I need help on those I made a mistake! Thank you so much!

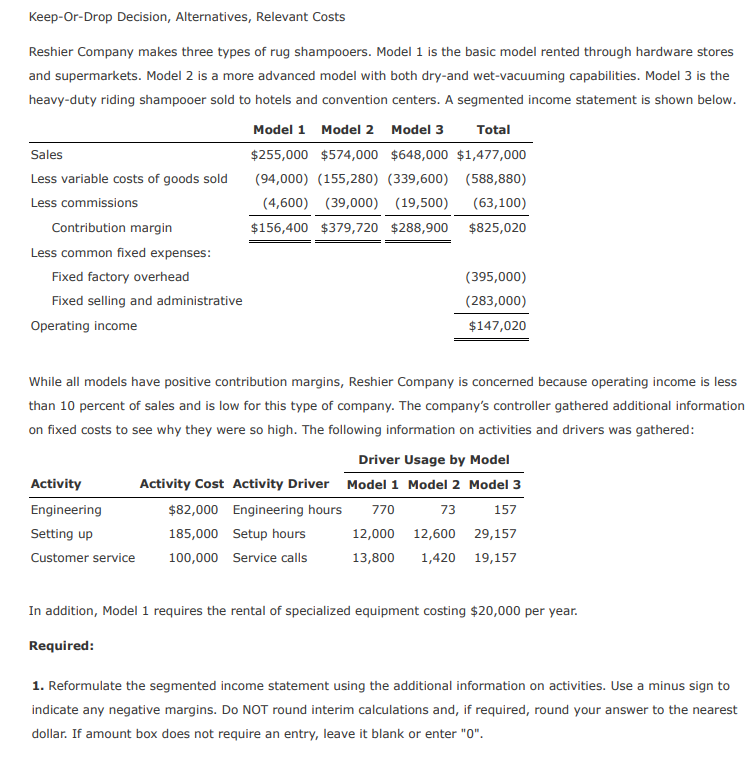

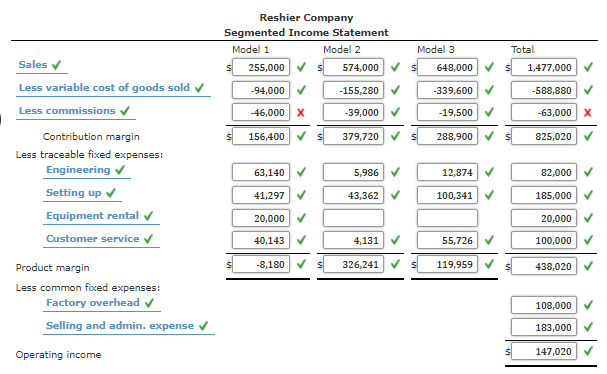

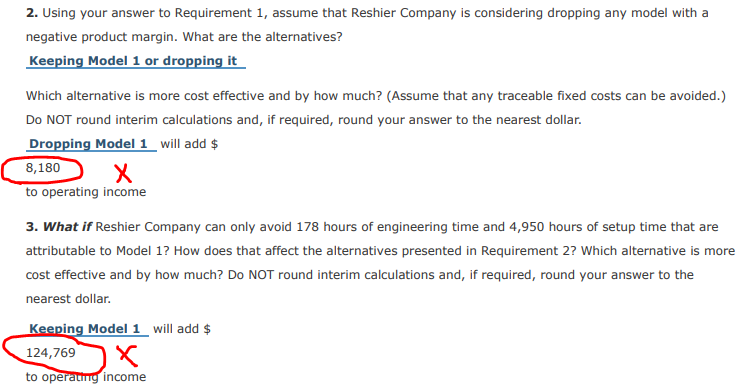

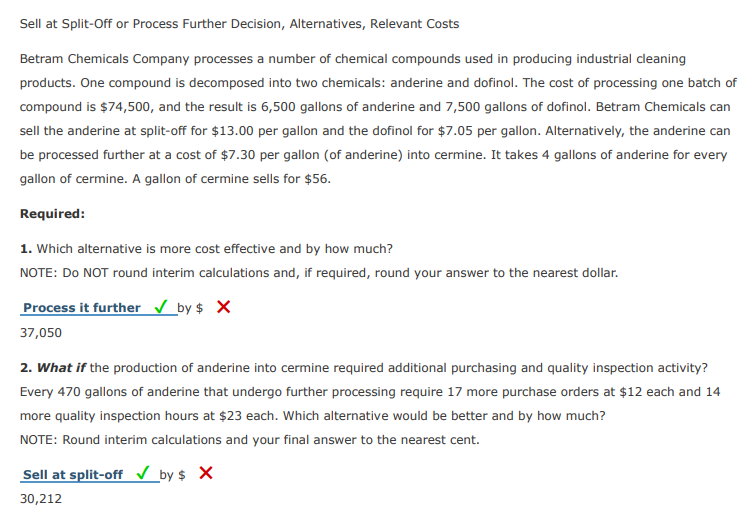

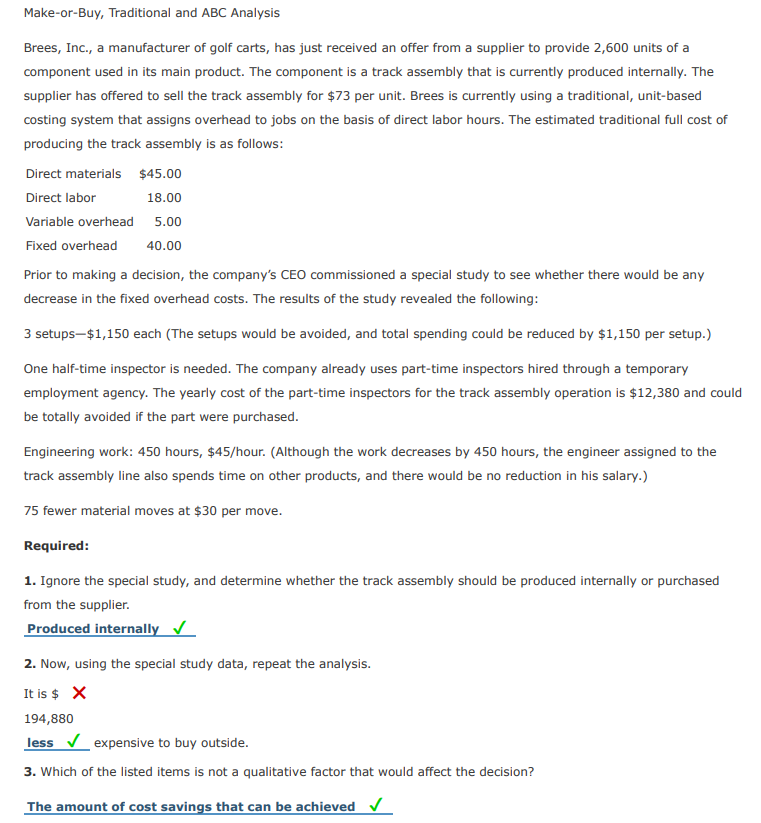

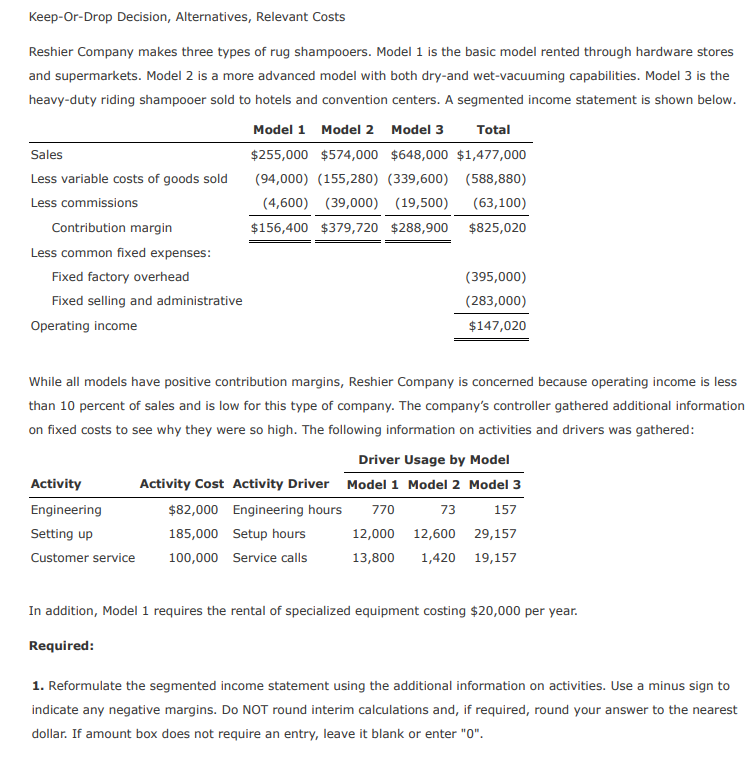

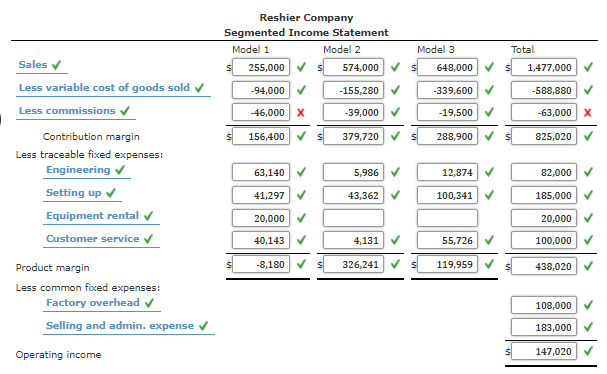

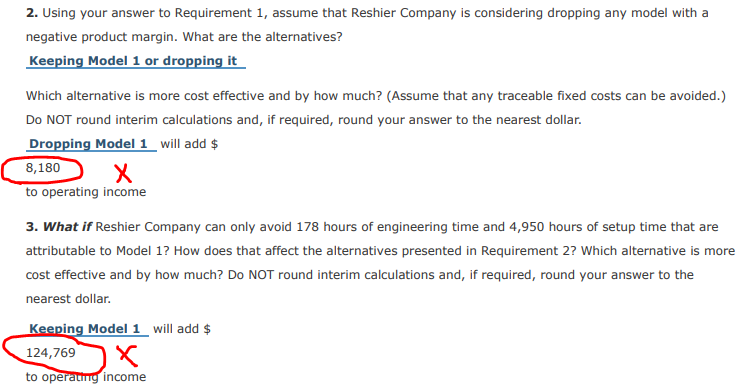

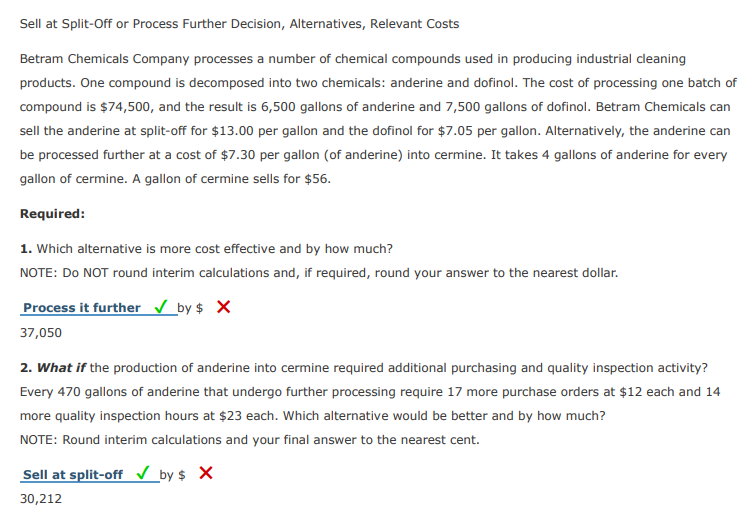

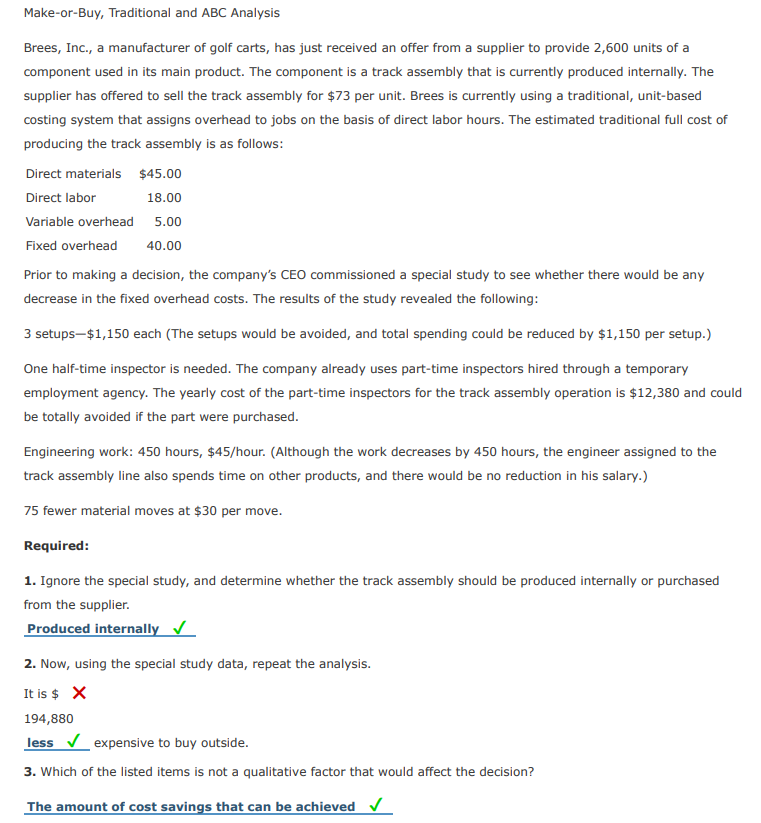

Keep-Or-Drop Decision, Alternatives, Relevant Costs Reshier Company makes three types of rug shampooers. Model 1 is the basic model rented through hardware stores and supermarkets. Model 2 is a more advanced model with both dry-and wet-vacuuming capabilities. Model 3 is the heavy-duty riding shampooer sold to hotels and convention centers. A segmented income statement is shown below. Model 1 Model 2 Model 3 Total Sales $255,000 $574,000 $648,000 $1,477,000 Less variable costs of goods sold (94,000) (155,280) (339,600) (588,880) Less commissions (4,600) (39,000) (19,500) (63,100) Contribution margin $156,400 $379,720 $288,900 $825,020 Less common fixed expenses: Fixed factory overhead (395,000) Fixed selling and administrative (283,000) Operating income $147,020 While all models have positive contribution margins, Reshier Company is concerned because operating income is less than 10 percent of sales and is low for this type of company. The company's controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was gathered: Driver Usage by Model Activity Activity Cost Activity Driver Model 1 Model 2 Model 3 Engineering $82,000 Engineering hours 73 Setting up 185,000 Setup hours 12,000 12,600 29,157 Customer service 100,000 Service calls 13,800 1,420 19,157 770 157 In addition, Model 1 requires the rental of specialized equipment costing $20,000 per year. Required: 1. Reformulate the segmented income statement using the additional information on activities. Use a minus sign to indicate any negative margins. Do NOT round interim calculations and, if required, round your answer to the nearest dollar. If amount box does not require an entry, leave it blank or enter "0". Reshier Company Segmented Income Statement Model 1 Model 2 255,000 574,000 Sales Model 3 648,000 Total 1,477,000 -94,000 - 155,280 -339,600 -588,880 -46,000 X -39,000 -19,500 -63,000 X 156,400 $ 379,720 S 288,900 825,020 Less variable cost of goods sold Less commissions Contribution margin Less traceable fixed expenses: Engineering Setting up Equipment rental Customer service 63,140 5,986 12,874 82,000 41,297 43,362 100,341 185,000 20,000 20,000 40,143 4, 131 55,726 100,000 -8,180 326,241 119,959 438,020 Product margin Less common fixed expenses: Factory overhead Selling and admin. expense 108,000 183,000 Operating income 147,020 2. Using your answer to Requirement 1, assume that Reshier Company is considering dropping any model with a negative product margin. What are the alternatives? Keeping Model 1 or dropping it Which alternative is more cost effective and by how much? (Assume that any traceable fixed costs can be avoided.) Do NOT round interim calculations and, if required, round your answer to the nearest dollar. Dropping Model 1 will add $ 8,180 X to operating income 3. What if Reshier Company can only avoid 178 hours of engineering time and 4,950 hours of setup time that are attributable to Model 1? How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much? Do NOT round interim calculations and, if required, round your answer to the nearest dollar Keeping Model 1 will add $ 124,769 X to operatmg income Sell at Split-Off or Process Further Decision, Alternatives, Relevant Costs Betram Chemicals Company processes a number of chemical compounds used in producing industrial cleaning products. One compound is decomposed into two chemicals: anderine and dofinol. The cost of processing one batch of compound is $74,500, and the result is 6,500 gallons of anderine and 7,500 gallons of dofinol. Betram Chemicals can sell the anderine at split-off for $13.00 per gallon and the dofinol for $7.05 per gallon. Alternatively, the anderine can be processed further at a cost of $7.30 per gallon (of anderine) into cermine. It takes 4 gallons of anderine for every gallon of cermine. A gallon of cermine sells for $56. Required: 1. Which alternative is more cost effective and by how much? NOTE: Do NOT round interim calculations and, if required, round your answer to the nearest dollar. Process it further _by $ x 37,050 2. What if the production of anderine into cermine required additional purchasing and quality inspection activity? Every 470 gallons of anderine that undergo further processing require 17 more purchase orders at $12 each and 14 more quality inspection hours at $23 each. Which alternative would be better and by how much? NOTE: Round interim calculations and your final answer to the nearest cent. Sell at split-off _by $ X 30,212 Make-or-Buy, Traditional and ABC Analysis Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for $73 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Direct materials $45.00 Direct labor 18.00 Variable overhead Fixed overhead 40.00 Prior to making a decision, the company's CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 5.00 3 setups-$1,150 each (The setups would be avoided, and total spending could be reduced by $1,150 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is $12,380 and could be totally avoided if the part were purchased. Engineering work: 450 hours, $45/hour. (Although the work decreases by 450 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at $30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. Produced internally 2. Now, using the special study data, repeat the analysis. It is $ X 194,880 less expensive to buy outside. 3. Which of the listed items is not a qualitative factor that would affect the decision? The amount of cost savings that can be achieved Keep-Or-Drop Decision, Alternatives, Relevant Costs Reshier Company makes three types of rug shampooers. Model 1 is the basic model rented through hardware stores and supermarkets. Model 2 is a more advanced model with both dry-and wet-vacuuming capabilities. Model 3 is the heavy-duty riding shampooer sold to hotels and convention centers. A segmented income statement is shown below. Model 1 Model 2 Model 3 Total Sales $255,000 $574,000 $648,000 $1,477,000 Less variable costs of goods sold (94,000) (155,280) (339,600) (588,880) Less commissions (4,600) (39,000) (19,500) (63,100) Contribution margin $156,400 $379,720 $288,900 $825,020 Less common fixed expenses: Fixed factory overhead (395,000) Fixed selling and administrative (283,000) Operating income $147,020 While all models have positive contribution margins, Reshier Company is concerned because operating income is less than 10 percent of sales and is low for this type of company. The company's controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was gathered: Driver Usage by Model Activity Activity Cost Activity Driver Model 1 Model 2 Model 3 Engineering $82,000 Engineering hours 73 Setting up 185,000 Setup hours 12,000 12,600 29,157 Customer service 100,000 Service calls 13,800 1,420 19,157 770 157 In addition, Model 1 requires the rental of specialized equipment costing $20,000 per year. Required: 1. Reformulate the segmented income statement using the additional information on activities. Use a minus sign to indicate any negative margins. Do NOT round interim calculations and, if required, round your answer to the nearest dollar. If amount box does not require an entry, leave it blank or enter "0". Reshier Company Segmented Income Statement Model 1 Model 2 255,000 574,000 Sales Model 3 648,000 Total 1,477,000 -94,000 - 155,280 -339,600 -588,880 -46,000 X -39,000 -19,500 -63,000 X 156,400 $ 379,720 S 288,900 825,020 Less variable cost of goods sold Less commissions Contribution margin Less traceable fixed expenses: Engineering Setting up Equipment rental Customer service 63,140 5,986 12,874 82,000 41,297 43,362 100,341 185,000 20,000 20,000 40,143 4, 131 55,726 100,000 -8,180 326,241 119,959 438,020 Product margin Less common fixed expenses: Factory overhead Selling and admin. expense 108,000 183,000 Operating income 147,020 2. Using your answer to Requirement 1, assume that Reshier Company is considering dropping any model with a negative product margin. What are the alternatives? Keeping Model 1 or dropping it Which alternative is more cost effective and by how much? (Assume that any traceable fixed costs can be avoided.) Do NOT round interim calculations and, if required, round your answer to the nearest dollar. Dropping Model 1 will add $ 8,180 X to operating income 3. What if Reshier Company can only avoid 178 hours of engineering time and 4,950 hours of setup time that are attributable to Model 1? How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much? Do NOT round interim calculations and, if required, round your answer to the nearest dollar Keeping Model 1 will add $ 124,769 X to operatmg income Sell at Split-Off or Process Further Decision, Alternatives, Relevant Costs Betram Chemicals Company processes a number of chemical compounds used in producing industrial cleaning products. One compound is decomposed into two chemicals: anderine and dofinol. The cost of processing one batch of compound is $74,500, and the result is 6,500 gallons of anderine and 7,500 gallons of dofinol. Betram Chemicals can sell the anderine at split-off for $13.00 per gallon and the dofinol for $7.05 per gallon. Alternatively, the anderine can be processed further at a cost of $7.30 per gallon (of anderine) into cermine. It takes 4 gallons of anderine for every gallon of cermine. A gallon of cermine sells for $56. Required: 1. Which alternative is more cost effective and by how much? NOTE: Do NOT round interim calculations and, if required, round your answer to the nearest dollar. Process it further _by $ x 37,050 2. What if the production of anderine into cermine required additional purchasing and quality inspection activity? Every 470 gallons of anderine that undergo further processing require 17 more purchase orders at $12 each and 14 more quality inspection hours at $23 each. Which alternative would be better and by how much? NOTE: Round interim calculations and your final answer to the nearest cent. Sell at split-off _by $ X 30,212 Make-or-Buy, Traditional and ABC Analysis Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for $73 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Direct materials $45.00 Direct labor 18.00 Variable overhead Fixed overhead 40.00 Prior to making a decision, the company's CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 5.00 3 setups-$1,150 each (The setups would be avoided, and total spending could be reduced by $1,150 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is $12,380 and could be totally avoided if the part were purchased. Engineering work: 450 hours, $45/hour. (Although the work decreases by 450 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at $30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. Produced internally 2. Now, using the special study data, repeat the analysis. It is $ X 194,880 less expensive to buy outside. 3. Which of the listed items is not a qualitative factor that would affect the decision? The amount of cost savings that can be achieved