Answered step by step

Verified Expert Solution

Question

1 Approved Answer

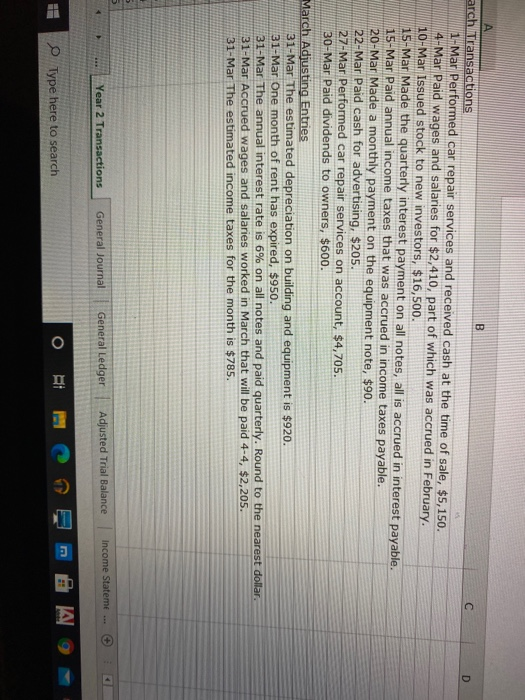

i need help on general journal and adjesting trial balance for march transaction B D arch Transactions 1-Mar Performed car repair services and received cash

i need help on general journal and adjesting trial balance for march transaction

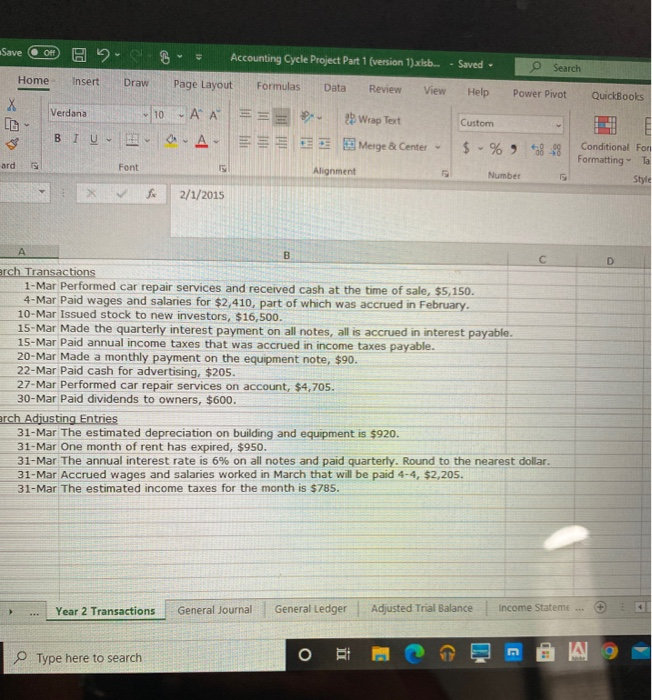

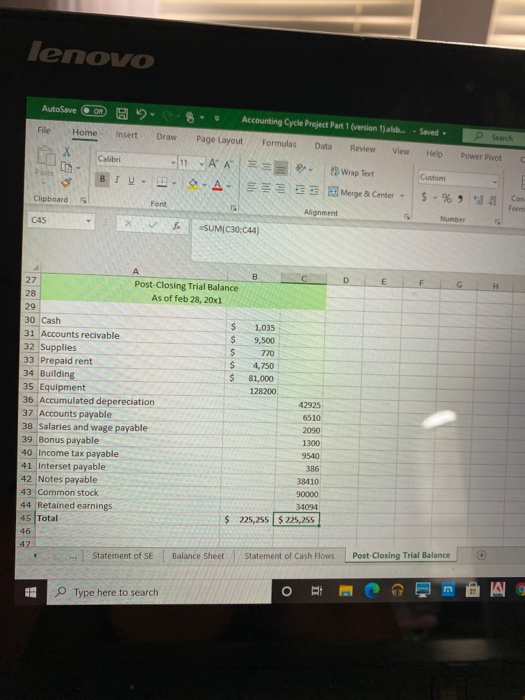

B D arch Transactions 1-Mar Performed car repair services and received cash at the time of sale, $5,150. 4-Mar Paid wages and salaries for $2,410, part of which was accrued in February. 10-Mar Issued stock to new investors, $16,500. 15-Mar Made the quarterly interest payment on all notes, all is accrued in interest payable. 15-Mar Paid annual income taxes that was accrued in income taxes payable. 20-Mar Made a monthly payment on the equipment note, $90. 22-Mar Paid cash for advertising, $205. 27-Mar Performed car repair services on account, $4,705. 30-Mar Paid dividends to owners, $600. March Adjusting Entries 31-Mar The estimated depreciation on building and equipment is $920. 31-Mar One month of rent has expired, $950. 31-Mar The annual interest rate is 6% on all notes and paid quarterly. Round to the nearest dollar. 31-Mar Accrued wages and salaries worked in March that will be paid 4-4, $2,205. 31-Mar The estimated income taxes for the month is $785. General Journal Year 2 Transactions General Ledger Income Stateme ... Adjusted Trial Balance E O E JA 11 Type here to search Save OFF Accounting Cycle Project Part 1 (version 1).xlsb... - Saved - Search Home Insert Draw Page Layout Formulas Data Review View Help Power Pivot QuickBooks Verdana Custom 10 AA = = 2 Wrap Text A ESSE Merge & Center E BIU $ -% -38-98 ard Conditional Fon Formatting Ta Style Font Alignment Number 5 2/1/2015 A D B arch Transactions 1-Mar Performed car repair services and received cash at the time of sale, $5,150. 4-Mar Paid wages and salaries for $2,410, part of which was accrued in February. 10-Mar Issued stock to new investors, $16,500. 15-Mar Made the quarterly interest payment on all notes, all is accrued in interest payable. 15-Mar Paid annual income taxes that was accrued in income taxes payable. 20-Mar Made a monthly payment on the equipment note, $90. 22-Mar Paid cash for advertising, $205. 27-Mar Performed car repair services on account, $4,705. 30-Mar Paid dividends to owners, $600. arch Adjusting Entries 31-Mar The estimated depreciation on building and equipment is $920. 31-Mar One month of rent has expired, $950. 31-Mar The annual interest rate is 6% on all notes and paid quarterly. Round to the nearest dollar. 31-Mar Accrued wages and salaries worked in March that will be paid 4-4, $2,205. 31-Mar The estimated income taxes for the month is $785. Year 2 Transactions General Journal General Ledger Adjusted Trial Balance Income Stateme... Type here to search O DK S JA 9 lenovo AutoSave On Accounting Cycle Project Part 1 (version 1).xls. - Saved File Home Insert Draw Page Layout Formulas Data Review View Help Power Pivot Calibri 11 AA== 23 Wrap Text Custom 09 B TV - - - A- E3Merge Center 5 - % 923 Clipboard Font Alignment Con form C45 SUM(C30:044) D E F H A B 27 Post-Closing Trial Balance 28 As of feb 28, 20x1 29 30 Cash $ 1,035 31 Accounts recivable $ 9,500 32 Supplies $ 770 33 Prepaid rent $ 4,750 34 Building $ 81,000 35 Equipment 128200 36 Accumulated depereciation 42925 37 Accounts payable 6510 38 Salaries and wage payable 2090 39 Bonus payable 1300 40 Income tax payable 9540 41 Interset payable 386 42 Notes payable 38410 43 Common stock 90000 44 Retained earnings 34094 45 Total $ 225,255 $ 225,255 46 Statement of SE Balance Sheet Statement of Cash Flows Post Closing Trial Balance Type here to search O BI CH E JA Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started