I need help gathering the information in an excell sheet. What should this look like as a journal entry? Updated Scenario: Many customers have been

I need help gathering the information in an excell sheet. What should this look like as a journal entry?

Updated Scenario: Many customers have been asking for more hypoallergenic products, so in September you start carrying a line of hypoallergenic shampoos on

a trial basis. The following information relates to the purchase and sales of the shampoo:

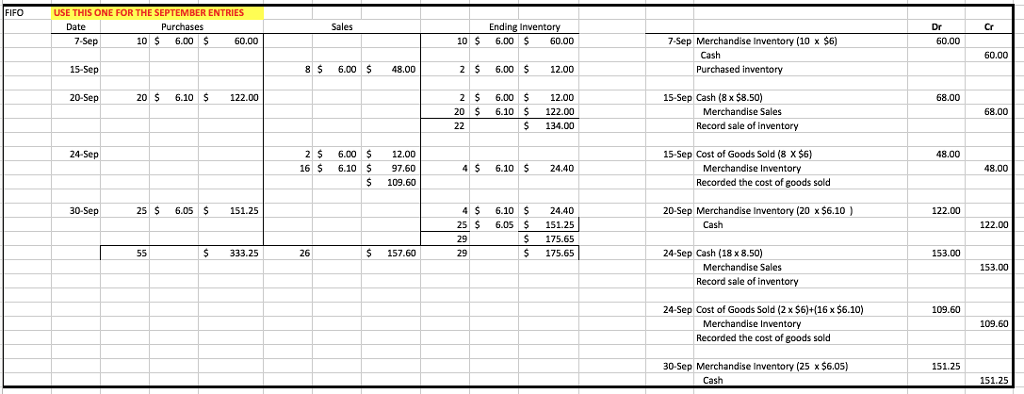

You use the perpetual inventory method. Although you could use thefollowing valuation methods FIFO, LIFO, or weighted average, you choose to use the FIFO method.

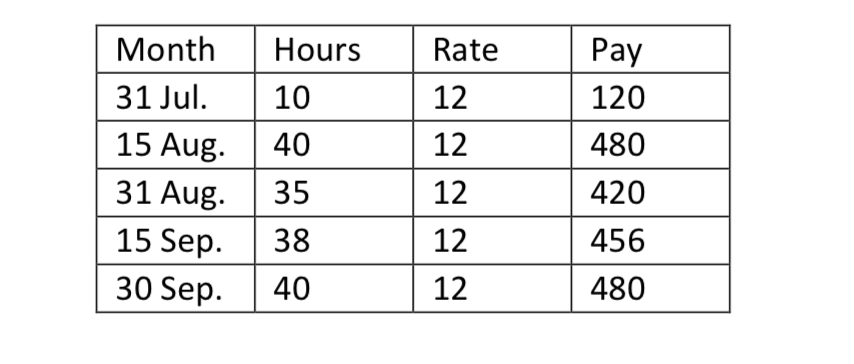

Data: The following events occur in September, 2018: September 1: Paid dividends to self in amount of $10,000. September 5: Pay employee for period ending 8/31. September 7: Purchase merchandise for resale. See Inventory Valuation tab for details. September 8: Receive payments from customers toward accounts receivable in amount of $4,000. September 10: Pay August telephone bill. September 11: Purchase baking supplies in amount of $7,000 from vendor on account. September 13: Paid on supplies vendor account in amount of $5,000. September 15: Accrue employee wages for period of September 1 through September 15. September 15: Pay rent on bakery space: $1,500. September 15: Record merchandise sales transaction. See Inventory Valuation tab for details. September 15: Record impact of sales transaction on COGS and the inventory asset. See Inventory Valuation tab for details.September 20: Pay employee for period ending 9/15. September 20: Purchase merchandise inventory for resale to customers. See Inventory Valuation tab for details.

September 24: Record sales of merchandise to customers. See Inventory Valuation tab for details.

September 24: Record impact of sales transaction on COGS and the inventory asset. See Inventory Valuation tab for details.September 30: Purchase merchandise inventory for resale to customers. See Inventory Valuation tab for details.September 30: Accrue employee wages for period of September 16th through September 30th

September 30: Total September bakery sales are $20,000. $6,000 of these sales are on accounts receivable.

Wage Calculation Data:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started