Answered step by step

Verified Expert Solution

Question

1 Approved Answer

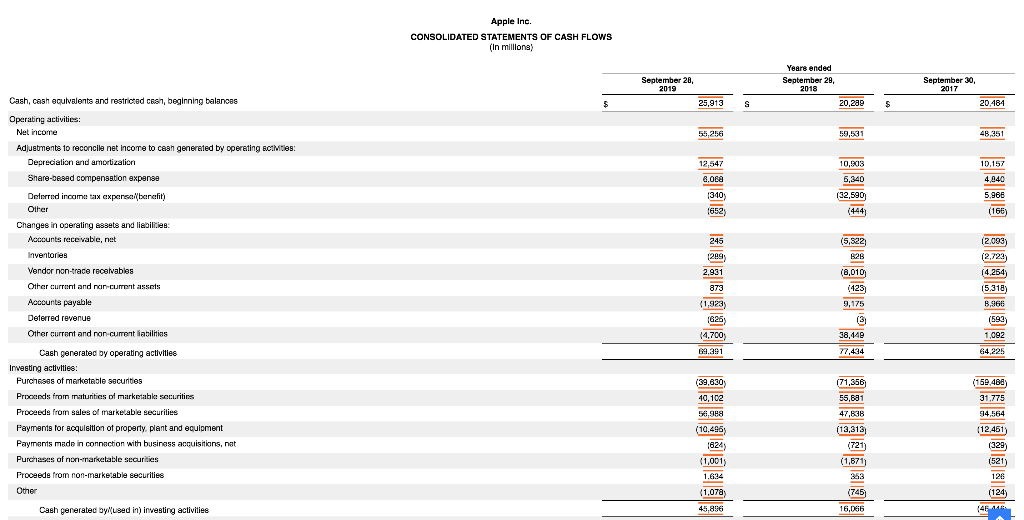

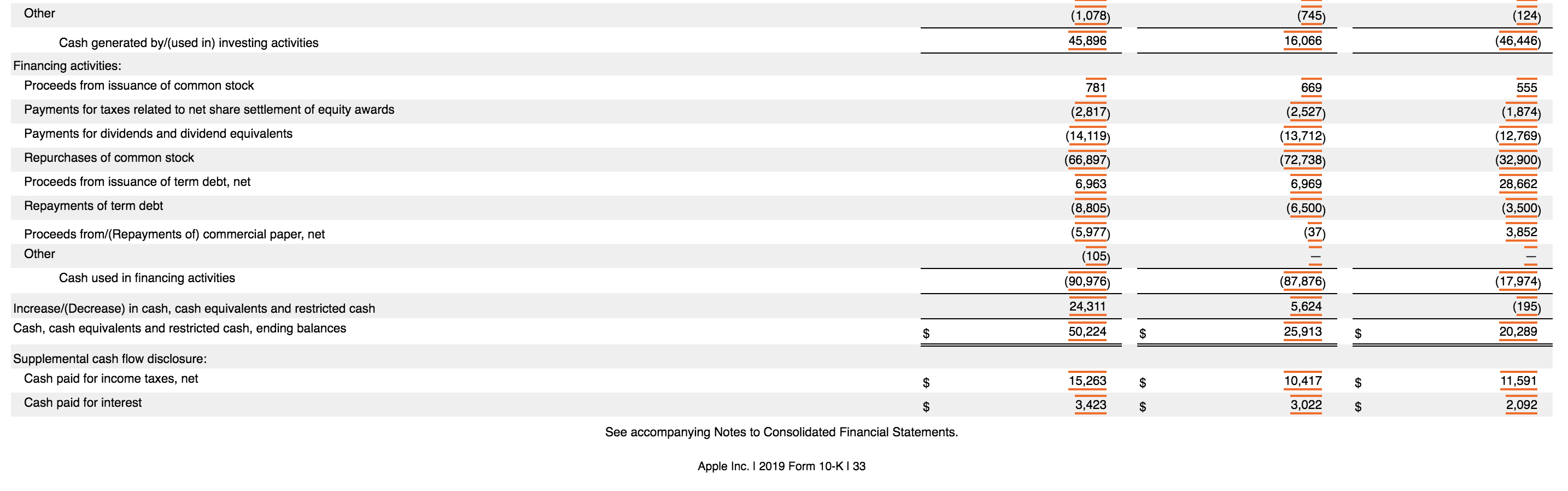

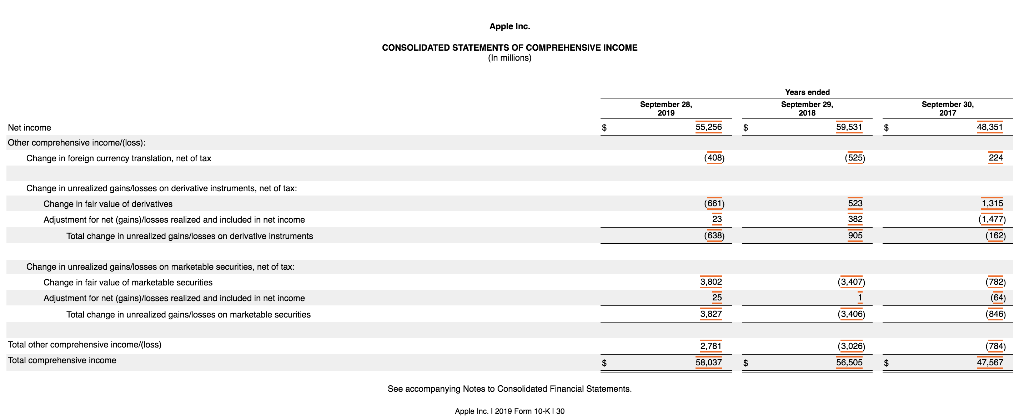

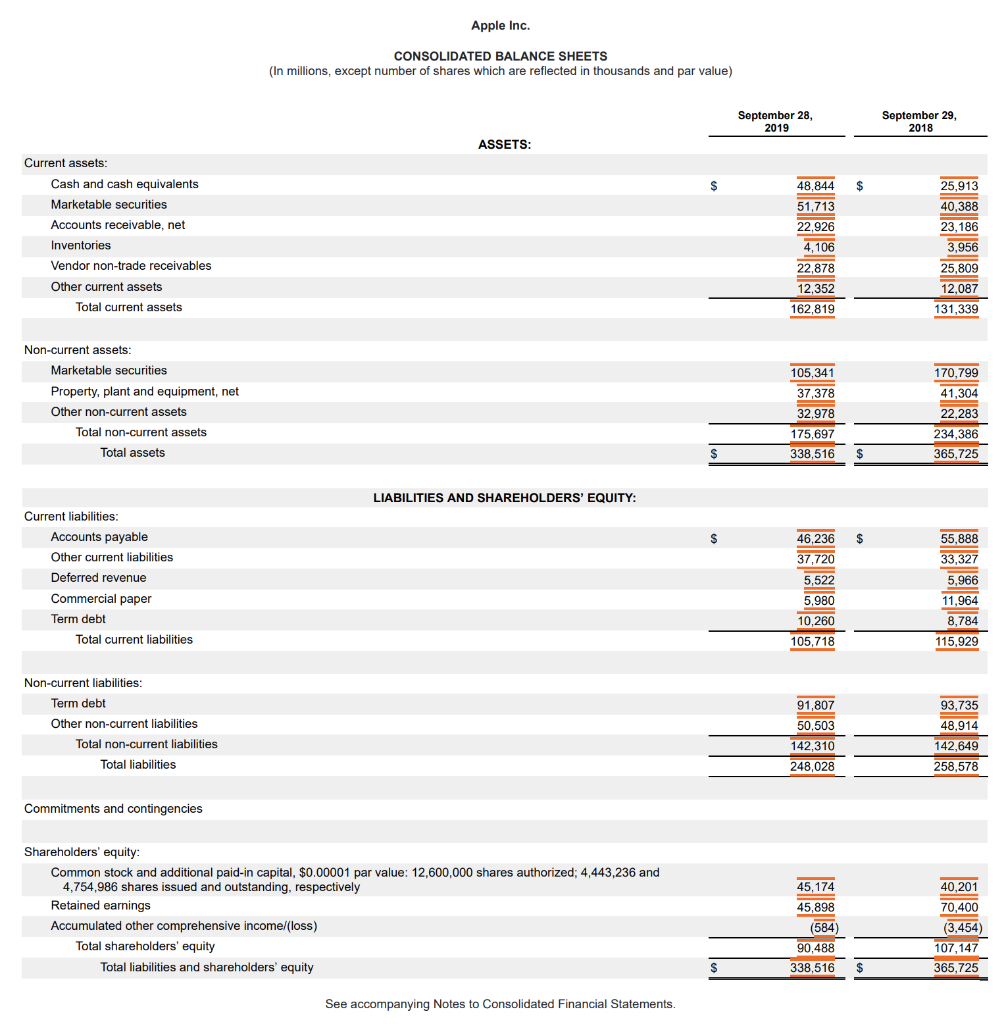

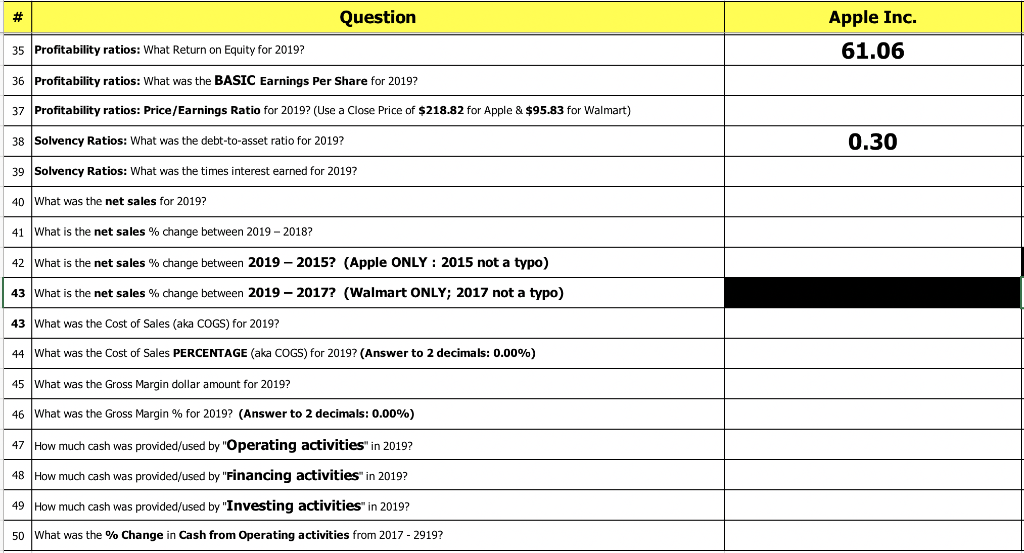

I need help on numbers 36-50 please. I have attached the balance sheet, statement of income, and statements of cash flows. , , , mida

I need help on numbers 36-50 please. I have attached the balance sheet, statement of income, and statements of cash flows.

, , , mida Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Years ended September 30, 2019 2018 2017 Cash, cash equivalents and restricted cash, beginning balances $ 25,913 20,289 20.484 Operating activities: Net Incore 55.2561 59,531 46,351 Adjustments to reconcile net income to cash generated by operating scilities: Depreciation and amortization 12,547 10,XIS 11.157 Share-based compensation expense 6.088 5,340 4.846 Deferred income tax expenselbenefit) 1310) (32,590 5,966 Other 1652) (444) (166) Changes in operating assets and liabilities: Accounts receivable, net 245 ( (5,522 12.093) 1289) B28 (2,722) Vendor non-trace receivables "" 2,931 (8,010 14.254 Other current and rain-current assets 873 1425 (5,318) Accounts payable 9,175 8.966 Deterred revenue ( G25 131 (592) Other current and non-current abilities (4,700 ) 38,149 1,092 Cash generated by operating activities 69.391 77,434 64,225 Investing activities: Furch638s of marketable securities (39,630) (71,356 (152.488) Proceeds from maturities of marketable securities 40,102 55,891 31.775 Proceeds from sales of marketable securities 56,988 47,636 94,564 Payments for scquisition of property, plant and equipment (10,496 (13,313) (12,451 Payments made in connection with business acquisitions, nat 1624) (721) (329) Purchases of non-rrarketable securities (1,0013 (1.671 (521) Proceeds from non-marketable securities 1.634 353 126 Other (1.070) (745) (124) Cash generated by used in) investing activities 16,066 (46 MB (1,973 45.896 Other (1,078) (745) (124) (46,446) 45,896 16,066 781 669 555 Cash generated by/(used in) investing activities Financing activities: Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock (2,817 (2,527 (1,874 (13,712) (14,119) (66,897) (72,738 (12,769) (32,900 28,662 Proceeds from issuance of term debt, net 6,963 6,969 Repayments of term debt (8,805) (6,500) (3,500) (5,977 (37 3,852 Proceeds from/(Repayments of) commercial paper, net Other (105) (90,976) Cash used in financing activities (87,876) (17,974) (195) 24,311 5,624 Increase/Decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash, ending balances $ 50,224 $ 25,913 $ 20,289 Supplemental cash flow disclosure: Cash paid for income taxes, net Cash paid for interest $ 15,263 $ 10,417 11,591 $ 3,423 $ 3,022 $ 2,092 See accompanying Notes to Consolidated Financial Statements. Apple Inc. I 2019 Form 10-K I 33 Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) September 28 2019 Years ended September 29, , 2018 59,531 September 20. 2017 48,351 Not income $ 55,255 $ $ Other comprehensive incomo loss): Change in foreign currency translation, nel of lax (408) 224 (681) Change in unrealized gains losses on derivative instruments, net of tax Change in teir value of derivatives Adjustment for net igains/osses realized and included in net income Total change in unrealized gains/losses an derivative Instruments 522 382 23 (638) 1.315 (1,477) (162) 905 (3.407) Change in unrealized gains losses on marketable securities, net of tax: Change in fair value of marketable securities Adjustment for net (gains/losses realized and included in net income Total change in unrealized gains/losses on marketable securities 3,802 25 (782) (64) (846) 3,827 (3,406) Total other comprehensive income loss) Total comprehensive income 2.781 56,037 (3,026) 58,505 (784) 47,567 $ $ $ See accompanying Notes to Consolidated Financial Statements Apple Inc. I 2010 Forin 10-K 130 Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 28, 2019 September 29, 2018 ASSETS: $ $ 48,844 51,713 25,913 40,388 23,186 3.956 22.926 Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 4,106 25,809 22,878 12,352 162,819 12,087 131,339 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 105,341 37,378 32,978 175,697 338,516 170.799 41.304 22,283 234,386 365.725 $ $ LIABILITIES AND SHAREHOLDERS' EQUITY: : $ $ 55,888 33,327 Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 46,236 37,720 5,522 5,980 10,260 105,718 5,966 11,964 8,784 115,929 Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities 91,807 50,503 142,310 248,028 93,735 48,914 142,649 258,578 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized: 4,443,236 and 4,754,986 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 45, 174 45,898 (584) 40,201 70,400 (3,454) 107,147 365,725 90,488 338,516 $ $ See accompanying Notes to Consolidated Financial Statements. # Question Apple Inc. 61.06 35 Profitability ratios: What Return on Equity for 2019? 36 Profitability ratios: What was the BASIC Earnings Per Share for 2019? 37 Profitability ratios: Price/Earnings Ratio for 2019? (Use a Close Price of $218.82 for Apple & $95.83 for Walmart) 38 Solvency Ratios: What was the debt-to-asset ratio for 2019? 0.30 39 Solvency Ratios: What was the times interest earned for 2019? 40 What was the net sales for 2019? 41 What is the net sales % change between 2019 - 2018? 42 What is the net sales % change between 2019 - 2015? (Apple ONLY : 2015 not a typo) 43 What is the net sales % change between 2019-2017? (Walmart ONLY; 2017 not a typo) 43 What was the Cost of Sales (aka COGS) for 2019? 44 What was the Cost of Sales PERCENTAGE (aka COGS) for 2019? (Answer to 2 decimals: 0.00%) 45 What was the Gross Margin dollar amount for 2019? 46 What was the Gross Margin % for 2019? (Answer to 2 decimals: 0.00%) 47 How much cash was provided/used by "Operating activities" in 2019? 48 How much cash was provided/used by "Financing activities" in 2019? 49 How much cash was provided/used by "Investing activities" in 2019? 50 What was the % Change in Cash from Operating activities from 2017 - 2919? , , , mida Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Years ended September 30, 2019 2018 2017 Cash, cash equivalents and restricted cash, beginning balances $ 25,913 20,289 20.484 Operating activities: Net Incore 55.2561 59,531 46,351 Adjustments to reconcile net income to cash generated by operating scilities: Depreciation and amortization 12,547 10,XIS 11.157 Share-based compensation expense 6.088 5,340 4.846 Deferred income tax expenselbenefit) 1310) (32,590 5,966 Other 1652) (444) (166) Changes in operating assets and liabilities: Accounts receivable, net 245 ( (5,522 12.093) 1289) B28 (2,722) Vendor non-trace receivables "" 2,931 (8,010 14.254 Other current and rain-current assets 873 1425 (5,318) Accounts payable 9,175 8.966 Deterred revenue ( G25 131 (592) Other current and non-current abilities (4,700 ) 38,149 1,092 Cash generated by operating activities 69.391 77,434 64,225 Investing activities: Furch638s of marketable securities (39,630) (71,356 (152.488) Proceeds from maturities of marketable securities 40,102 55,891 31.775 Proceeds from sales of marketable securities 56,988 47,636 94,564 Payments for scquisition of property, plant and equipment (10,496 (13,313) (12,451 Payments made in connection with business acquisitions, nat 1624) (721) (329) Purchases of non-rrarketable securities (1,0013 (1.671 (521) Proceeds from non-marketable securities 1.634 353 126 Other (1.070) (745) (124) Cash generated by used in) investing activities 16,066 (46 MB (1,973 45.896 Other (1,078) (745) (124) (46,446) 45,896 16,066 781 669 555 Cash generated by/(used in) investing activities Financing activities: Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock (2,817 (2,527 (1,874 (13,712) (14,119) (66,897) (72,738 (12,769) (32,900 28,662 Proceeds from issuance of term debt, net 6,963 6,969 Repayments of term debt (8,805) (6,500) (3,500) (5,977 (37 3,852 Proceeds from/(Repayments of) commercial paper, net Other (105) (90,976) Cash used in financing activities (87,876) (17,974) (195) 24,311 5,624 Increase/Decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash, ending balances $ 50,224 $ 25,913 $ 20,289 Supplemental cash flow disclosure: Cash paid for income taxes, net Cash paid for interest $ 15,263 $ 10,417 11,591 $ 3,423 $ 3,022 $ 2,092 See accompanying Notes to Consolidated Financial Statements. Apple Inc. I 2019 Form 10-K I 33 Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) September 28 2019 Years ended September 29, , 2018 59,531 September 20. 2017 48,351 Not income $ 55,255 $ $ Other comprehensive incomo loss): Change in foreign currency translation, nel of lax (408) 224 (681) Change in unrealized gains losses on derivative instruments, net of tax Change in teir value of derivatives Adjustment for net igains/osses realized and included in net income Total change in unrealized gains/losses an derivative Instruments 522 382 23 (638) 1.315 (1,477) (162) 905 (3.407) Change in unrealized gains losses on marketable securities, net of tax: Change in fair value of marketable securities Adjustment for net (gains/losses realized and included in net income Total change in unrealized gains/losses on marketable securities 3,802 25 (782) (64) (846) 3,827 (3,406) Total other comprehensive income loss) Total comprehensive income 2.781 56,037 (3,026) 58,505 (784) 47,567 $ $ $ See accompanying Notes to Consolidated Financial Statements Apple Inc. I 2010 Forin 10-K 130 Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 28, 2019 September 29, 2018 ASSETS: $ $ 48,844 51,713 25,913 40,388 23,186 3.956 22.926 Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 4,106 25,809 22,878 12,352 162,819 12,087 131,339 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 105,341 37,378 32,978 175,697 338,516 170.799 41.304 22,283 234,386 365.725 $ $ LIABILITIES AND SHAREHOLDERS' EQUITY: : $ $ 55,888 33,327 Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 46,236 37,720 5,522 5,980 10,260 105,718 5,966 11,964 8,784 115,929 Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities 91,807 50,503 142,310 248,028 93,735 48,914 142,649 258,578 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized: 4,443,236 and 4,754,986 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 45, 174 45,898 (584) 40,201 70,400 (3,454) 107,147 365,725 90,488 338,516 $ $ See accompanying Notes to Consolidated Financial Statements. # Question Apple Inc. 61.06 35 Profitability ratios: What Return on Equity for 2019? 36 Profitability ratios: What was the BASIC Earnings Per Share for 2019? 37 Profitability ratios: Price/Earnings Ratio for 2019? (Use a Close Price of $218.82 for Apple & $95.83 for Walmart) 38 Solvency Ratios: What was the debt-to-asset ratio for 2019? 0.30 39 Solvency Ratios: What was the times interest earned for 2019? 40 What was the net sales for 2019? 41 What is the net sales % change between 2019 - 2018? 42 What is the net sales % change between 2019 - 2015? (Apple ONLY : 2015 not a typo) 43 What is the net sales % change between 2019-2017? (Walmart ONLY; 2017 not a typo) 43 What was the Cost of Sales (aka COGS) for 2019? 44 What was the Cost of Sales PERCENTAGE (aka COGS) for 2019? (Answer to 2 decimals: 0.00%) 45 What was the Gross Margin dollar amount for 2019? 46 What was the Gross Margin % for 2019? (Answer to 2 decimals: 0.00%) 47 How much cash was provided/used by "Operating activities" in 2019? 48 How much cash was provided/used by "Financing activities" in 2019? 49 How much cash was provided/used by "Investing activities" in 2019? 50 What was the % Change in Cash from Operating activities from 2017 - 2919Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started