Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help on this problem! This picture is just for reference down here. Madden International Industries Madden International Industries has used the FIFO inventory

I need help on this problem!

This picture is just for reference down here.

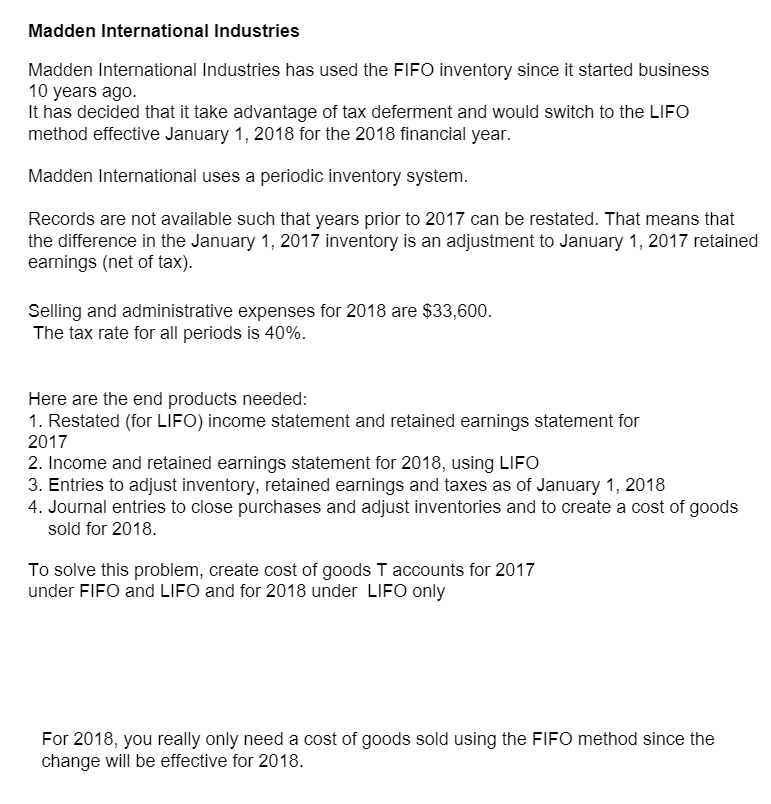

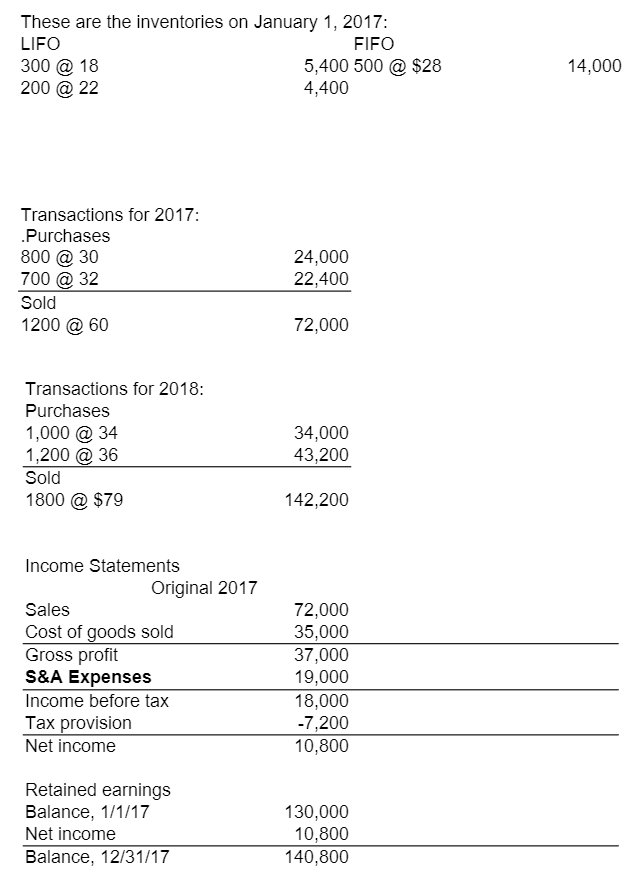

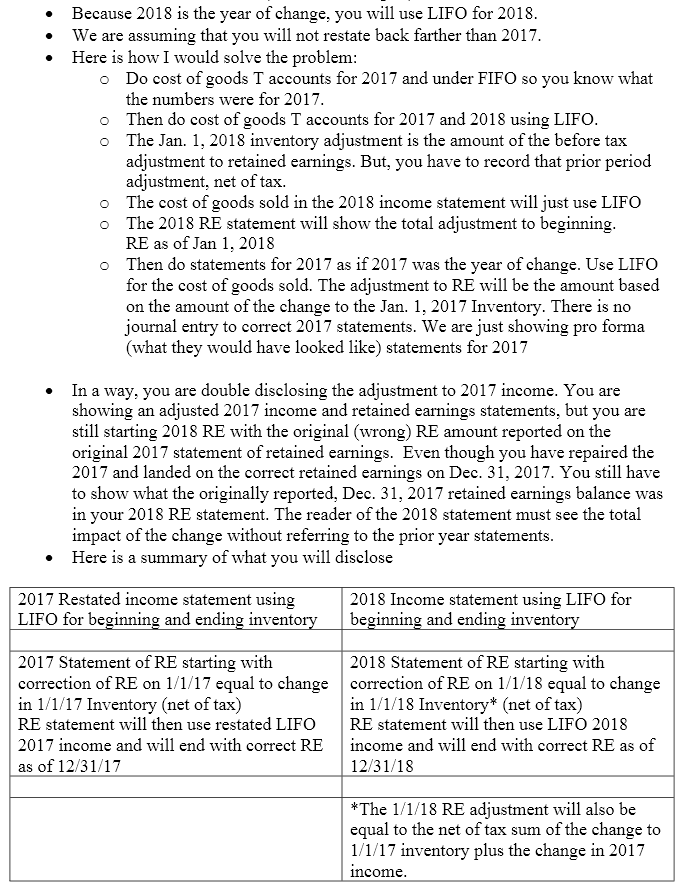

Madden International Industries Madden International Industries has used the FIFO inventory since it started business 10 years ago. It has decided that it take advantage of tax deferment and would switch to the LIFO method effective January 1, 2018 for the 2018 financial year. Madden International uses a periodic inventory system. Records are not available such that years prior to 2017 can be restated. That means that the difference in the January 1, 2017 inventory is an adjustment to January 1, 2017 retained earnings (net of tax). Selling and administrative expenses for 2018 are $33,600. The tax rate for all periods is 40%. Here are the end products needed: 1. Restated (for LIFO) income statement and retained earnings statement for 2017 2. Income and retained earnings statement for 2018, using LIFO 3. Entries to adjust inventory, retained earnings and taxes as of January 1, 2018 4. Journal entries to close purchases and adjust inventories and to create a cost of goods sold for 2018. To solve this problem, create cost of goods T accounts for 2017 under FIFO and LIFO and for 2018 under LIFO only For 2018, you really only need a cost of goods sold using the FIFO method since the change will be effective for 2018. These are the inventories on January 1, 2017: LIFO FIFO 300 @ 18 5,400 500 @ $28 200 @ 22 4,400 14,000 Transactions for 2017: .Purchases 800 @30 700 @ 32 Sold 1200 @ 60 24,000 22,400 72,000 Transactions for 2018: Purchases 1,000 @ 34 1,200 @36 Sold 1800 @ $79 34,000 43,200 142,200 Income Statements Original 2017 Sales Cost of goods sold Gross profit S&A Expenses Income before tax Tax provision Net income 72,000 35,000 37,000 19,000 18,000 -7,200 10,800 Retained earnings Balance, 1/1/17 Net income Balance, 12/31/17 130,000 10,800 140,800 . Because 2018 is the year of change, you will use LIFO for 2018. We are assuming that you will not restate back farther than 2017. Here is how I would solve the problem: o Do cost of goods T accounts for 2017 and under FIFO so you know what the numbers were for 2017. o Then do cost of goods T accounts for 2017 and 2018 using LIFO. o The Jan. 1, 2018 inventory adjustment is the amount of the before tax adjustment to retained earnings. But, you have to record that prior period adjustment, net of tax. The cost of goods sold in the 2018 income statement will just use LIFO The 2018 RE statement will show the total adjustment to beginning. RE as of Jan 1, 2018 o Then do statements for 2017 as if 2017 was the year of change. Use LIFO for the cost of goods sold. The adjustment to RE will be the amount based on the amount of the change to the Jan. 1, 2017 Inventory. There is no journal entry to correct 2017 statements. We are just showing pro forma (what they would have looked like) statements for 2017 In a way, you are double disclosing the adjustment to 2017 income. You are showing an adjusted 2017 income and retained earnings statements, but you are still starting 2018 RE with the original (wrong) RE amount reported on the original 2017 statement of retained earnings. Even though you have repaired the 2017 and landed on the correct retained earnings on Dec 31, 2017. You still have to show what the originally reported, Dec. 31, 2017 retained earnings balance wa in your 2018 RE statement. The reader of the 2018 statement must see the total impact of the change without referring to the prior year statements. Here is a summary of what you will disclose was 2017 Restated income statement using LIFO for beginning and ending inventory 2018 Income statement using LIFO for beginning and ending inventory 2017 Statement of RE starting with 2018 Statement of RE starting with correction of RE on 1/1/17 equal to change correction of RE on 1/1/18 equal to change in 1/1/17 Inventory (net of tax) in 1/1/18 Inventory* (net of tax) RE statement will then use restated LIFO RE statement will then use LIFO 2018 2017 income and will end with correct RE income and will end with correct RE as of as of 12/31/17 12/31/18 *The 1/1/18 RE adjustment will also be equal to the net of tax sum of the change to 1/1/17 inventory plus the change in 2017 income. Madden International Industries Madden International Industries has used the FIFO inventory since it started business 10 years ago. It has decided that it take advantage of tax deferment and would switch to the LIFO method effective January 1, 2018 for the 2018 financial year. Madden International uses a periodic inventory system. Records are not available such that years prior to 2017 can be restated. That means that the difference in the January 1, 2017 inventory is an adjustment to January 1, 2017 retained earnings (net of tax). Selling and administrative expenses for 2018 are $33,600. The tax rate for all periods is 40%. Here are the end products needed: 1. Restated (for LIFO) income statement and retained earnings statement for 2017 2. Income and retained earnings statement for 2018, using LIFO 3. Entries to adjust inventory, retained earnings and taxes as of January 1, 2018 4. Journal entries to close purchases and adjust inventories and to create a cost of goods sold for 2018. To solve this problem, create cost of goods T accounts for 2017 under FIFO and LIFO and for 2018 under LIFO only For 2018, you really only need a cost of goods sold using the FIFO method since the change will be effective for 2018. These are the inventories on January 1, 2017: LIFO FIFO 300 @ 18 5,400 500 @ $28 200 @ 22 4,400 14,000 Transactions for 2017: .Purchases 800 @30 700 @ 32 Sold 1200 @ 60 24,000 22,400 72,000 Transactions for 2018: Purchases 1,000 @ 34 1,200 @36 Sold 1800 @ $79 34,000 43,200 142,200 Income Statements Original 2017 Sales Cost of goods sold Gross profit S&A Expenses Income before tax Tax provision Net income 72,000 35,000 37,000 19,000 18,000 -7,200 10,800 Retained earnings Balance, 1/1/17 Net income Balance, 12/31/17 130,000 10,800 140,800 . Because 2018 is the year of change, you will use LIFO for 2018. We are assuming that you will not restate back farther than 2017. Here is how I would solve the problem: o Do cost of goods T accounts for 2017 and under FIFO so you know what the numbers were for 2017. o Then do cost of goods T accounts for 2017 and 2018 using LIFO. o The Jan. 1, 2018 inventory adjustment is the amount of the before tax adjustment to retained earnings. But, you have to record that prior period adjustment, net of tax. The cost of goods sold in the 2018 income statement will just use LIFO The 2018 RE statement will show the total adjustment to beginning. RE as of Jan 1, 2018 o Then do statements for 2017 as if 2017 was the year of change. Use LIFO for the cost of goods sold. The adjustment to RE will be the amount based on the amount of the change to the Jan. 1, 2017 Inventory. There is no journal entry to correct 2017 statements. We are just showing pro forma (what they would have looked like) statements for 2017 In a way, you are double disclosing the adjustment to 2017 income. You are showing an adjusted 2017 income and retained earnings statements, but you are still starting 2018 RE with the original (wrong) RE amount reported on the original 2017 statement of retained earnings. Even though you have repaired the 2017 and landed on the correct retained earnings on Dec 31, 2017. You still have to show what the originally reported, Dec. 31, 2017 retained earnings balance wa in your 2018 RE statement. The reader of the 2018 statement must see the total impact of the change without referring to the prior year statements. Here is a summary of what you will disclose was 2017 Restated income statement using LIFO for beginning and ending inventory 2018 Income statement using LIFO for beginning and ending inventory 2017 Statement of RE starting with 2018 Statement of RE starting with correction of RE on 1/1/17 equal to change correction of RE on 1/1/18 equal to change in 1/1/17 Inventory (net of tax) in 1/1/18 Inventory* (net of tax) RE statement will then use restated LIFO RE statement will then use LIFO 2018 2017 income and will end with correct RE income and will end with correct RE as of as of 12/31/17 12/31/18 *The 1/1/18 RE adjustment will also be equal to the net of tax sum of the change to 1/1/17 inventory plus the change in 2017 income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started