 Before-Tax Cash Flow 76 77 Sle Price 78 Sales Costs 79 80 Original Cost Basis 81 Accumulated Depreciation 82 Adjusted Basis 83 84 Capital Gain 85 Depreciation Recapture 86 Pirce Appreciation 87 88 89 Tax on Price Appreciation 90 Tax on Depreciation Recapture 91 Total Capital Gain Tax H91 B Cash Flow From Sale in Year 5 D G89 VEX fx 89 Tax on Price Appreciation 90 Tax on Depreciation Recapture 91 Total Capital Gain Tax 92 93 After-Tax Cash Flow from Sale 94 95 96 97 Before-Tax Cash Flow 98 After-Tax Cash Flow 99 100 Befor-Tax IRR (BTIRR) to Equity 101 After-Tax IRR (ATIRR) to Equity 102 103 104 PV of ATCF, 105 PV of ATCF (Reversion value) 106 Total Present Value 107 Less Original Equity Investment 100 After-Tax Net Present Value 109 0 AFTER-TAX NET PRESENT VALUE Cash Flow Summary D 2 3 G H

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started