Answered step by step

Verified Expert Solution

Question

1 Approved Answer

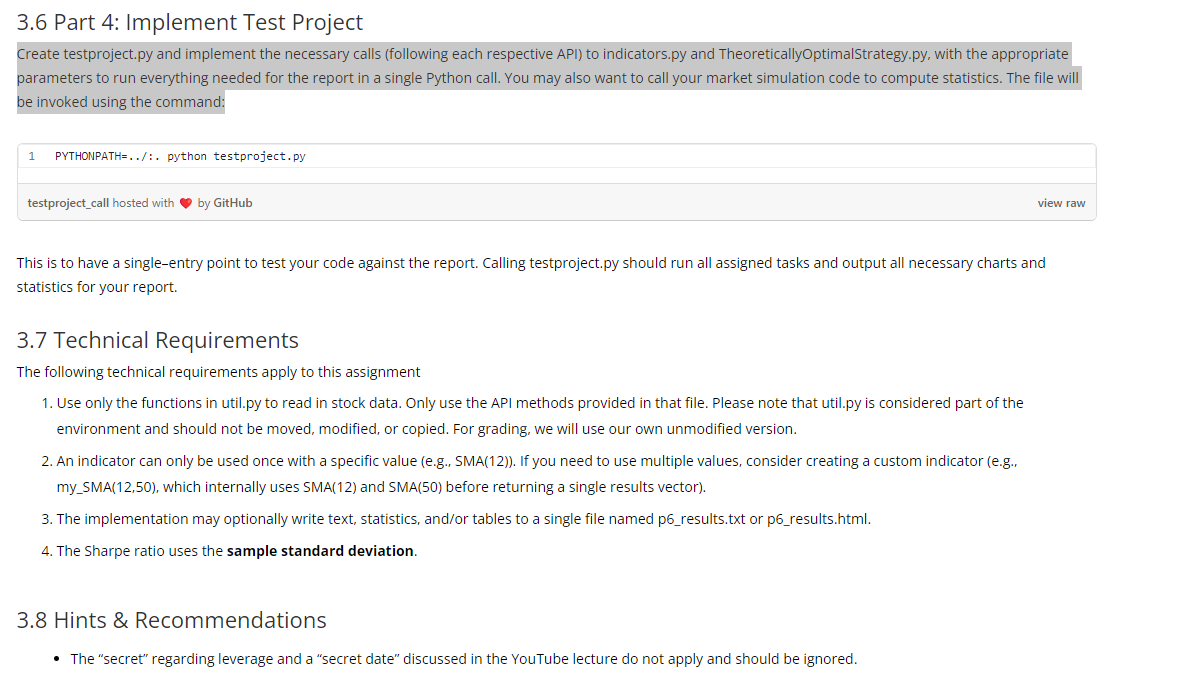

I need help finishing this code. All codes should be good I just need help with 3.6 in the guidelines above. testproject.py should implement the

I need help finishing this code. All codes should be good I just need help with 3.6 in the guidelines above. testproject.py should implement the correct calls to indicators and TheoreticallOptimalStrategy with the appropriate parameters to run everything and to gain the graphs. These graphs should be printed in the testproject, not another file. Please help in getting this fixed and running properly. Thanks in advance!

import pandas as pd

import datetime as dt

class TheoreticallyOptimalStrategy:

def testPolicy(self, symbol, sd, ed, sv):

# date range for the specified start and end dates

dates = pd.date_range(sd, ed)

# DataFrame for trades, initialize all trades to 0

trades = pd.DataFrame(index=dates)

trades[symbol] = 0

# Determine the number of trading days

num_trading_days = len(dates)

# Determine the maximum number of shares that can be bought/sold

max_shares = 1000

# Calculate the number of shares to buy/sell on each trading day

shares_per_day = max_shares // 2

# Buy and sell alternatively each day (starting with buying)

for i in range(num_trading_days):

if i % 2 == 0:

trades.iloc[i] = shares_per_day

else:

trades.iloc[i] = -shares_per_day

return trades

indicators.py

import pandas as pd

import matplotlib.pyplot as plt

def bollinger_bands(df, window=20):

rolling_mean = df['Price'].rolling(window=window).mean()

rolling_std = df['Price'].rolling(window=window).std()

upper_band = rolling_mean + (2 * rolling_std)

lower_band = rolling_mean - (2 * rolling_std)

return upper_band, lower_band

def relative_strength_index(df, window=14):

daily_returns = df['Price'].pct_change()

gain = daily_returns.where(daily_returns > 0, 0)

loss = -daily_returns.where(daily_returns < 0, 0)

avg_gain = gain.rolling(window=window).mean()

avg_loss = loss.rolling(window=window).mean()

relative_strength = avg_gain / avg_loss

rsi = 100 - (100 / (1 + relative_strength))

return rsi

def moving_average_convergence_divergence(df, short_window=12, long_window=26, signal_window=9):

short_ema = df['Price'].ewm(span=short_window, adjust=False).mean()

long_ema = df['Price'].ewm(span=long_window, adjust=False).mean()

macd = short_ema - long_ema

signal = macd.ewm(span=signal_window, adjust=False).mean()

return macd, signal

def stochastic_oscillator(df, window=14):

high = df['High'].rolling(window=window).max()

low = df['Low'].rolling(window=window).min()

stochastic_osc = (df['Price'] - low) / (high - low) * 100

return stochastic_osc

def percentage_price_indicator(df, window=20):

rolling_max = df['Price'].rolling(window=window).max()

rolling_min = df['Price'].rolling(window=window).min()

ppi = (df['Price'] - rolling_min) / (rolling_max - rolling_min)

return ppi

# Example usage for each indicator

if __name__ == "__main__":

# Load price data using util.py or from a CSV file

df = pd.read_csv('../data/JPM.csv', index_col='Date', parse_dates=True, usecols=['Date', 'Adj Close', 'High', 'Low'])

# sub-plots for each indicator

fig, axes = plt.subplots(5, 1, figsize=(10, 15))

# Calculate and plot Bollinger Bands

upper_band, lower_band = bollinger_bands(df)

axes[0].plot(df.index, df['Adj Close'], label='Price')

axes[0].plot(upper_band.index, upper_band, label='Upper Bollinger Band', color='orange')

axes[0].plot(lower_band.index, lower_band, label='Lower Bollinger Band', color='green')

axes[0].set_title('Bollinger Bands')

axes[0].legend()

# Calculate and plot RSI

rsi = relative_strength_index(df)

axes[1].plot(rsi.index, rsi, label='RSI', color='purple')

axes[1].set_title('Relative Strength Index (RSI)')

axes[1].legend()

# Calculate and plot MACD

macd, signal = moving_average_convergence_divergence(df)

axes[2].plot(df.index, df['Adj Close'], label='Price')

axes[2].plot(macd.index, macd, label='MACD', color='orange')

axes[2].plot(signal.index, signal, label='Signal Line', color='green')

axes[2].set_title('Moving Average Convergence Divergence (MACD)')

axes[2].legend()

# Calculate and plot Stochastic Oscillator

stochastic_osc = stochastic_oscillator(df)

axes[3].plot(stochastic_osc.index, stochastic_osc, label='Stochastic Oscillator', color='purple')

axes[3].set_title('Stochastic Oscillator')

axes[3].legend()

# Calculate and plot Percentage Price Indicator

ppi = percentage_price_indicator(df)

axes[4].plot(ppi.index, ppi, label='Percentage Price Indicator', color='orange')

axes[4].set_title('Percentage Price Indicator')

axes[4].legend()

plt.tight_layout()

plt.show()

testproject.py

import datetime as dt

import TheoreticallyOptimalStrategy as tos

import marketsimcode as ms

def calculate_portfolio_statistics(start_date, end_date, symbol, start_value):

# instance of the TheoreticallyOptimalStrategy

tos_strategy = tos.TheoreticallyOptimalStrategy()

# Get trades generated by the TOS strategy

trades = tos_strategy.testPolicy(symbol, start_date, end_date, start_value)

# Call the market simulator with the generated trades

portvals = ms.compute_portvals(trades, start_date, end_date, start_value)

# Calculate daily returns

daily_returns = portvals / portvals.shift(1) - 1

daily_returns.iloc[0] = 0 # Set the first day's return to 0

# Calculate statistics

cumulative_return = portvals.iloc[-1] / portvals.iloc[0] - 1

stdev_daily_returns = daily_returns.std()

mean_daily_returns = daily_returns.mean()

return cumulative_return, stdev_daily_returns, mean_daily_returns

if __name__ == "__main__":

symbol = "JPM"

start_date = dt.datetime(2008, 1, 1)

end_date = dt.datetime(2009, 12, 31)

start_value = 100000

# Calculate portfolio statistics

cumulative_return, stdev_daily_returns, mean_daily_returns = calculate_portfolio_statistics(start_date, end_date, symbol, start_value)

# Print the results

print(f"Cumulative return: {cumulative_return:.6f}")

print(f"Stdev of daily returns: {stdev_daily_returns:.6f}")

print(f"Mean of daily returns: {mean_daily_returns:.6f}")

marketsimcode.py

import datetime as dt

import numpy as np

import pandas as pd

from util import get_data, plot_data

def compute_portvals(

trades_df = None,

orders_file="./orders/orders.csv",

start_val=1000000,

commission=9.95,

impact=0.005,

):

"""

Computes the portfolio values.

:param orders_file: Path of the order file or the file object

:type orders_file: str or file object

:param start_val: The starting value of the portfolio

:type start_val: int

:param commission: The fixed amount in dollars charged for each transaction (both entry and exit)

:type commission: float

:param impact: The amount the price moves against the trader compared to the historical data at each transaction

:type impact: float

:return: the result (portvals) as a single-column dataframe, containing the value of the portfolio for each trading day in the first column from start_date to end_date, inclusive.

:rtype: pandas.DataFrame

"""

# Initialize variables and data

if trades_df is not None:

start_date, end_date, order_dates = get_dates(trades_df)

else:

orders_df = pd.read_csv(orders_file, index_col='Date', parse_dates=True, na_values=['nan'])

start_date, end_date, order_dates = get_dates(orders_df)

portfolio_vals = get_data(['SPY'], pd.date_range(start_date, end_date), addSPY=True, colname='Adj Close')

portfolio_vals = portfolio_vals.rename(columns={'SPY': 'Portfolio Value'})

dates = portfolio_vals.index

current_cash = start_val

shares_owned = {}

symbol_data = {}

# Loop through dates and execute orders

for current_date in dates:

if current_date in order_dates:

details = orders_df.loc[current_date]

if isinstance(details, pd.DataFrame):

for _, row in details.iterrows():

symbol = row.loc['Symbol']

order_type = row.loc['Order']

shares_to_trade = row.loc['Shares']

current_cash, shares_owned, symbol_data = update_portfolio(symbol, order_type, shares_to_trade, current_cash,

shares_owned, symbol_data, current_date, end_date,

commission, impact)

else:

symbol = details.loc['Symbol']

order_type = details.loc['Order']

shares_to_trade = details.loc['Shares']

current_cash, shares_owned, symbol_data = update_portfolio(symbol, order_type, shares_to_trade, current_cash,

shares_owned, symbol_data, current_date, end_date,

commission, impact)

# Calculate portfolio value for the current date

portfolio_vals.loc[current_date]['Portfolio Value'] = calculate_portfolio_value(current_date, current_cash, shares_owned, symbol_data)

return portfolio_vals

def get_dates(orders_df):

order_dates = orders_df.index

start_date = orders_df.index[0]

end_date = orders_df.index[-1]

return start_date, end_date, order_dates

def update_portfolio(symbol, order_type, shares_to_trade, current_cash, shares_owned, symbol_data, current_date, end_date, commission_fee, market_impact):

if symbol not in symbol_data:

symbol_df = get_data([symbol], pd.date_range(current_date, end_date), addSPY=True, colname='Adj Close')

symbol_df = symbol_df.ffill().bfill()

symbol_data[symbol] = symbol_df

if order_type == 'BUY':

shares_change = shares_to_trade

cash_change = -symbol_data[symbol].loc[current_date][symbol] * (1 + market_impact) * shares_to_trade

elif order_type == 'SELL':

shares_change = -shares_to_trade

cash_change = symbol_data[symbol].loc[current_date][symbol] * (1 - market_impact) * shares_to_trade

shares_owned[symbol] = shares_owned.get(symbol, 0) + shares_change

current_cash += cash_change - commission_fee

return current_cash, shares_owned, symbol_data

def calculate_portfolio_value(current_date, current_cash, shares_owned, symbol_data):

shares_value = 0

for symbol in shares_owned:

shares_value += symbol_data[symbol].loc[current_date][symbol] * shares_owned[symbol]

return current_cash + shares_value

def test_code():

# This is a helper function you can use to test your code

# Note that during autograding, this function will not be called.

order_file = "./orders/orders-02.csv"

starting_val = 1000000

portfolio_values = compute_portvals(orders_file=order_file, start_val=starting_val)

print(portfolio_values)

if __name__ == "__main__":

test_code()

3.1 Getting Started This framework assumes you have already set up the local environment and ML4T Software. There is no distributed template for this project. You will have access to the ML4T/Data directory data, but you should use ONLY the API functions in util.py to read it. You may create a new folder called indicator_evaluation to contain your code for this project. You should create the following code files for submission. They should contain ALL code from you that is necessary to run your evaluations. indicators.py Code implementing your indicators as functions that operate on DataFrames. There is no defined API for indicators.py, but when it runs, the main method should generate the charts that will illustrate your indicators in the report. marketsimcode.py An improved version of your marketsim code accepts a "trades" DataFrame (instead of a file). More info on the trades data frame is below. It is OK not to submit this file if you have subsumed its functionality into one of your other required code files. This file has a different name and a slightly different setup than your previous project. However, that solution can be used with several edits for the new requirements. TheoreticallyOptimalStrategy.py Code implementing a TheoreticallyOptimalStrategy (details below). It should implement testPolicy(), which returns a trades data frame (see below). testproject.py This file should be considered the entry point to the project. The if "_name_" == "_main___": section of the code will call the testPolicy function in TheoreticallyOptimalStrategy, as well as your indicators and marketsimcode as needed, to generate the plots and statistics for your report (more details below).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started