Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help in completing this math assignment and I have no idea how to complete it, it has to be done an on an

I need help in completing this math assignment and I have no idea how to complete it, it has to be done an on an excel sheet

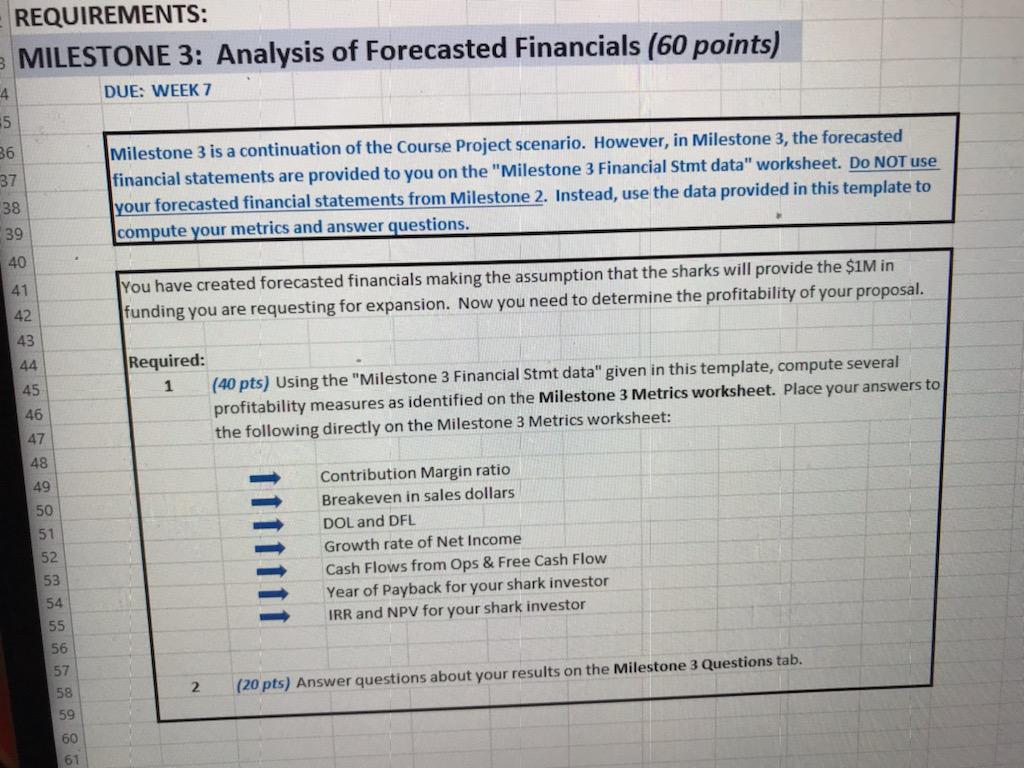

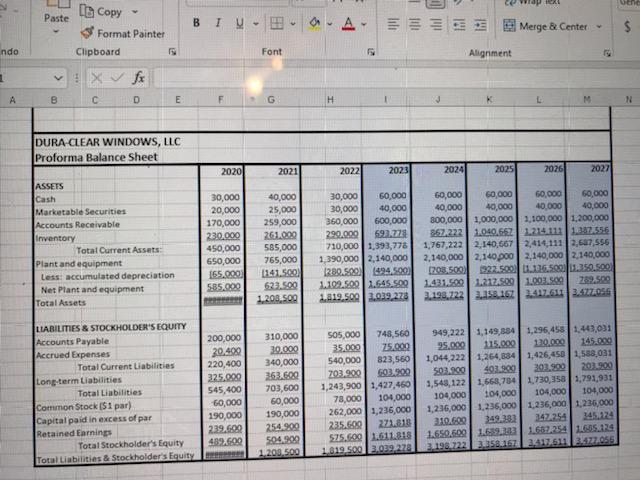

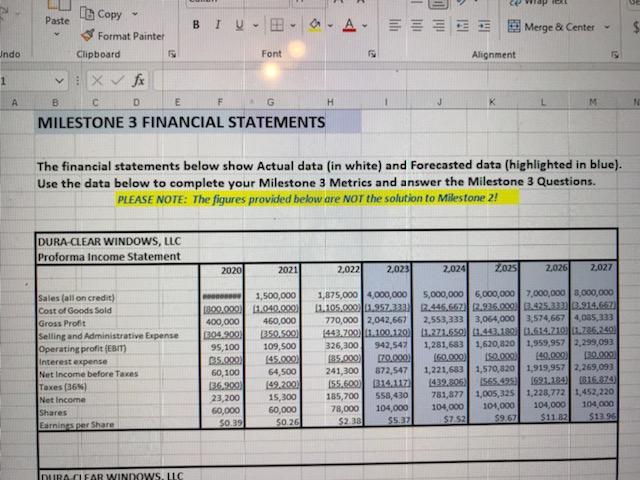

REQUIREMENTS: MILESTONE 3: Analysis of Forecasted Financials (60 points) DUE: WEEK 7 Milestone 3 is a continuation of the Course Project scenario. However, in Milestone 3 , the forecasted financial statements are provided to you on the "Milestone 3 Financial Stmt data" worksheet. Do NOT use your forecasted financial statements from Milestone 2. Instead, use the data provided in this template to compute your metrics and answer questions. You have created forecasted financials making the assumption that the sharks will provide the $1M in funding you are requesting for expansion. Now you need to determine the profitability of your proposal. 1 (40 pts) Using the "Milestone 3 Financial Stmt data" given in this template, compute several Required: profitability measures as identified on the Milestone 3 Metrics worksheet. Place your answers to the following directly on the Milestone 3 Metrics worksheet: Contribution Margin ratio Breakeven in sales dollars DOL and DFL Growth rate of Net Income Cash Flows from Ops \& Free Cash Flow Year of Payback for your shark investor 2 (20 pts) Answer questions about your results on the Milestone 3 Questions tab. [8] Copy B I 4= Format Painter Clipboard r. Font 9 Alignment (4) The financial statements below show Actual data (in white) and Forecasted data (highlighted in bluc). Use the data below to complete your Milestone 3 Metrics and answer the Milestone 3 Questions. PLEASE NOTE: The figures provided below are NOT the solution to Milestone 2! (5 points: 1 pt for grammar/spelling. 4 pts for thought-out, correct answers) Looking at your Gross Profits across the forecasted years, do you think the sharks will provide the funding you are requesting? Explain why or why not. (5 points: 1 pt for grommar/spelling, 4 pts for thought-out, correct answers) How reliable is your Sales Forecast? Explain your answer. 2 (5 polnts: 1 pt for grommar/spelling, 4 pts for thought-out, correct answers) You used a weighted moving average to forecast your sales flgures. Name two other methods of forecasting that may produce a more accurate result, and explain why you think the results would be better with these two selected methods. (HINT: See Week 1 and Week 3 Lessons) (5 points: 1pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Looking at your FCF results, do you think you should go to the Sharks for money? b. If so, why? If not, why REQUIREMENTS: MILESTONE 3: Analysis of Forecasted Financials (60 points) DUE: WEEK 7 Milestone 3 is a continuation of the Course Project scenario. However, in Milestone 3 , the forecasted financial statements are provided to you on the "Milestone 3 Financial Stmt data" worksheet. Do NOT use your forecasted financial statements from Milestone 2. Instead, use the data provided in this template to compute your metrics and answer questions. You have created forecasted financials making the assumption that the sharks will provide the $1M in funding you are requesting for expansion. Now you need to determine the profitability of your proposal. 1 (40 pts) Using the "Milestone 3 Financial Stmt data" given in this template, compute several Required: profitability measures as identified on the Milestone 3 Metrics worksheet. Place your answers to the following directly on the Milestone 3 Metrics worksheet: Contribution Margin ratio Breakeven in sales dollars DOL and DFL Growth rate of Net Income Cash Flows from Ops \& Free Cash Flow Year of Payback for your shark investor 2 (20 pts) Answer questions about your results on the Milestone 3 Questions tab. [8] Copy B I 4= Format Painter Clipboard r. Font 9 Alignment (4) The financial statements below show Actual data (in white) and Forecasted data (highlighted in bluc). Use the data below to complete your Milestone 3 Metrics and answer the Milestone 3 Questions. PLEASE NOTE: The figures provided below are NOT the solution to Milestone 2! (5 points: 1 pt for grammar/spelling. 4 pts for thought-out, correct answers) Looking at your Gross Profits across the forecasted years, do you think the sharks will provide the funding you are requesting? Explain why or why not. (5 points: 1 pt for grommar/spelling, 4 pts for thought-out, correct answers) How reliable is your Sales Forecast? Explain your answer. 2 (5 polnts: 1 pt for grommar/spelling, 4 pts for thought-out, correct answers) You used a weighted moving average to forecast your sales flgures. Name two other methods of forecasting that may produce a more accurate result, and explain why you think the results would be better with these two selected methods. (HINT: See Week 1 and Week 3 Lessons) (5 points: 1pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Looking at your FCF results, do you think you should go to the Sharks for money? b. If so, why? If not, why

Step by Step Solution

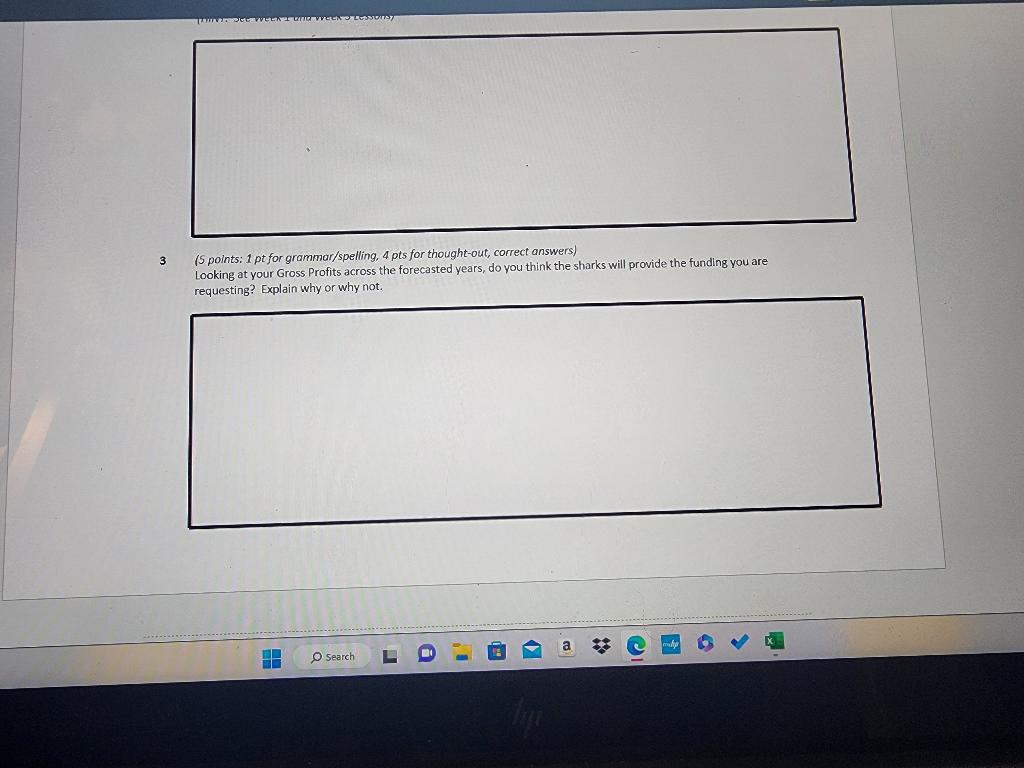

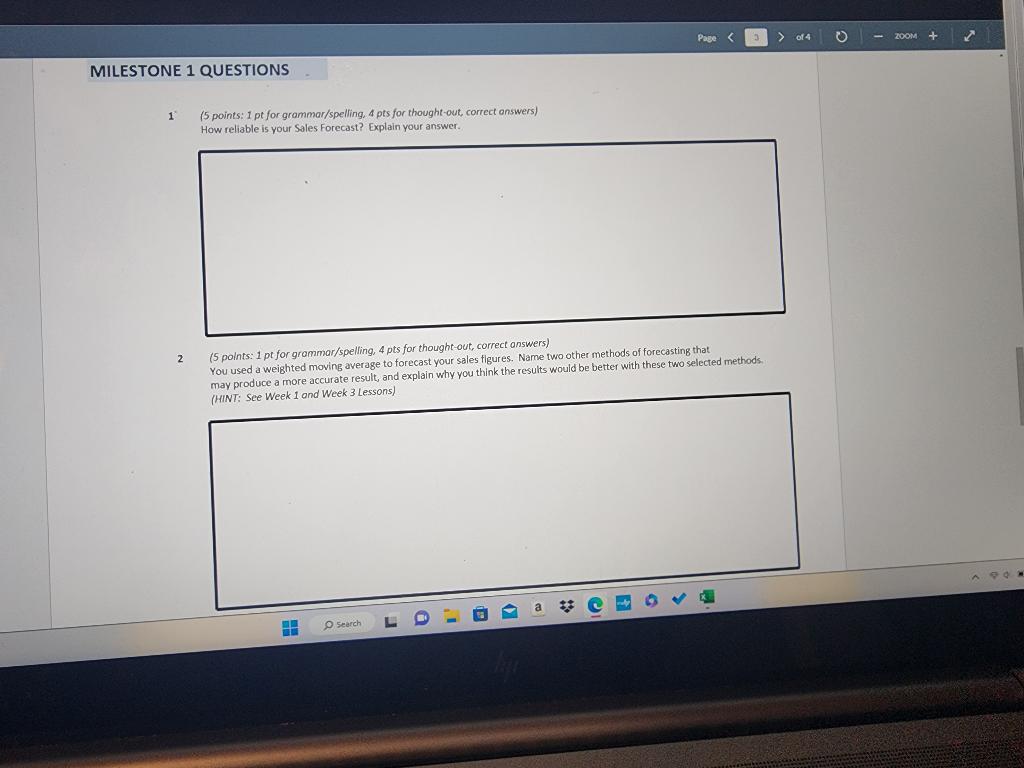

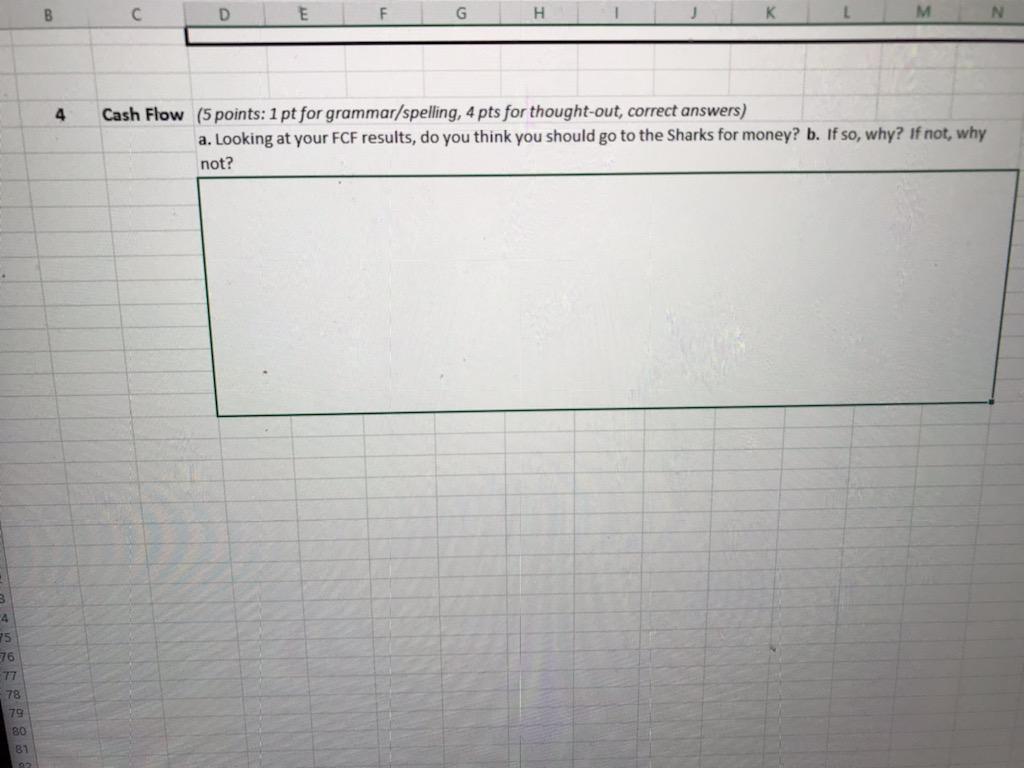

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started