Answered step by step

Verified Expert Solution

Question

1 Approved Answer

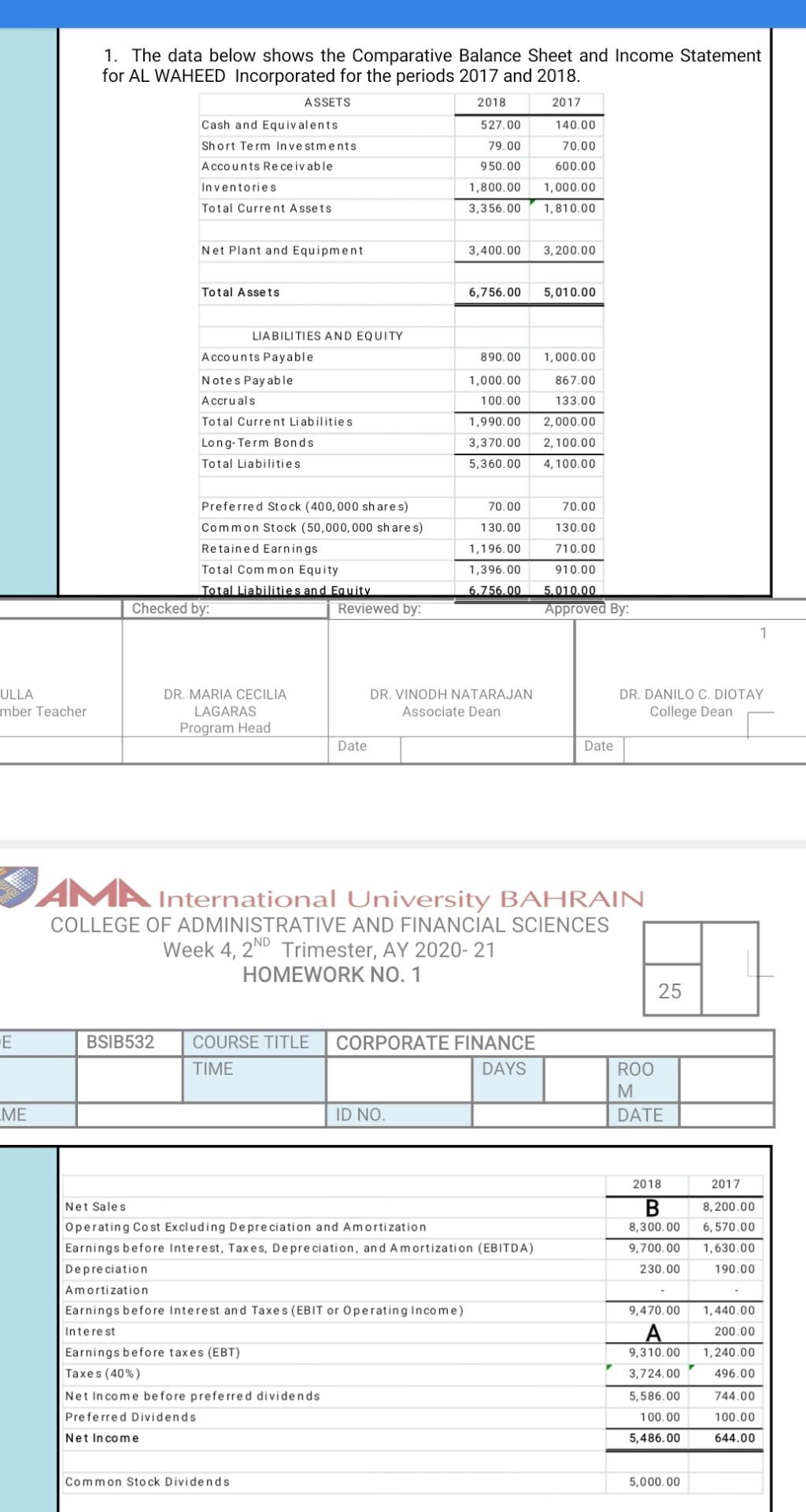

I need help in preperation of statement of cash flow by using indirect method 1. The data below shows the Comparative Balance Sheet and Income

I need help in preperation of statement of cash flow by using indirect method

1. The data below shows the Comparative Balance Sheet and Income Statement for AL WAHEED Incorporated for the periods 2017 and 2018. ASSETS 2018 2017 Cash and Equivalents Short Term Investments Accounts Receivable Inventories Total Current Assets 527.00 79.00 950.00 1,800.00 3,356.00 140.00 70.00 600.00 1,000.00 1,810.00 Net Plant and Equipment 3,400.00 3,200.00 Total Assets 6,756.00 5,010.00 890.00 1,000.00 LIABILITIES AND EQUITY Accounts Payable Notes Payable Accruals Total Current Liabilities Long-Term Bonds Total Liabilities 867.00 133.00 1,000.00 100.00 1.990.00 3,370.00 5,360.00 2,000.00 2,100.00 4,100.00 70.00 70.00 130.00 130.00 1,196.00 710.00 Preferred Stock (400,000 shares) Common Stock (50,000,000 shares) Retained Earnings Total Common Equity Total Liabilities and Equity Checked by: Reviewed by: 910.00 1,396.00 6.756.00 5.010.00 Approved By: 1 ULLA mber Teacher DR. MARIA CECILIA LAGARAS Program Head DR. VINODH NATARAJAN Associate Dean DR. DANILO C. DIOTAY College Dean Date Date AMA International University BAHRAIN COLLEGE OF ADMINISTRATIVE AND FINANCIAL SCIENCES Week 4, 2ND Trimester, AY 2020-21 HOMEWORK NO. 1 25 E BSIB532 COURSE TITLE TIME CORPORATE FINANCE DAYS ROO M DATE ME ID NO. 2018 2017 B 8,300.00 9,700.00 230.00 8,200.00 6,570.00 1,630.00 190.00 Net Sales Operating Cost Excluding Depreciation and Amortization Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA) Depreciation Amortization Earnings before Interest and Taxes (EBIT or Operating Income) Interest Earnings before taxes (EBT) Taxes (40%) Net Income before preferred dividends Preferred Dividends 9,470.00 1,440.00 200.00 1,240.00 496.00 9,310.00 3,724.00 5,586.00 744.00 100.00 100.00 5,486.00 Net Income 644.00 Common Stock Dividends 5,000.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started