Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help please. I forgot the formulas for every part of the question Use the following financial statements for Lake of Egypt Marino, Inc.

I need help please.

I forgot the formulas for every part of the question

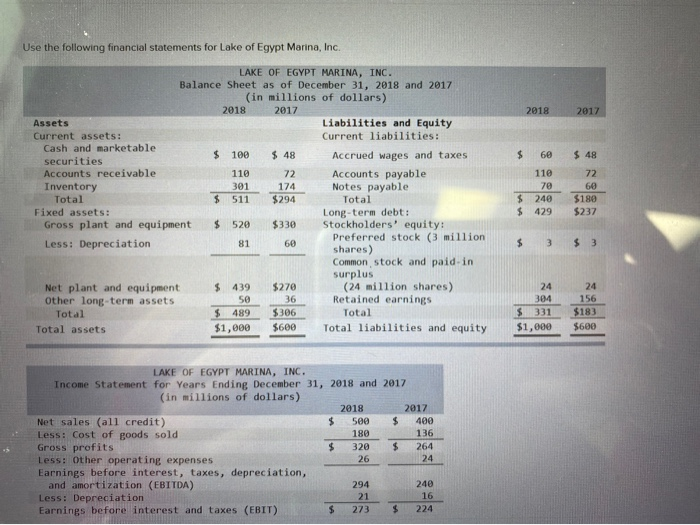

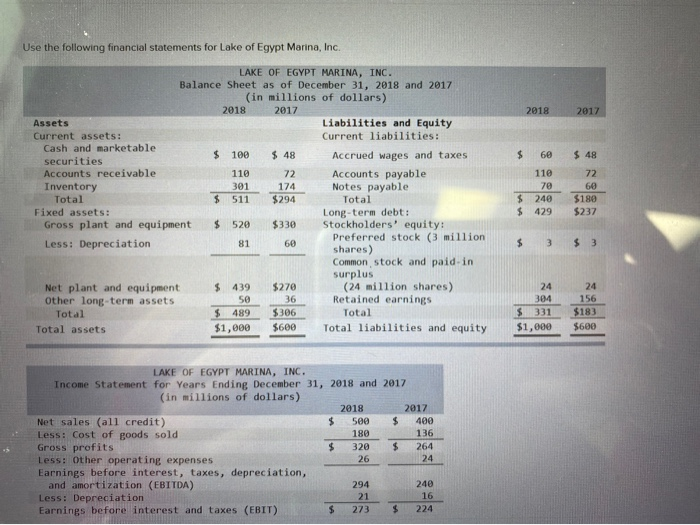

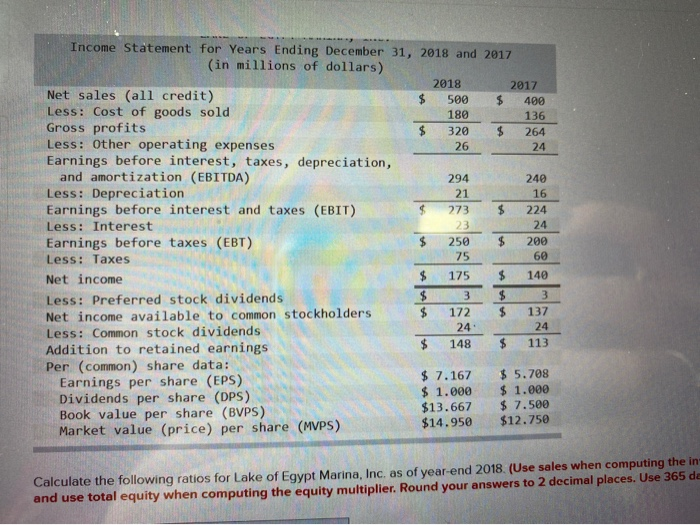

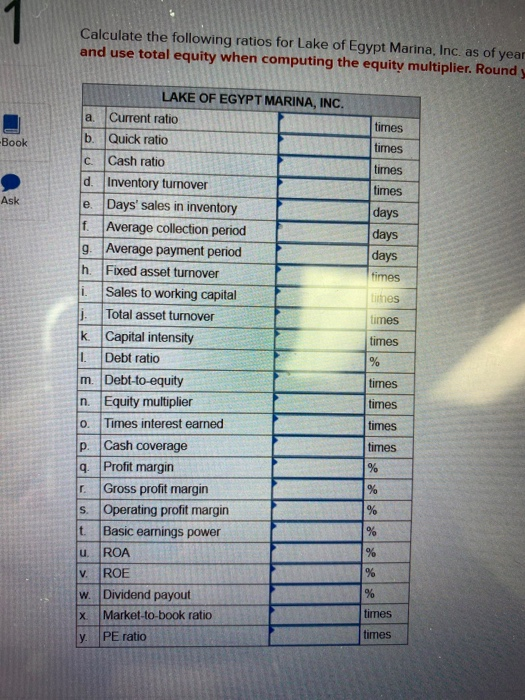

Use the following financial statements for Lake of Egypt Marino, Inc. 2018 2017 $ 60 72 110 LAKE OF EGYPT MARINA, INC. Balance Sheet as of December 31, 2018 and 2017 (in millions of dollars) 2018 2017 Assets Liabilities and Equity Current assets: Current liabilities: Cash and marketable $ 100 $ 48 Accrued wages and taxes securities Accounts receivable 110 Accounts payable Inventory 301 174 Notes payable Total $ 511 $294 Total Fixed assets: Long-term debt: Gross plant and equipment $ 520 $330 Stockholders' equity: Preferred stock (3 million Less: Depreciation shares) Common stock and paid in surplus Net plant and equipment $ 439 $270 (24 million shares) Other long-term assets 50 36 Retained earnings Total $ 489 $306 Total Total assets $1,000 $600 Total liabilities and equity $ $ 240 429 180 $237 81 $ 3 $ 3 304 $ 331 $1,000 156 $183 $600 LAKE OF EGYPT MARINA, INC. Income Statement for Years Ending December 31, 2018 and 2017 (in millions of dollars) 2018 2017 Net sales (all credit) $ 500 $ 400 Less: Cost of goods sold 180 136 Gross profits 320 $ 264 Less: Other operating expenses Earnings before interest, taxes, depreciation, and amortization (EBITDA) 294 240 Less: Depreciation Earnings before interest and taxes (EBIT) 273 $ 224 180 249 Income Statement for Years Ending December 31, 2018 and 2017 (in millions of dollars) 2018 2017 Net sales (all credit) 500 $ 400 Less: Cost of goods sold 136 Gross profits 320 264 Less: Other operating expenses 26 24 Earnings before interest, taxes, depreciation, and amortization (EBITDA) 294 Less: Depreciation Earnings before interest and taxes (EBIT) 273 224 Less: Interest Earnings before taxes (EBT) 250 Less: Taxes Net income 175 $ Less: Preferred stock dividends Net income available to common stockholders Less: Common stock dividends 24 Addition to retained earnings $ 148 $ 113 Per (common) share data: Earnings per share (EPS) $ 7.167 $ 5.708 Dividends per share (DPS) $ 1.000 $ 1.000 Book value per share (BVPS) $13.667 $ 7.500 Market value (price) per share (MVPS) $14.950 $12.750 20A 1/2 Calculate the following ratios for Lake of Egypt Marina, Inc. as of year-end 2018. (Use sales when computing the in and use total equity when computing the equity multiplier. Round your answers to 2 decimal places. Use 365 de Calculate the following ratios for Lake of Egypt Marina, Inc. as of year and use total equity when computing the equity multiplier. Round -Book times times times Ask times days days days times titnes times times LAKE OF EGYPT MARINA, INC. a. Current ratio b. Quick ratio Cash ratio Inventory turnover Days' sales in inventory Average collection period Average payment period Fixed asset turnover Sales to working capital j. Total asset turnover k. Capital intensity Debt ratio Debt-to-equity Equity multiplier 0. Times interest earned p. Cash coverage 9. Profit margin r. Gross profit margin s. Operating profit margin t Basic earnings power u ROA ROE Dividend payout Market-to-book ratio PE ratio times times n. times times times times Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started