Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help finishing Paul Company completed the salary and wage payroll for March 2014. The payroll provided the following details Salaries and wages earned

I need help finishing

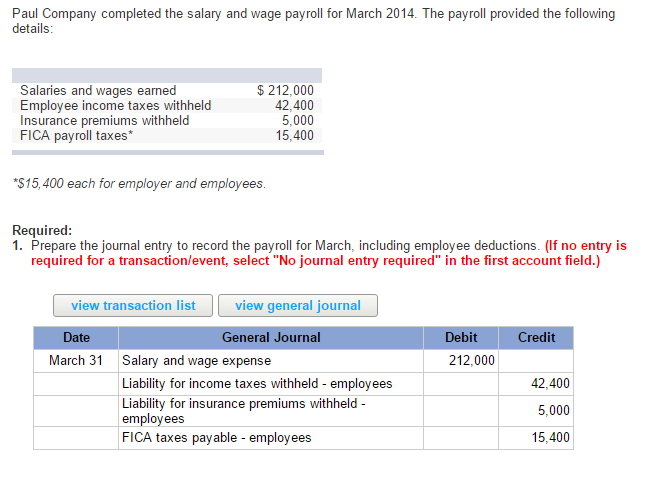

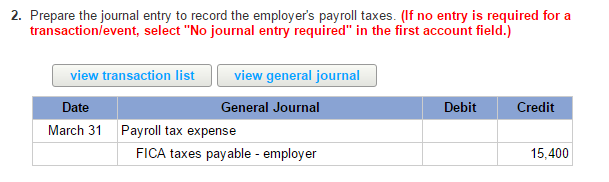

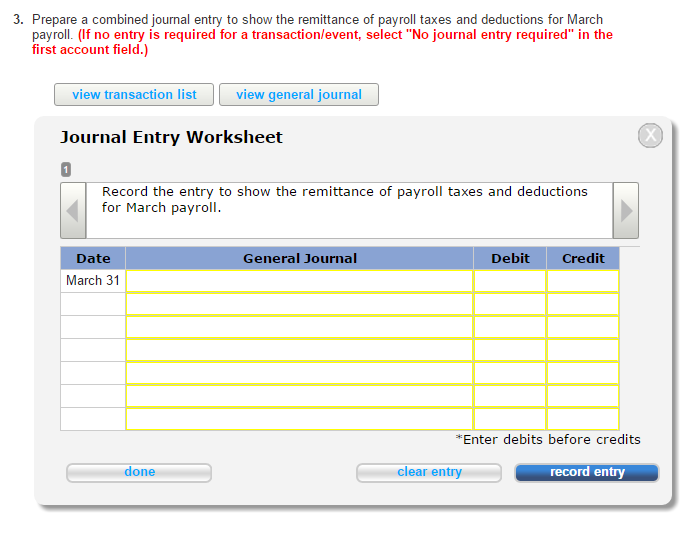

Paul Company completed the salary and wage payroll for March 2014. The payroll provided the following details Salaries and wages earned Employee income taxes withheld Insurance premiums withheld FICA payroll taxes* $212,000 42,400 5,000 15,400 $15,400 each for employer and employees Required 1. Prepare the journal entry to record the payroll for March, including employee deductions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list view general journal Date General Journal Debit Credit March 31Salary and wage expense 212,000 Liability for income taxes withheld - employees Liability for insurance premiums withheld- employees FICA taxes payable - employees 42,400 5,000 15,400 taxes payable employeesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started