Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help interpreting the sentences that contain financial information that make up the Comprehensive income items and Tax information and implications. It is because

I need help interpreting the sentences that contain financial information that make up the Comprehensive income items and Tax information and implications. It is because I need to perform adjusting journal entries based on the financial information you see above. Can you show the step by step mathematical work as how you calculated a certain dollar amount using the accounts that appear in the Trial Balance for 2017, please?

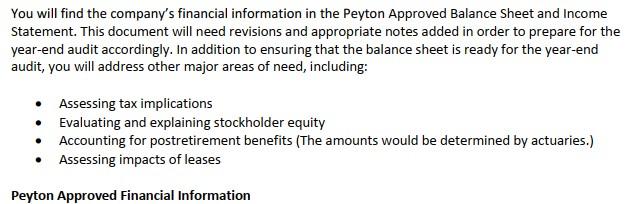

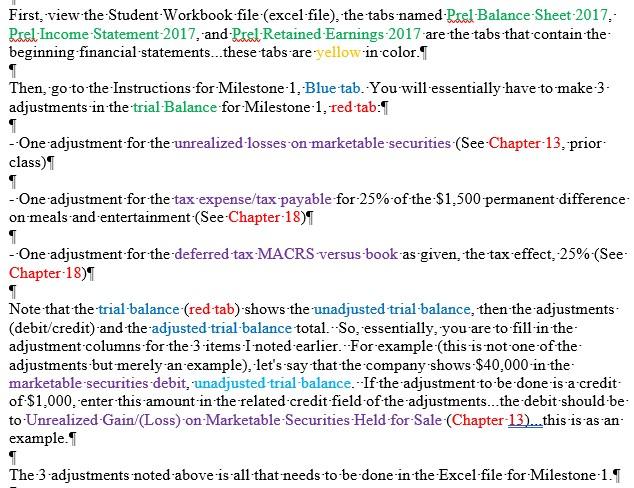

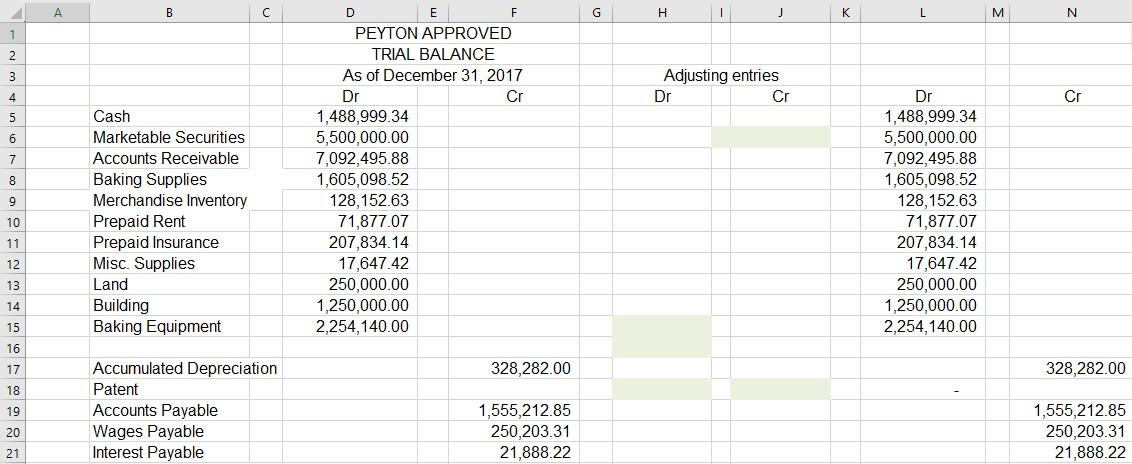

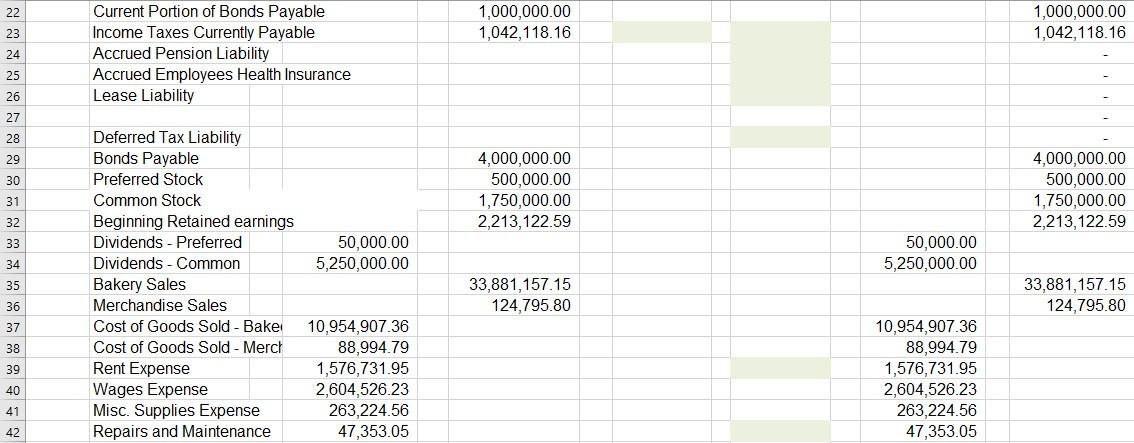

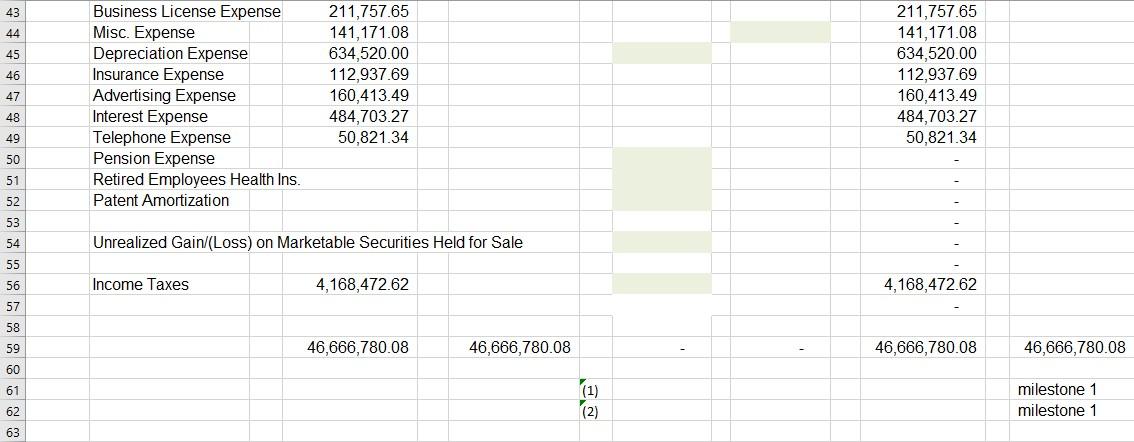

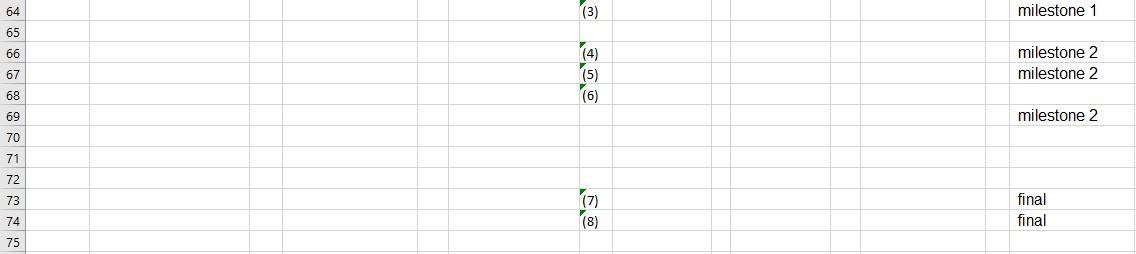

Overview: For Milestone One, which is due in Module Three, you will develop a portion of the workbook and a brief memo to management explaining the impacts to stockholder equity and the impact of tax structures. You will build on this milestone in subsequent modules to create the balance sheet and executive summary portions of your final project. Prompt: First, review the Final Project Scenario document. Using your review of the scenario, begin your workbook and discuss the impacts in your management brief, including impacts on stockholder equity and impacts based on changes to tax structure. Note: Milestone One is a draft of some of the critical elements of the final project. Specifically, the following critical elements must be addressed: 1. Workbook A. Prepare adjusting entries for unrealized loss and tax issues. You will find the company's financial information in the Peyton Approved Balance Sheet and Income Statement. This document will need revisions and appropriate notes added in order to prepare for the year-end audit accordingly. In addition to ensuring that the balance sheet is ready for the year-end audit, you will address other major areas of need, including: Assessing tax implications Evaluating and explaining stockholder equity Accounting for postretirement benefits (The amounts would be determined by actuaries.) Assessing impacts of leases Peyton Approved Financial Information Comprehensive income items Marketable securities on the balance sheet at a cost of $5,500,000 are available-for-sale Market value at the balance sheet date is $5,235,000 Prepare the adjusting entry to record the unrealized loss and include in comprehensive income Tax information and implications $1,500 in meal and entertainment expenses show as a permanent difference for tax. Prepare the necessary adjusting entry. The company uses straight line depreciation for book and MACRS depreciation for the tax return MACRS depreciation was $209,301 higher than book. Prepare the adjusting entry for the deferred tax. There have been recent tax structure changes that could impact the company. Peyton Approved has been a C Corp since the beginning of these changes. Peyton provides for taxes at 25% of pretax income (20% Federal, 5% state). . First, view the Student-Workbook file (excel-file), the tabs named-Poel Balance Sheet 2017.: Prel-Income Statement-2017, and-Piel-Retained Earnings 2017 are the tabs that contain the beginning financial statements... these tabs are yellow in color. Then, go to the Instructions for Milestone-1, Blue tab. You will essentially have to make-3. adjustments in the trial-Balance for Milestone-1, red tab:1 --One adjustment for the unrealized-losses on marketable-securities (See Chapter 13, prior class) - One adjustment for the tax-expense/tax payable for 25% of the $1,500 permanent difference on meals and entertainment (See Chapter 18) - One adjustment for the deferred tax-MACRS versus book as given the tax effect, 25% (See Chapter 18) Note that the trial-balance (red tab) shows the unadjusted trial balance, then the adjustments (debit/credit) and the adjusted trial balance total. --So, essentially, you are to fill in the adjustment-columns for the 3-items-I noted earlier. --For example (this is not one of the adjustments but merely an example), let's say that the company shows-$40,000 in the marketable-securities debit, unadjusted trial balance.--If the adjustment to be done is a credit- of $1,000, enter this amount in the related credit field of the adjustments...the debit-should-be- to-Unrealized Gain (Loss) on Marketable-Securities-Held for Sale (Chapter 13)...this is as an- example. The 3 adjustments noted above is all that needs to be done in the Excel-file-for-Milestone-1. A B C G H 1 K L M N 1 2 3 Adjusting entries Dr Cr Cr 4 5 6 7 D E F PEYTON APPROVED TRIAL BALANCE As of December 31, 2017 Dr Cr 1,488,999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877,07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 8 9 Cash Marketable Securities Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Land Building Baking Equipment Dr 1,488,999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 10 12 13 14 15 16 17 328,282.00 328,282.00 18 19 Accumulated Depreciation Patent Accounts Payable Wages Payable Interest Payable 20 1,555,212.85 250,203.31 21,888.22 1,555,212.85 250,203.31 21,888.22 21 22 23 24 1,000,000.00 1,042,118.16 1,000,000.00 1,042,118.16 Current Portion of Bonds Payable Income Taxes Currently Payable Accrued Pension Liability Accrued Employees Health Insurance Lease Liability 25 26 27 28 29 30 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 31 32 33 34 50,000.00 5,250,000.00 50,000.00 5,250,000.00 35 Deferred Tax Liability Bonds Payable Preferred Stock Common Stock Beginning Retained earnings Dividends - Preferred Dividends - Common Bakery Sales Merchandise Sales Cost of Goods Sold - Bakel Cost of Goods Sold - Merch Rent Expense Wages Expense Misc. Supplies Expense Repairs and Maintenance 33,881,157.15 124,795.80 33,881,157.15 124,795.80 36 37 38 39 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 40 41 42 43 44 45 46 Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Pension Expense Retired Employees Health Ins. Patent Amortization 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 47 48 49 50 51 52 53 54 Unrealized Gain/(Loss) on Marketable Securities Held for Sale 55 56 Income Taxes 4,168,472.62 4,168,472.62 57 58 46,666,780.08 46,666,780.08 46,666,780.08 46,666,780.08 59 60 61 (1) (2) milestone 1 milestone 1 62 63 64 (3) milestone 1 65 66 (4) (5) (6) milestone 2 milestone 2 67 68 69 milestone 2 70 71 72 73 (7) (8) final final 74 75 Overview: For Milestone One, which is due in Module Three, you will develop a portion of the workbook and a brief memo to management explaining the impacts to stockholder equity and the impact of tax structures. You will build on this milestone in subsequent modules to create the balance sheet and executive summary portions of your final project. Prompt: First, review the Final Project Scenario document. Using your review of the scenario, begin your workbook and discuss the impacts in your management brief, including impacts on stockholder equity and impacts based on changes to tax structure. Note: Milestone One is a draft of some of the critical elements of the final project. Specifically, the following critical elements must be addressed: 1. Workbook A. Prepare adjusting entries for unrealized loss and tax issues. You will find the company's financial information in the Peyton Approved Balance Sheet and Income Statement. This document will need revisions and appropriate notes added in order to prepare for the year-end audit accordingly. In addition to ensuring that the balance sheet is ready for the year-end audit, you will address other major areas of need, including: Assessing tax implications Evaluating and explaining stockholder equity Accounting for postretirement benefits (The amounts would be determined by actuaries.) Assessing impacts of leases Peyton Approved Financial Information Comprehensive income items Marketable securities on the balance sheet at a cost of $5,500,000 are available-for-sale Market value at the balance sheet date is $5,235,000 Prepare the adjusting entry to record the unrealized loss and include in comprehensive income Tax information and implications $1,500 in meal and entertainment expenses show as a permanent difference for tax. Prepare the necessary adjusting entry. The company uses straight line depreciation for book and MACRS depreciation for the tax return MACRS depreciation was $209,301 higher than book. Prepare the adjusting entry for the deferred tax. There have been recent tax structure changes that could impact the company. Peyton Approved has been a C Corp since the beginning of these changes. Peyton provides for taxes at 25% of pretax income (20% Federal, 5% state). . First, view the Student-Workbook file (excel-file), the tabs named-Poel Balance Sheet 2017.: Prel-Income Statement-2017, and-Piel-Retained Earnings 2017 are the tabs that contain the beginning financial statements... these tabs are yellow in color. Then, go to the Instructions for Milestone-1, Blue tab. You will essentially have to make-3. adjustments in the trial-Balance for Milestone-1, red tab:1 --One adjustment for the unrealized-losses on marketable-securities (See Chapter 13, prior class) - One adjustment for the tax-expense/tax payable for 25% of the $1,500 permanent difference on meals and entertainment (See Chapter 18) - One adjustment for the deferred tax-MACRS versus book as given the tax effect, 25% (See Chapter 18) Note that the trial-balance (red tab) shows the unadjusted trial balance, then the adjustments (debit/credit) and the adjusted trial balance total. --So, essentially, you are to fill in the adjustment-columns for the 3-items-I noted earlier. --For example (this is not one of the adjustments but merely an example), let's say that the company shows-$40,000 in the marketable-securities debit, unadjusted trial balance.--If the adjustment to be done is a credit- of $1,000, enter this amount in the related credit field of the adjustments...the debit-should-be- to-Unrealized Gain (Loss) on Marketable-Securities-Held for Sale (Chapter 13)...this is as an- example. The 3 adjustments noted above is all that needs to be done in the Excel-file-for-Milestone-1. A B C G H 1 K L M N 1 2 3 Adjusting entries Dr Cr Cr 4 5 6 7 D E F PEYTON APPROVED TRIAL BALANCE As of December 31, 2017 Dr Cr 1,488,999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877,07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 8 9 Cash Marketable Securities Accounts Receivable Baking Supplies Merchandise Inventory Prepaid Rent Prepaid Insurance Misc. Supplies Land Building Baking Equipment Dr 1,488,999.34 5,500,000.00 7,092,495.88 1,605,098.52 128,152.63 71,877.07 207,834.14 17,647.42 250,000.00 1,250,000.00 2,254,140.00 10 12 13 14 15 16 17 328,282.00 328,282.00 18 19 Accumulated Depreciation Patent Accounts Payable Wages Payable Interest Payable 20 1,555,212.85 250,203.31 21,888.22 1,555,212.85 250,203.31 21,888.22 21 22 23 24 1,000,000.00 1,042,118.16 1,000,000.00 1,042,118.16 Current Portion of Bonds Payable Income Taxes Currently Payable Accrued Pension Liability Accrued Employees Health Insurance Lease Liability 25 26 27 28 29 30 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 4,000,000.00 500,000.00 1,750,000.00 2,213,122.59 31 32 33 34 50,000.00 5,250,000.00 50,000.00 5,250,000.00 35 Deferred Tax Liability Bonds Payable Preferred Stock Common Stock Beginning Retained earnings Dividends - Preferred Dividends - Common Bakery Sales Merchandise Sales Cost of Goods Sold - Bakel Cost of Goods Sold - Merch Rent Expense Wages Expense Misc. Supplies Expense Repairs and Maintenance 33,881,157.15 124,795.80 33,881,157.15 124,795.80 36 37 38 39 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 10,954,907.36 88,994.79 1,576,731.95 2,604,526.23 263,224.56 47,353.05 40 41 42 43 44 45 46 Business License Expense Misc. Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense Pension Expense Retired Employees Health Ins. Patent Amortization 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 211,757.65 141,171.08 634,520.00 112,937.69 160,413.49 484,703.27 50,821.34 47 48 49 50 51 52 53 54 Unrealized Gain/(Loss) on Marketable Securities Held for Sale 55 56 Income Taxes 4,168,472.62 4,168,472.62 57 58 46,666,780.08 46,666,780.08 46,666,780.08 46,666,780.08 59 60 61 (1) (2) milestone 1 milestone 1 62 63 64 (3) milestone 1 65 66 (4) (5) (6) milestone 2 milestone 2 67 68 69 milestone 2 70 71 72 73 (7) (8) final final 74 75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started