Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help please, I can not get the answer correct. Question 2 of 2 View Policies Current Attempt in Progress On May 31, 2021,

I need help please, I can not get the answer correct.

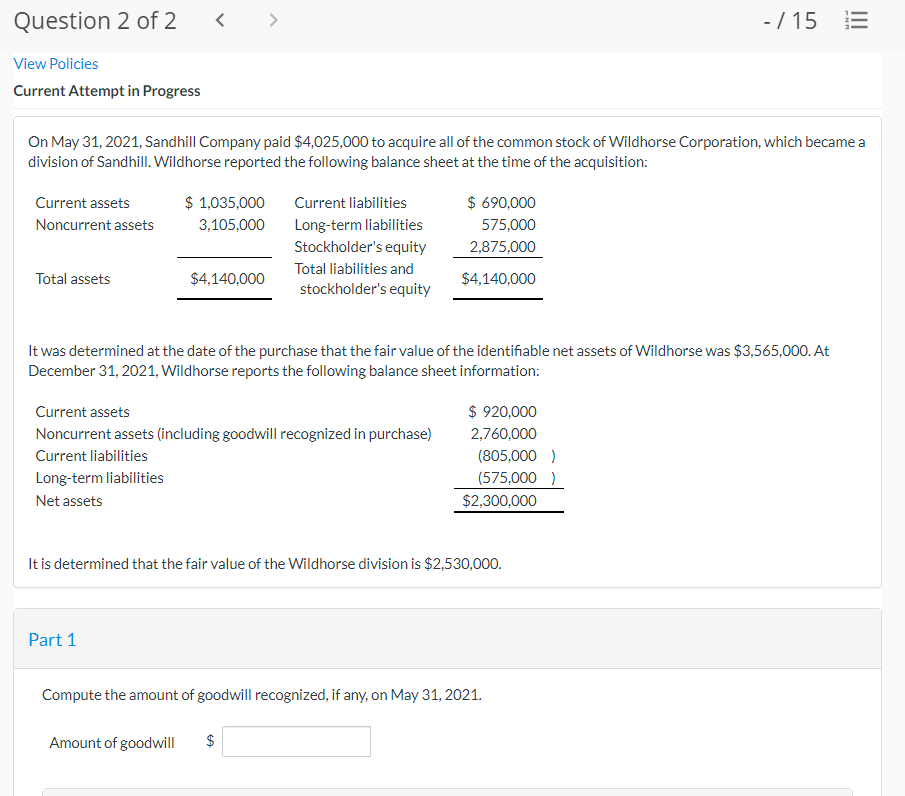

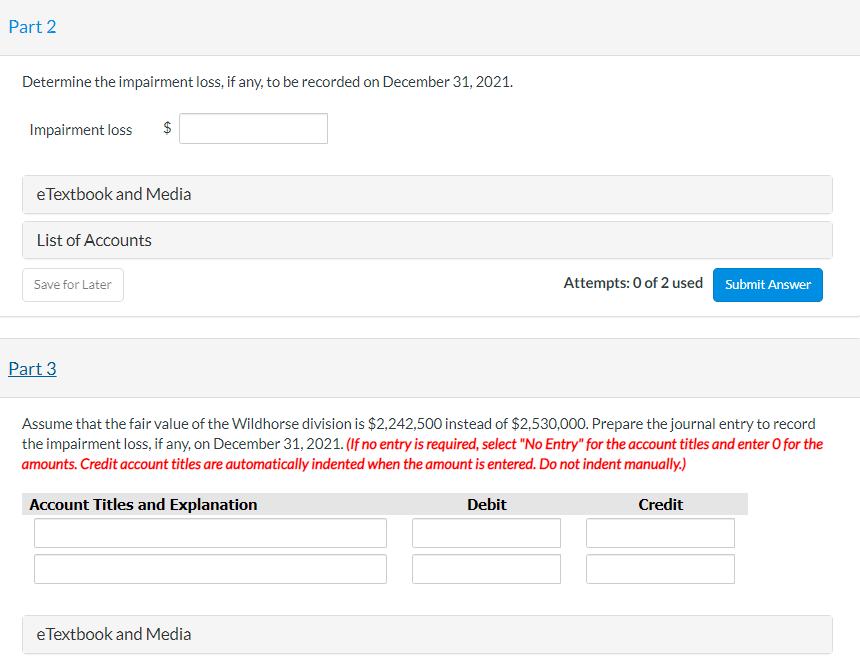

Question 2 of 2 View Policies Current Attempt in Progress On May 31, 2021, Sandhill Company paid $4,025,000 to acquire all of the common stock of Wildhorse Corporation, which became a division of Sandhill. Wildhorse reported the following balance sheet at the time of the acquisition: Current assets Noncurrent assets Total assets Current liabilities Long-term liabilities Stockholder 's equity Total liabilities and stockholder's equity $ 690,000 575,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Wildhorse was $3,565,000. At December 31, 2021, Wildhorse reports the following balance sheet information: Current assets Noncurrent assets (including goodwill recognized in purchase) Current liabilities Long-term liabilities Net assets $ 920,000 (805,000 ) (575,000 It is determined that the fair value of the Wildhorse division is $2,530,000. Part 1 Compute the amount of goodwill recognized, if any, on May 31, 2021. Amount of goodwill $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started