I need help on where I left blank thats it.

I need help on where I left blank thats it.

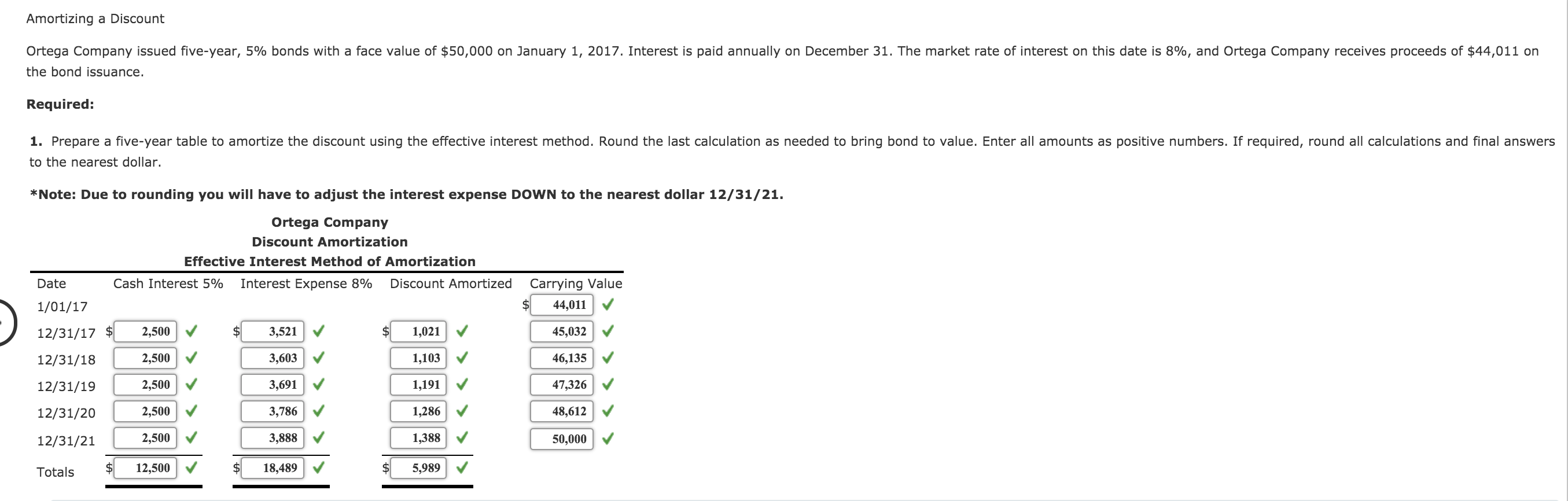

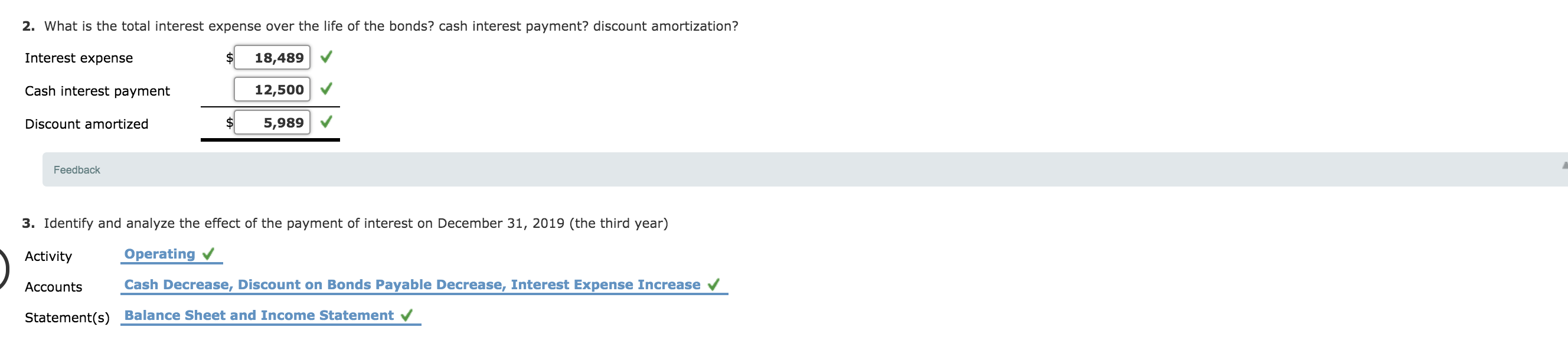

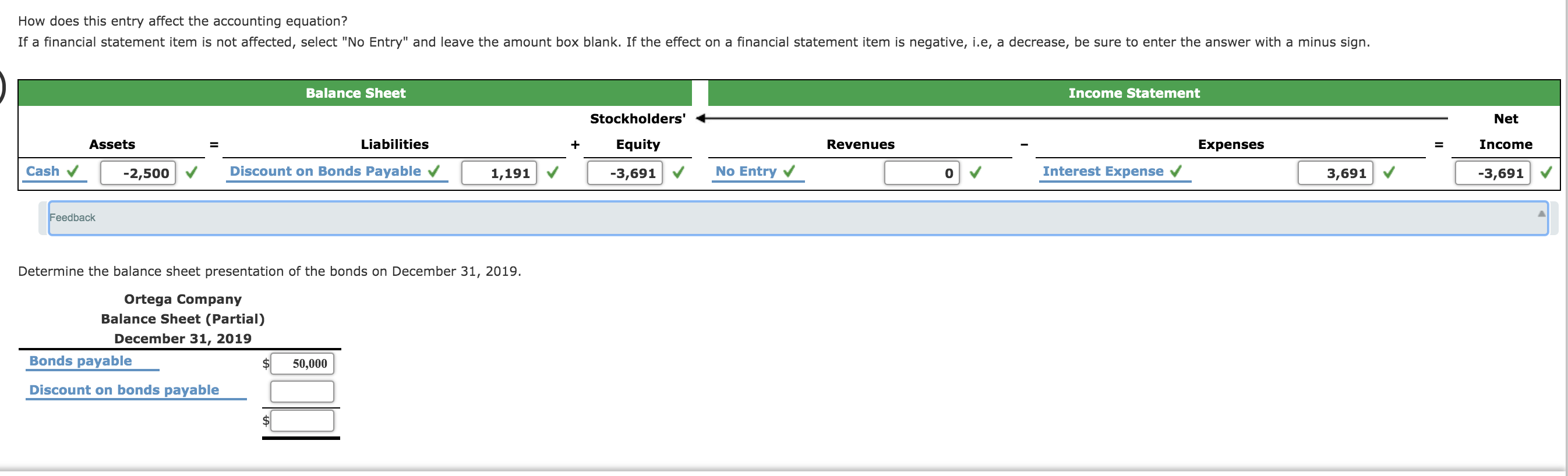

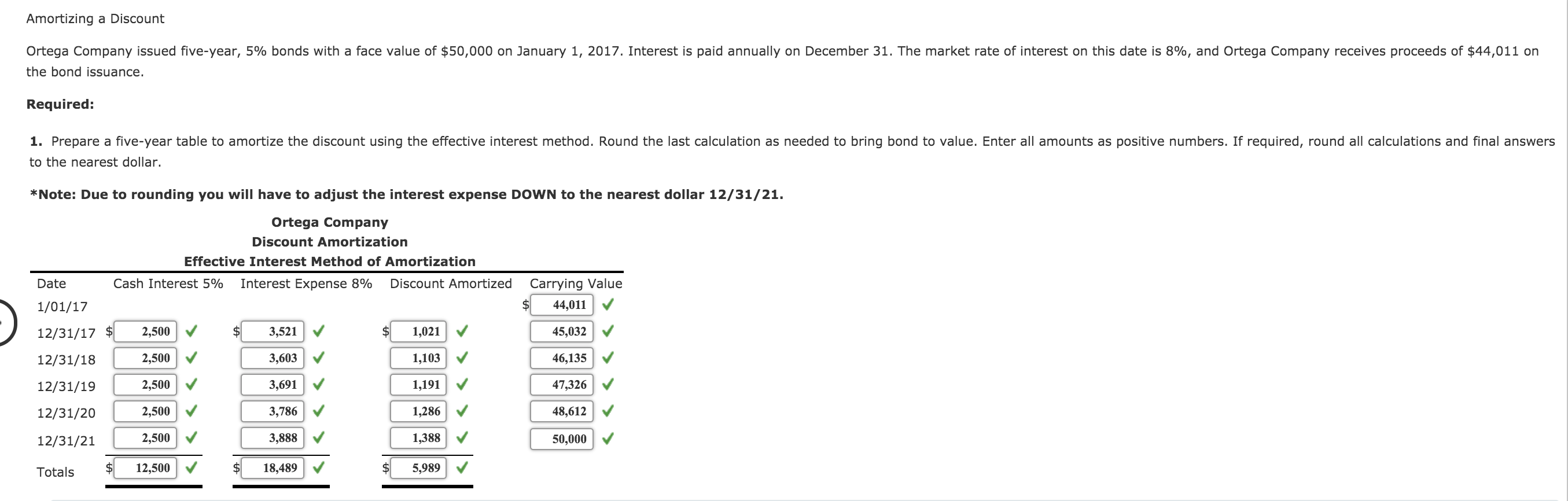

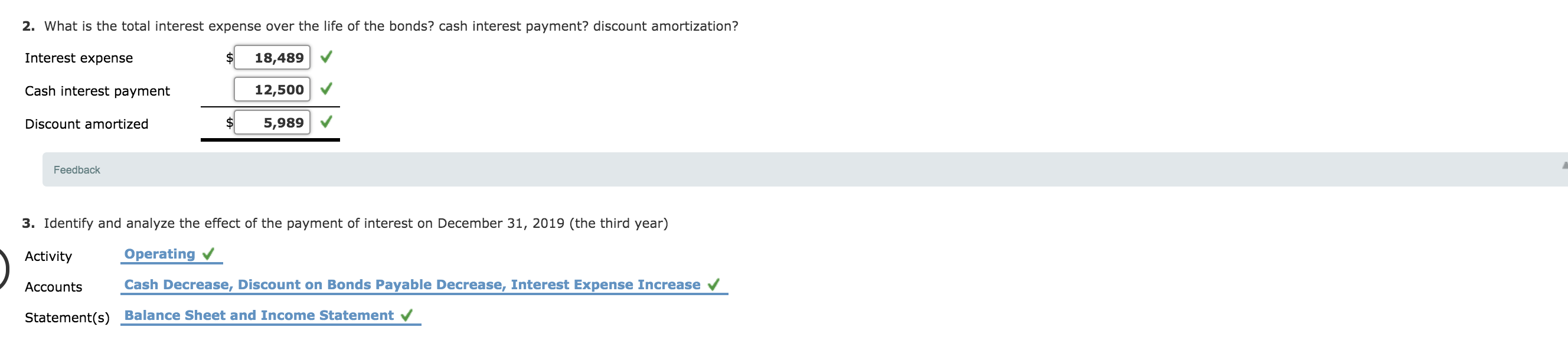

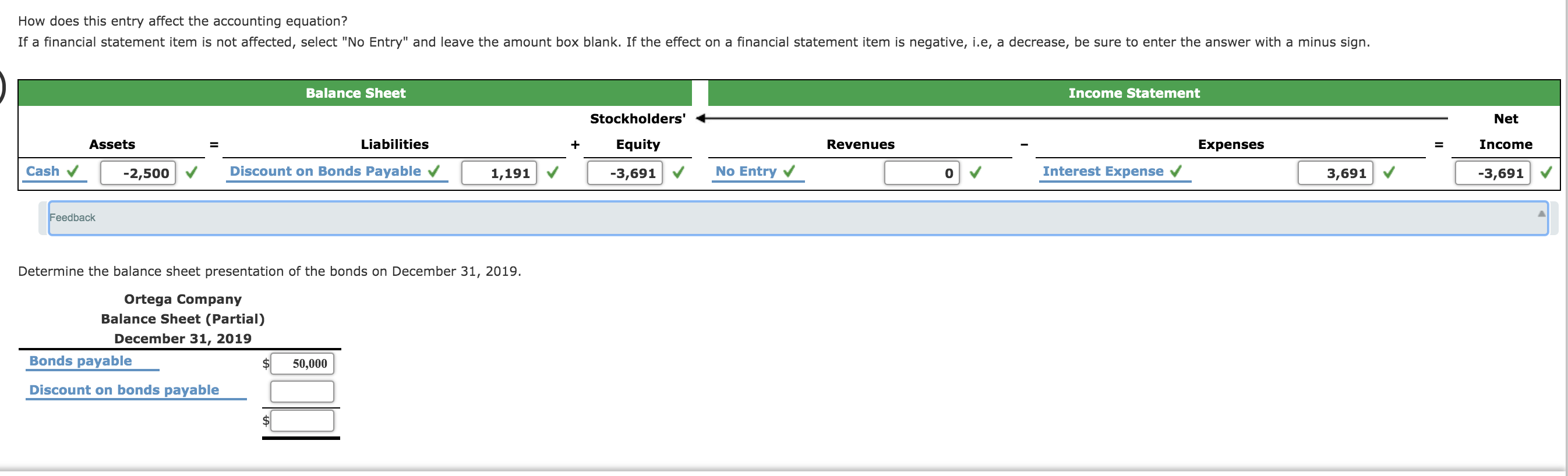

Amortizing a Discount Ortega Company issued five-year, 5% bonds with a face value of $50,000 on January 1, 2017. Interest is paid annually on December 31. The market rate of interest on this date is 8%, and Ortega Company receives proceeds of $44,011 on the bond issuance. Required: 1. Prepare a five-year table to amortize the discount using the effective interest method. Round the last calculation as needed to bring bond to value. Enter all amounts as positive numbers. If required, round all calculations and final answers to the nearest dollar. *Note: Due to rounding you will have to adjust the interest expense DOWN to the nearest dollar 12/31/21. Ortega Company Discount Amortization Effective Interest Method of Amortization Cash Interest 5% Interest Expense 8% Discount Amortized Date Carrying Value $ 44,011 1/01/17 12/31/17 $ 2,500 3,521 1,021 45,032 2,500 3,603 1,103 46,135 12/31/18 12/31/19 2,500 3,691 1,191 47,326 12/31/20 2,500 3,786 1,286 48,612 12/31/21 2,500 3,888 1,388 50,000 $ Totals 12,500 18,489 5,989 2. What is the total interest expense over the life of the bonds? cash interest payment? discount amortization? Interest expense $ 18,489 Cash interest payment 12,500 Discount amortized $ 5,989 Feedback 3. Identify and analyze the effect of the payment of interest on December 31, 2019 (the third year) Activity Operating Accounts Cash Decrease, Discount on Bonds Payable Decrease, Interest Expense Increase Statement(s) Balance Sheet and Income Statement How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Balance Sheet Income Statement Stockholders' Net Assets Liabilities + Equity Revenues Expenses Income Cash -2,500 Discount on Bonds Payable 1,191 -3,691 No Entry Interest Expense 3,691 -3,691 Feedback Determine the balance sheet presentation of the bonds on December 31, 2019. Ortega Company Balance Sheet (Partial) December 31, 2019 Bonds payable $ 50,000 Discount on bonds payable

I need help on where I left blank thats it.

I need help on where I left blank thats it.