I need help on questions 2 and 3.

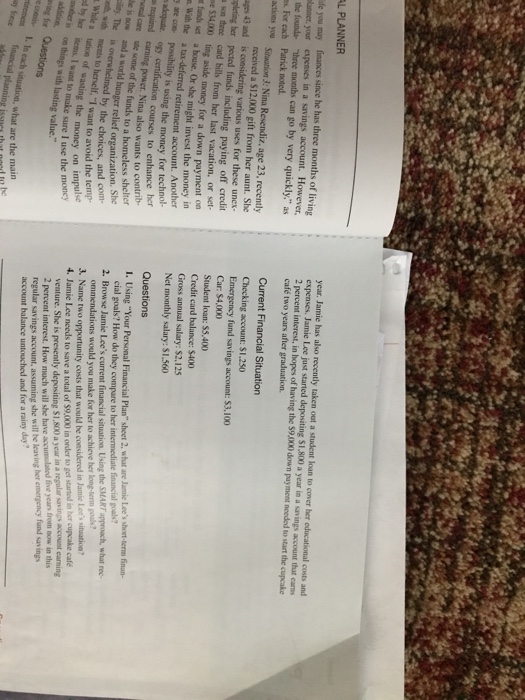

Continuing Case SETTING FINANCIAL GOALS Jamie Lee Jackson, age 24, has recently decided to switch from attending college to full-time in order to part-time pursue her business degree, and aims to graduate within the three years. She has 55 credit hours remaining in order to earn her bachelor's degree, and knows that it will be a challenge to complete her course of study while still working pat- time in the bakery department of a local grocery store, where she earns $390 a week, Jamie Lee wants to keep her part-time job at the grocery store as she loves baking and creates very decorative cakes. She dreams of opening her own cupcake caf within the next five years. Jamie Leecurrently shares a small apartment with a friend, and they split all of the associ- Jamie Lee currently shares a small apartment with a friend, and they split all of the associ- ated living expenses, such as rent and utilities, although she would really like to eventually have a place of her own. Her car is still going strong, even though it is seven years old, and she has no plans to buy a new one any time soon. She is carrying a balance on her credit card and is making regular monthly payments of $50 with hopes of paying it off within a Continuing Case SETTING FINANCIAL GOALS Jamie Lee Jackson, age 24, has recently decided to switch from attending college to full-time in order to part-time pursue her business degree, and aims to graduate within the three years. She has 55 credit hours remaining in order to earn her bachelor's degree, and knows that it will be a challenge to complete her course of study while still working pat- time in the bakery department of a local grocery store, where she earns $390 a week, Jamie Lee wants to keep her part-time job at the grocery store as she loves baking and creates very decorative cakes. She dreams of opening her own cupcake caf within the next five years. Jamie Leecurrently shares a small apartment with a friend, and they split all of the associ- Jamie Lee currently shares a small apartment with a friend, and they split all of the associ- ated living expenses, such as rent and utilities, although she would really like to eventually have a place of her own. Her car is still going strong, even though it is seven years old, and she has no plans to buy a new one any time soon. She is carrying a balance on her credit card and is making regular monthly payments of $50 with hopes of paying it off within a