Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help on both 2 & 3 2) On Feb 1st, Custom Manufacturing Company's work in process inventory was $49,800; its raw materials inventory

i need help on both 2 & 3

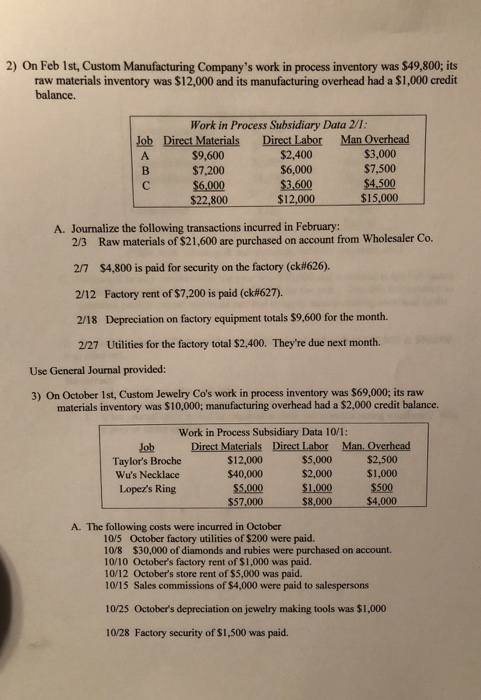

2) On Feb 1st, Custom Manufacturing Company's work in process inventory was $49,800; its raw materials inventory was $12,000 and its manufacturing overhead had a $1,000 credit balance. Work in Process Subsidiary Data 2/1: Job Direct Materials Direct Labor Man Overhead $9,600 $2,400 $3,000 $7,200 $6,000 $7,500 $6,000 $3.600 $4,500 $22,800 $12,000 $15.000 A. Journalize the following transactions incurred in February: 2/3 Raw materials of $21,600 are purchased on account from Wholesaler Co. 2/7 $4,800 is paid for security on the factory (ck#626). 2/12 Factory rent of $7,200 is paid (ck#627). 2/18 Depreciation on factory equipment totals 89,600 for the month. 2/27 Utilities for the factory total $2,400. They're due next month. Use General Journal provided: 3) On October 1st, Custom Jewelry Co's work in process inventory was $69.000: its raw materials inventory was $10,000; manufacturing overhead had a $2,000 credit balance. Work in Process Subsidiary Data 10/1: Job Direct Materials Direct Labor Man Overhead Taylor's Broche $12.000 $5,000 $2,500 Wu's Necklace $40,000 $2,000 $1,000 Lopez's Ring $5.000 $1.000 $500 $57,000 $8,000 $4.000 A. The following costs were incurred in October 10/5 October factory utilities of $200 were paid. 10/8 $30,000 of diamonds and rubies were purchased on account. 10/10 October's factory rent of $1,000 was paid. 10/12 October's store rent of $5,000 was paid. 10/15 Sales commissions of $4,000 were paid to salespersons 10/25 October's depreciation on jewelry making tools was $1,000 10/28 Factory security of $1,500 was paid Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started