Answered step by step

Verified Expert Solution

Question

1 Approved Answer

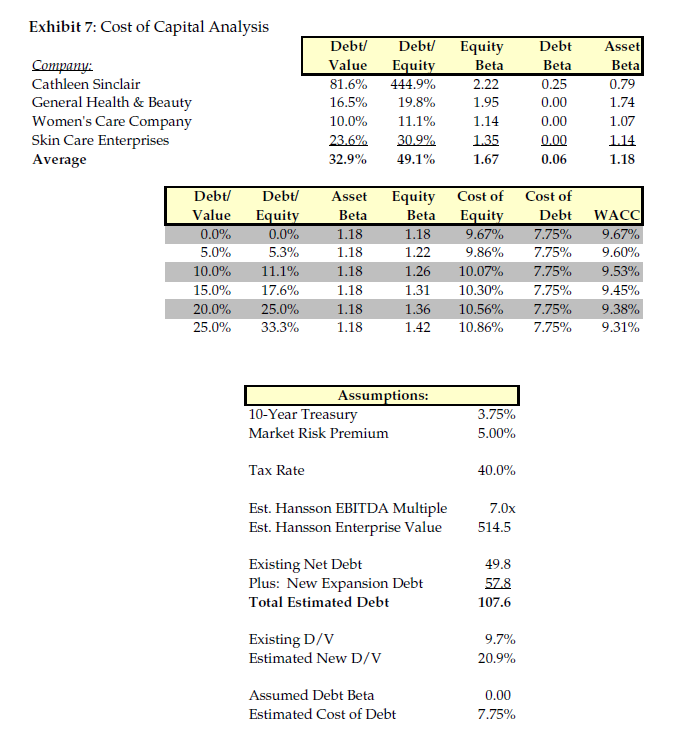

I need help on how to evaluate a project using the WACC and what discount rate should be applied when evaluating the project??? The project

I need help on how to evaluate a project using the WACC and what discount rate should be applied when evaluating the project???

The project is Hansson Private Label Case, IF you google Hanson private label case pdf, you will find the pdf file of the case and all the information about it

Here is some data from the project:

Exhibit 7: Cost of Capital Analysis Company: Cathleen Sinclair General Health & Beauty Women's Care Company Skin Care Enterprises Average Debt/ Value 81.6% 16.5% 10.0% 23.6% 32.9% Debt/ Equity 444.9% 19.8% 11.1% 30.9% 49.1% Equity Beta 2.22 1.95 1.14 1.35 1.67 Debt Beta 0.25 0.00 0.00 0.00 0.06 Asset Beta 0.79 1.74 1.07 1.14 1.18 Debt/ Value 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% Debt/ Equity 0.0% 5.3% 11.1% 17.6% 25.0% 33.3% Asset Beta 1.18 1.18 1.18 1.18 1.18 1.18 Equity Beta 1.18 1.22 1.26 1.31 1.36 1.42 Cost of Equity 9.67% 9.86% 10.07% 10.30% 10.56% 10.86% Cost of Debt WACC 7.75% 9.67% 7.75% 7.75% 9.53% 7.75% 9.45% 7.75% 9.38% 7.75% 9.31% Assumptions: 10-Year Treasury Market Risk Premium 3.75% 5.00% Tax Rate 40.0% Est. Hansson EBITDA Multiple Est. Hansson Enterprise Value 7.0x 514.5 Existing Net Debt Plus: New Expansion Debt Total Estimated Debt 49.8 57.8 107.6 Existing D/V Estimated New D/V 9.7% 20.9% Assumed Debt Beta Estimated Cost of Debt 0.00 7.75%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started