Question

I need help on this specific accounting question relating to budgets. Can you please show your calculations for the problem involved? I need to learn

I need help on this specific accounting question relating to budgets. Can you please show your calculations for the problem involved? I need to learn how to do this but I am stuck. Need to know if I am doing this correctly..

I don't get your comment, NA? Can you please tell me what i need to update because all of the information is given, its kind of unprofessional to not answer the question and not state why. You chegg workers do this all the time when you don't want to answer the question (no offense) but if i can work 40hrs a week you should be able to complete an accounting problem you're tutoring for...

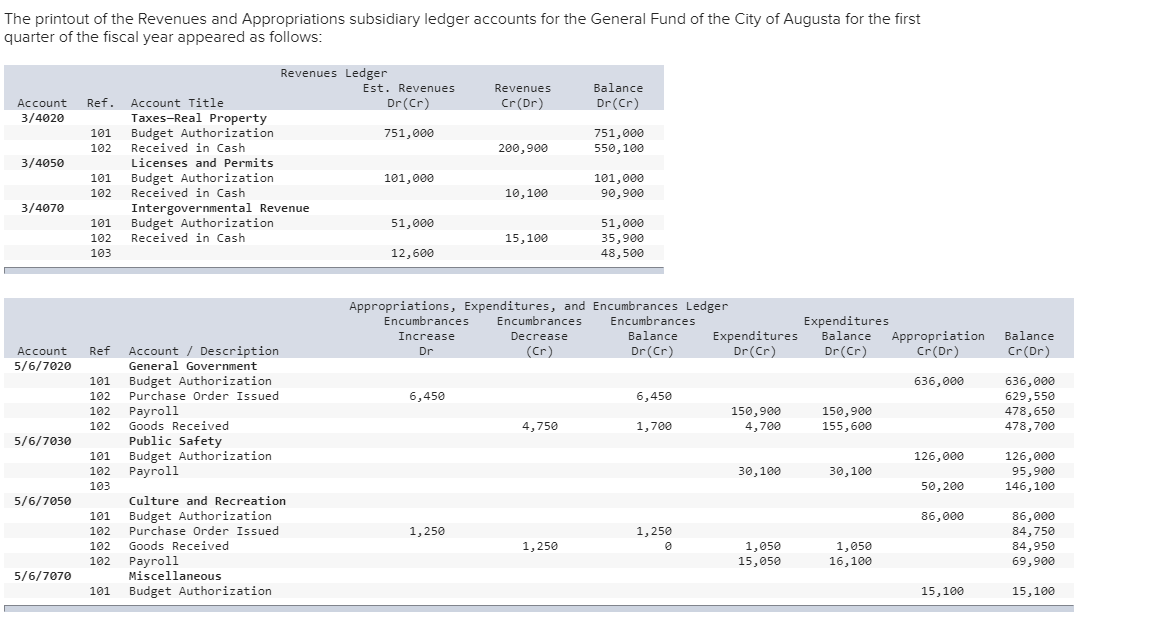

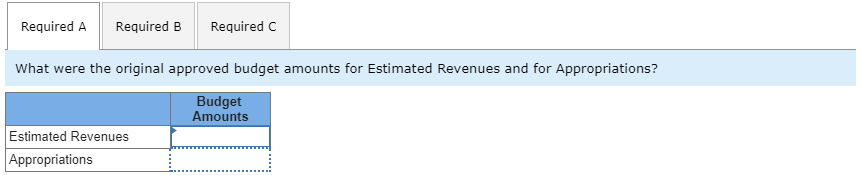

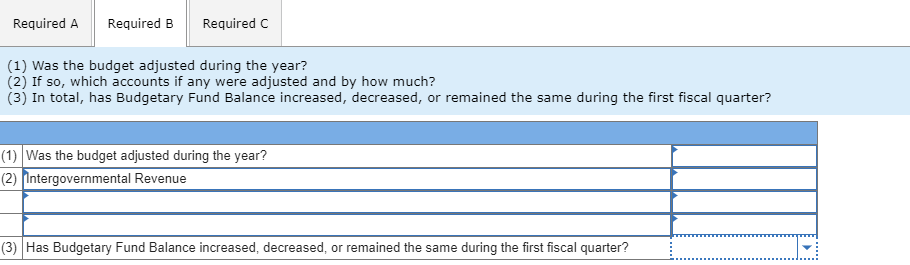

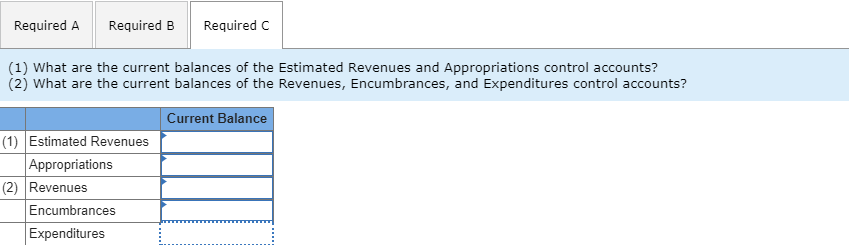

The printout of the Revenues and Appropriations subsidiary ledger accounts for the General Fund of the City of Augusta for the first quarter of the fiscal year appeared as follows: Revenues Cr(Dr) Balance Dr(Cr) 751,000 550, 100 200,900 Revenues Ledger Est. Revenues Account Ref. Account Title Dr(Cr) 3/4020 Taxes-Real Property 101 Budget Authorization Budget Author 751,000 102 Received in Cash 3/4050 Licenses and Permits 101 Budget Authorization 101,000 Received in Cash 3/4070 Intergovernmental Revenue 101 Budget Authorization 51,000 102 Received in Cash 103 12,600 101,000 90,900 102 Re 10,100 15,100 15,100 51,000 35,900 48,500 31,90 Appropriations, Expenditures, and Encumbrances Ledger Encumbrances Encumbrances Encumbrances Expenditures Increase Decrease Balance Expenditures Balance Appropriation (Cr) Dr(Cr) Dr(Cr). Dr(Cr) Cr(Dr) Account 5/6/7020 Ref Balance Cr(Dr) 636,000 6,450 101 102 102 102 Account / Description General Government Budget Authorization Purchase Order Issued Payroll Goods Received Public Safety Budget Authorization Payroll 6,450 1,700 636,000 629,550 478,650 478,700 4,750 150,900 4,700 150,900 155,600 5/6/7030 126,000 101 102 103 30,100 30,100 126,000 95,900 146, 100 50,200 5/6/7050 86,000 101 102 102 102 1,250 1,250 Culture and Recreation Budget Authorization Purchase Order Issued Goods Received Payroll Miscellaneous Budget Authorization 1,250 1,050 15,050 86,000 84,750 84,950 69,900 1,050 16,100 5/6/7070 101 15,100 15,100 Required A Required B Required C What were the original approved budget amounts for Estimated Revenues and for Appropriations? Budget Amounts Estimated Revenues Appropriations Required A Required B Required C (1) Was the budget adjusted during the year? (2) If so, which accounts if any were adjusted and by how much? (3) In total, has Budgetary Fund Balance increased, decreased, or remained the same during the first fiscal quarter? (1) Was the budget adjusted during the year? (2) Intergovernmental Revenue (3) Has Budgetary Fund Balance increased, decreased, or remained the same during the first fiscal quarter? Required A Required B Required C (1) What are the current balances of the Estimated Revenues and Appropriations control accounts? (2) What are the current balances of the Revenues, Encumbrances, and Expenditures control accounts? Current Balance (1) Estimated Revenues Appropriations (2) Revenues Encumbrances ExpendituresStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started