Answered step by step

Verified Expert Solution

Question

1 Approved Answer

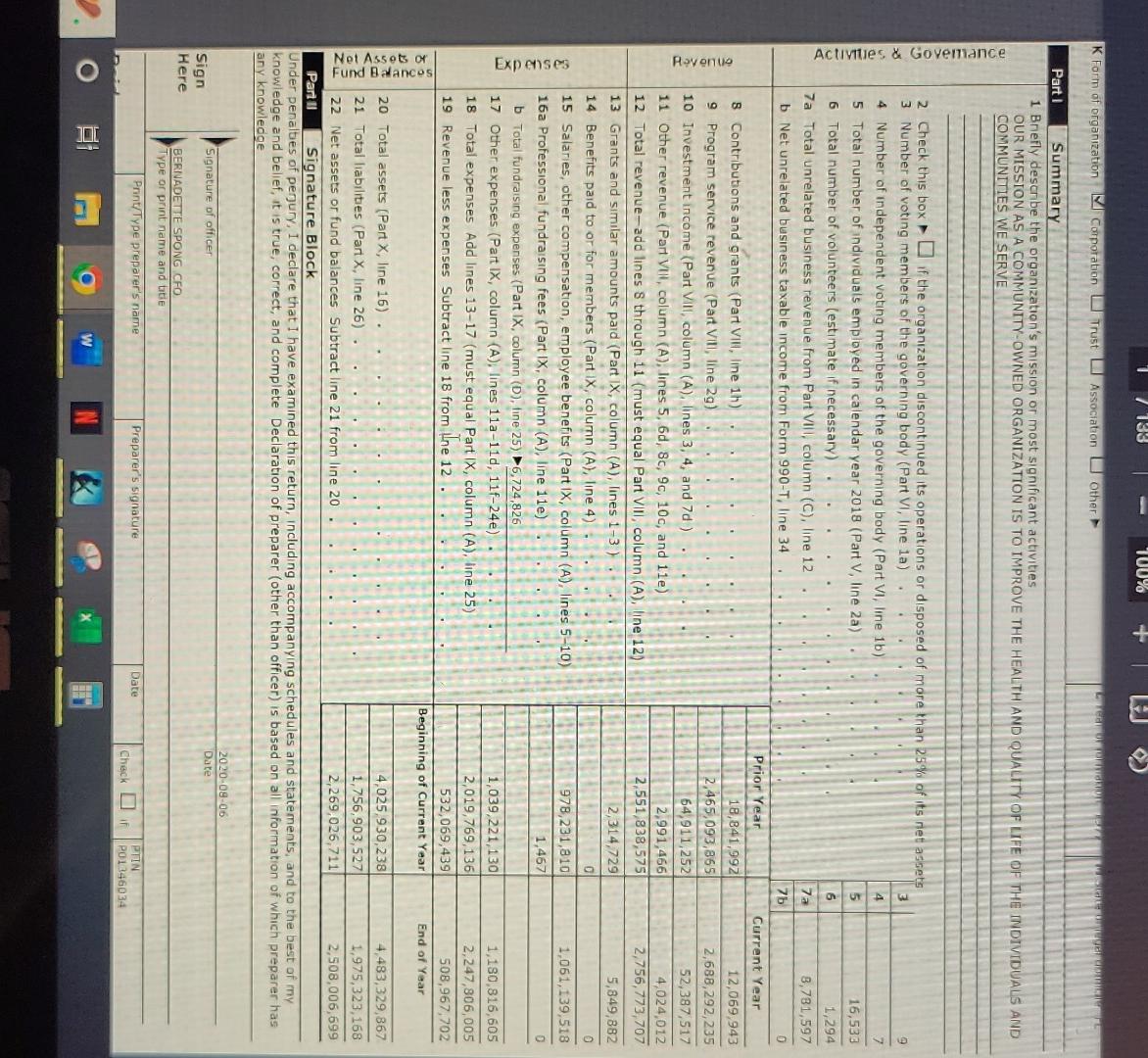

I need help on how to calculate operating margin using the form 990 of a hospital. I don't understand it. Operating Margin Operating income x

I need help on how to calculate operating margin using the form 990 of a hospital. I don't understand it.

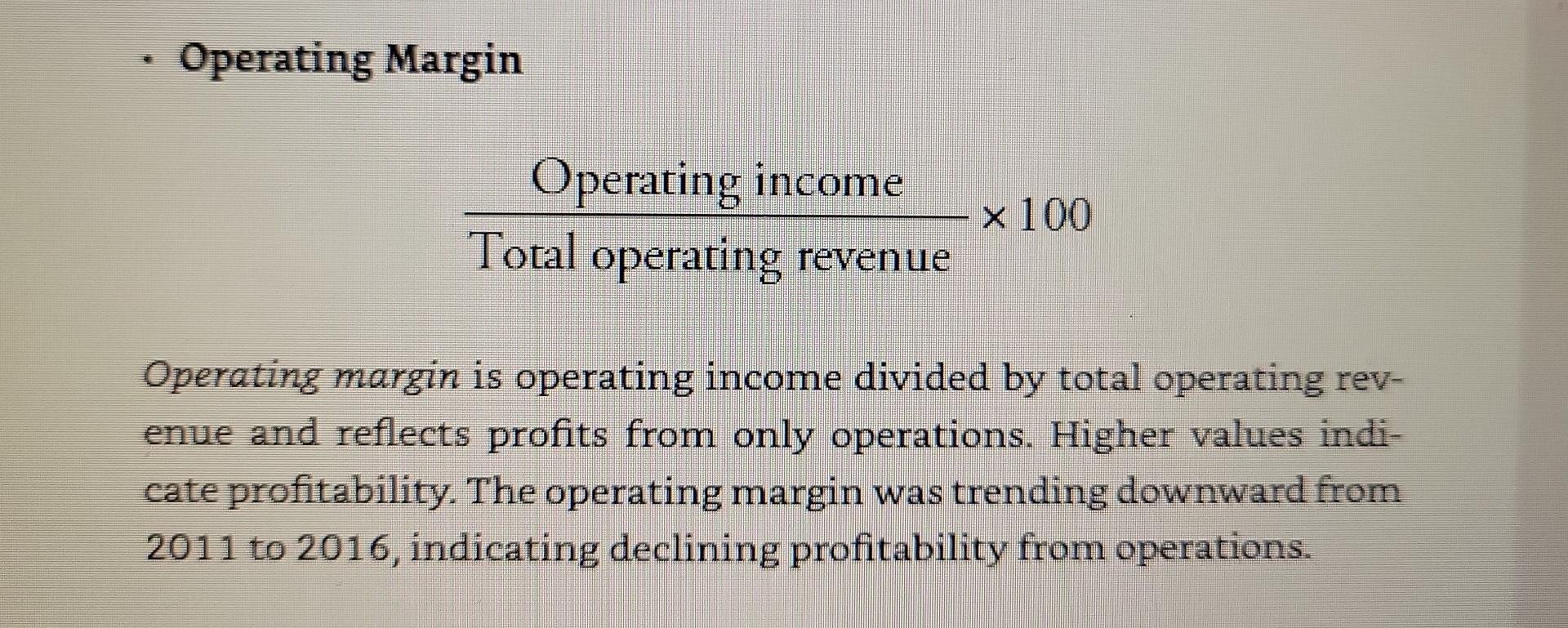

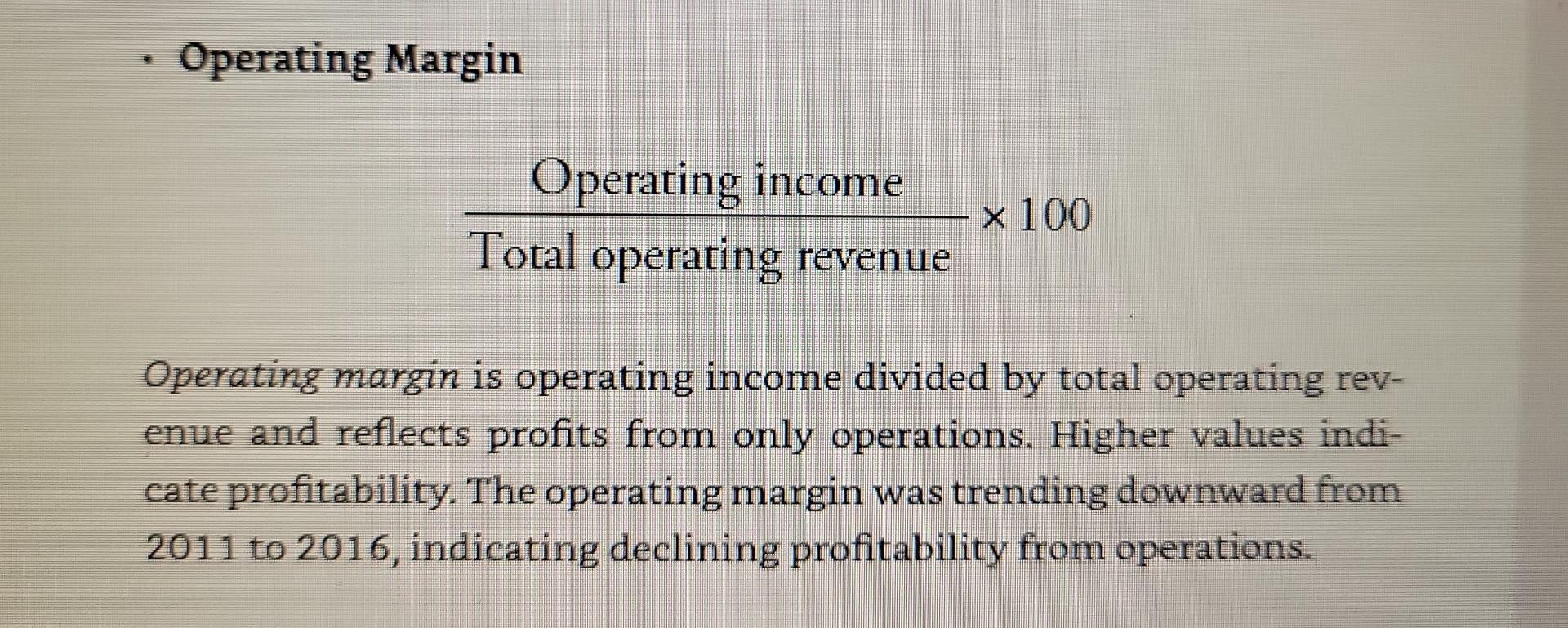

Operating Margin Operating income x 100 Total operating revenue Operating margin is operating income divided by total operating rev- enue and reflects profits from only operations. Higher values indi- cate profitability. The operating margin was trending downward from 2011 to 2016, indicating declining profitability from operations. Operating Margin Operating income x 100 Total operating revenue Operating margin is operating income divided by total operating rev- enue and reflects profits from only operations. Higher values indi- cate profitability. The operating margin was trending downward from 2011 to 2016, indicating declining profitability from operations. 133 100% K Form of organization Corporation Trust Association Other Part I Summary 1 Bnefly describe the organization's mission or most significant activities OUR MISSION AS A COMMUNITY-OWNED ORGANIZATION IS TO IMPROVE THE HEALTH AND QUALITY OF LIFE OF THE INDIVIDUALS AND COMMUNITIES WE SERVE 2 Check this box if the organization discontinued its operations or disposed of more than 25% of its net assets 3 Number of voting members of the governing body (Part VI, line la). 3 4 7 4 Number of independent voting members of the governing body (Part VI, line 1b) 5 Total number of individuals employed in calendar year 2018 (Part V, line 2a). 6 Total number of volunteers (estimate if necessary) 5 16,533 6 7a Total unrelated business revenue from Part VIII, column (C), line 12 7a 7b b Net unrelated business taxable income from Form 990-T, line 34 Prior Year 1,294 8,781,597 0 Current Year 12,069,943 2,688,292,235 52,387,517 8 Contributions and grants (Part VIII, line 1h) . 9 Program service revenue (Part VIII, line 2g) 18,841,992 2,465,093,865 64,911,252 10 Investment income (Part Vill, column (A), lines 3, 4, and 7d). 11 Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and 11e) 2,991,466 4,024,012 2,551,838,575 2,756,773,707 12 Total revenue-add lines 8 through 11 (must equal Part VIII, column (A), line 12) 13 Grants and similar amounts paid (Part IX, column (A), lines 1-3) 2,314,729 14 Benefits paid to or for members (Part IX, column (A), line 4) 5,849,882 0 1,061,139,518 0 15 Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10) 16a Professional fundraising fees (Part IX, column (A), line 11e) 978,231,810 1,467 . . . b Total fundraising expenses (Part IX, column (D), fine 25) 6,724,826 17 Other expenses (Part IX, column (A), lines 11a-11d, 11f-24e). 1,039,221,130 1,180,816,605 2,019,769,136 18 Total expenses Add lines 13-17 (must equal Part IX, column (A), line 25) 19 Revenue less expenses Subtract line 18 from ne 12. 2,247,806,005 508,967,702 532,069,439 Beginning of Current Year 20 Total assets (Part X, line 16). 181 4,025,930,238 4,483,329,867 21 Total liabilities (Part X, line 26). 1,756,903,527 1,975,323,168 22 Net assets or fund balances Subtract line 21 from line 20. . 2,269,026,711 2,508,006,699 Part II Signature Block Under penalbes of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge 2020-08-06 Date Signature of officer Sign Here BERNADETTE SPONG CFO Type or print name and title Preparer's signature Date PTIN Check if P01346034 Activities & Govemance Revenue Expenses Not Assets of Balances Fund O 10 Print/Type preparer's name: End of Year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started