Answered step by step

Verified Expert Solution

Question

1 Approved Answer

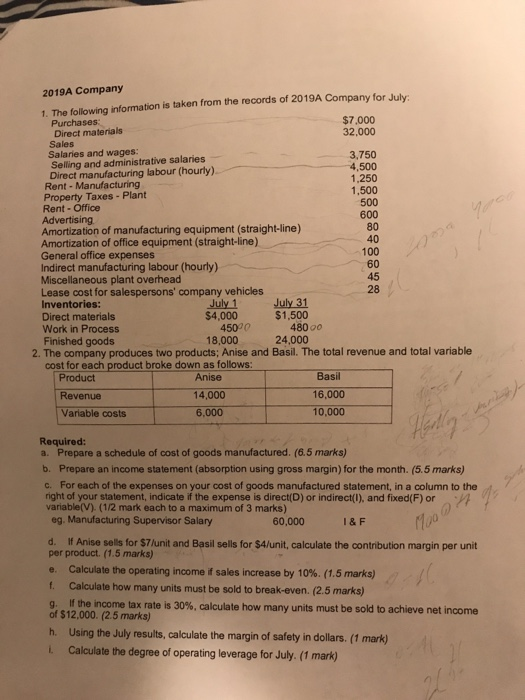

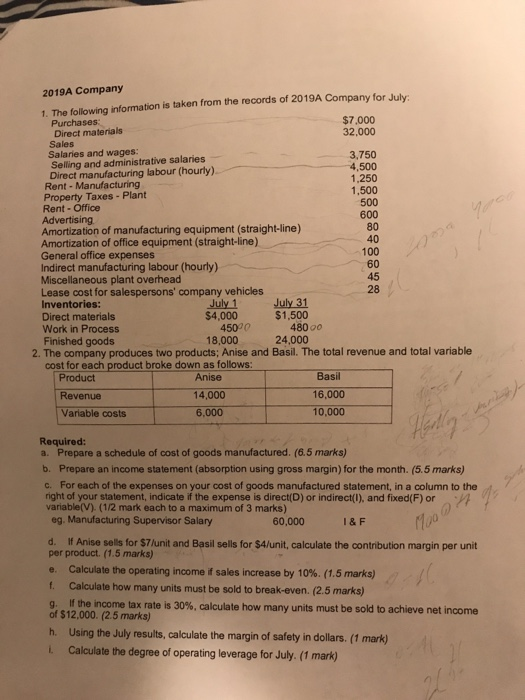

I need help part e to part I 2019A Company 1. The following information is taken from the records of 2019A Company for July: $7,000

I need help part e to part I

2019A Company 1. The following information is taken from the records of 2019A Company for July: $7,000 32,000 Direct materials Sales 3,750 4,500 1,250 1,500 500 600 80 40 100 Salaries and wages: Selling and administrative salaries Direct manufacturing labour (hourly) Rent - Manufacturing Property Taxes - Plant Rent-Office Advertising Amortization of manufacturing equipment (straight-line) Amortization of office equipment (straight-line) General office expenses Indirect manufacturing labour (hourly) Miscellaneous plant overhead Lease cost for salespersons' company vehicles Inventories: Direct materials Work in Process Finished goods 45 28 $4,000 $1,500 4500 18,000 480 00 24,000 2. The company produces two products; Anise and Basil. The total revenue and total variable cost for each product broke down as follows: Product 14,000 16,000 10,000 Revenue Variable costs 6,000 Required: a. Prepare a schedule of cost of goods manufactured. (6.5 marks) b. Prepare an income statement (absorption using gross margin) for the month. (5.5 marks) c. For each of the expenses on your cost of goods manufactured statement, in a column to the right of your statement, indicate if the expense is direct(D) or indirect(I), and fixed(F) orok variable(V). (1/2 mark each to a maximum of 3 marks) eg. Manufacturing Supervisor Salary 60,000 I& F d. If Anise sells for $7/unit and Basil sells for $4/unit, calculate the contribution margin per unit per product. (1.5 marks) e. Calculate the operating income if sales increase by 10%. (1.5 marks) f. Calculate how many units must be sold to break-even. (2.5 marks) come tax rate is 30%, calculate how many units must be sold to achieve net income of $12,000. (2.5 marks) h. Using the July results, calculate the margin of safety in dollars. (1 mark) L Calculate the degree of operating leverage for July. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started