I need help making a income statement, statement of owner's equity, and Balance sheet.

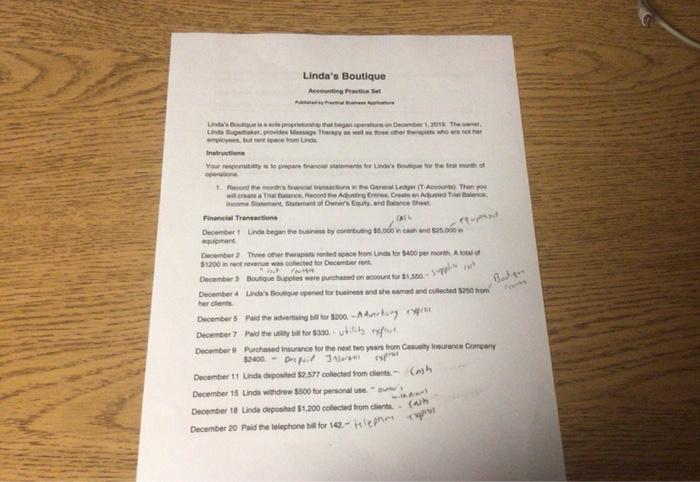

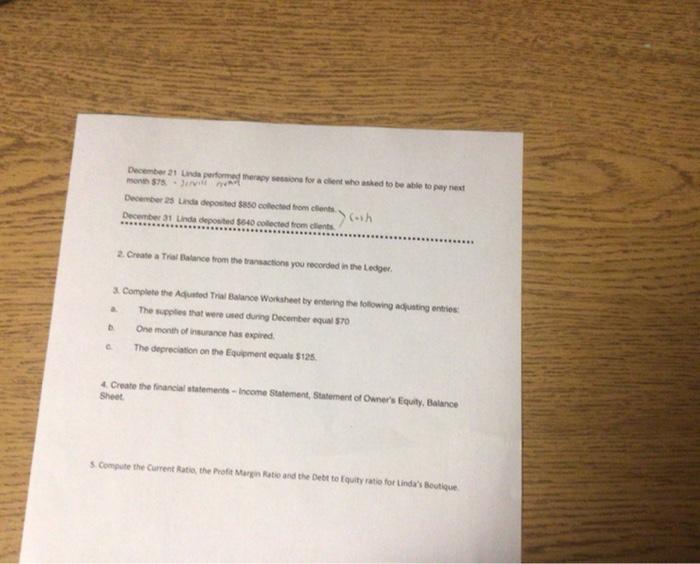

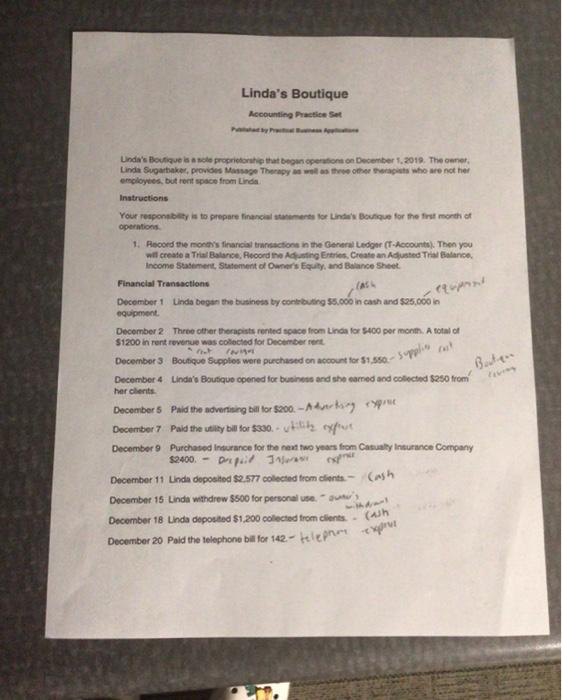

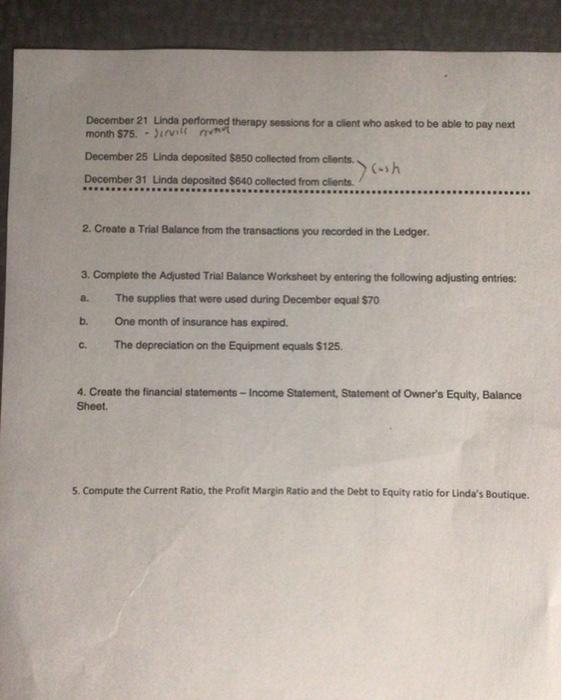

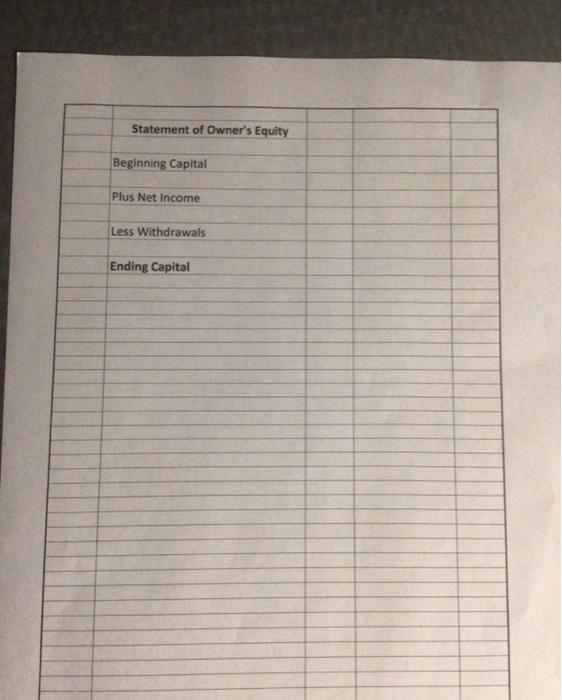

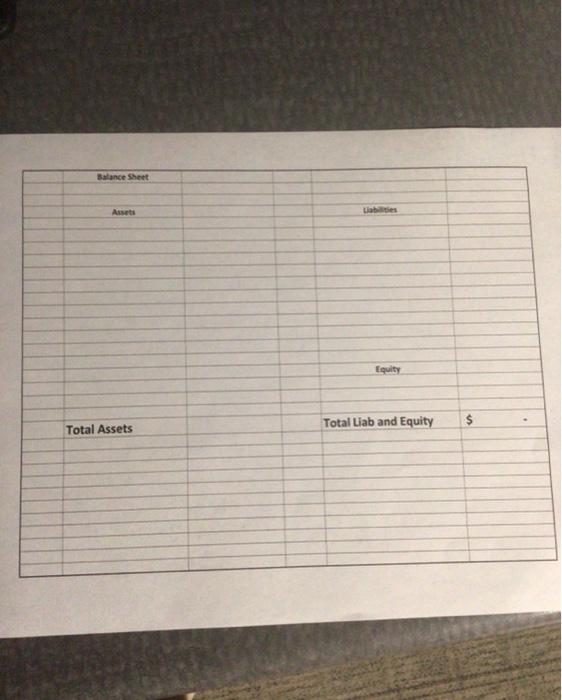

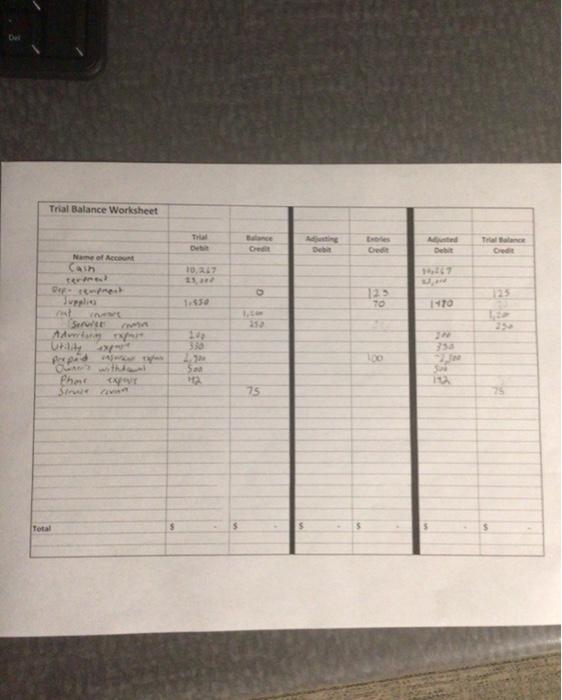

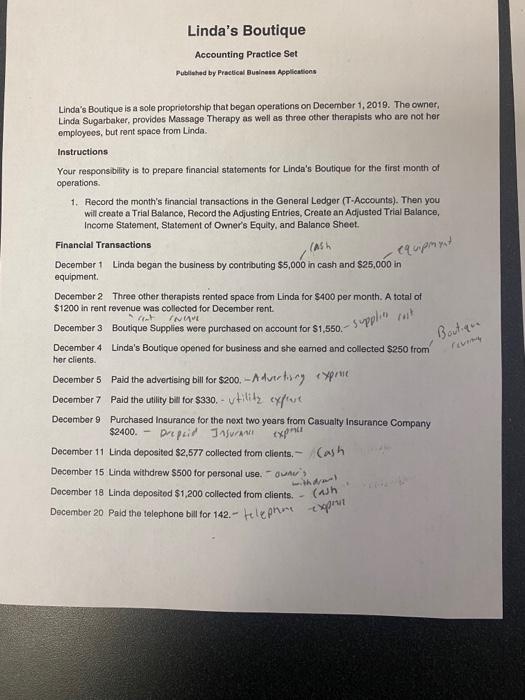

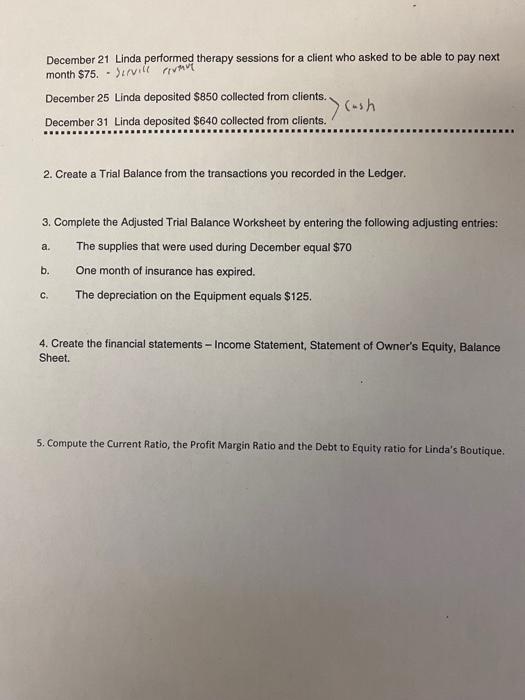

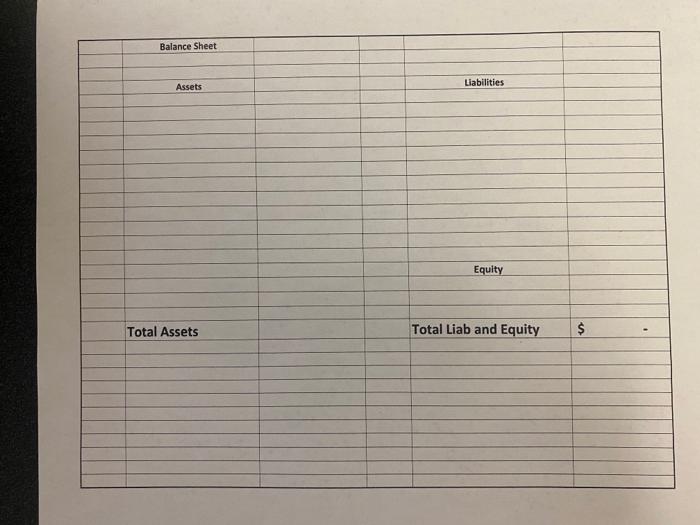

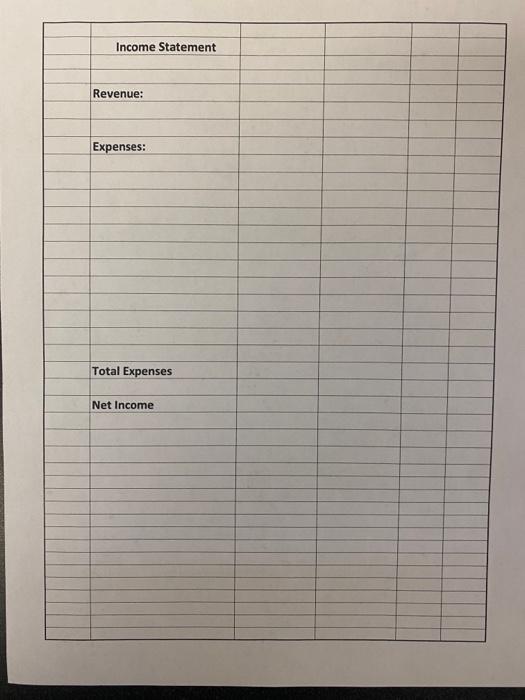

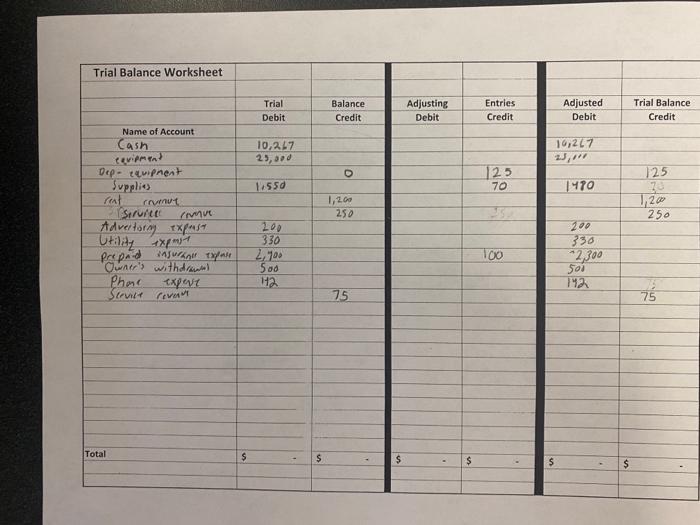

Linda's Boutique Mesetwriting Frcectice Fet Inatruetione arondherat. Financial Trantectoon stipo in reri reverue was ochested for Decertese rant. hilr alects. Becember 11 Linda doposted $2517 collected from clients. December 13 Linda withdrew 5300 for pertional use. - gution December ta Linde depotiled 51,200 collected trom clants. - ( December 20 Paid the lelephone balt for 142 . He ICP monn 375 . " Jivid Desenter 31 Lnda deposted $640 oolected from clente 2. Crease a Tral Palarce from the tranasctions you recorded in the Ledger. 3. Complete the Aquatod Traa Balance Workaheet ty entering the following adpusting ontrios: a. The supples that weve uted dunng Decenber equal 570 b. One minenth of insurance has expired. c. The depreciation on the Equapment equale 5125 . 4. Create the financlal statements - hecome Statement, Statement of Owner's fquity, Batance Sheet. 5. Compute the Current fatio, the Profit Margin Ratio and the Dett to Iquity ratio for linda's Beutique. Linda's Boutique Acooventing Brastice Sett Unda's Bouficue is a scie proprietorahip that began operafont on Decenber 1,2019. The oener, Linda Sugariaker, provides Massage Therapy an welt as throe offee thoragists atho are not her erecloyies. but rert space from Lirdas. Instructions Your respontbity is to prepare financial atanemonts for Lindir Bounque for the first month of operintiont. 1. Record the rionals finariaial trarsactiona in the Cieneral tedger (f-Accounts). Then you will create a Trat Ralarice, Reoord fro Adfaging Craries, Create an Adusted Tral Ealanot. Income Stasermeri, Statement of Danwis fquity, and Bulance Stheet. Financial Transactions December. 1 Unda began the bustiness ty contriating 5.5000 in cash and 505,000 in equipmont. December 2 Three ofthar Bherapists rented space from Uinda for Soco per monm. A total of S1200 in rert revenue sas collocted for Dectrber nert. Desember 4 Linda'e Boufiquo cponed for butinws and she sarned and collected 5250 from har clierits. December 5 Paid the advertising bali for 5200 . A dyer tsey eyput. December 7 . Paid the utily bill for $300.u+ith2. ryfrut December 9 Purchased inwerance for the neat two years from Catualy inturance Company Decernber 11 Linda doposited $2.577 colected from clienth.- Cash Docember 15 Linda withdrew $500 for personal vee. - aretw i December 18 Lnda deposted $1,200 colected from clients. . (A) December 20 Paid the telephone bill for 142. fel eprent December 21. Linda performed therapy sessions for a client who asked to be able to pay next month\$75. - Dirvilf rithre December 25 Linda deposited $850 collected from clionts. December 31 Linda deposited $640 collected from clients. 2. Create a Trial Balance from the transactions you recorded in the Ledger. 3. Complete the Adjusted Trial Balance Worksheet by entering the following adjusting entries: a. The supplies that were used during December equat $70 b. One month of insurance has expired. c. The depreciation on the Equipment equals $125. 4. Create the financial statements - Income Statement, Statement of Owner's Equity, Balance Sheet. 5. Compute the Current Ratio, the Profit Margin Ratio and the Debt to Equity ratio for Linda's Boutique. Statement of Owner's Equity Beginning Capital Plus Net Income Less Withdrawals Ending Capital Statement of Owner's Equity Beginning Capital Plus Net Income Less Withdrawals Ending Capital Linda's Boutique Accounting Practice Set Publehed by Proctical Euniness Acplieations Linda's Boutique is a sole propriotorship that began operations on December 1,2019 . The owner, Linda Sugarbaker, provides Massage Therapy as well as three other theraplats who are not her employeos, but rent space from Linda. Instructions Your responsibility is to prepare financial statements for Linda's Boutique for the first month of operations. 1. Record the month's financial transactions in the General Ledger (T-Accounts). Then you will create a Trial Balance, Fecord the Adjusting Entries, Create an Acjusted Trial Balance, Income Statement, Statement of Owner's Equity, and Balance Sheet. Financial Transactions December 1 Linda began the business by contributing $5,000 in cash and $25,000 in equipment. December 2 Three other therapists rented space from Linda for $400 per month. A total of $1200 in rent revenue was collected for December rent. December 4 Linda's Boutique opened for business and she eamed and collected $250 from her clients. December 5 Paid the advertising bill for $200,A Avertinny iYpruic Docember 7 Paid the utility bill for $330. - vtitity exfiul December 9 Purchased Insurance for the next two years from Casualty insurance Company \$2400. - prepicil Insurant expphit December 11 Linda deposited $2,577 collected from clients, - (a) h December 15 Linda withdrew $500 for personal use. - ounvi? Docember 18 Linda deposited $1,200 colfected from clients. - (A) December 20 Paid the telephone bill for 142. - tetephne t xpprit December 21 Linda performed therapy sessions for a client who asked to be able to pay next month \$75. - )irvill fivant December 25 Linda deposited $850 collected from clients. December 31 Linda deposited $640 collected from clients. 2. Create a Trial Balance from the transactions you recorded in the Ledger. 3. Complete the Adjusted Trial Balance Worksheet by entering the following adjusting entries: a. The supplies that were used during December equal $70 b. One month of insurance has expired. c. The depreciation on the Equipment equals $125. 4. Create the financial statements - Income Statement, Statement of Owner's Equity, Balance Sheet. 5. Compute the Current Ratio, the Profit Margin Ratio and the Debt to Equity ratio for Linda's Boutique. Income Statement Revenue: Expenses: Total Expenses Net Income