Answered step by step

Verified Expert Solution

Question

1 Approved Answer

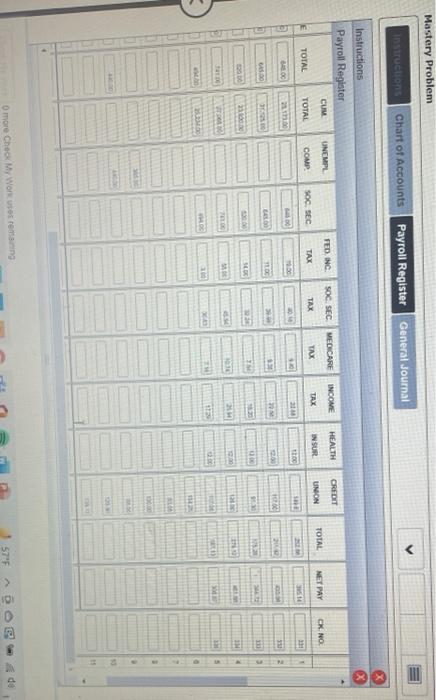

i need help. i have this but I am lost on what to do now. please be clear! Mastery Problem Instructions Chart of Accounts Payroll

i need help. i have this but I am lost on what to do now.

please be clear!

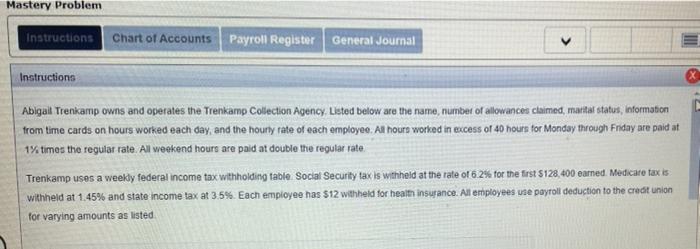

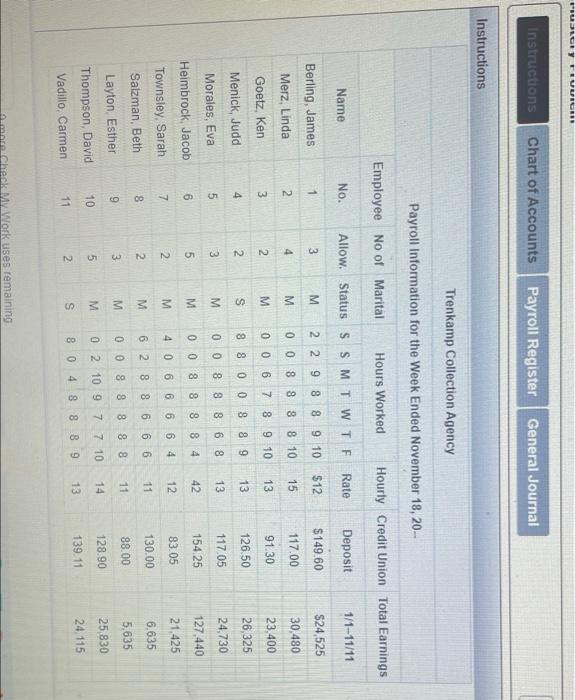

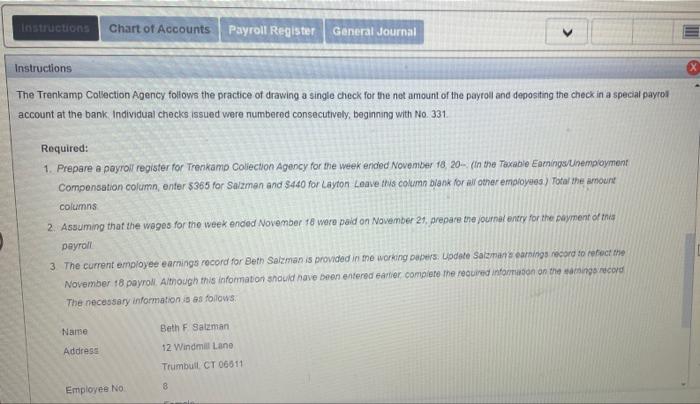

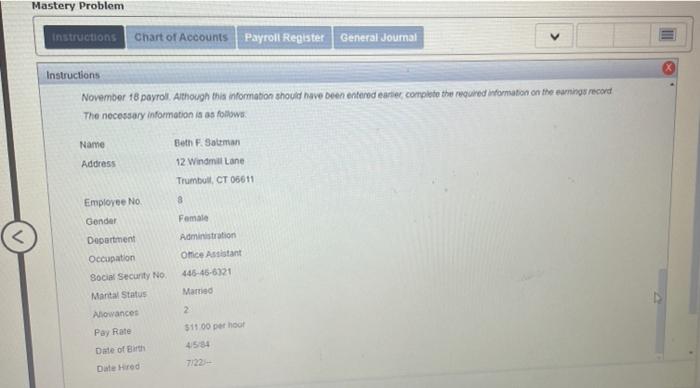

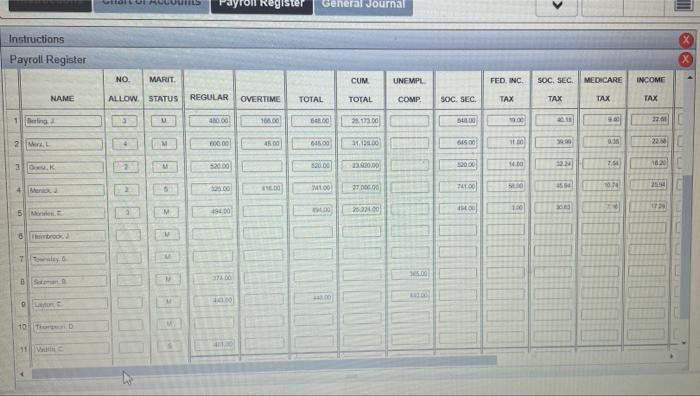

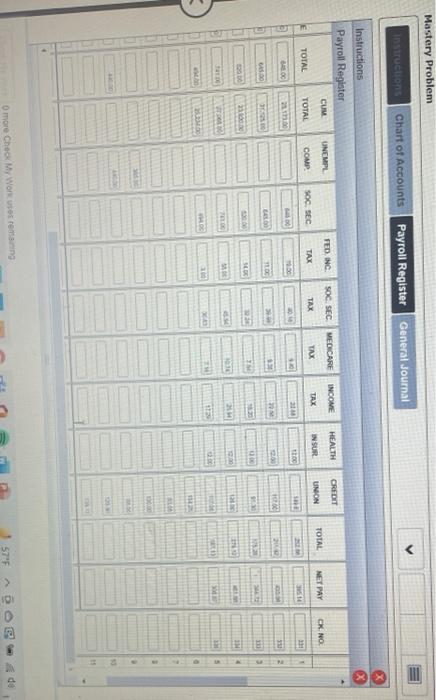

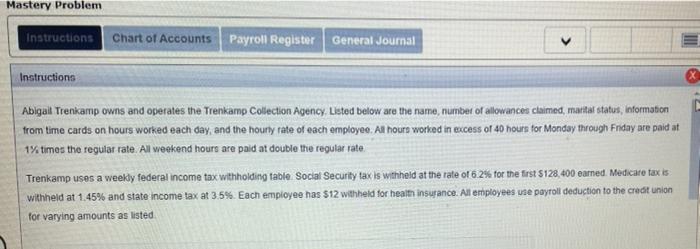

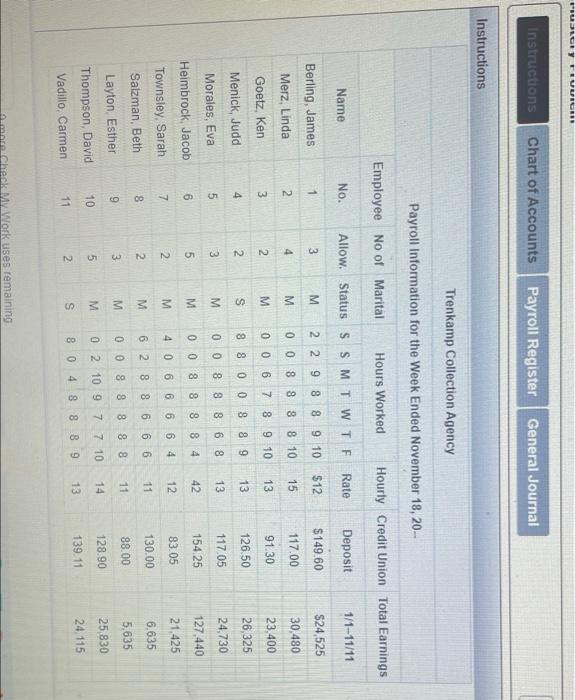

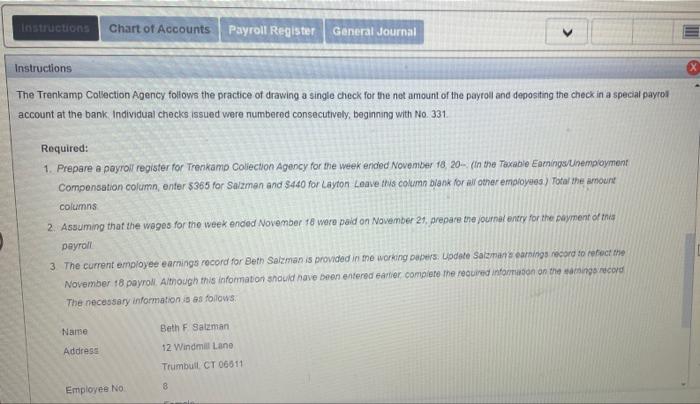

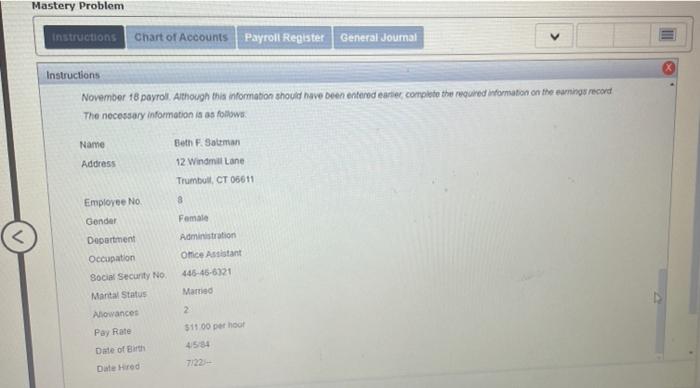

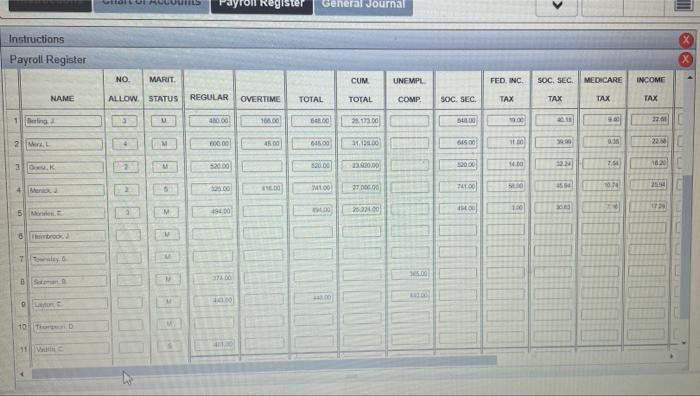

Mastery Problem Instructions Chart of Accounts Payroll Register General Journal Instructions Abigail Trenkamp owns and operates the Trenkamp Collection Agency Listed below are the name, number of allowances claimed, marital status, Information from time cards on hours worked each day, and the houny rate of each employee. Al hours worked in excess of 40 hours for Monday through Friday are paid at 1% times the regular rate. All weekend hours are paid at double the regular rate. Trenkamp uses a weekly federal income tax withholding table Social Security tax is withheld at the rate of 6.2% for the first 5128, 400 earned. Medicare tax is withheld at 1.45% and state income tax at 35%. Each employee has 512 withheld for health insurance. All employees use payroll deduction to the credit union for varying amounts as listed MUSEIYUUICERE Instructions Chart of Accounts Payroll Register General Journal Instructions Trenkamp Collection Agency Payroll Information for the Week Ended November 18, 20-- Employee No of Marital Hours Worked Hourly Credit Union Total Earnings Name No. Allow. Status S S M T W T F Rate Deposit 1/1-11/11 3 1 M 2 2 9 8 8 9 10 $12 $24,525 $149.60 117.00 2 4 30.480 0 0 8 8 8 8 10 M 15 Berling, James Merz, Linda Goetz, Ken Menick, Judd 2 M 3 M 23.400 13 0 0 6 7 8 9 10 91.30 4 4 26,325 126.50 00 88008 2 13 8 9 3 M 0 0 3 8 88 5 13 6 8 24.730 117.05 Morales, Eva Heimbrock, Jacob 5 008 M 8 8 8 6 84 127 440 154 25 42 12 2 7 83.05 6 4 06 M M 6 6 4 21.425 6,635 130.00 11 66 2 00 6 2 8 8 6 M 8 0 0 8 8 8 M 11 8 3 88.00 9 Townsley, Sarah Salzman, Beth Layton, Esther Thompson, David Vadillo, Carmen 5,635 25,830 14 128.90 10 5 M 0 2 10 9 7 7 10 139.11 13 24. 115 8 8 8 9 S N 11 8 0 4 CheckMy Work uses remaining astructions Chart of Accounts Payroll Register General Journal Instructions The Trenkamp Collection Agency follows the practice of drawing a single check for the net amount of the payroll and depositing the check in a special payrol account at the bank. Individual checks issued were numbered consecutively, beginning with No 331 Required: 1. Prepare a payroll register for Trenkamp Collection Agency for the week ended November 18 20- (In the Taxable Earnings Cinemployment Compensation column, enter $365 for Salzman and $440 for Layton Leave this column blank for all other employees) Total the amount columns 2. Assuming that the weges for the week ended November 18 were paid on November 21, prepare the journal entry for the payment of his payroll 3. The current employee earnings record for Beth Salzman is provided in me working papers Lodele Salzman earnings record so rotect the November 18 payroll. Although this information should have been entered earlier complete the roured information on the sings record The necessary information is as follows: Name Address Beth F. Salman 12 Windmill Lane Trumbull CT 06611 8 Employee No Mastery Problem Instructions Chart of Accounts Payroll Register General Journal Instructions November 18 payrol. Although this information should have been entered earter complete the required information on the earnings record The necessary information is as follows: Beth F.Satman Address 12 Windmill Lane Trumbull, CT 06611 Name 8 Employee No Gender Female Administration Once Assistant 445-45-6321 Matted Department Occupation Social Security NO Marital Status Allowances Pay Rate Date of Birth Date Hard 2 51100 per hool 4554 7122- Si yron Register General Journal Instructions Payroll Register NO MARUIT CUM UNEMPL FED, INC SOC. SEC. MEDICARE INCOME NAME ALLOW STATUS REGULAR OVERTIME TOTAL TOTAL COMP SOC. SEC TAX TAX TAX TAX 40.00 168.00 58.00 21.11 06 22:00 12 2 BE M 000 00 845.00 11.10 5500 220 50 3 18.20 WO -2 520.00 520.00 20.00 S000 2 DTH 2 M100 00 2000 TO DS 1997 101 4Meria 2154 5 M 10 M 00157 DO 25000 7 WTE 15.00 10.00 10 TD DBU Mastery Problem Instructions Chart of Accounts Payroll Register General Journal Instructions Payroll Register CUM SOC. SEC FED. NC INCOME MEDICARE UNEMPL CREDIT HEALTH CK NO TOTAL NET PAY INSUR UNON TAX TAX TOTAL TOTAL COMP TAX TAX SOC. SEC 31 BOC 102 BABE A. Lisa EE M ta more Check My Wortes reming 57F 10 10 Mastery Problem Instructions Chart of Accounts Payroll Register General Journal Instructions Abigail Trenkamp owns and operates the Trenkamp Collection Agency Listed below are the name, number of allowances claimed, marital status, Information from time cards on hours worked each day, and the houny rate of each employee. Al hours worked in excess of 40 hours for Monday through Friday are paid at 1% times the regular rate. All weekend hours are paid at double the regular rate. Trenkamp uses a weekly federal income tax withholding table Social Security tax is withheld at the rate of 6.2% for the first 5128, 400 earned. Medicare tax is withheld at 1.45% and state income tax at 35%. Each employee has 512 withheld for health insurance. All employees use payroll deduction to the credit union for varying amounts as listed MUSEIYUUICERE Instructions Chart of Accounts Payroll Register General Journal Instructions Trenkamp Collection Agency Payroll Information for the Week Ended November 18, 20-- Employee No of Marital Hours Worked Hourly Credit Union Total Earnings Name No. Allow. Status S S M T W T F Rate Deposit 1/1-11/11 3 1 M 2 2 9 8 8 9 10 $12 $24,525 $149.60 117.00 2 4 30.480 0 0 8 8 8 8 10 M 15 Berling, James Merz, Linda Goetz, Ken Menick, Judd 2 M 3 M 23.400 13 0 0 6 7 8 9 10 91.30 4 4 26,325 126.50 00 88008 2 13 8 9 3 M 0 0 3 8 88 5 13 6 8 24.730 117.05 Morales, Eva Heimbrock, Jacob 5 008 M 8 8 8 6 84 127 440 154 25 42 12 2 7 83.05 6 4 06 M M 6 6 4 21.425 6,635 130.00 11 66 2 00 6 2 8 8 6 M 8 0 0 8 8 8 M 11 8 3 88.00 9 Townsley, Sarah Salzman, Beth Layton, Esther Thompson, David Vadillo, Carmen 5,635 25,830 14 128.90 10 5 M 0 2 10 9 7 7 10 139.11 13 24. 115 8 8 8 9 S N 11 8 0 4 CheckMy Work uses remaining astructions Chart of Accounts Payroll Register General Journal Instructions The Trenkamp Collection Agency follows the practice of drawing a single check for the net amount of the payroll and depositing the check in a special payrol account at the bank. Individual checks issued were numbered consecutively, beginning with No 331 Required: 1. Prepare a payroll register for Trenkamp Collection Agency for the week ended November 18 20- (In the Taxable Earnings Cinemployment Compensation column, enter $365 for Salzman and $440 for Layton Leave this column blank for all other employees) Total the amount columns 2. Assuming that the weges for the week ended November 18 were paid on November 21, prepare the journal entry for the payment of his payroll 3. The current employee earnings record for Beth Salzman is provided in me working papers Lodele Salzman earnings record so rotect the November 18 payroll. Although this information should have been entered earlier complete the roured information on the sings record The necessary information is as follows: Name Address Beth F. Salman 12 Windmill Lane Trumbull CT 06611 8 Employee No Mastery Problem Instructions Chart of Accounts Payroll Register General Journal Instructions November 18 payrol. Although this information should have been entered earter complete the required information on the earnings record The necessary information is as follows: Beth F.Satman Address 12 Windmill Lane Trumbull, CT 06611 Name 8 Employee No Gender Female Administration Once Assistant 445-45-6321 Matted Department Occupation Social Security NO Marital Status Allowances Pay Rate Date of Birth Date Hard 2 51100 per hool 4554 7122- Si yron Register General Journal Instructions Payroll Register NO MARUIT CUM UNEMPL FED, INC SOC. SEC. MEDICARE INCOME NAME ALLOW STATUS REGULAR OVERTIME TOTAL TOTAL COMP SOC. SEC TAX TAX TAX TAX 40.00 168.00 58.00 21.11 06 22:00 12 2 BE M 000 00 845.00 11.10 5500 220 50 3 18.20 WO -2 520.00 520.00 20.00 S000 2 DTH 2 M100 00 2000 TO DS 1997 101 4Meria 2154 5 M 10 M 00157 DO 25000 7 WTE 15.00 10.00 10 TD DBU Mastery Problem Instructions Chart of Accounts Payroll Register General Journal Instructions Payroll Register CUM SOC. SEC FED. NC INCOME MEDICARE UNEMPL CREDIT HEALTH CK NO TOTAL NET PAY INSUR UNON TAX TAX TOTAL TOTAL COMP TAX TAX SOC. SEC 31 BOC 102 BABE A. Lisa EE M ta more Check My Wortes reming 57F 10 10 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started