I need help in this question. Please do it correctly and 100%. Please do not make any mistake in this

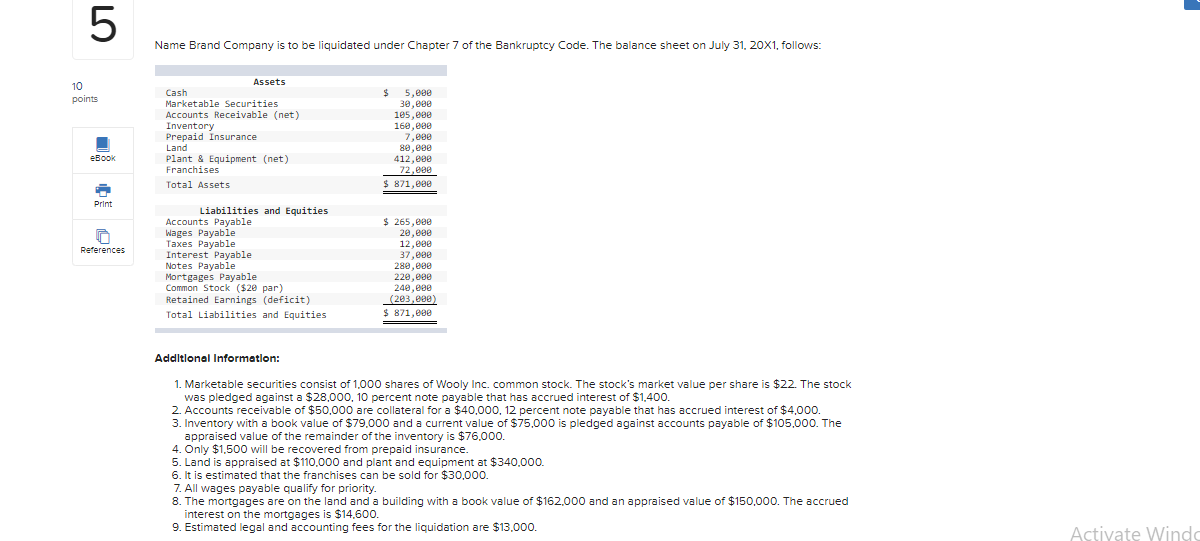

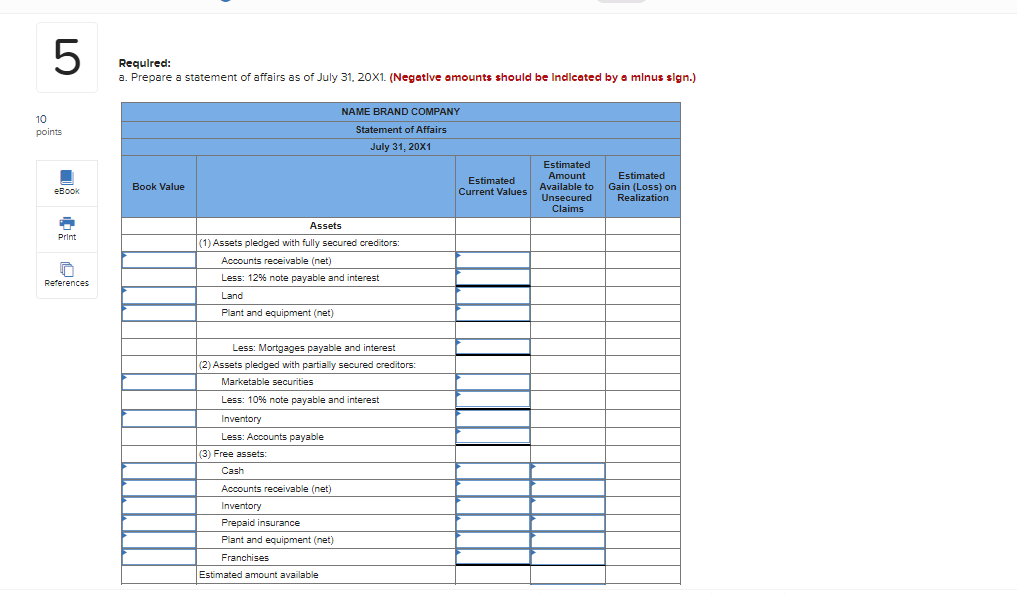

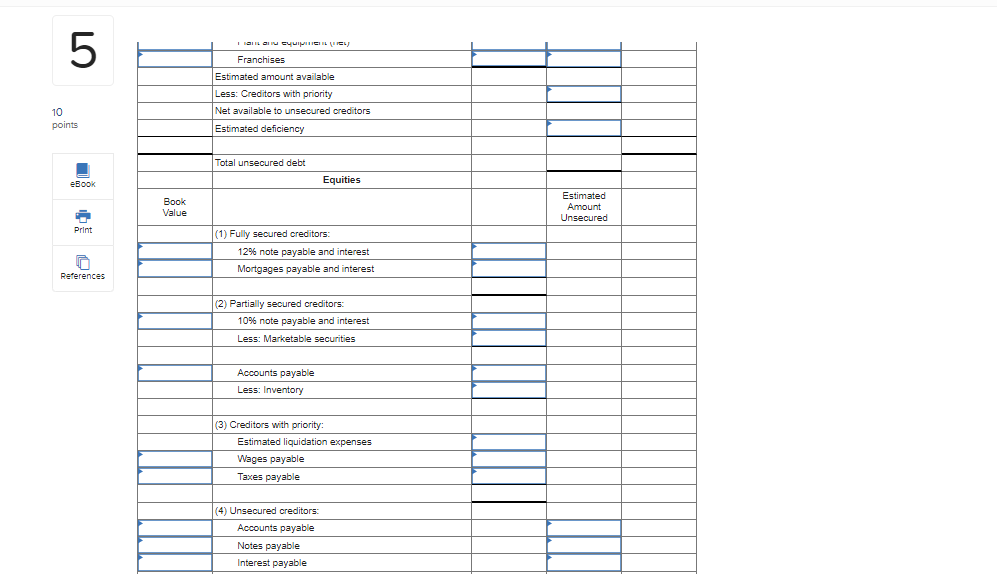

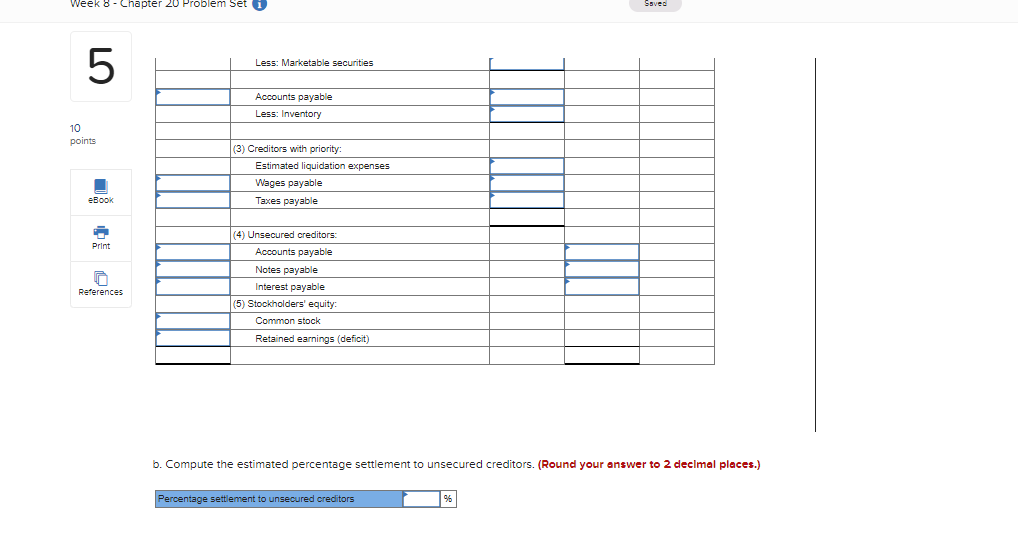

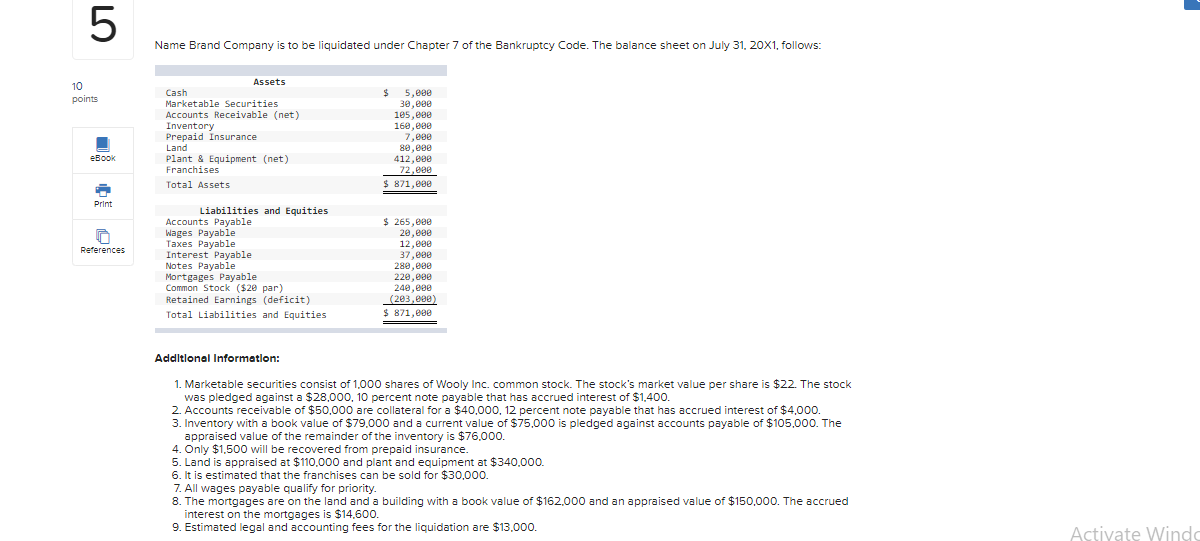

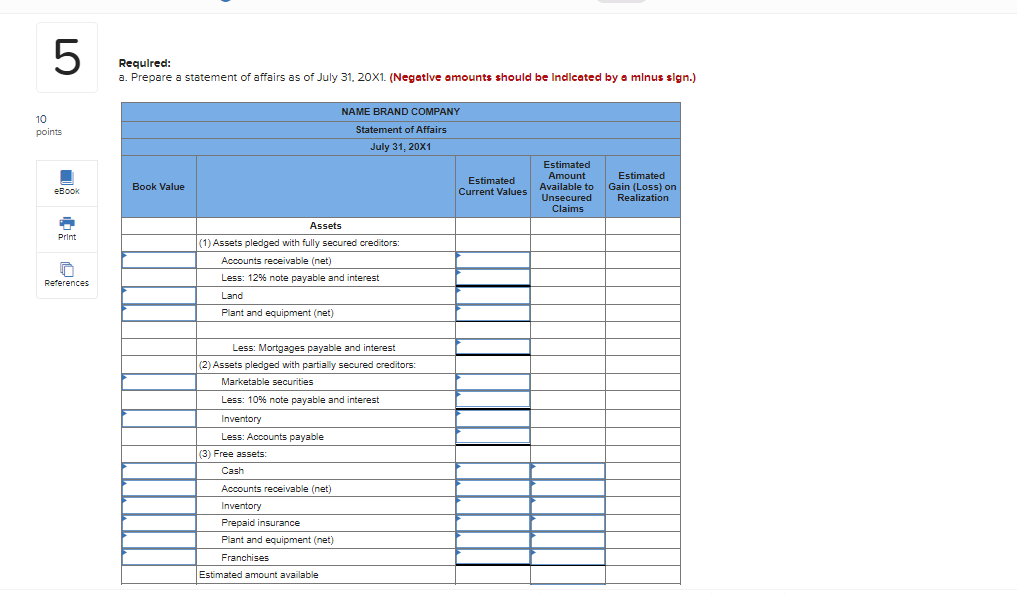

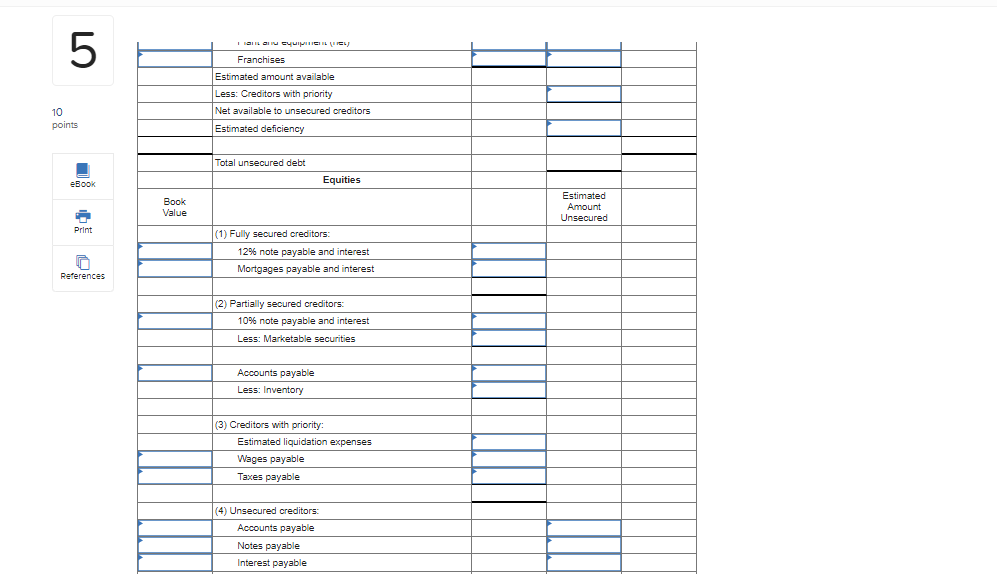

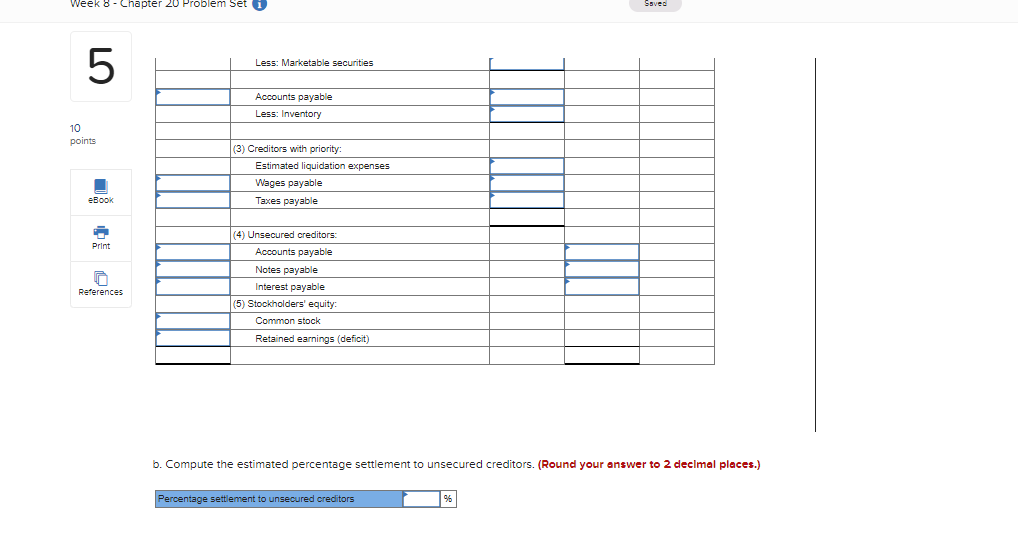

5 Name Brand Company is to be liquidated under Chapter 7 of the Bankruptcy Code. The balance sheet on July 31, 20x1, follows: 10 points Assets Cash Marketable Securities Accounts Receivable (net) Inventory Prepaid Insurance Land Plant & Equipment (net) Franchises Total Assets $ 5,000 30,00 105,000 160,000 7,000 80,ese 412,000 72,eee $ 871,000 eBook Print References Liabilities and Equities Accounts Payable Wages Payable Taxes Payable Interest Payable Notes Payable Mortgages Payable Common Stock ($2e par) Retained Earnings (deficit) Total Liabilities and Equities $ 265,00 20,eee 12,eee 37,000 280,000 220,000 240,000 (203,eee) $ 871,080 Additional Information: 1. Marketable securities consist of 1.000 shares of Wooly Inc. common stock. The stock's market value per share is $22. The stock was pledged against a $28,000, 10 percent note payable that has accrued interest of $1.400. 2. Accounts receivable of $50.000 are collateral for a $40,000. 12 percent note payable that has accrued interest of $4.000. 3. Inventory with a book value of $79.000 and a current value of $75,000 is pledged against accounts payable of $105,000. The appraised value of the remainder of the inventory is $76.000. 4. Only $1,500 will be recovered from prepaid insurance. 5. Land is appraised at $110.000 and plant and equipment at $340,000. 6. It is estimated that the franchises can be sold for $30,000. 7. All wages payable qualify for priority. 8. The mortgages are on the land and a building with a book value of $162.000 and an appraised value of $150,000. The accrued interest on the mortgages is $14.600. 9. Estimated legal and accounting fees for the liquidation are $13.000. Activate Windo 07 Requlred: a. Prepare a statement of affairs as of July 31, 20X1. (Negative amounts should be Indicated by a minus sign.) 10 points NAME BRAND COMPANY Statement of Affairs July 31, 20X1 Estimated Amount Available to Unsecured Estimated Current Values Book Value Estimated Gain (Loss) on Realization eBook Claims Print Assets (1) Assets pledged with fully secured creditors Accounts receivable (net) Less: 12% note payable and interest Land References Plant and equipment (net) Less: Mortgages payable and interest (2) Assets pledged with partially secured creditors: Marketable securities Less: 10% note payable and interest Inventory Less: Accounts payable (3) Free assets: Cash Accounts receivable (net) Inventory Prepaid insurance Plant and equipment (net) Franchises Estimated amount available HOU UIMICILLIES) UT Franchises Estimated amount available Less: Creditors with priority Net available to unsecured creditors Estimated deficiency 10 points Total unsecured debt eBook Equities Book Value Estimated Amount Unsecured Print (1) Fully secured creditors: 12% note payable and interest Mortgages payable and interest References (2) Partially secured creditors 10% note payable and interest Less: Marketable securities Accounts payable Less: Inventory (3) Creditors with priority: Estimated liquidation expenses Wages payable Taxes payable (4) Unsecured creditors Accounts payable Notes payable Interest payable Week 8 - Chapter 20 Problem Set i Sovec 5 Less: Marketable securities Accounts payable Less: Inventory 10 points (3) Creditors with priority: Estimated liquidation expenses Wages payable Taxes payable eBook Print References (4) Unsecured creditors Accounts payable Notes payable Interest payable (5) Stockholders' equity: Common stock Retained earnings (deficit) b. Compute the estimated percentage settlement to unsecured creditors. (Round your answer to 2 decimal places.) Percentage settlement to unsecured creditors