Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help, I have some examples on the first three pictures then my questions at the bottom. Year 2 1. You are in charge

I need help, I have some examples on the first three pictures then my questions at the bottom.

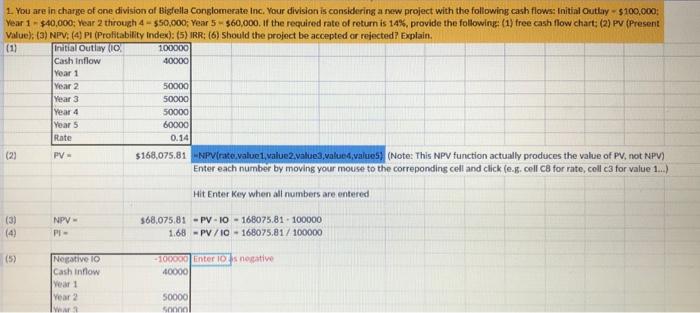

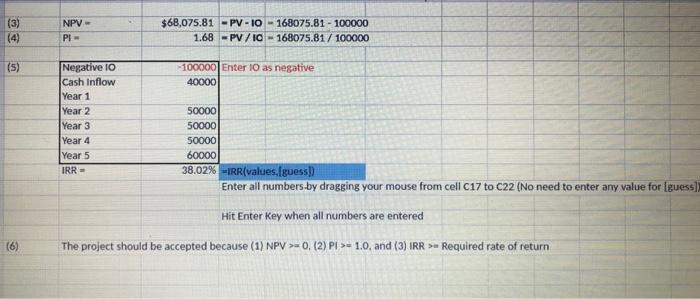

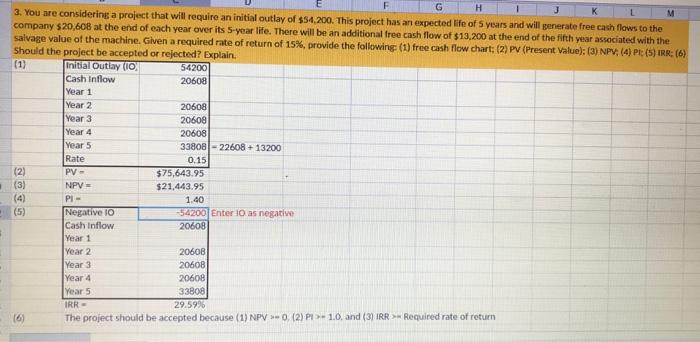

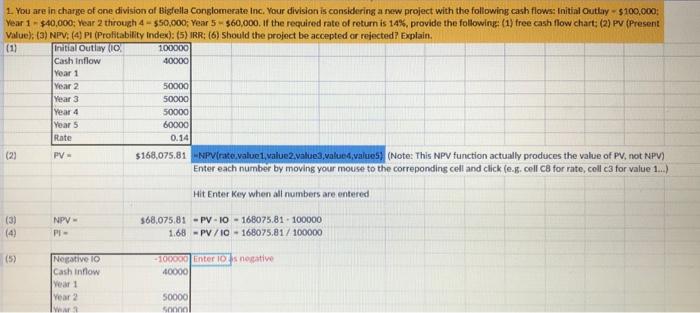

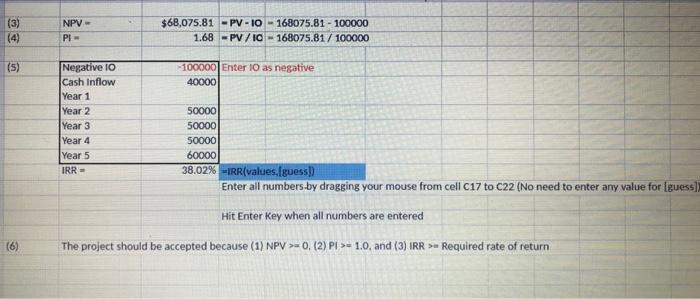

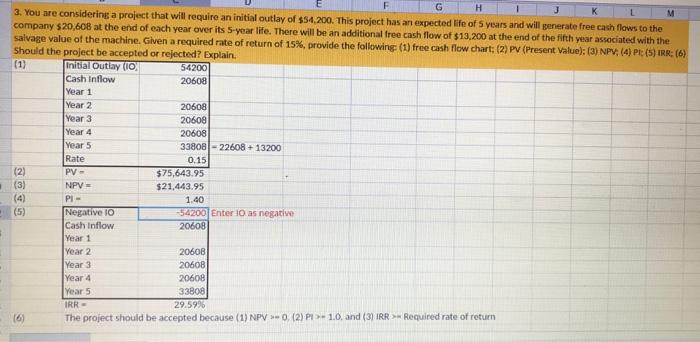

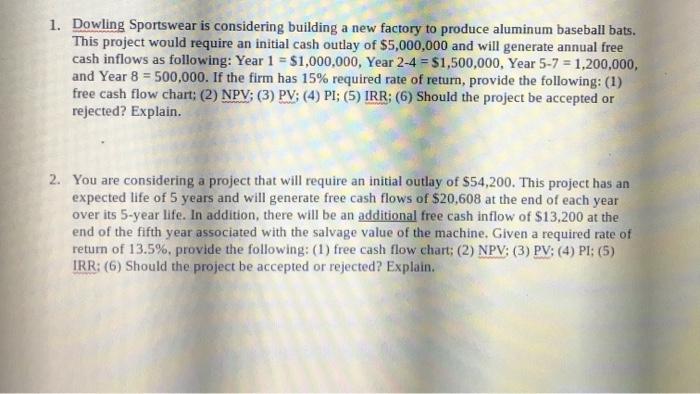

Year 2 1. You are in charge of one division of Bigfella Conglomerate Inc. Your division is considering a new project with the following cash flows: Initial Outlay$100,000; Year 1 - $40,000: Year 2 through 4 - $50.000; Year 5 - $60,000. If the required rate of return is 14%, provide the following: (1) free cash flow chart: (2) PV (Present Value): (a) NPV: (4) Pi (Profitability Index): (5) IRR: (6) Should the project be accepted or rejected? Explain. (1) Initial Outlay (10) 100000 Cash Intlow 40000 Year 1 50000 Year 3 50000 Year 4 50000 Years 60000 Rate 0.14 PV- $168,075.81 NPV (rate value1, value2value3,value, value) (Note: This NPV function actually produces the value of PV, not NPV) Enter each number by moving your mouse to the correponding cell and click (e.&.cell C for rate, coll c3 for value 1...) Hit Enter Key when all numbers are entered (3) NPV- $68,075.81 - PV-10-168075.81 - 100000 (4) P- 1.68 - PV/10 - 168075.81/100000 (23) (5) -100000 Enter 10 nocative 40000 Negative 10 Cash inflow Yeart Year 2 1 50000 son (3) (4) NPV- PL- $68,075.81 -PV-10-168075.81 - 100000 1.68 -PV/10 - 168075.81 / 100000 (5) 100000 Enter 10 as negative 40000 Negative 10 Cash Inflow Year 1 Year 2 Year 3 Year 4 Year 5 IRR - 50000 50000 50000 60000 38.02% -IRR(values. Iguess) Enter all numbers by dragging your mouse from cell C17 to C22 (No need to enter any value for guess] Hit Enter Key when all numbers are entered (6) The project should be accepted because (1) NPV >=0. (2) PI >= 1.0 and (3) IRR > Required rate of return F G H J K 3. You are considering a project that will require an initial outlay of $54,200. This project has an expected life of Syears and will generate free cash flows to the M company $20,608 at the end of each year over its 5-year life. There will be an additional free cash flow of $13,200 at the end of the fifth year associated with the salvage value of the machine. Given a required rate of return of 15%, provide the following (1) free cash flow chart: (2) PV (Present Value): (3) NPV (4) PE (5) IRR: (6) Should the project be accepted or rejected? Explain. (1) Initial Outiay (10) 54200 Cash Inflow 20608 Year 1 Year 2 20608 Year 3 20608 Year 4 20608 Year 5 33808-22608 +13200 Rate 0.15 (2) PV- $75,643.95 (3) NPV = $21,443.95 (4) PL - 1.40 Negative 10 54200 Enter 10 as negative Cash Inflow 20608 Year 1 Year 2 20608 Year 3 20608 Year 4 20608 Year 5 33808 IRR - 29.59% 16 The project should be accepted because (1) NPV -0. (2) PI>-1.0. and (3) IRR > Required rate of return (5) 1. Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $5,000,000 and will generate annual free cash inflows as following: Year 1 = $1,000,000, Year 2-4 = $1,500,000, Year 5-7 = 1,200,000, and Year 8 = 500,000. If the firm has 15% required rate of return, provide the following: (1) free cash flow chart: (2) NPV; (3) PV: (4) PI; (5) IRR; (6) Should the project be accepted or rejected? Explain. 2. You are considering a project that will require an initial outlay of $54,200. This project has an expected life of 5 years and will generate free cash flows of $20,608 at the end of each year over its 5-year life. In addition, there will be an additional free cash inflow of $13.200 at the end of the fifth year associated with the salvage value of the machine. Given a required rate of return of 13.5%, provide the following: (1) free cash flow chart; (2) NPV; (3) PV; (4) PI; (5) IRR: (6) Should the project be accepted or rejected? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started