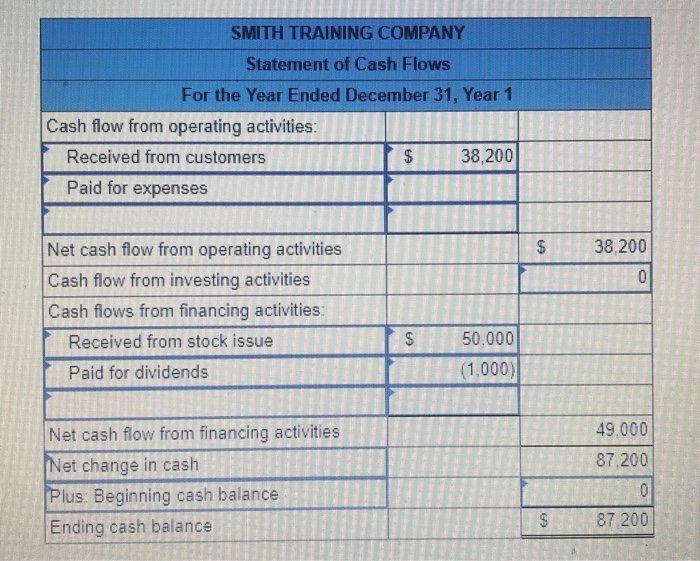

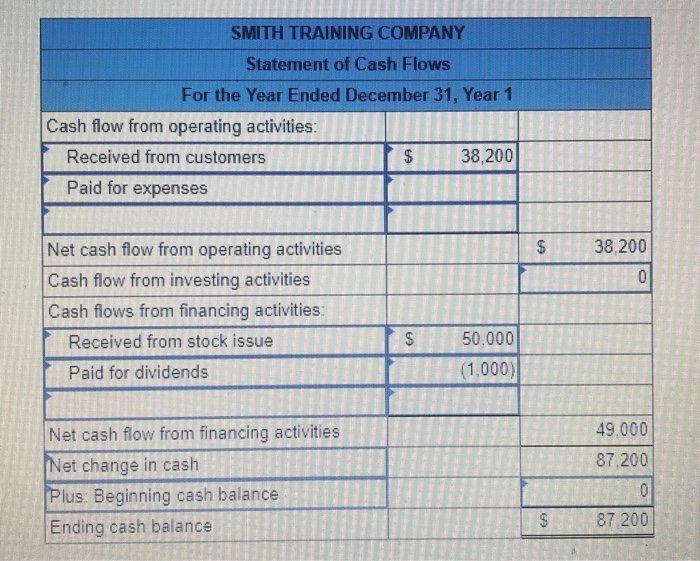

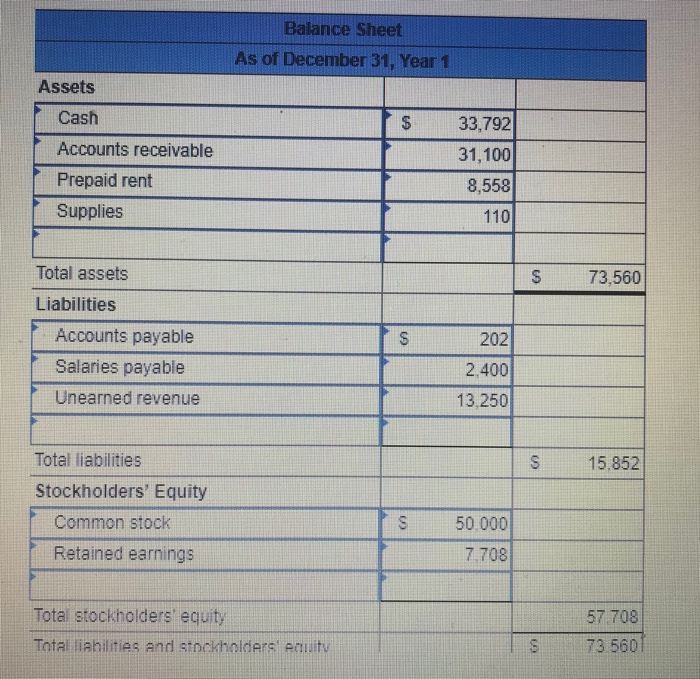

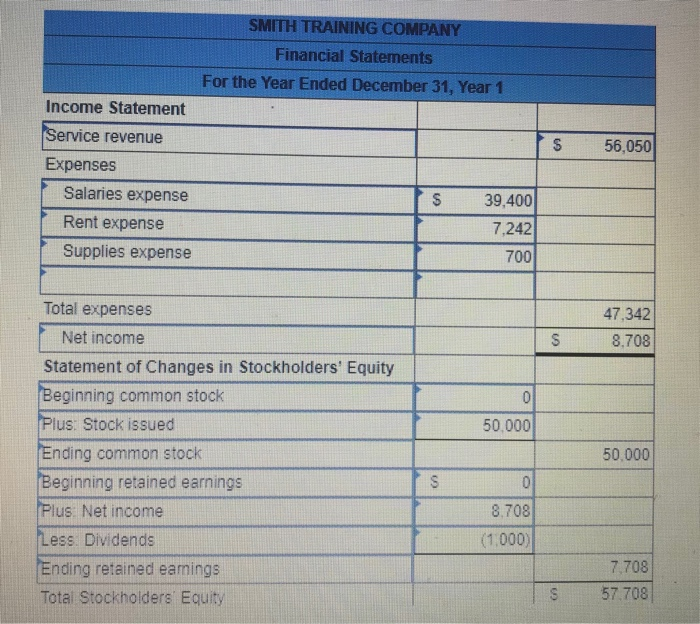

I need help finding 'Paid for Expenses' in the Statement of Cash Flows. I tried calculating the number and couldn't figure it out. I know it is not $47,342 positive or negative. I want an expliantion on how to obtain the answer not just give me the answer so I can learn how to do it, please and thank you. I also added the Balance Sheet and Financial Statements since they were part of the same question and might be of help.

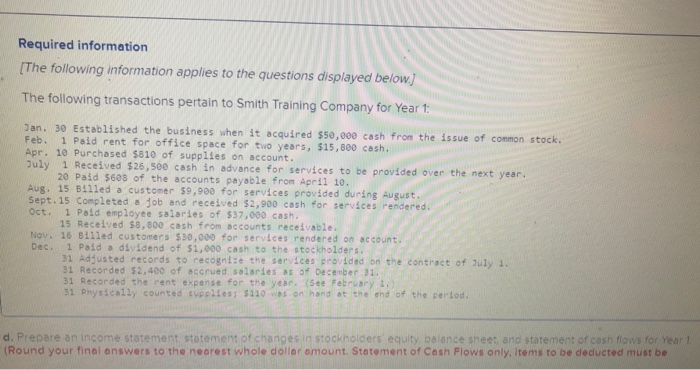

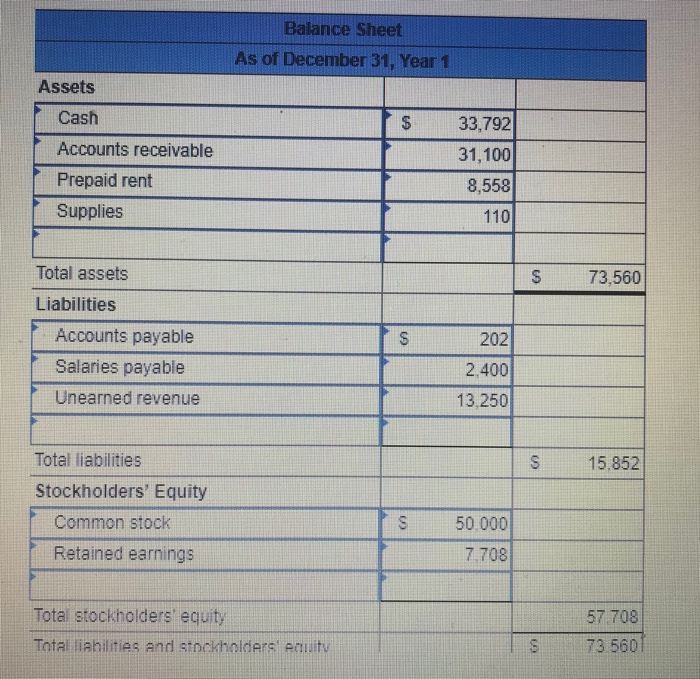

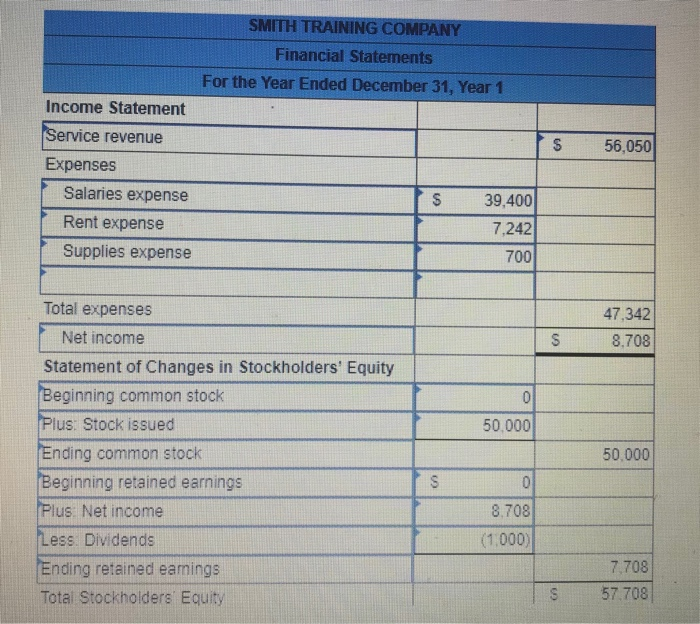

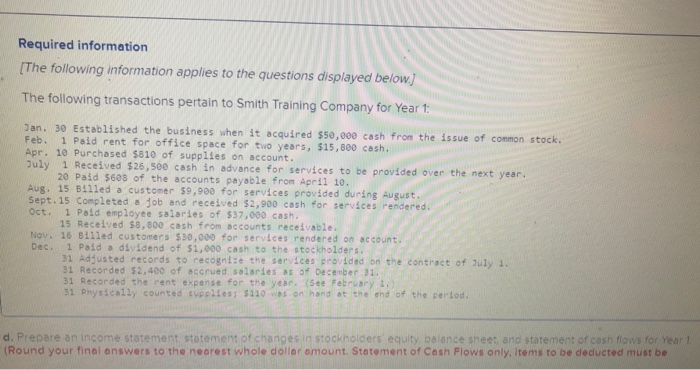

Required information [The following information applies to the questions displayed below The following transactions pertain to Smith Training Company for Year 1 Dan. 30 Established the business when it acquired $50,000 cash fron the issue of common stock Feb. 1 Paid rent for office space for two years, $15,800 cash Apr. 10 Purchased $810 of supplies on account. July 1 Received $26,500 cash in advance for services to be provided over th 20 Paid $6es of the accounts payable from April 10. Aug. 15 Billed a customer $9,900 for services provided during August. Sept. 15 Completed job and received $2,900 cash for services rendered Oct. 1 Paid employee salaries of $37,000 cash 15 Received $8,800 cash from accounts receivable. Nov. 16 BIlled customers $30,000 for services rendered on sccount. Dec 1 Paid a dividend of $1,000 cash to the stockholders 31 Adjusted records to recognize the services provided on the contract of uly 1. 31 Recorded $2,400 of accrued salaries as of December 31. 31 Recorded the rent expense for the year, (see Februsry 1 31 physically counted supplies; $110 s on hand at the end of the period. d. Prepare an income statement statement of changes in stockholders equity balance sheet and statement of cash flows for Round your final answers to the nearest whole doller amount. Statement of Cosh Flows only, Items to be deducted must be SMITH TRAINING COMPANY Statement of Cash Flows For the Year Ended December 31, Year 1 Cash flow from operating activities: Received from customers $38,200 Paid for expenses S38,200 Net cash flow from operating activities Cash flow from investing activities Cash flows from financing activities: 50,000 Received from stock issue Paid for dividends (1,000) 49.000 Net cash flow from financing activities Net change in cash Plus Beginning cash balance Ending cash balance 87,200 87.200 Balance Sheet As of December 31, Year 1 Assets Cash Accounts receivable Prepaid rent Supplies 33,792 31,100 8,558 110 Total assets S 73,560 Liabilities Accounts payable Salaries payable Unearned revenue 202 2.400 13.250 Total liabilities S 15,852 Stockholders' Equity 50.000 7.708 Common stock Retained earnings Total stockholders' equity Total liahilities and stockholders enuity 57 708 S73 560 SMITH TRAINING COMPANY Financial Statements For the Year Ended December 31, Year 1 Income Statement Service revenue Expenses $ 56,050 Salaries expense Rent expense Supplies expense S 39,400 7,242 700 Total expenses 47,342 Net income Statement of Changes in Stockholders' Equity Beginning common stock Plus. Stock issued Ending common stock Beginning retained earnings Plus. Net income Less. Dividends Ending retained eamings Total Stockholders Equity 8,708 50,000 50,000 8,708 (1,000 7.708 57.708