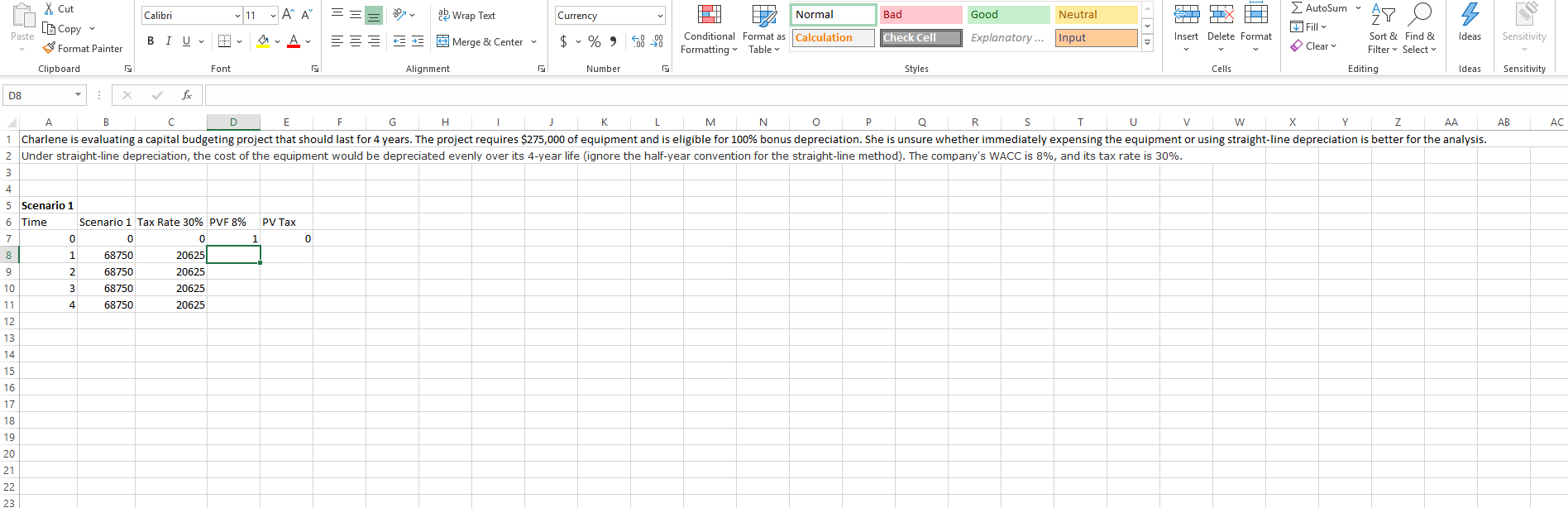

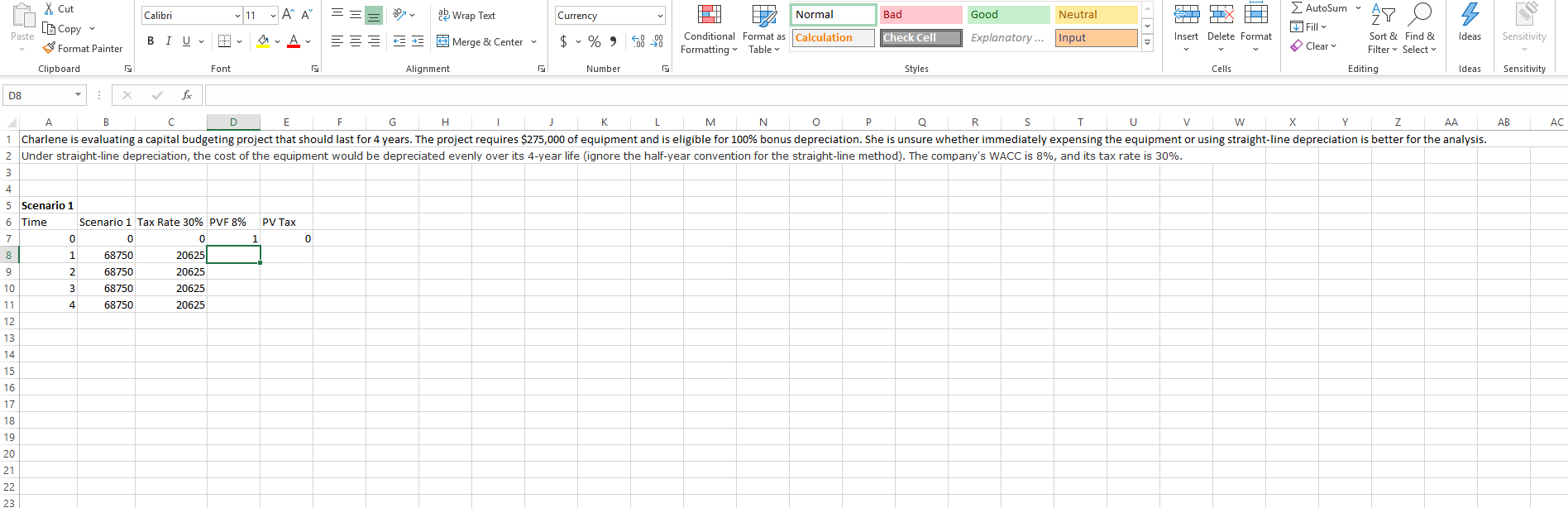

I need help finding pvf 8% I cant figure out how to fill out column D. Please show formula on excel

I need help finding pvf 8% I cant figure out how to fill out column D. Please show formula on excel

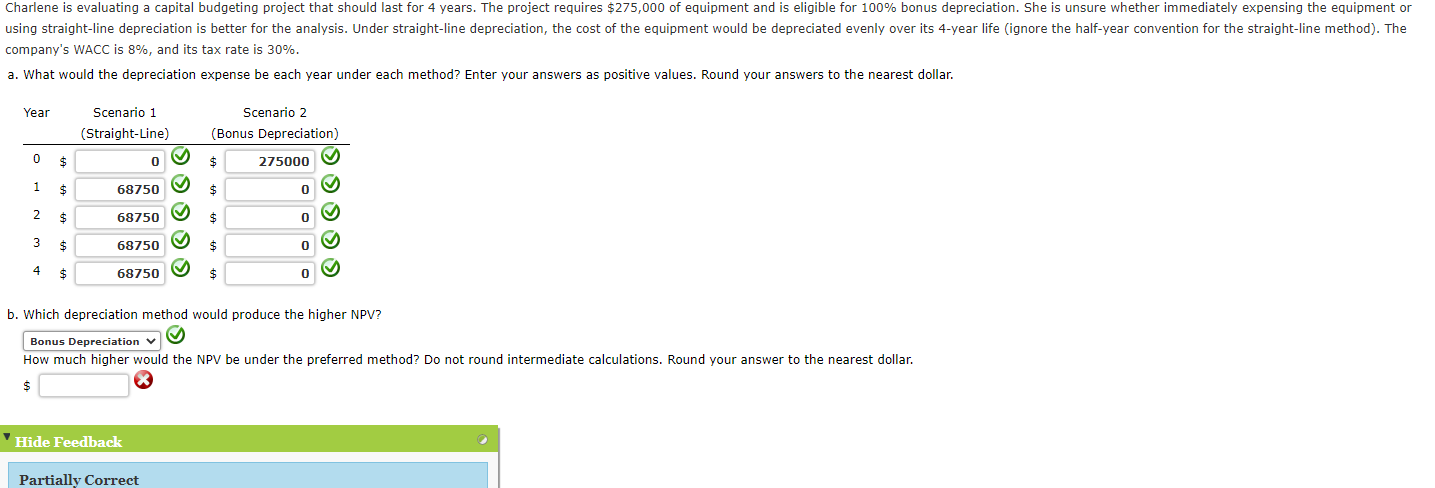

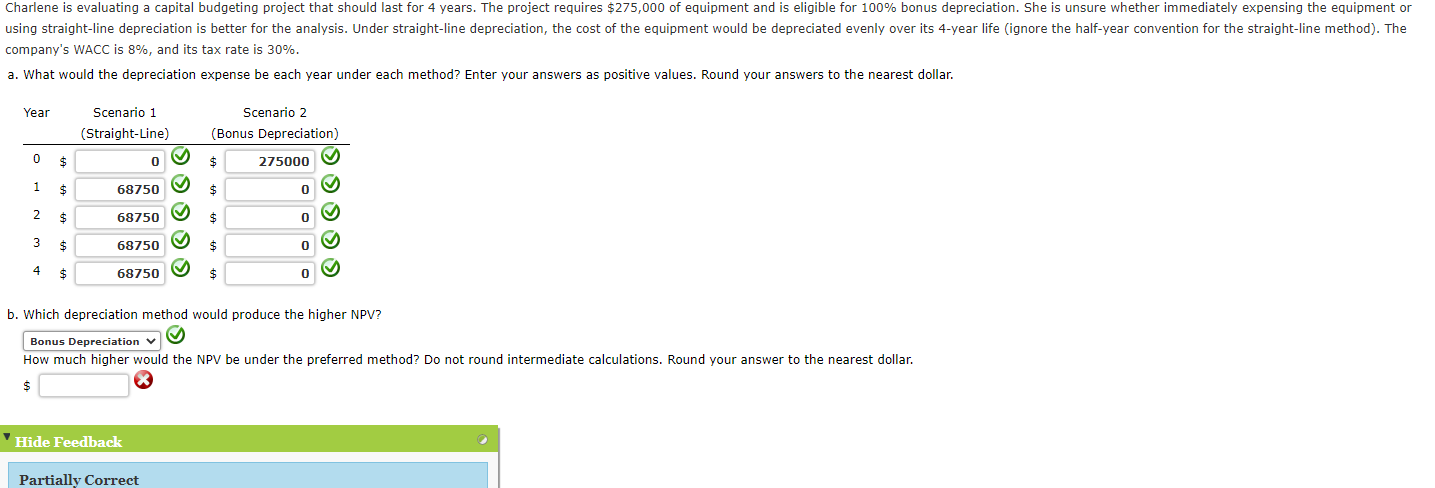

X Cut L@ Copy Calibri 11 A A a Wrap Text Currency PA Normal Bad Good Neutral LX AutoSum Fill 28 O 3 Paste BIU A $ -% -8 Insert Delete Format SEE E Merge & Center Check Cell Ideas Explanatory... Input y Conditional Format as Calculation Formatting Table Sensitivity Sort & Find & Filter Select Format Painter Clear Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity D8 3 A B D 1 P Z AA AB AC E F F G H L M . N Q R S U W X Y 1 Charlene is evaluating a capital budgeting project that should last for 4 years. The project requires $275,000 of equipment and is eligible for 100% bonus depreciation. She is unsure whether immediately expensing the equipment or using straight-line depreciation is better for the analysis. 2 Under straight-line depreciation, the cost of the equipment would be depreciated evenly over its 4-year life (ignore the half-year convention for the straight-line method). The company's WACC is 8%, and its tax rate is 30%. 3 4 PV Tax 1 0 5 Scenario 1 6 Time Scenario 1 Tax Rate 30% PVF 8% 7 0 0 0 0 0 8 1 68750 206251 9 2 68750 20625 10 3 68750 20625 11 4 68750 20625 12 13 14 15 16 17 18 19 20 21 22 23 Charlene is evaluating a capital budgeting project that should last for 4 years. The project requires $275,000 of equipment and is eligible for 100% bonus depreciation. She is unsure whether immediately expensing the equipment or using straight-line depreciation is better for the analysis. Under straight-line depreciation, the cost of the equipment would be depreciated evenly over its 4-year life (ignore the half-year convention for the straight-line method). The company's WACC is 8%, and its tax rate is 30%. a. What would the depreciation expense be each year under each method? Enter your answers as positive values. Round your answers to the nearest dollar. Year Scenario 1 (Straight-Line) Scenario 2 (Bonus Depreciation) 0 $ 0 $ 275000 1 $ 68750 $ 0 2 $ 68750 $ 0 3 $ 68750 $ 0 > > 4 $ 68750 $ 0 b. Which depreciation method would produce the higher NPV? Bonus Depreciation V How much higher would the NPV be under the preferred method? Do not round intermediate calculations. Round your answer to the nearest dollar. Hide Feedback Partially Correct

I need help finding pvf 8% I cant figure out how to fill out column D. Please show formula on excel

I need help finding pvf 8% I cant figure out how to fill out column D. Please show formula on excel