Question

I need help in Finance. Case Study: the case study started here that Shiner Threads Limited (STL) is in the business of textile and is

I need help in Finance.

Case Study:

the case study started here that Shiner Threads Limited (STL) is in the business of textile and is a renowned supplier of toddler and teens outfits in the industry. The company is equipped with hi-tech machinery and is recognized for its unique designs. Due to its key investment in technology and human capital, companys financials of last five years depict a continuous increasing trend in sales and profits at the rates of 30% and 35% respectively. Companys management is now planning to expand its business operations, for which, Research and Development (R&D) department of STL has proposed following three Mutually Exclusive projects based on their market surveys:

(It is notable that feasibility report of each project is based on the estimates of six years).

Project 1:

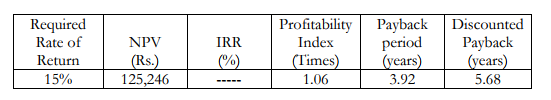

The first project proposed by R&D is to open companys own Clothing Stores. Estimates presented in the feasibility report tell that this project requires an investment of Rs. 1,950,000. This will generate after tax cash inflows of Rs. 400,000 each in the first and second years, Rs. 600,000 each in 3rd , 4th & 5th years while Rs. 900,000 in 6th year. Other information which has been provided in the report is as follow:

Project 2:

The second project proposed by R&D is to open Consultancy Centers. These centers will aim to provide consultancy services to other factories of the industry and to its buyers regarding their real- life problems of doing business. This project requires an initial cost of Rs. 900,000 while it will generate after tax cash inflows of Rs. 300,000 each in first five years and Rs. 500,000 in 6th year. The required rate of return for the project is 28%. However, the feasibility report for this project is not very much comprehensive as it is providing information only about capital budgeting measure of IRR which is approximately 26.7%.

Project 3:

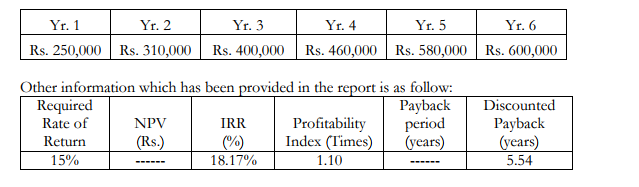

The third project proposed by R&D is to open Skill Development Cells. The aim of these development cells will be to launch different professional training courses in the market. The initial investment required for this project is Rs. 1,270,000. This project also requires net working capital of Rs. 180,000 at the start of the project which will be recovered at the end of 6th year. After tax cash inflows estimated to be generated from this project are as follows:

Requirements

Requirement No. 1: It can be observed that the feasibility report of project 1 is providing values against all capital budgeting measures except IRR. So, you are required to determine the approximate value of IRR to complete the report. (5 Marks)

Requirement No. 2: Although the information provided in feasibility report of project 2 is missing for most of the capital budgeting measures, however, you are required to determine only the values of NPV & Profitability Index (PI) for this project. (5 Marks)

Requirement No. 3: Determine the missing values of NPV and Payback period for project 3 to complete its feasibility report. (8 Marks)

Requirement No. 4: After finding out all the required values of each project, analyze which of the projects should be selected by STL and why? (2 Marks)

Profitability Payback Discounted Required Rate of Return 150/o IRR NPV s. 125,246 Times) 1.06 Index periodPaybaclk ears 3.92 ears 5.68

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started