I need help for these questions. Thank you in advance

Question 1

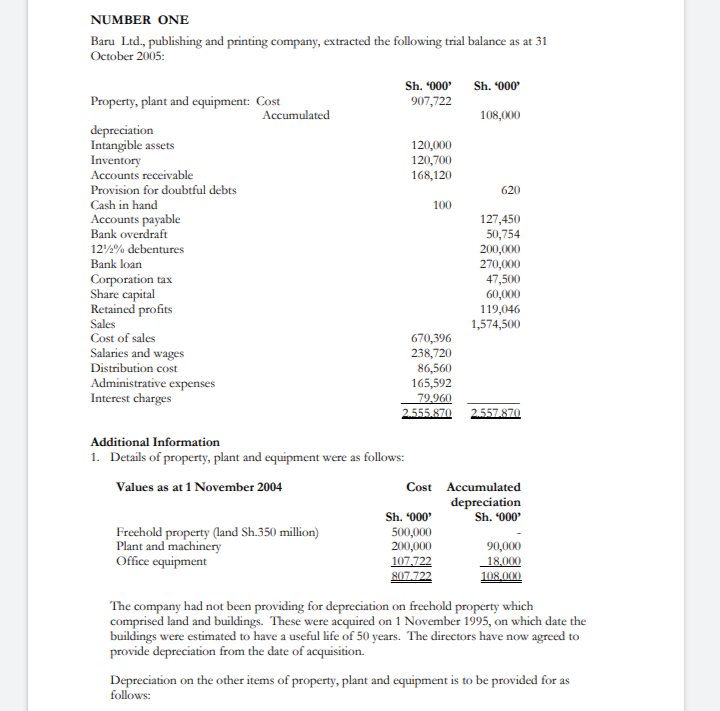

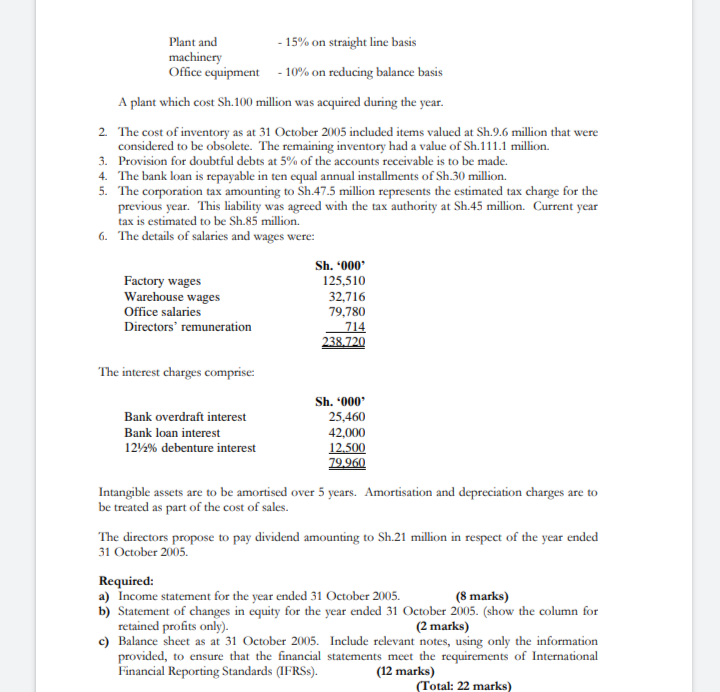

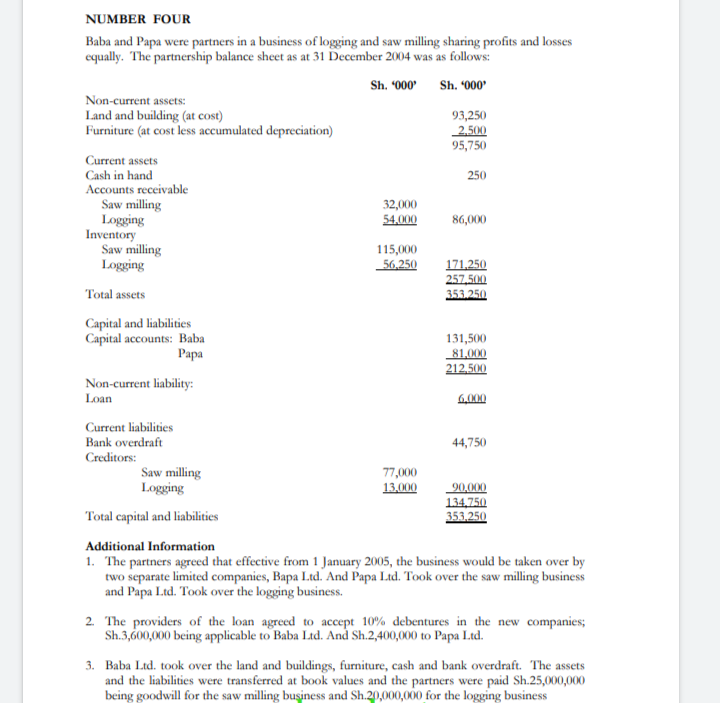

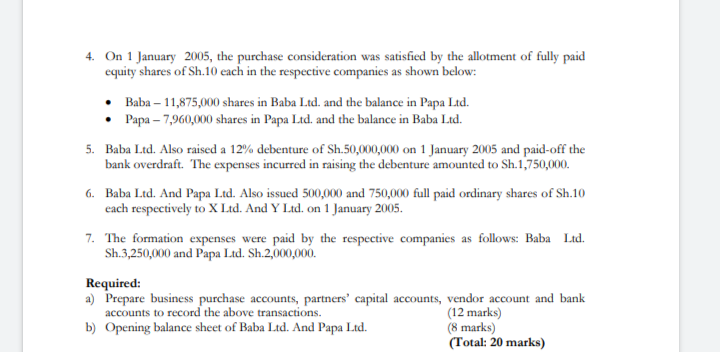

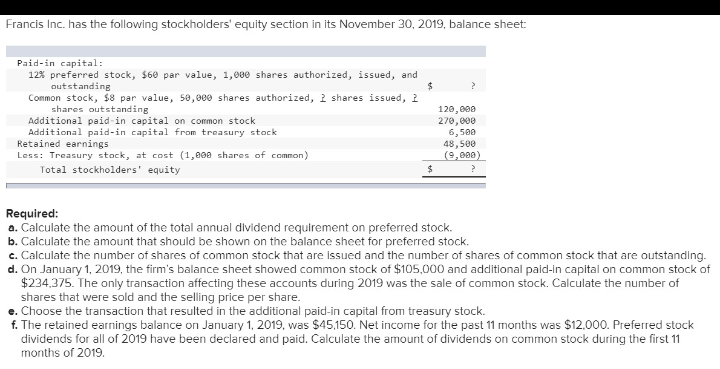

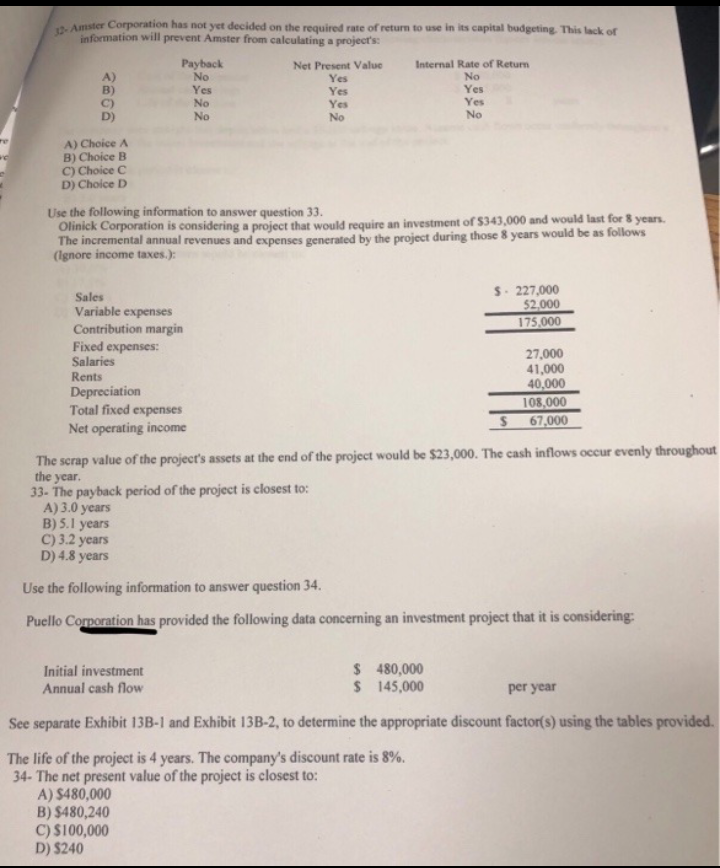

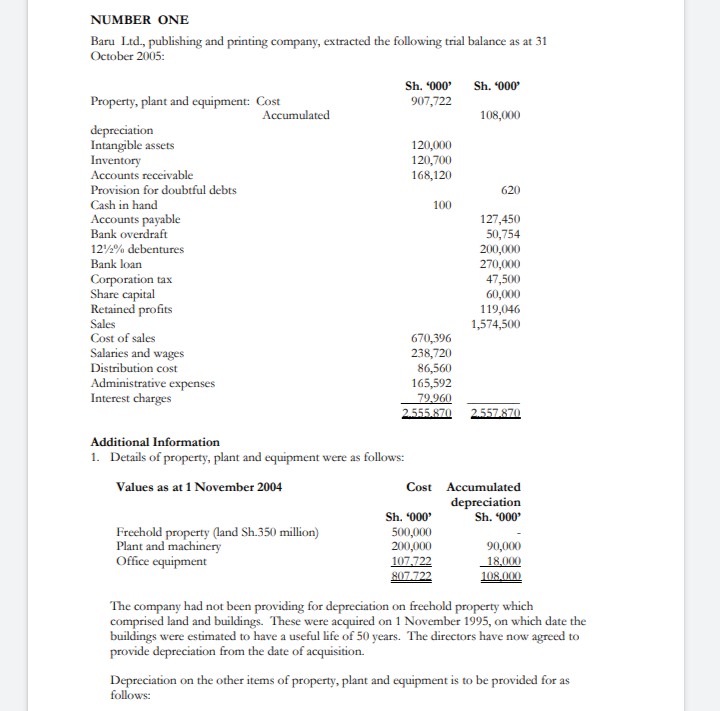

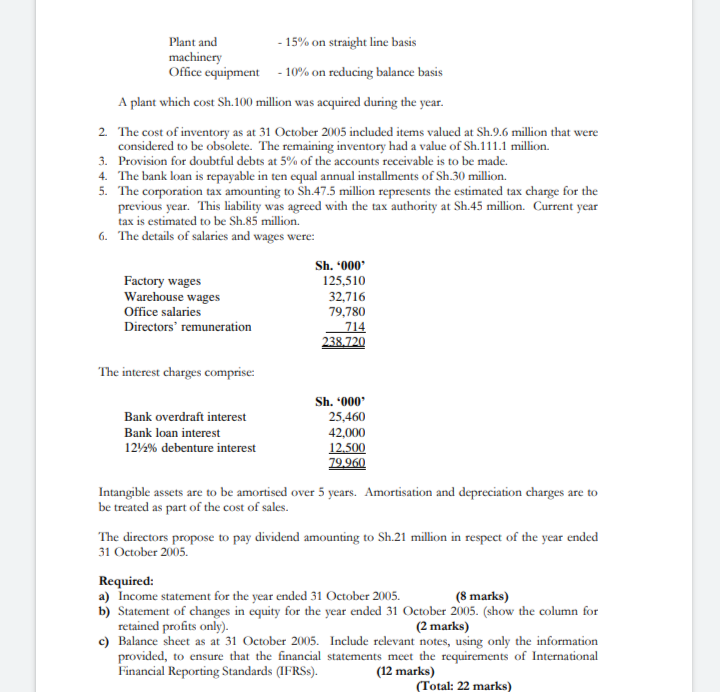

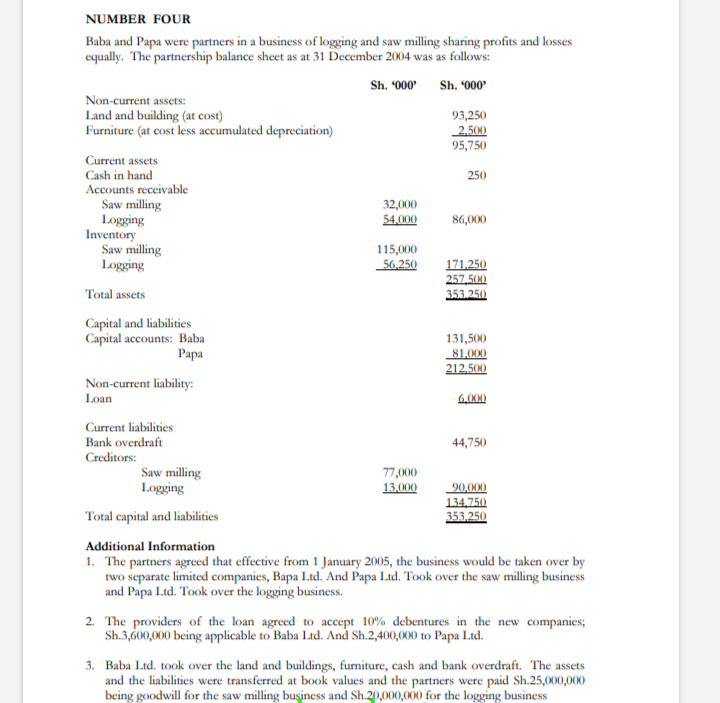

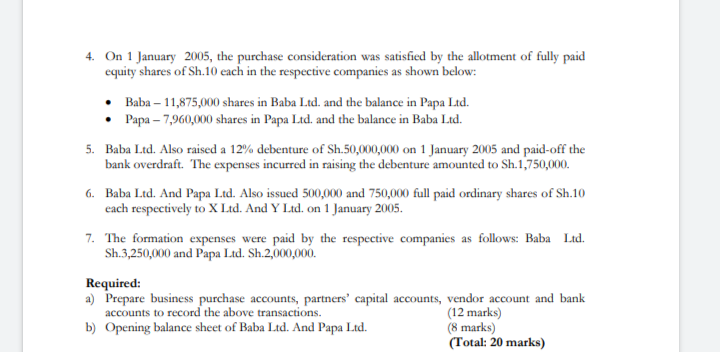

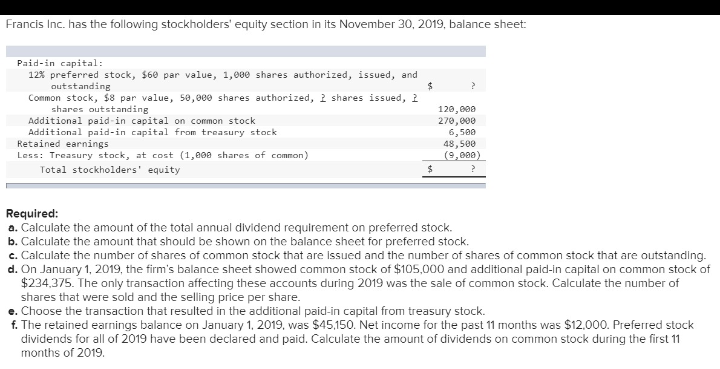

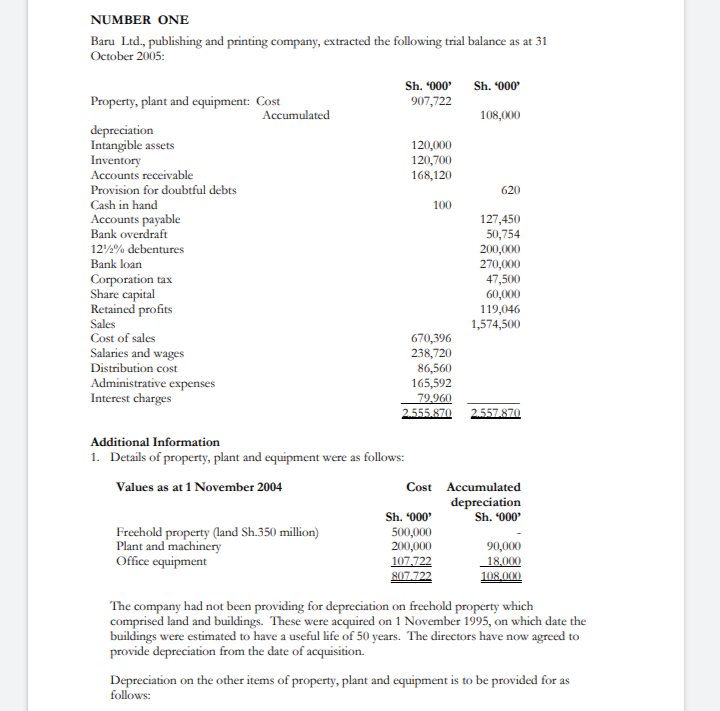

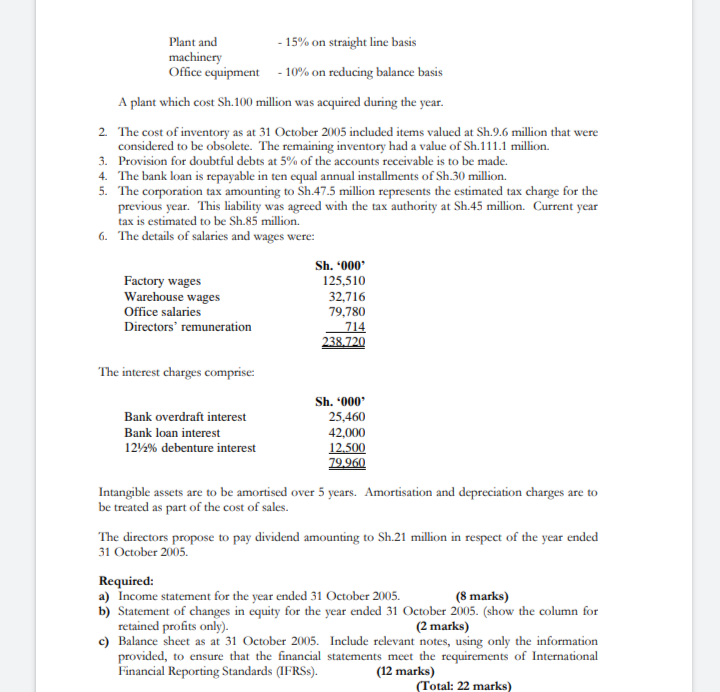

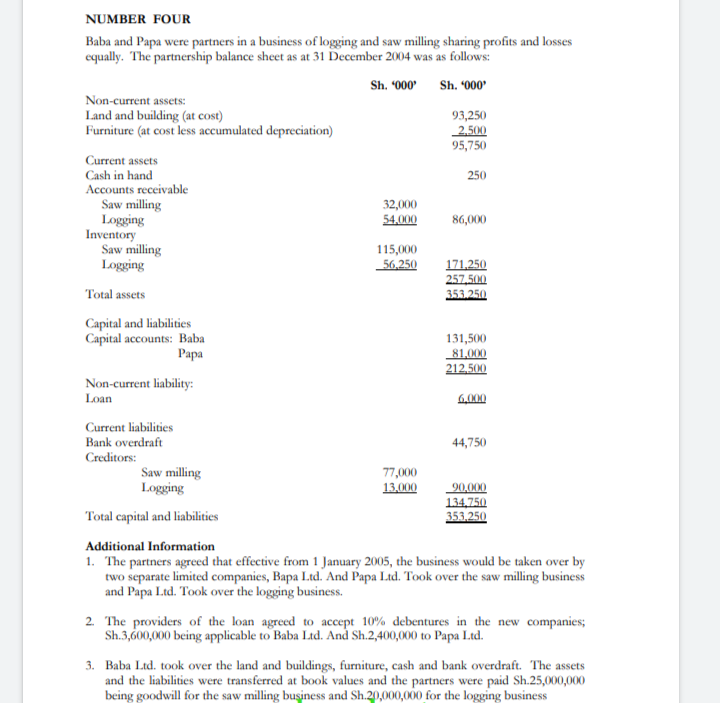

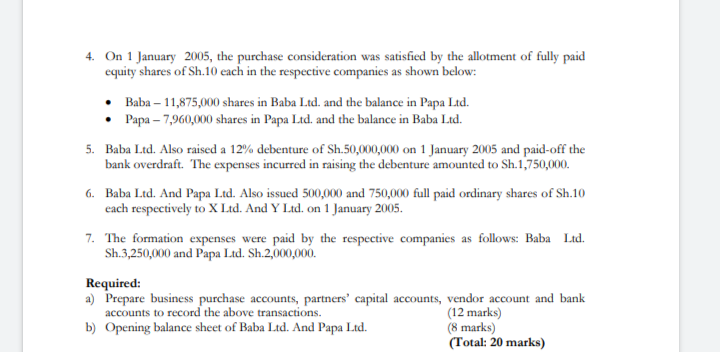

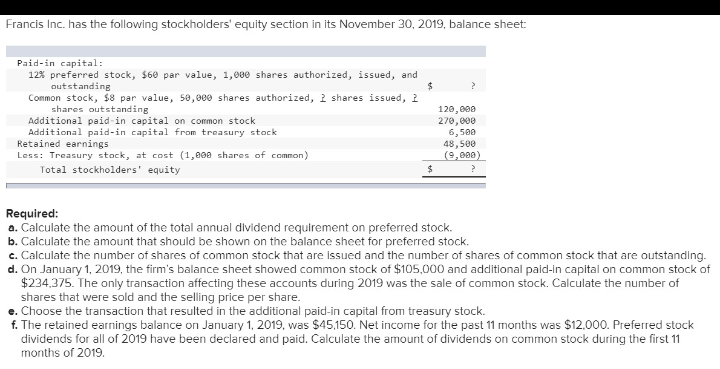

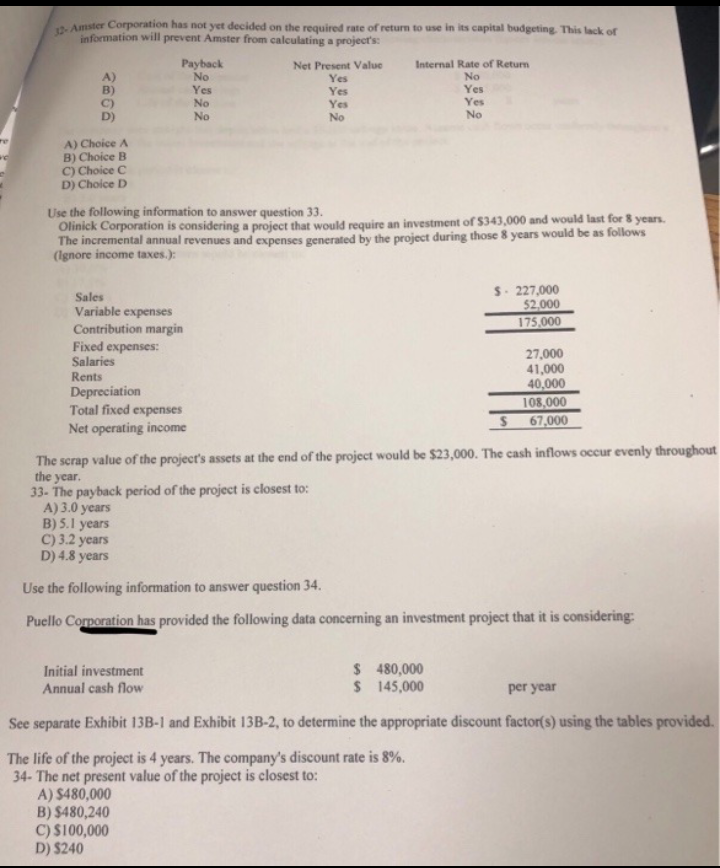

NUMBER ONE Baru Led., publishing and printing company, extracted the following trial balance as at 31 October 2005: Sh. '000" Sh. '000" Property, plant and equipment: Cost 907,722 Accumulated 108,000 depreciation Intangible assets 120,000 Inventory 120,700 Accounts receivable 168,120 Provision for doubtful debts 620 Cash in hand 100 Accounts payable 127,450 Bank overdraft 50,754 121/2% debentures 200,000 Bank loan 270,000 Corporation tax 47,500 Share capital 60,000 Retained profits 119,046 Sales 1,574,500 Cost of sales 670,396 Salaries and wages 238,720 Distribution cost 86,560 Administrative expenses 165,592 Interest charges 79.960 2.555.870 2.557.870 Additional Information 1. Details of property, plant and equipment were as follows: Values as at 1 November 2004 Cost Accumulated depreciation Sh. '000" Sh. '000' Freehold property (land Sh.350 million) 500,000 Plant and machinery 200,000 90,000 Office equipment 107.722 18,000 807.722 108 000 The company had not been providing for depreciation on freehold property which comprised land and buildings. These were acquired on 1 November 1995, on which date the buildings were estimated to have a useful life of 50 years. The directors have now agreed to provide depreciation from the date of acquisition. Depreciation on the other items of property, plant and equipment is to be provided for as follows:Plant and - 15% on straight line basis machinery Office equipment - 10% on reducing balance basis A plant which cost Sh. 100 million was acquired during the year. 2. The cost of inventory as at 31 October 2005 included items valued at Sh.9.6 million that were considered to be obsolete. The remaining inventory had a value of Sh.111.1 million. 3. Provision for doubtful debts at 5% of the accounts receivable is to be made. 4. The bank loan is repayable in ten equal annual installments of Sh.30 million. 5. The corporation tax amounting to Sh.47.5 million represents the estimated tax charge for the previous year. This liability was agreed with the tax authority at Sh.45 million. Current year tax is estimated to be Sh.85 million. 6. The details of salaries and wages were: Sh. '000" Factory wages 125,510 Warehouse wages 32,716 Office salaries 79,780 Directors' remuneration 714 238.720 The interest charges comprise: Sh. '000' Bank overdraft interest 25,460 Bank loan interest 42.000 1212% debenture interest 12.500 79.960 Intangible assets are to be amortised over 5 years. Amortisation and depreciation charges are to be treated as part of the cost of sales. The directors propose to pay dividend amounting to Sh.21 million in respect of the year ended 31 October 2005. Required: a) Income statement for the year ended 31 October 2005. (8 marks) b) Statement of changes in equity for the year ended 31 October 2005. (show the column for retained profits only). (2 marks) c) Balance sheet as at 31 October 2005. Include relevant notes, using only the information provided, to ensure that the financial statements meet the requirements of International Financial Reporting Standards (IFRSs). (12 marks) Total: 22 marks)NUMBER FOUR Baba and Papa were partners in a business of logging and saw milling sharing profits and losses equally. The partnership balance sheet as at 31 December 2004 was as follows: Sh. '000' Sh. '(00" Non-current assets: Land and building (at cost) 93,250 Furniture (at cost less accumulated depreciation) 2.500 95,750 Current assets Cash in hand 250 Accounts receivable Saw milling 32,000 Logging 54.000 86,000 Inventory Saw milling 1 15,000 Logging 56.250 171,250 257.500 Total assets 353.250 Capital and liabilities Capital accounts: Baba 131,500 Papa 81.000 212,500 Non-current liability: Loan 6.000 Current liabilities Bank overdraft 44,750 Creditors: Saw milling 77,000 Logging 13,000 90,000 134.750 Total capital and liabilities 353,250 Additional Information 1. The partners agreed that effective from 1 January 2005, the business would be taken over by two separate limited companies, Bapa Lid. And Papa Lid. Took over the saw milling business and Papa Lid. Took over the logging business. 2. The providers of the loan agreed to accept 10% debentures in the new companies; Sh.3,600,000 being applicable to Baba Lid. And Sh.2,400,000 to Papa Ltd. 3. Baba Led. took over the land and buildings, furniture, cash and bank overdraft. The assets and the liabilities were transferred at book values and the partners were paid Sh.25,000,000 being goodwill for the saw milling business and Sh.20,000,000 for the logging business4. On 1 January 2005, the purchase consideration was satisfied by the allotment of fully paid equity shares of Sh.10 each in the respective companies as shown below: Baba - 11,875,000 shares in Baba Ltd. and the balance in Papa Lid. . Papa - 7,960,000 shares in Papa Lid. and the balance in Baba Ltd. 5. Baba Led. Also raised a 12% debenture of Sh.50,000,000 on 1 January 2005 and paid-off the bank overdraft. The expenses incurred in raising the debenture amounted to Sh.1,750,000. 6. Baba Led. And Papa Led. Also issued 500,000 and 750,000 full paid ordinary shares of Sh.10 each respectively to X Lid. And Y Lid. on 1 January 2005. 7. The formation expenses were paid by the respective companies as follows: Baba Lid. Sh.3,250,000 and Papa Lid. Sh.2,000,000. Required: a) Prepare business purchase accounts, partners' capital accounts, vendor account and bank accounts to record the above transactions. (12 marks) b) Opening balance sheet of Baba Lid. And Papa Led. (8 marks) (Total: 20 marks)Francis Inc. has the following stockholders' equity section in its November 30, 2019, balance sheet: Paid-in capital: 12% preferred stock, $60 par value, 1,000 shares authorized, issued, and outstanding $ Common stock, $8 par value, 50,000 shares authorized, I shares issued, 1 shares outstanding 120, 600 Additional paid-in capital on common stock 270,090 Additional paid-in capital from treasury stock 6,500 Retained earnings 48, 500 Loss: Treasury stock, at cost (1,060 shares of common) (9,080) Total stockholders' equity $ Required: a. Calculate the amount of the total annual dividend requirement on preferred stock. b. Calculate the amount that should be shown on the balance sheet for preferred stock. c. Calculate the number of shares of common stock that are Issued and the number of shares of common stock that are outstanding. d. On January 1, 2019, the firm's balance sheet showed common stock of $105,000 and additional paid-in capital on common stock of $234.375. The only transaction affecting these accounts during 2019 was the sale of common stock. Calculate the number of shares that were sold and the selling price per share. e. Choose the transaction that resulted in the additional paid-in capital from treasury stock. f. The retained earnings balance on January 1, 2019, was $45150. Net income for the past 11 months was $12,000. Preferred stock dividends for all of 2019 have been declared and paid. Calculate the amount of dividends on common stock during the first 11 months of 2019.12- Amster Corporation has not yet decided on the required rate of return to use in its capital budgeting. This lack of information will prevent Amster from calculating a project's: Payback Net Present Value Internal Rate of Return No Yes No Yes Yes Yes No Ya Yes No No No A) Choice A B) Choice B C) Choice C D) Choice D Use the following information to answer question 33. Olinick Corporation is considering a project that would require an investment of $343,000 and would last for 8 years The incremental annual revenues and expenses generated by the project during those 8 years would be as follows (Ignore income taxes.): Sales $ . 227,000 Variable expenses 52,000 Contribution margin 175,000 Fixed expenses: Salaries 27,000 Rents 41,000 Depreciation 40,000 Total fixed expenses 108,000 Net operating income 67.000 The scrap value of the project's assets at the end of the project would be $23,000. The cash inflows occur evenly throughout the year. 33- The payback period of the project is closest to: A) 3.0 years B) 5.1 years C) 3.2 years D) 4.8 years Use the following information to answer question 34. Puello Corporation has provided the following data concerning an investment project that it is considering: Initial investment 480,000 Annual cash flow S 145,000 per year See separate Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided. The life of the project is 4 years. The company's discount rate is 8%. 34- The net present value of the project is closest to: A) $480,000 B) $480,240 C) $100,000 D) $240