Answered step by step

Verified Expert Solution

Question

1 Approved Answer

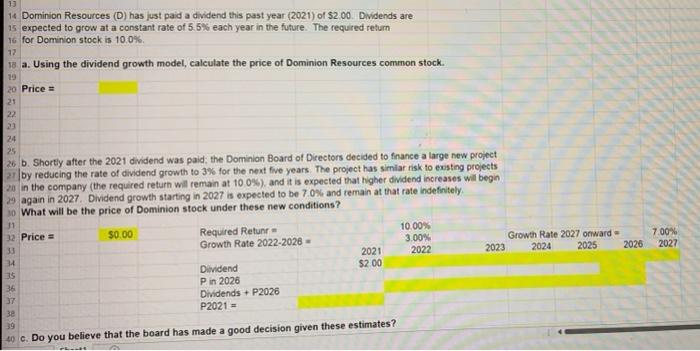

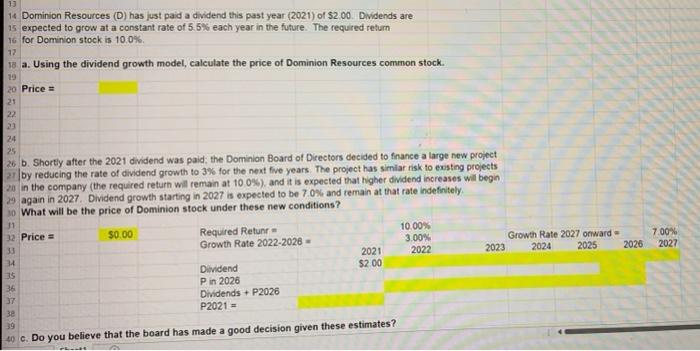

i need help on a, b and c please 13 1 Dominion Resources (D) has just paid a dividend this past year (2021) of $2.00.

i need help on a, b and c please

13 1 Dominion Resources (D) has just paid a dividend this past year (2021) of $2.00. Dividends are 15 expected to grow at a constant rate of 5, 5% each year in the future. The required return 16 for Dominion stock is 100% 18 a. Using the dividend growth model, calculate the price of Dominion Resources common stock. 20 Price : 17 29 21 22 24 25 26 b. Shortly after the 2021 dividend was paid, the Dominion Board of Directors decided to finance a large new project 21 by reducing the rate of dividend growth to 3% for the next five years. The project has simlar risk to existing projects 20 in the company (the required return will remain at 100%), and it is expected that higher dividend increases wil begin 29 again in 2027. Dividend growth starting in 2027 is expected to be 70% and remain at that rate indefinitely 30 What will be the price of Dominion stock under these new conditions? 10.00% 3.00% 2022 Growth Rate 2027 onward 2023 2024 2025 7.00% 2027 2026 14 32 Price = $0.00 Required Retur 3 Growth Rate 2022-2028 2021 Dividend $2.00 36 Pin 2026 37 Dividends + P2026 38 P2021 = 39 40 c. Do you believe that the board has made a good decision given these estimates ? 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started