I need help on the questions below PLEASE! It is my last homework assignment! It is a healthcare finance question looking at projections and answering just a couple of things. FFWCC is a made-up clinic name (Free Falling Wound Care Center. I need help with this and Thank you!

Identify 3 factors that come into play in the risk analysis that differ from income or loss and ROI in the baseline projection?

Compare Total/Expected outcomes to the baseline projection and comment on your analysis?

When the committee takes a final vote on a recommendation to TPMH would you support the baseline projection?

Do you feel the  stand-alone risk was addressed?

stand-alone risk was addressed?

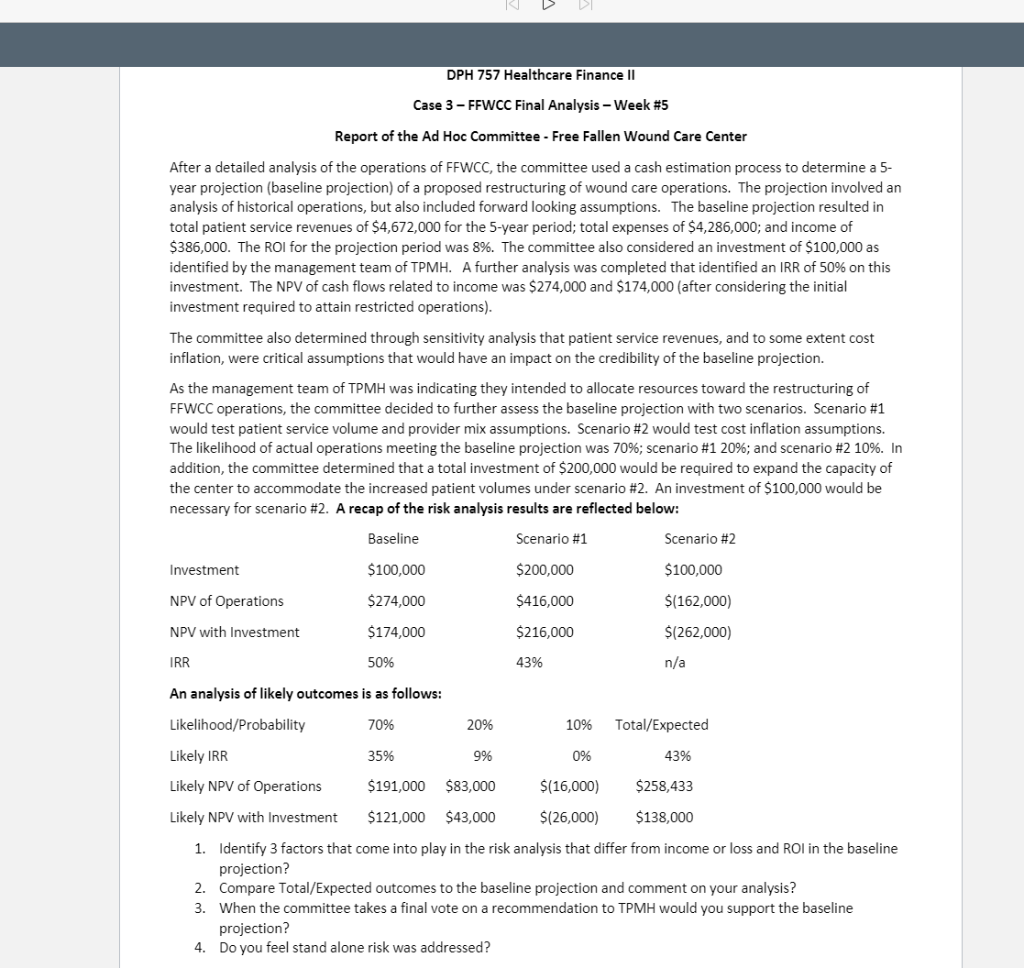

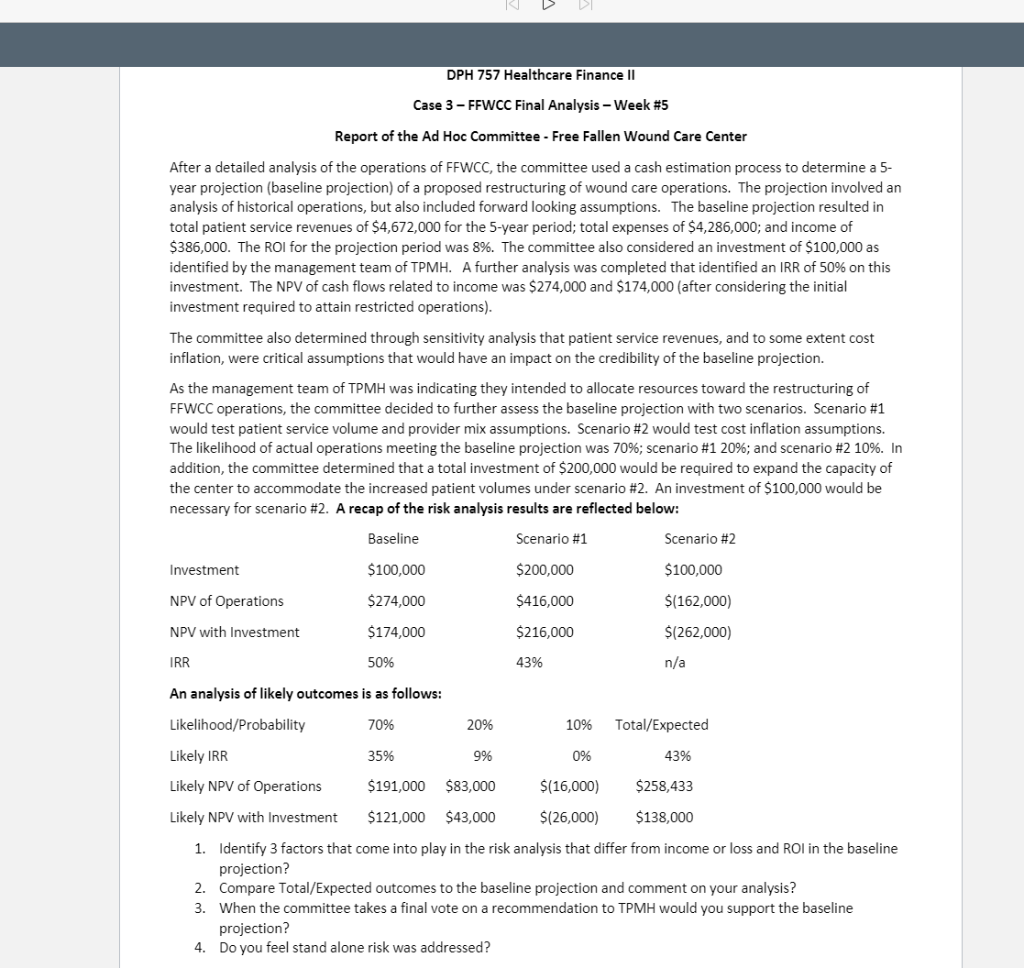

DPH 757 Healthcare Finance II Case 3 - FFWCC Final Analysis - Week #5 Report of the Ad Hoc Committee - Free Fallen Wound Care Center After a detailed analysis of the operations of FFWCC, the committee used a cash estimation process to determine a 5- year projection (baseline projection) of a proposed restructuring of wound care operations. The projection involved an analysis of historical operations, but also included forward looking assumptions. The baseline projection resulted in total patient service revenues of $4,672,000 for the 5-year period; total expenses of $4,286,000; and income of $386,000. The ROI for the projection period was 8%. The committee also considered an investment of $100,000 as identified by the management team of TPMH. A further analysis was completed that identified an IRR of 50% on this investment. The NPV of cash flows related to income was $274,000 and $174,000 (after considering the initial investment required to attain restricted operations). The committee also determined through sensitivity analysis that patient service revenues, and to some extent cost inflation, were critical assumptions that would have an impact on the credibility of the baseline projection. As the management team of TPMH was indicating they intended to allocate resources toward the restructuring of FFWCC operations, the committee decided to further assess the baseline projection with two scenarios. Scenario #1 would test patient service volume and provider mix assumptions. Scenario #2 would test cost inflation assumptions. The likelihood of actual operations meeting the baseline projection was 70%; scenario #1 20%; and scenario #2 10%. In addition, the committee determined that a total investment of $200,000 would be required to expand the capacity of the center to accommodate the increased patient volumes under scenario #2. An investment of $100,000 would be necessary for scenario #2. A recap of the risk analysis results are reflected below: Baseline Scenario #1 Scenario #2 Investment $100,000 $200,000 $100,000 NPV of Operations $274,000 $416,000 $(162,000) $174,000 $216,000 $(262,000) NPV with Investment IRR 50% 43% n/a 10% Total/Expected An analysis of likely outcomes is as follows: Likelihood/Probability 70% 20% Likely IRR 35% 9% Likely NPV of Operations $191,000 $83,000 0% 43% $(16,000) $258,433 Likely NPV with Investment $121,000 $43,000 $(26,000) $138,000 1. Identify 3 factors that come into play in the risk analysis that differ from income or loss and ROI in the baseline projection? 2. Compare Total/Expected outcomes to the baseline projection and comment on your analysis? 3. When the committee takes a final vote on a recommendation to TPMH would you support the baseline projection? 4. Do you feel stand alone risk was addressed? DPH 757 Healthcare Finance II Case 3 - FFWCC Final Analysis - Week #5 Report of the Ad Hoc Committee - Free Fallen Wound Care Center After a detailed analysis of the operations of FFWCC, the committee used a cash estimation process to determine a 5- year projection (baseline projection) of a proposed restructuring of wound care operations. The projection involved an analysis of historical operations, but also included forward looking assumptions. The baseline projection resulted in total patient service revenues of $4,672,000 for the 5-year period; total expenses of $4,286,000; and income of $386,000. The ROI for the projection period was 8%. The committee also considered an investment of $100,000 as identified by the management team of TPMH. A further analysis was completed that identified an IRR of 50% on this investment. The NPV of cash flows related to income was $274,000 and $174,000 (after considering the initial investment required to attain restricted operations). The committee also determined through sensitivity analysis that patient service revenues, and to some extent cost inflation, were critical assumptions that would have an impact on the credibility of the baseline projection. As the management team of TPMH was indicating they intended to allocate resources toward the restructuring of FFWCC operations, the committee decided to further assess the baseline projection with two scenarios. Scenario #1 would test patient service volume and provider mix assumptions. Scenario #2 would test cost inflation assumptions. The likelihood of actual operations meeting the baseline projection was 70%; scenario #1 20%; and scenario #2 10%. In addition, the committee determined that a total investment of $200,000 would be required to expand the capacity of the center to accommodate the increased patient volumes under scenario #2. An investment of $100,000 would be necessary for scenario #2. A recap of the risk analysis results are reflected below: Baseline Scenario #1 Scenario #2 Investment $100,000 $200,000 $100,000 NPV of Operations $274,000 $416,000 $(162,000) $174,000 $216,000 $(262,000) NPV with Investment IRR 50% 43% n/a 10% Total/Expected An analysis of likely outcomes is as follows: Likelihood/Probability 70% 20% Likely IRR 35% 9% Likely NPV of Operations $191,000 $83,000 0% 43% $(16,000) $258,433 Likely NPV with Investment $121,000 $43,000 $(26,000) $138,000 1. Identify 3 factors that come into play in the risk analysis that differ from income or loss and ROI in the baseline projection? 2. Compare Total/Expected outcomes to the baseline projection and comment on your analysis? 3. When the committee takes a final vote on a recommendation to TPMH would you support the baseline projection? 4. Do you feel stand alone risk was addressed

stand-alone risk was addressed?

stand-alone risk was addressed?