Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help on #6, thank you in advance! using the data from exercise (1) above and the data below, analyze the financial efficiency of

i need help on #6, thank you in advance!

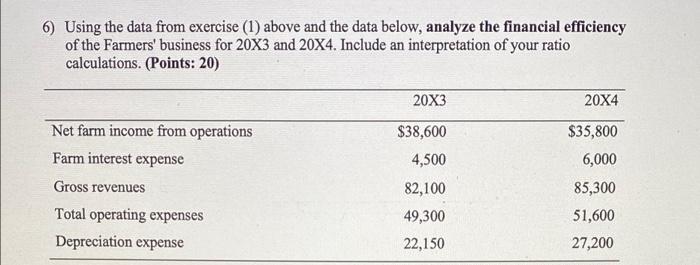

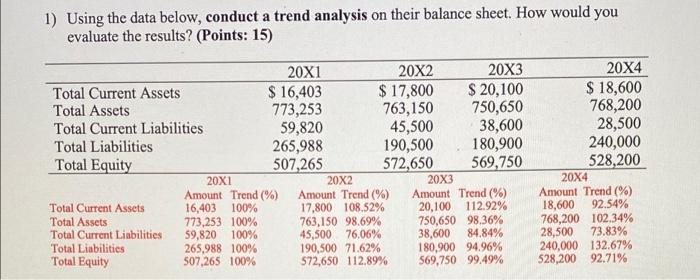

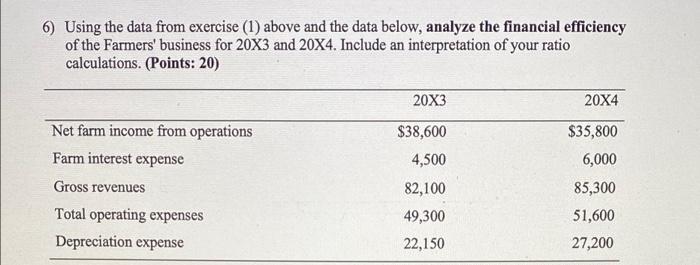

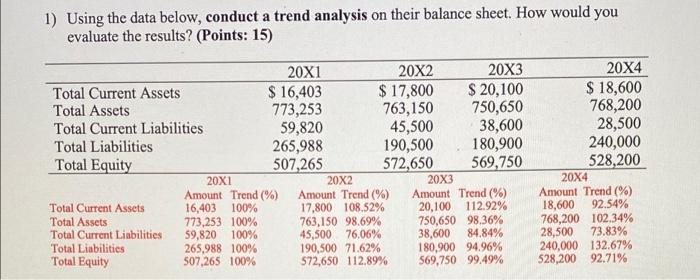

6) Using the data from exercise (1) above and the data below, analyze the financial efficiency of the Farmers' business for 20X3 and 20X4. Include an interpretation of your ratio calculations. (Points: 20) 20X4 Net farm income from operations Farm interest expense Gross revenues Total operating expenses Depreciation expense 20X3 $38,600 4,500 82,100 49,300 22,150 $35,800 6,000 85,300 51,600 27,200 1) Using the data below, conduct a trend analysis on their balance sheet. How would you evaluate the results? (Points: 15) 20x1 20X2 20X3 Total Current Assets $ 16,403 $ 17,800 $ 20,100 Total Assets 773,253 763,150 750,650 Total Current Liabilities 59,820 45,500 38,600 Total Liabilities 265,988 190,500 180,900 Total Equity 507,265 572,650 569,750 20X1 20X2 20X3 Amount Trend (%) Amount Trend (%) Amount Trend (%) Total Current Assets 16,403 100% 17,800 108.52% 20,100 112.92% Total Assets 773,253 100% 763,150 98.69% 750,650 98.36% Total Current Liabilities 59,820 100% 45,500 76.06% 38,600 84.84% Total Liabilities 265,988 100% 190,500 71.62% 180,900 94.96% Total Equity 507,265 100% 572,650 112.89% 569,750 99.49% 20X4 $ 18,600 768,200 28,500 240,000 528,200 20X4 Amount Trend (%) 18,600 92.54% 768,200 102.34% 28,500 73.83% 240,000 132.67% 528,200 92.71% 6) Using the data from exercise (1) above and the data below, analyze the financial efficiency of the Farmers' business for 20X3 and 20X4. Include an interpretation of your ratio calculations. (Points: 20) 20X4 Net farm income from operations Farm interest expense Gross revenues Total operating expenses Depreciation expense 20X3 $38,600 4,500 82,100 49,300 22,150 $35,800 6,000 85,300 51,600 27,200 1) Using the data below, conduct a trend analysis on their balance sheet. How would you evaluate the results? (Points: 15) 20x1 20X2 20X3 Total Current Assets $ 16,403 $ 17,800 $ 20,100 Total Assets 773,253 763,150 750,650 Total Current Liabilities 59,820 45,500 38,600 Total Liabilities 265,988 190,500 180,900 Total Equity 507,265 572,650 569,750 20X1 20X2 20X3 Amount Trend (%) Amount Trend (%) Amount Trend (%) Total Current Assets 16,403 100% 17,800 108.52% 20,100 112.92% Total Assets 773,253 100% 763,150 98.69% 750,650 98.36% Total Current Liabilities 59,820 100% 45,500 76.06% 38,600 84.84% Total Liabilities 265,988 100% 190,500 71.62% 180,900 94.96% Total Equity 507,265 100% 572,650 112.89% 569,750 99.49% 20X4 $ 18,600 768,200 28,500 240,000 528,200 20X4 Amount Trend (%) 18,600 92.54% 768,200 102.34% 28,500 73.83% 240,000 132.67% 528,200 92.71% "using the data from exercise (1) above and the data below, analyze the financial efficiency of the Farmers business for 20X3 and 20X4. include an interpretation of your ratio calculations"

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started