Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help Financial Literacy Unit 3 - Deductions - 3.2 - State Income Taxes Assignment Use the personal allowance table below to answer the

i need help

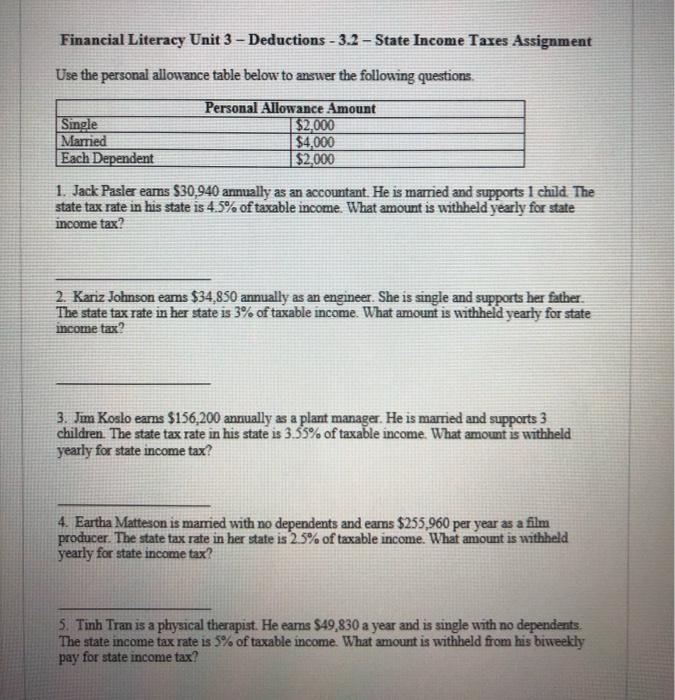

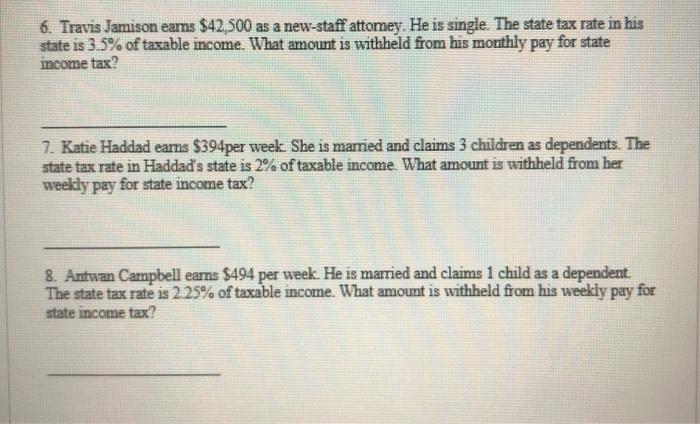

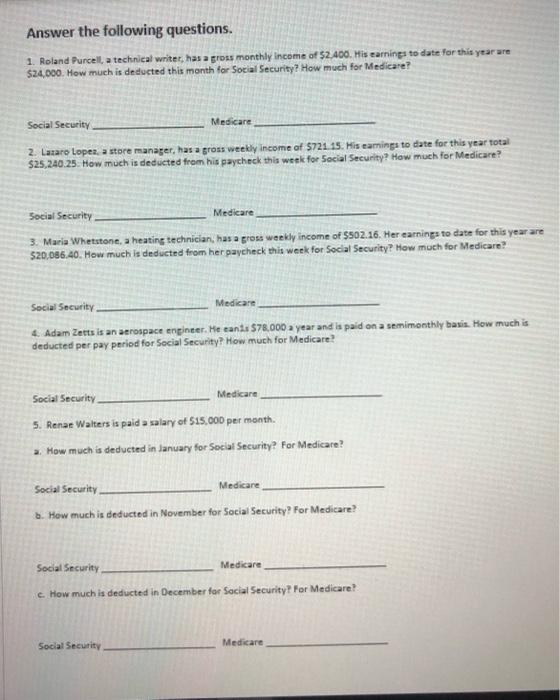

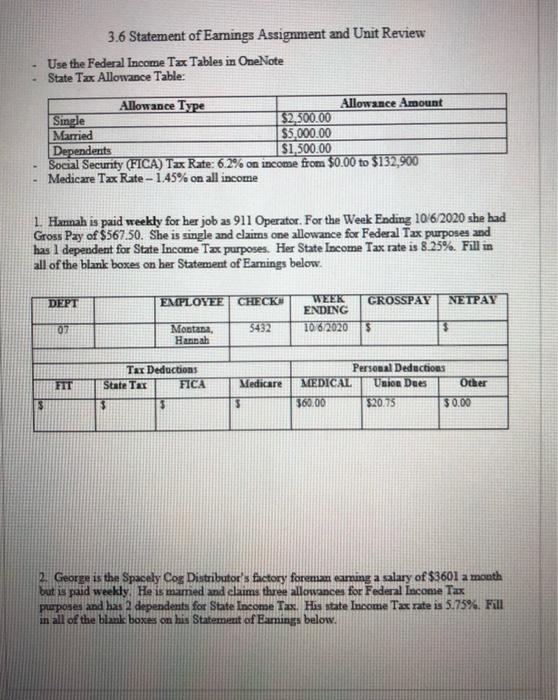

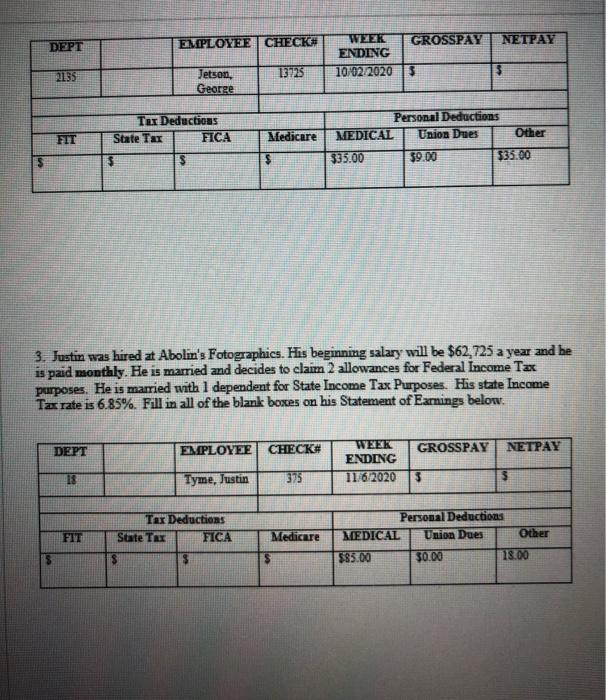

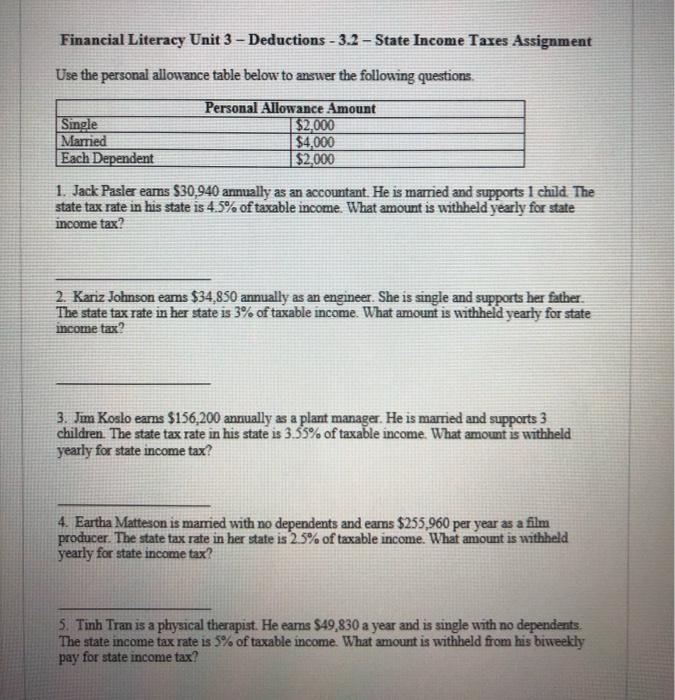

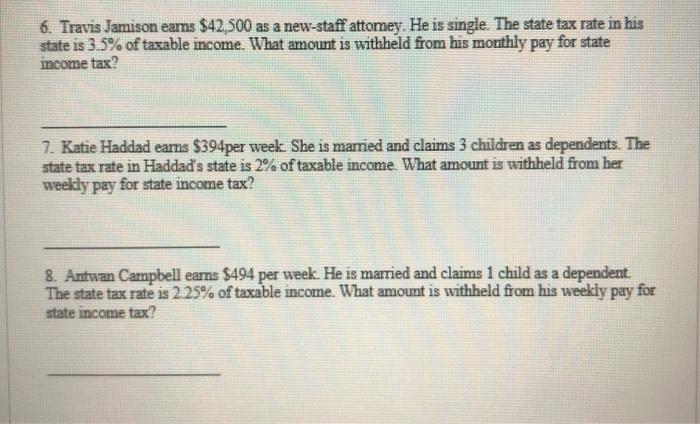

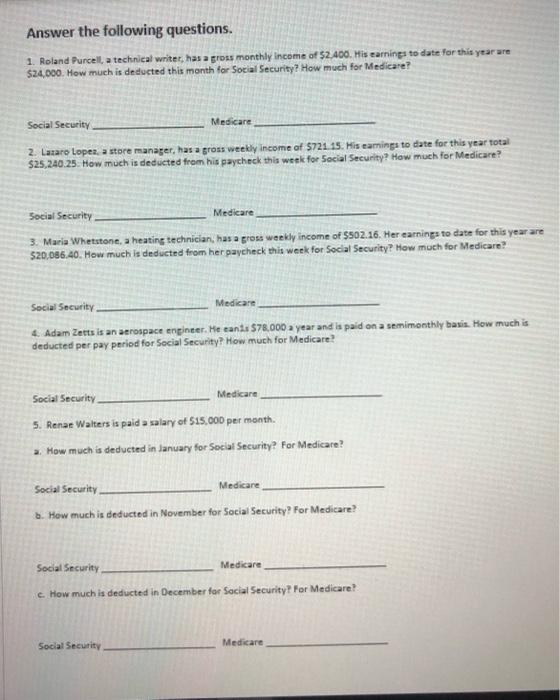

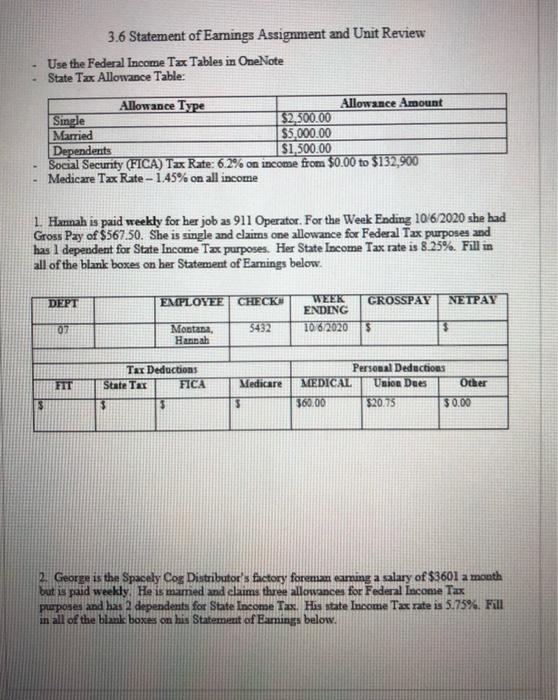

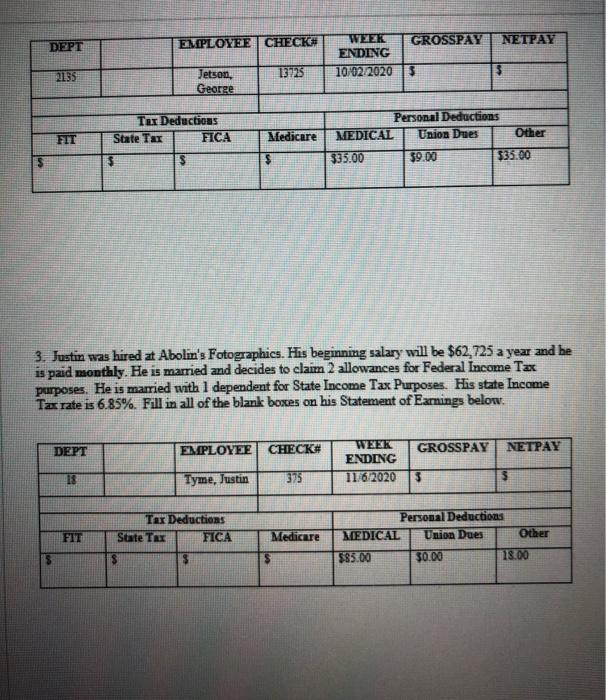

Financial Literacy Unit 3 - Deductions - 3.2 - State Income Taxes Assignment Use the personal allowance table below to answer the following questions, Single Married Each Dependent Personal Allowance Amount $2.000 $4,000 $2,000 1. Jack Pasler earns $30,940 annually as an accountant. He is married and supports 1 child. The state tax rate in his state is 4.5% of taxable income. What amount is withheld yearly for state income tax? 2. Kariz Johnson earns $34,850 annually as an engineer. She is single and supports her father. The state tax rate in her state is 3% of taxable income. What amount is withheld yearly for state income tax? 3. Jm Koslo earns $156,200 annually as a plant manager. He is married and supports 3 children. The state tax rate in his state is 3.35% of taxable income. What amount is withheld yearly for state income tax? 4. Eartha Matteson is married with no dependents and earns $255,960 per year as a film producer. The state tax rate in her state is 25% of taxable income. What amount is withheld yearly for state income tax? 5. Tinh Tran is a physical therapist. He eams $49,830 a year and is single with no dependents. The state income tax rate is 5% of taxable income. What amount is withheld from his biweekly pay for state income tax? 6. Travis Jamison earns $42,500 as a new-staff attorney. He is single. The state tax rate in his state is 3.5% of taxable income. What amount is withheld from his monthly pay for state income tax? 7. Katie Haddad earns $394per week. She is married and claims 3 children as dependents. The state tax rate in Haddad's state is 2% of taxable income. What amount is withheld from her weekly pay for state income tax? 8. Antwan Campbell earns $494 per week. He is married and claims 1 child as a dependent. The state tax rate is 2.25% of taxable income. What amount is withheld from his weekly pay for state income tax? Answer the following questions. 1. Roland Purcell, a technical writer, has a gross monthly income of 52,400. His earnings to date for this yearure $24,000. How much is deducted this month for Social Security? How much for Medicare? Social Security Medicare 2. Lazaro Lopes, a store manager, has a gross weekly income of 5721 15. His eamings to date for this year total $25,240:25. How much is deducted from his paycheck this week for Social Security? How much for Medicare? Social Security Medicare 3. Maria Whetstone, a heating technician, has a gross weekly income of $502.26. Her earnings to date for this year are 520,086.40. How much is deducted from her paycheck this week for Social Security? How much for Medicare? Social Security Medicare 4. Adam Zetts is an aerospace engineer. He canis 578.000 a year and is paid on a semimonthly basis. How much is deducted per pay period for Social Security? How much for Medicare? Social Security Medicare 5. Renae Walters is paid a salary of 515.000 per month 2. How much is deducted in January for Social Security? For Medicare? Social Security Medicare d. How much is deducted in November for Social Security? For Medicare? Social Security Medicare c. How much is deducted in December for Social Security For Medicare? Social Security Medicare 3.6 Statement of Earnings Assignment and Unit Review Use the Federal Income Tax Tables in OneNote State Tax Allowance Table: Allowance Type Allowance Amount Single $2,500.00 Married $5,000.00 Dependents $1,500.00 Social Security (FICA) Tax Rate: 6.2% on income from $0.00 to $132,900 Medicare Tax Rate - 1.45% on all income 1. Hannah is paid weekly for her job as 911 Operator. For the Week Ending 10/6/2020 she had Gross Pay of $567.50. She is single and claims one allowance for Federal Tax purposes and has 1 dependent for State Income Tax purposes. Her State Income Tax rate is 8.25%. Fill in all of the blank boxes on her Statement of Eamings below. DEPT EMPLOYEE CHECK GROSSPAY NETPAY WEEK ENDING 10 62020 07 5432 $ $ Montana, Hannah FTT Tar Deductions State Tax FICA $ $ Medicare Personal Deductions MEDICAL Union Dues Other 360.00 $20.73 $0.00 S $ 2. George is the Spacely Cog Distributor's factory foreman earning a salary of $3601 a mouth but is paid weekly. He is mamed and claims three allowances for Federal Income Tax purposes and has a dependents for State Income Tax. Has state Income Tax rate is 5.75%. Fill in all of the blank boxes on his Statement of Earnings below. DEPT EMPLOYEE CHECK GROSSPAY NETPAY WEEK ENDING 10/02/2020 2155 13723 $ Jetson, George FIT Tax Deductions State TAT FICA $ Personal Deductions Medicare MEDICAL Union Dues Other $ $35.00 39.00 $35.00 $ 3. Justin was hired at Abolin's Fotographics. His beginning salary will be $62,725 a year and he is paid monthly. He is married and decides to claim 2 allowances for Federal Income Tax purposes. He is married with 1 dependent for State Income Tax Purposes. His state Income Tax rate is 6.85%. Fill in all of the blank boxes on his Statement of Earnings below. DEPT EMPLOYEE CHECK# GROSSPAY NETPAY WEEK ENDING 116/2020 18 Tyme, Justin 375 3 TAT Deductions State TAX FICA FIT Medicare Personal Deductions MEDICAL Union Dues Other $85.00 $0.00 18.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started