Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help in this financial statements Instructions: . Visit SEC.GOV and find the latest 10-K reports of your company. Carefully review the 10-K reports

I need help in this financial statements

Instructions: .

- Visit SEC.GOV and find the latest 10-K reports of your company.

- Carefully review the 10-K reports

-

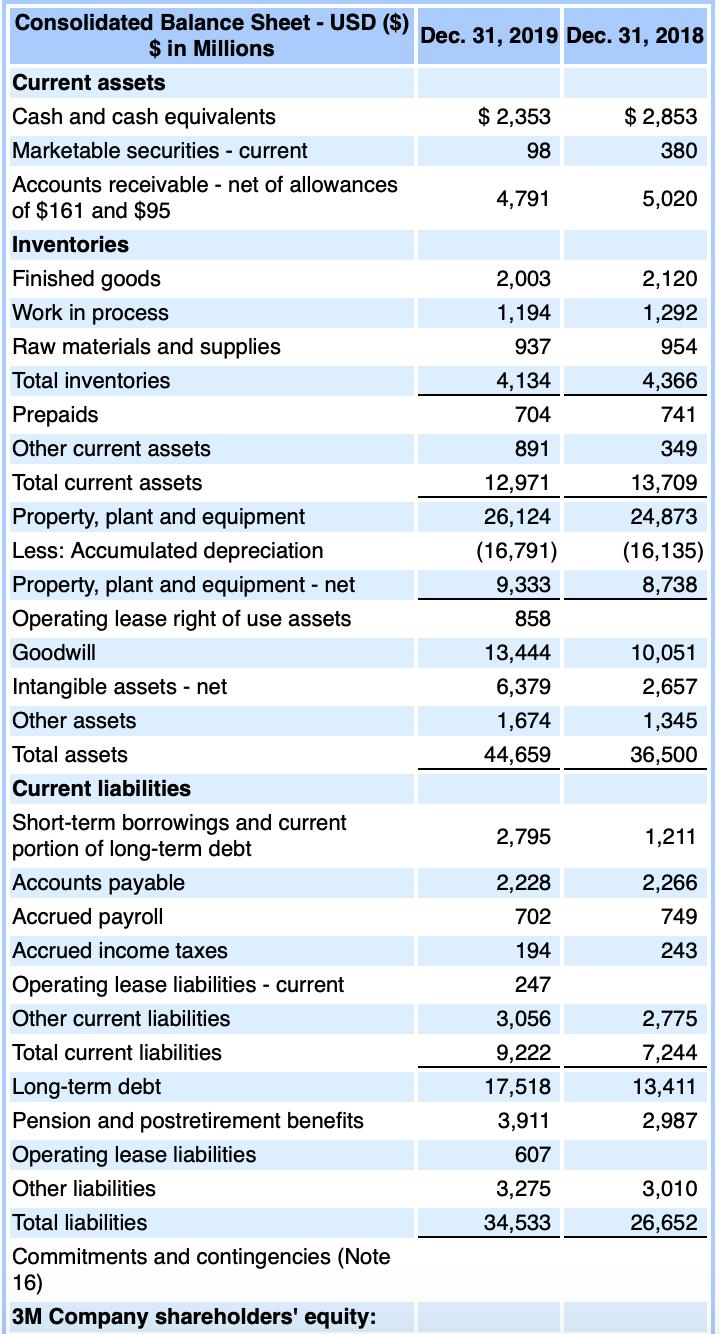

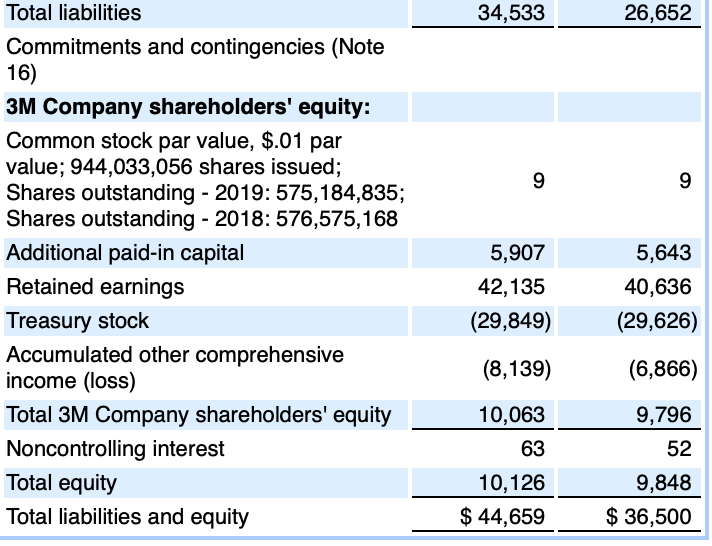

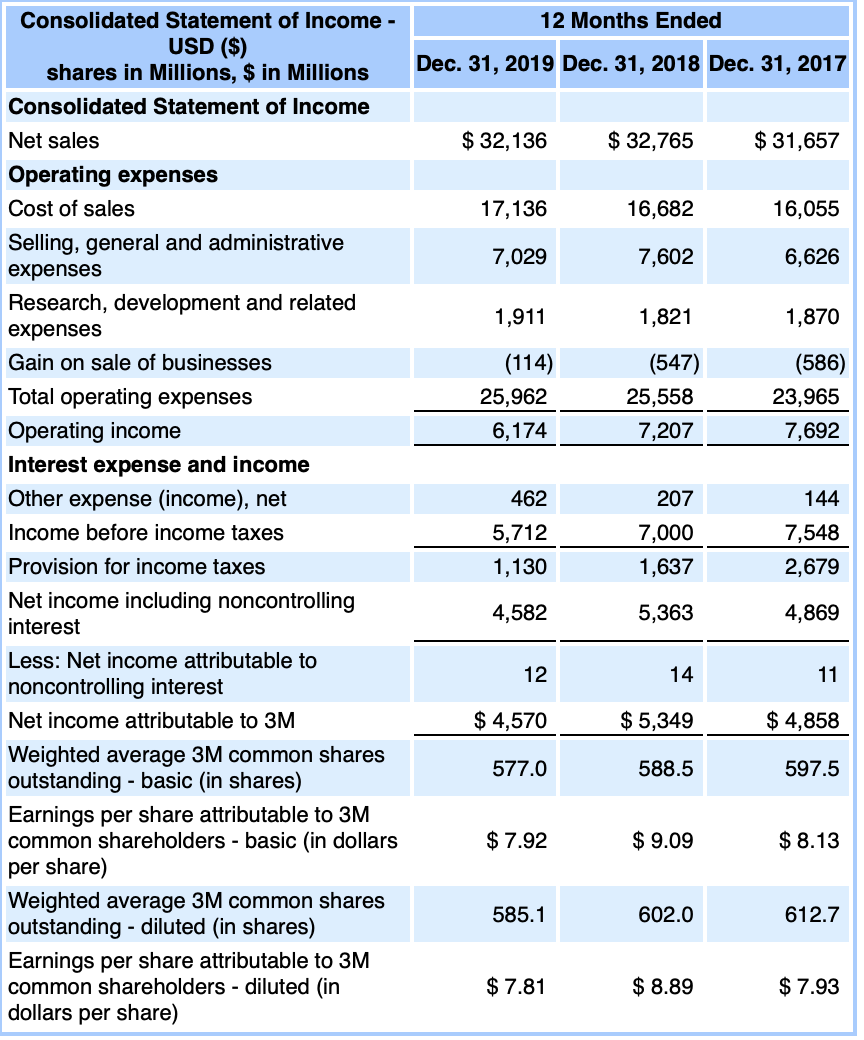

Part III Ratio Analysis:

- Calculate the company's current ratio and working capital for the past two years. Comment on the companys liquidity.

- Calculate the company's inventory turnover ratio for the past two years. Interpret the results.

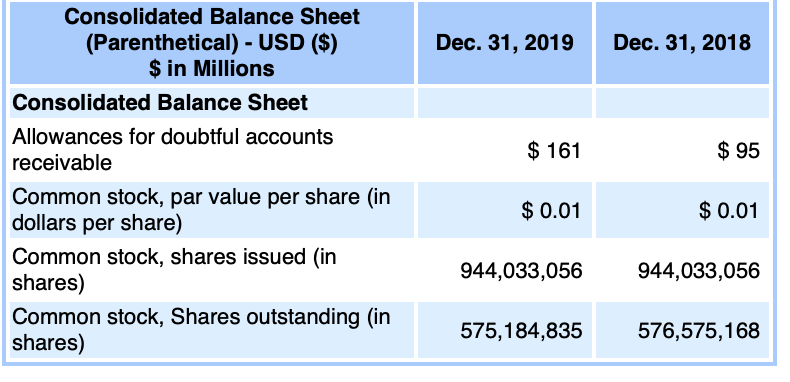

- Calculate the company's account receivable turnover ratio for the past two years. Interpret the results.

- Calculate the company's asset turnover ratio for the past two years. Interpret the results.

Income Statement:

- Read the footnotes to the financial statements. What is the company's revenue recognition policy?

- For how many years of information does the companys 10-K show for(a) Balance Sheet

-

What is your overall evaluation of the companys financial performance?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started