Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help on practice problem on accounting please. Question 1 Order: *ervggyg, Inc. produces a single product. The cost of producing and selling &lle

I need help on practice problem on accounting please.

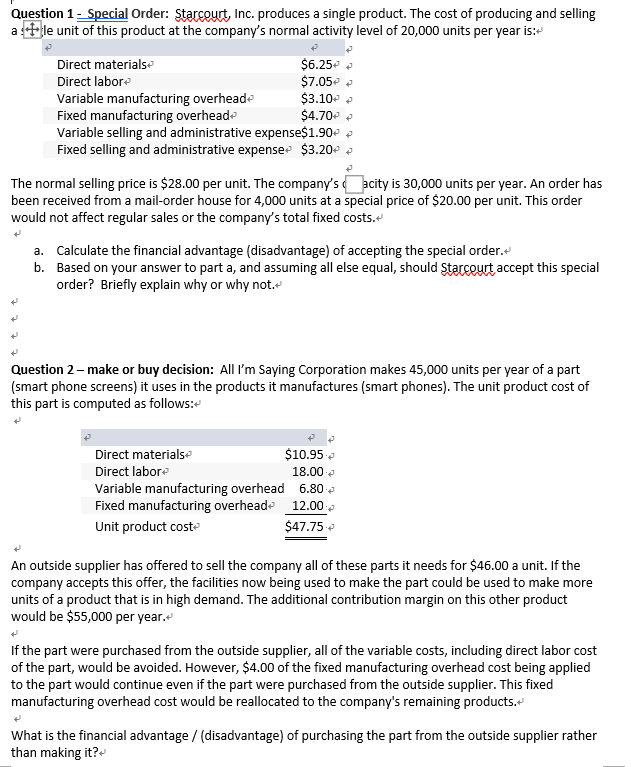

Question 1 Order: *ervggyg, Inc. produces a single product. The cost of producing and selling &lle unit of this product at the company's normal activity level of 20,000 units per year is:' Direct materialse Direct labore Variable manufacturing overheade Fixed manufacturing overhead' $6.25. $7.05. $3.10. S4.70e Variable selling and administrative expenseS1.90e Fixed selling and administrative expensee $3.20e The normal selling price is $28.00 per unit. The compam/s city is 30,000 units per year. An order has been received from a mail-order house for 4,000 units at a speeal price of $20.00 per unit. This order would not affect regular sales or the compam/s total fixed costs. a. Calculate the financial advantage (disadvantage) of accepting the special order.v b. Based on your answerto part a, and assuming all else equal, should yr.ygaccept this special order? Briefly explain why or why not.v Question 2 make or buy decision: All I'm Saying Corporation makes 45,000 units per year of a part (smart phone screens) it uses in the products it manufactures (smart phones). The unit product cost of this part is computed as follows: Direct materials' Direct labore $10.95 Variable manufacturing overhead 6.80 Fixed manufacturing overheade 12.00 unit product cost $47.75 An outside supplier has offered to sell the company all of these parts it needs for $46.00 a unit. Ifthe company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $55,000 per year.v If the part were purchased from the outside supplier, all of the variable costs, including direct labor cost of the part, would be avoided. However, $4.00 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be reallocated to the company's remaining products. What is the financial advantage / (disadvantage) of purchasing the part from the outside supplier rather than making it?'

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started