Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help on requirment 4 a. b. c. d. please make sute to answer all the parts 28.44 of 50 pts 1 of 1

i need help on requirment 4

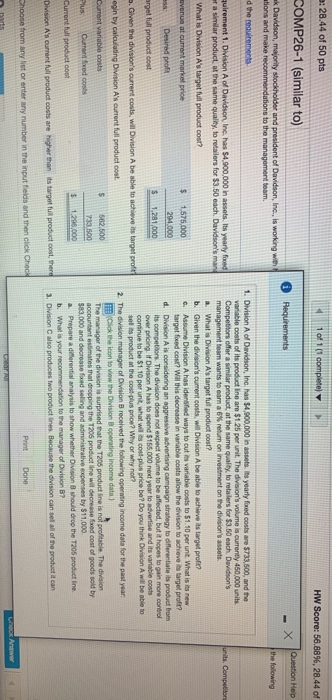

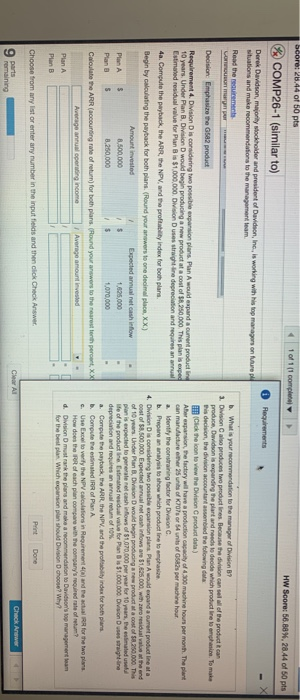

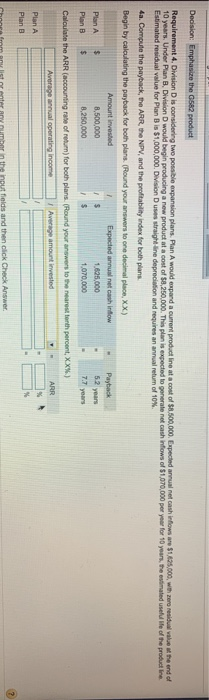

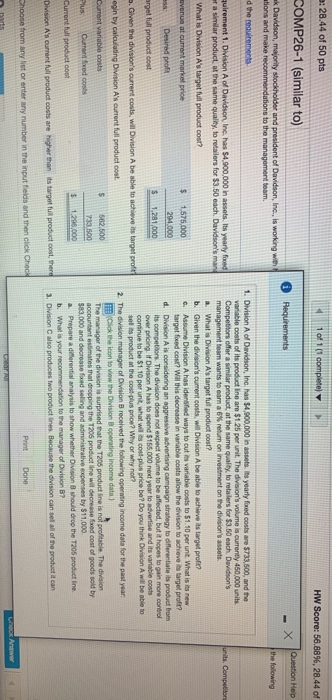

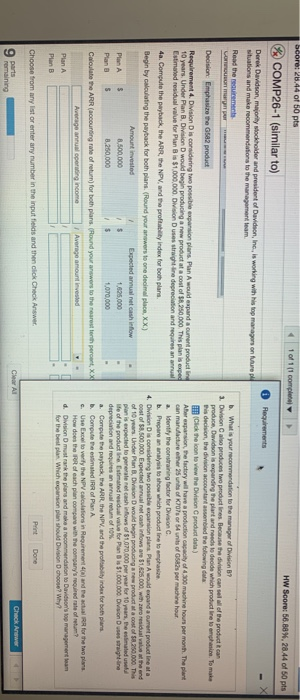

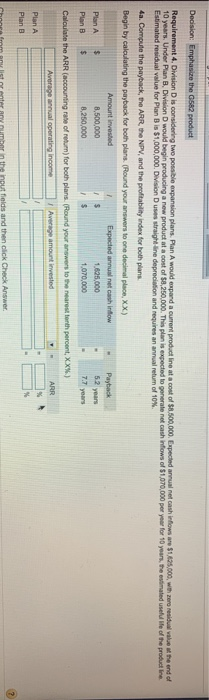

28.44 of 50 pts 1 of 1 (1 completely COMP26-1 (similar to) HW Score: 56.88%, 28.440 Requirements k Davidson, majority stockholder and president of Davidson, Inc. is working with tions and make recommendations to the management foam the following the rourements irement 1. Division of Davidson Inc. has 54.800,000 in assets. Its yearly fed a similar product at the same quality to retailers for $5.50 each. Davidson's man What is Division A's target full product out? units. Competitor vers at current mon price 1.575.000 s Desired profit arget f productos $ 1.281.000 . Given the division's current costs, wil Division A be able to achieve target profit egin by calculating Division A's current full product cost Current r epost 5 562.500 Plus Current foredo Current S2000 producto 1. Division of Davidson Inc. has $4.500.000 inase s yearly feed costs are so and the val ot of its product linear $125 peruntThe division's volume is curreny 450.000 uri Competitions offer a product at the same quality to readers for 0.50 each. D o n's management team wants to com a return on investment on the division's assets What Division A's target full product cost? b v en the division's current , Division A bere to achieve target proto A Division A hasieradwy o outr os 51.10 perunt What is now targeted cost with decrease in variable costs allow the division to achieve target profit d. Division Als considering an aggressive advertising campaign strategy to differentiate its product from its competitors. The division does not expect volume to be affected, but it hopes to gain more control Overprong Di A has to spend $155.000 next year to advertise and its anable costs connue to be 51.10 perut what will price be? Do you think Di b e se product the cost plus pros? Why wyno 2. The division manager of vision received the following operating income data for the past year Click then to view the Division operating income data) The manager of the i n surprised that the T205 product line is no profitable The division account manera dropre product wil decreased cost of goods by $3.000 and decrease feeling and administrative perses by $11,000 a. Prepare a differential analysis to show whether Division should drop the T206 product line b. What is your recommendation to the manager of Division B? 2. Division produces we products B u s ion can sea of the product it can Division A's current products are herra stargetful productos en hoose from any list of enter any number in the input felds and then click check Print Done bcore: 28.44 of 60 pts % COMP26-1 (similar to) a.

b.

c.

d.

please make sute to answer all the parts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started