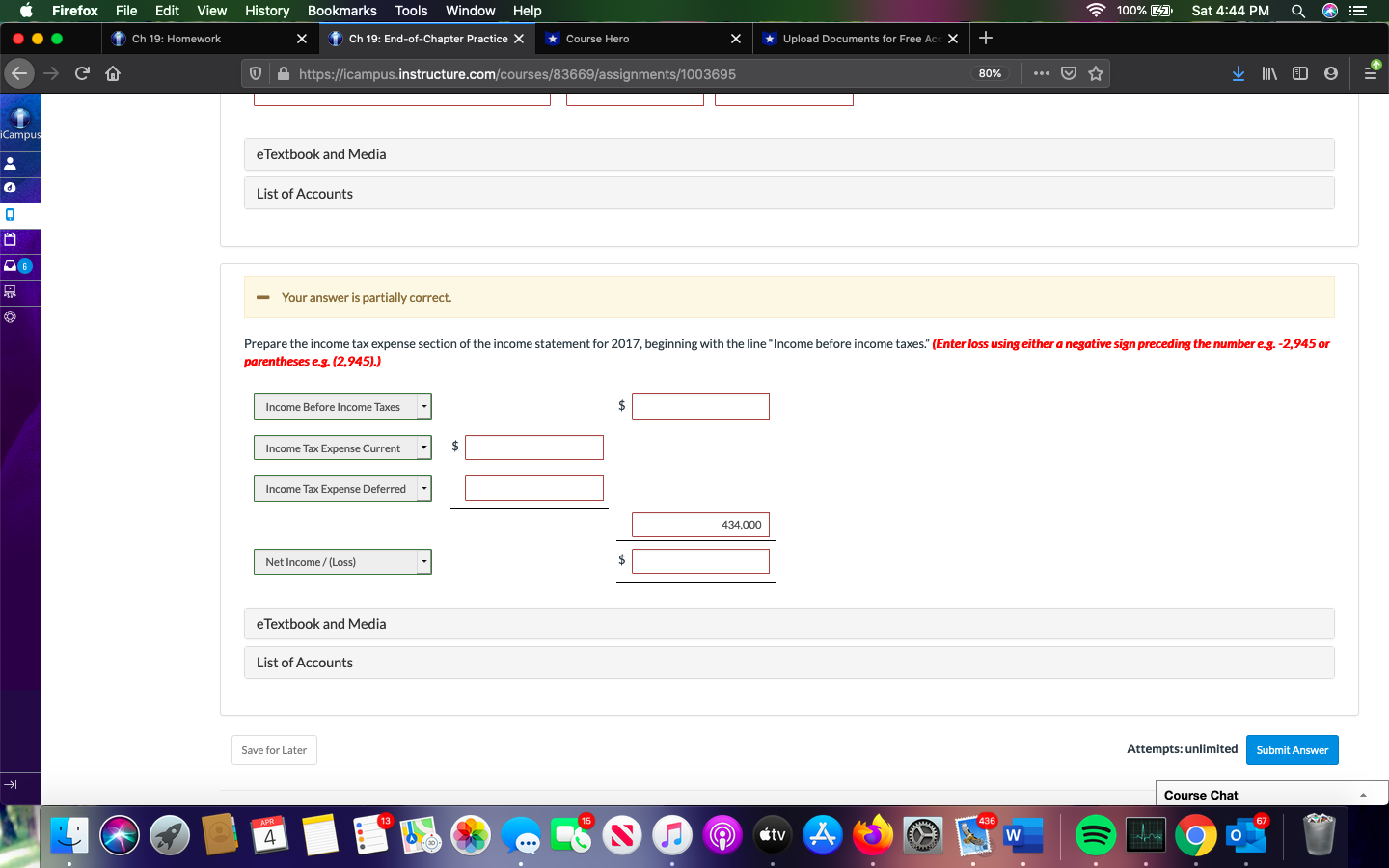

I need help getting started on this one, thanks in advance

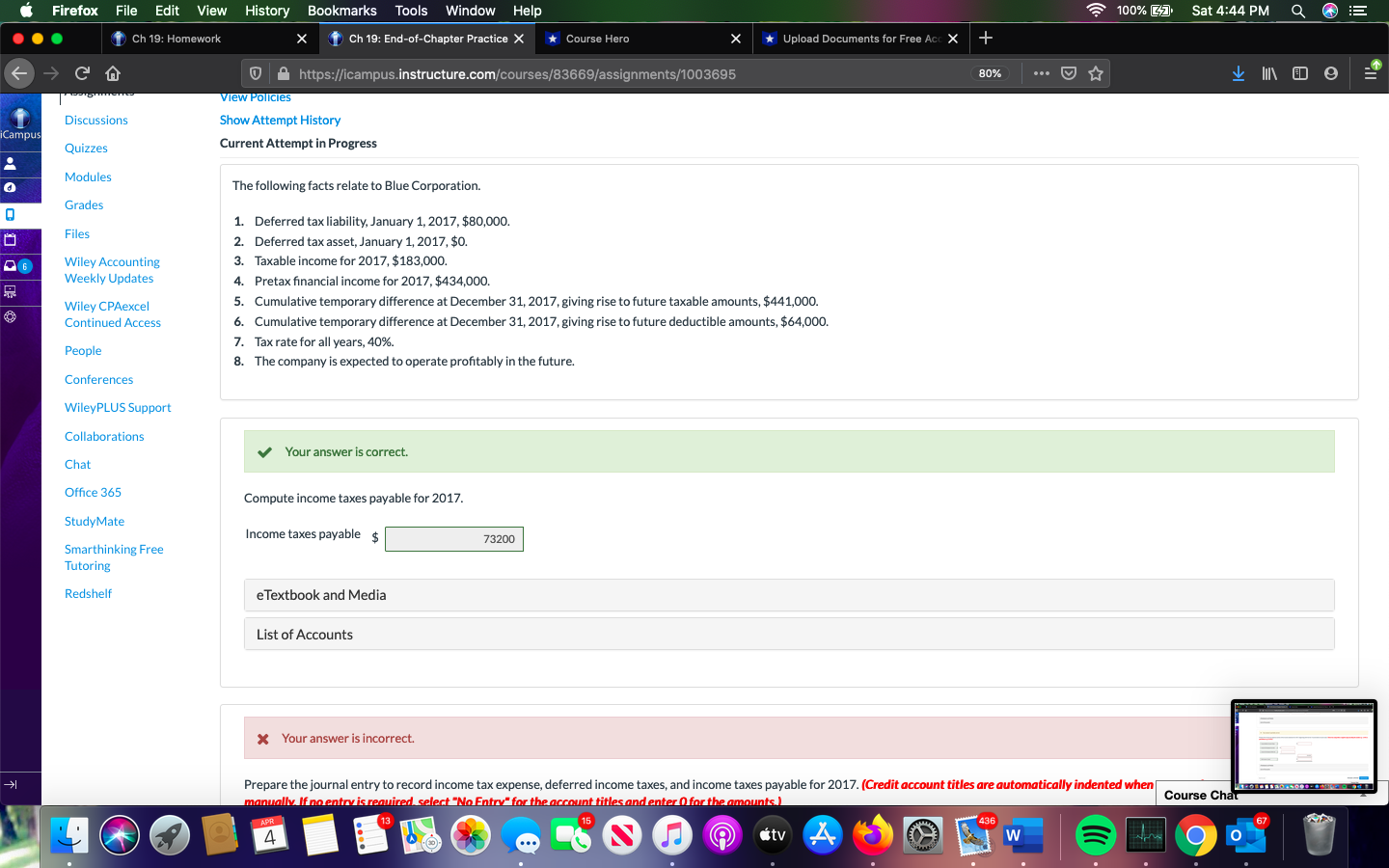

Firefox File Edit View History Bookmarks Tools Window Help 100% [7 Sat 4:44 PM Q . . . Ch 19: Homework X Ch 19: End-of-Chapter Practice X *Course Hero X * Upload Documents for Free Acc X + A https://icampus.instructure.com/courses/83669/assignments/1003695 80% . .. V iCampus e Textbook and Media List of Accounts 6 - Your answer is partially correct. Prepare the income tax expense section of the income statement for 2017, beginning with the line "Income before income taxes." (Enter loss using either a negative sign preceding the number e-g. -2,945 or parentheses e.g. (2,945).) Income Before Income Taxes Income Tax Expense Current Income Tax Expense Deferred 434,000 Net Income / (Loss) e Textbook and Media List of Accounts Save for Later Attempts: unlimited Submit Answer Course Chat APR tv 4 67 4 W OFirefox File Edit View History Bookmarks Tools Window Help 100% [7 Sat 4:44 PM Q 1Ch 19: Homework X Ch 19: End-of-Chapter Practice X *Course Hero X Upload Documents for Free Acc X + CA https://icampus.instructure.com/courses/83669/assignments/1003695 80% . .. V 2 In 0 9 View Policies Discussions Show Attempt History Campus Quizzes Current Attempt in Progress O Modules The following facts relate to Blue Corporation. Grades Files 1. Deferred tax liability, January 1, 2017, $80,000. 2. Deferred tax asset, January 1, 2017, $0. Wiley Accounting 3. Taxable income for 2017, $183,000. Weekly Updates 4. Pretax financial income for 2017, $434,000. Wiley CPAexcel 5. Cumulative temporary difference at December 31, 2017, giving rise to future taxable amounts, $441,000. Continued Access 6. Cumulative temporary difference at December 31, 2017, giving rise to future deductible amounts, $64,000. People 7. Tax rate for all years, 40%. 8. The company is expected to operate profitably in the future. Conferences WileyPLUS Support Collaborations Your answer is correct. Chat Office 365 Compute income taxes payable for 2017. StudyMate Smarthinking Free Income taxes payable $ 73200 Tutoring Redshelf e Textbook and Media List of Accounts * Your answer is incorrect. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017. (Credit account titles are automatically indented when manually If no entry is required select "No Entry" for the account titles and enter ( for the amounts ) Course Chat APR 436 67 4 4 W O